- Consumer 150

- Posts

- Prime Day’s Record Run: Boomers and GenZ Fuel a $14B Boom

Prime Day’s Record Run: Boomers and GenZ Fuel a $14B Boom

Older shoppers and planned purchases drove a record-setting $14B as Prime Day cemented its status as the cloud-era Black Friday.

Good morning, ! This week we’re diving into Gen Z’s paradoxical splurging habits, Prime Day’s record-breaking run driven by older consumers, Florida’s crackdown on gift card fraud, and why consumer confidence is collapsing even as inflation cools—proving once again that in retail, feelings beat facts.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer M&A Team

DATA DIVE

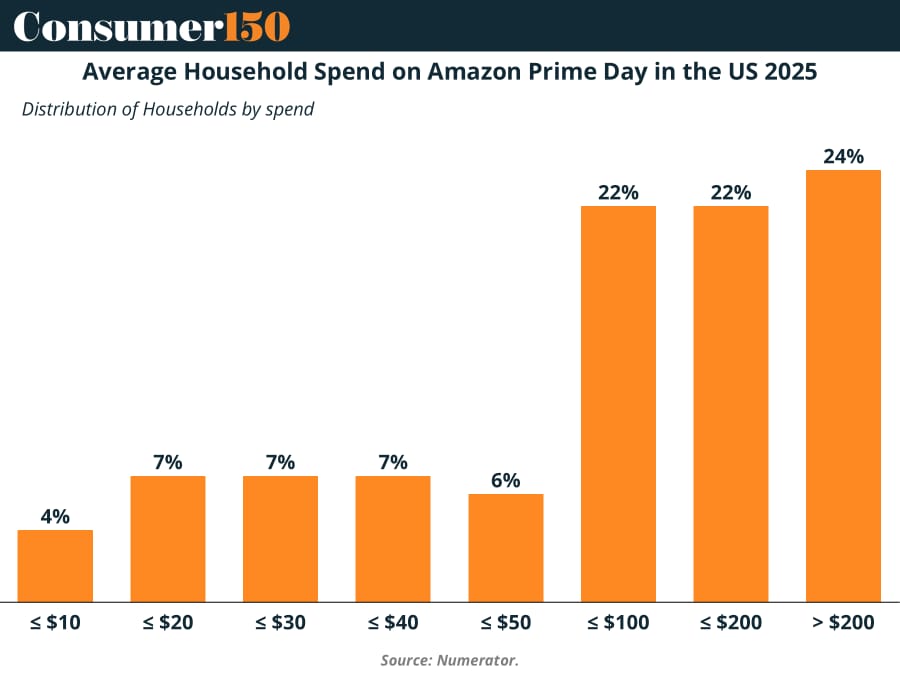

Prime Day: The $14B “Summer Christmas”

Prime Day has morphed into a July ritual where America’s most loyal online households drop $200+ like it’s Thanksgiving. Amazon’s cart average beat rivals by $54, planned purchases outnumbered impulse buys, and even with a dip in item count vs. 2023, total spend hit all-time highs. Older consumers (55+) are leading the charge, proving that speed, selection, and same-day shipping now dominate the loyalty economy. Forget Black Friday. The real shopping holiday lives in the cloud — and Amazon owns the calendar.

TREND OF THE WEEK

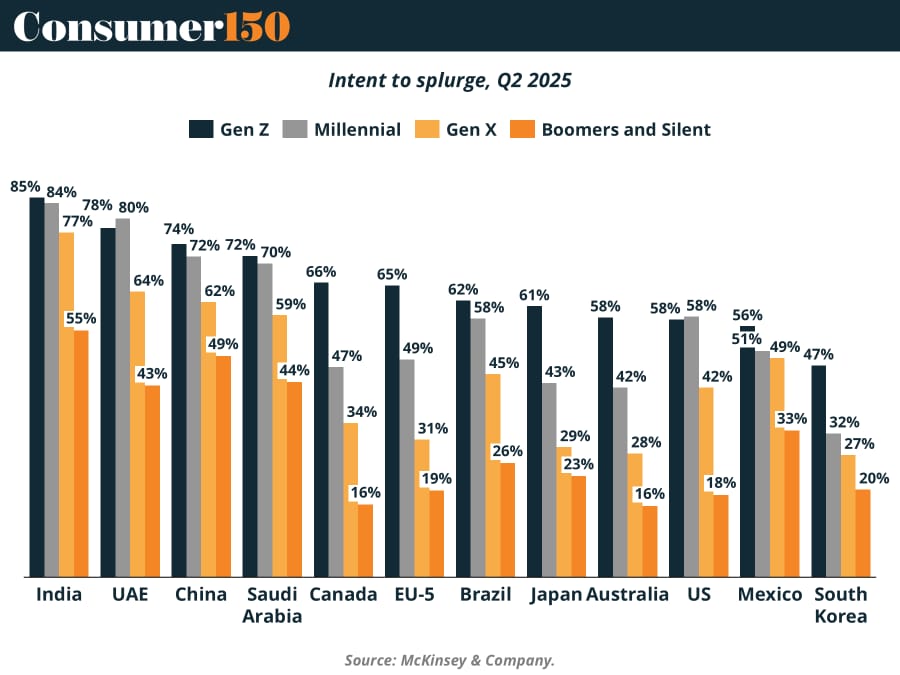

Broke But Bougie

Gen Z may be the most financially anxious generation—but they’re also the most eager to spend. Despite 50% of U.S. Gen Zers saying they couldn't maintain their lifestyle for a month without income, they’re splurging on apparel and beauty, often via buy-now-pay-later schemes. This isn’t just lifestyle inflation; it’s a paradox. Gen Z’s spending is growing twice as fast as previous generations’, and they’ll eclipse Boomers’ global spend by 2029. The catch? Brands need to serve up splurgeworthy experiences that straddle aspiration and affordability—because this generation defines adulthood more by financial success than by milestones like marriage or kids. (More)

PRESENTED BY AG1

This Daily Ritual Goes Wherever You Do

Summer travel season is here!

And that means adventure + skipped meals, red eye flights, and way too many pastries.

AG1 is not your average greens powder. It's a daily health drink that combines over 75 high-quality ingredients, including vitamins, minerals, prebiotics, probiotics, and adaptogens to support gut health, immune function, and support energy, even when your routine is off.

What makes it stand out? The integrity. AG1 is NSF Certified for Sport, which means it's been thoroughly tested for over 280 banned substances, heavy metals, allergens, and pesticides.

No fillers. No junk. All you need is a travel pack and a bottle of water and you’re covered, wherever your adventures take you.

Subscribe now and get:

✔️ 10 FREE Travel Packs

✔️ FREE Vitamin D3+K2 Drops

✔️ FREE Canister + Shaker

All for less than $3 a day.

ECOMMERCE

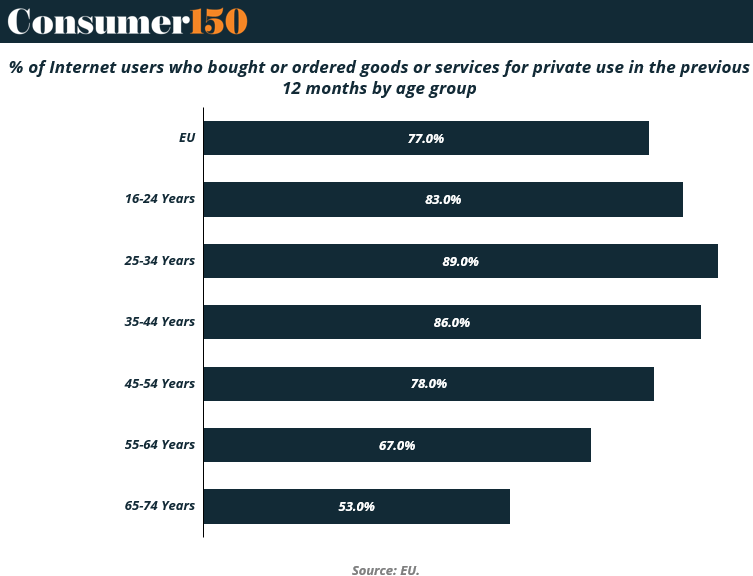

eCommerce Corner – EU digital adoption by age

The latest EU data shows 89% of internet users aged 25–34 purchased goods or services online over the past year—the highest penetration of any age cohort. This tapers to 86% (35–44), 83% (16–24), and 78% (45–54). Penetration drops notably among older users: 67% (55–64) and just 53% (65–74).

Why it matters:

Core online consumers remain firmly within the 25–44 segment—where brand loyalty, frequency, and average basket size tend to peak.

Younger shoppers (16–24) are engaged but might under-index in spending versus slightly older cohorts, presenting opportunity for retention strategies.

The 55+ segment still includes two-thirds of internet users actively shopping—far from negligible. That’s a meaningful market for tailored messaging, simplified UX, and relevant product offerings (e.g., health, gardening, travel).

Bottom line: while 25–44 dominate market penetration, growth opportunities lie in converting high-engagement younger cohorts into loyal buyers, and optimizing the substantial, yet underserved, older demographic. (More)

DEAL OF THE WEEK

Sweet Stamp of Approval

ChrysCapital’s ₹2,410 crore (~ $280 million) bid to acquire a 90% stake in beloved bakery chain Theobroma has hit a crucial milestone with the Competition Commission of India (CCI) receiving the acquisition filing from Aqua, Infinity, and Atreides. The trio assures there are no operational overlaps, and only a minor logistics tie‑in exists—hardly enough to raise eyebrows. The spotlight now shifts to whether the CCI will greenlight ChrysCapital's largest consumer play of the year. (More)

TOGETHER WITH AD QUICK

Modernize your marketing with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

Gift Card Corner – Florida Cracks Down on Gift Card Fraud

Starting October 1, Florida will formally classify gift card fraud under state law, introducing first-degree misdemeanor charges (up to 1 year in jail, $1,000 fine) for offenses like unauthorized use, tampering, or data theft. If the value exceeds $750, the crime escalates to a third-degree felony, carrying up to 5 years in prison and $5,000 in fines.

Why it matters:

Florida becomes one of the few states to codify specific penalties for gift card-related fraud, addressing a loophole that’s long hampered enforcement.

With $217M lost to gift card fraud nationally in 2023 (FTC), and rising cases in Florida, this law could act as both deterrent and tool for prosecutors.

Retailers and brands issuing cards in Florida must now treat fraud not just as a cost of business, but as a criminal matter with real legal weight.

Bottom line: Gift cards are increasingly treated like cash—and now, in Florida, stealing them comes with consequences that match. For platforms, issuers, and corporate users, this may set precedent for tighter fraud mitigation protocols nationwide. (More)

CONSUMER TECH

Wearables Go Wide and Deep

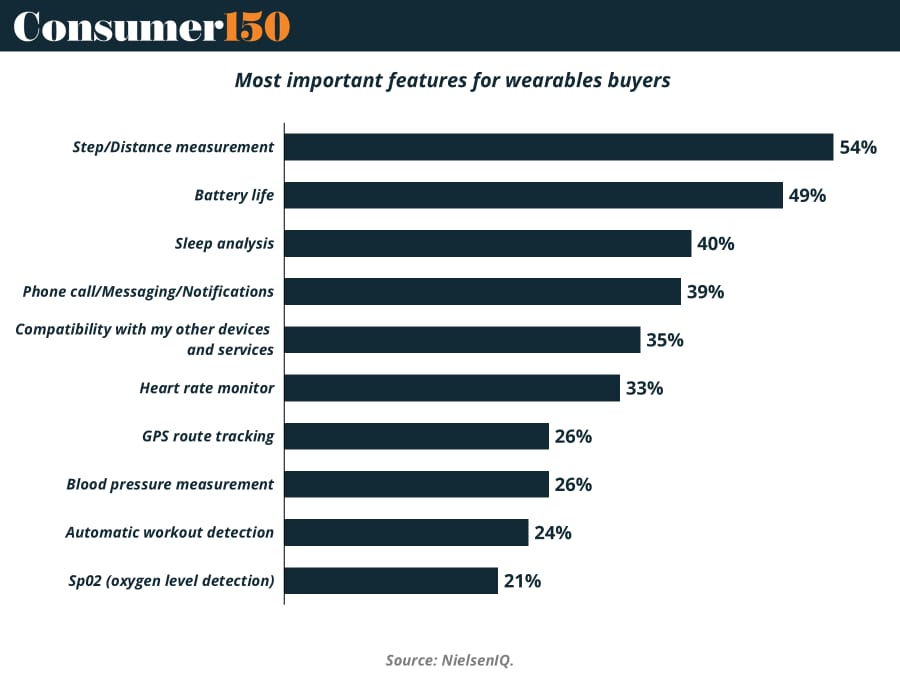

Wearables are no longer niche. In 2024, the category outpaced even Telecom, jumping 4% in value year-over-year. That’s no accident: with 54% of buyers prioritizing step tracking and 49% focused on battery life, consumers are crystal clear on what they want—and they’re getting it. From 18,000 new products to first-time buyers making up 45% of EU5 sales, the growth is as broad as it is deep. The kicker? AI-driven features and new form factors (hello, smart rings) are setting the stage for premiumization, especially in APAC and the Middle East, where disposable income and tech appetite are surging. (More)

CONSUMER BEHAVIOR

When Feelings Trump Facts: The New Consumer Economy

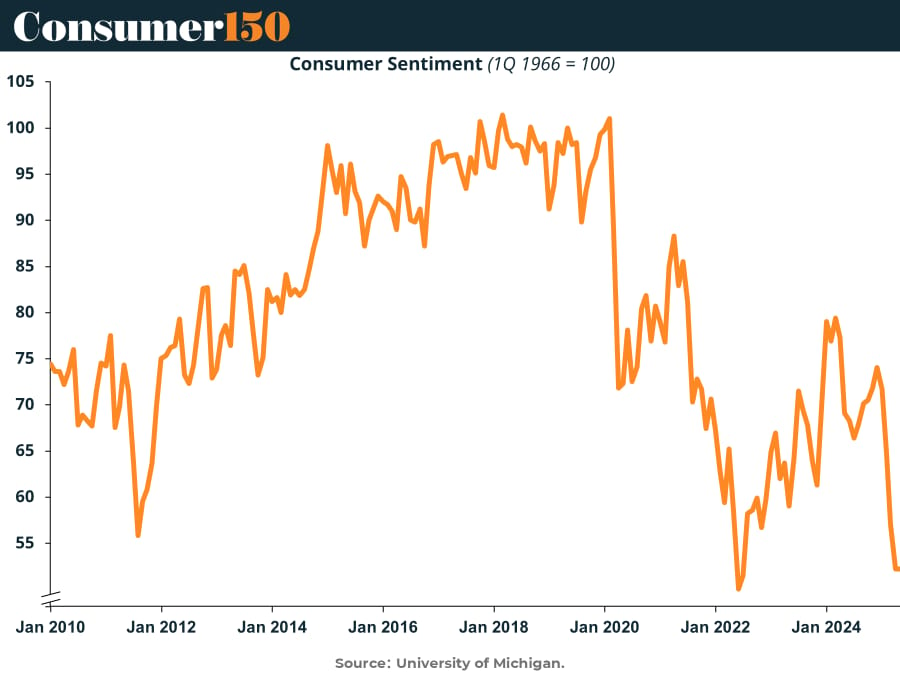

Even as inflation data cools and the Fed taps the brakes on rate hikes, consumer sentiment is crashing harder than your uncle’s crypto portfolio. Confidence took a nosedive back to early-2022 lows, and the implications are real: less spending, more saving, and fewer big-ticket splurges. While the CPI looks tame, it’s consumer expectations that are on fire—now anticipating 6%+ inflation. Translation: we’re either panic-buying or cutting back entirely. Toss in the aftershock of sustained interest rates, and you've got a cocktail of psychological pressure that turns economic optimism into a mirage. When it comes to spending, it’s not just the math—it’s the mood. (More)

INTERESTING ARTICLES

"The only place where success comes before work is in the dictionary."

Vidal Sassoon