- Consumer 150

- Posts

- Amazon Prime Day: Behind the Numbers

Amazon Prime Day: Behind the Numbers

Since its launch in 2015, Amazon Prime Day has grown from a one-off promotional experiment into one of the most influential retail events in the world.

Introduction

Since its launch in 2015, Amazon Prime Day has grown from a one-off promotional experiment into one of the most influential retail events in the world. Strategically placed in the summer months — a traditionally slower period in retail — Prime Day has carved out a powerful niche by combining deep discounts, time-limited urgency, and the magnetism of Amazon’s massive Prime membership base. What began as a 24-hour sale has become a multi-day global commerce moment that now rivals Black Friday and Cyber Monday in terms of both scale and strategic importance.

For brands and consumers alike, Prime Day has become more than just a sale — it's a ritual. It's when deal-hunters, loyal Amazon users, and first-time shoppers alike converge in a digital shopping environment optimized for conversion. The event now serves as a pivotal test of Amazon’s logistics infrastructure, pricing strategy, and retail innovation engine — and it provides an unmatched look into shifting consumer preferences in real time.

This year’s edition, Prime Day 2025, offered new insights into how the retail landscape is evolving. Sales once again reached record levels, but beneath the surface, the shape of the Prime Day shopper is changing. Our analysis shows that older consumers are playing a growing role in driving spend; household basket sizes are climbing; and the average shopper is approaching Prime Day with greater intentionality than ever before. Prime Day is no longer just about discovering deals — it’s about executing purchase plans, stocking up on essentials, and in many cases, splurging on high-value items that align with long-considered buying decisions.

Meanwhile, Amazon’s ability to outperform rival retailers during the same promotional window continues to widen. From higher average cart values to deeper Prime penetration, Amazon has strengthened its dominance by building a more loyal, more predictable, and more profitable customer base. As we explore in this report, the platform’s ecosystem has evolved into more than a marketplace — it’s a high-efficiency retail machine that sets the pace for the entire consumer industry.

In the pages that follow, we dive into the numbers that shaped Prime Day 2025, unpacking key trends in shopper demographics, purchase intent, basket composition, and household spending behavior. Together, they paint a portrait of a retail event that is bigger, smarter, and more influential than ever before.

Amazon Prime Day Sales Continue Upward Climb

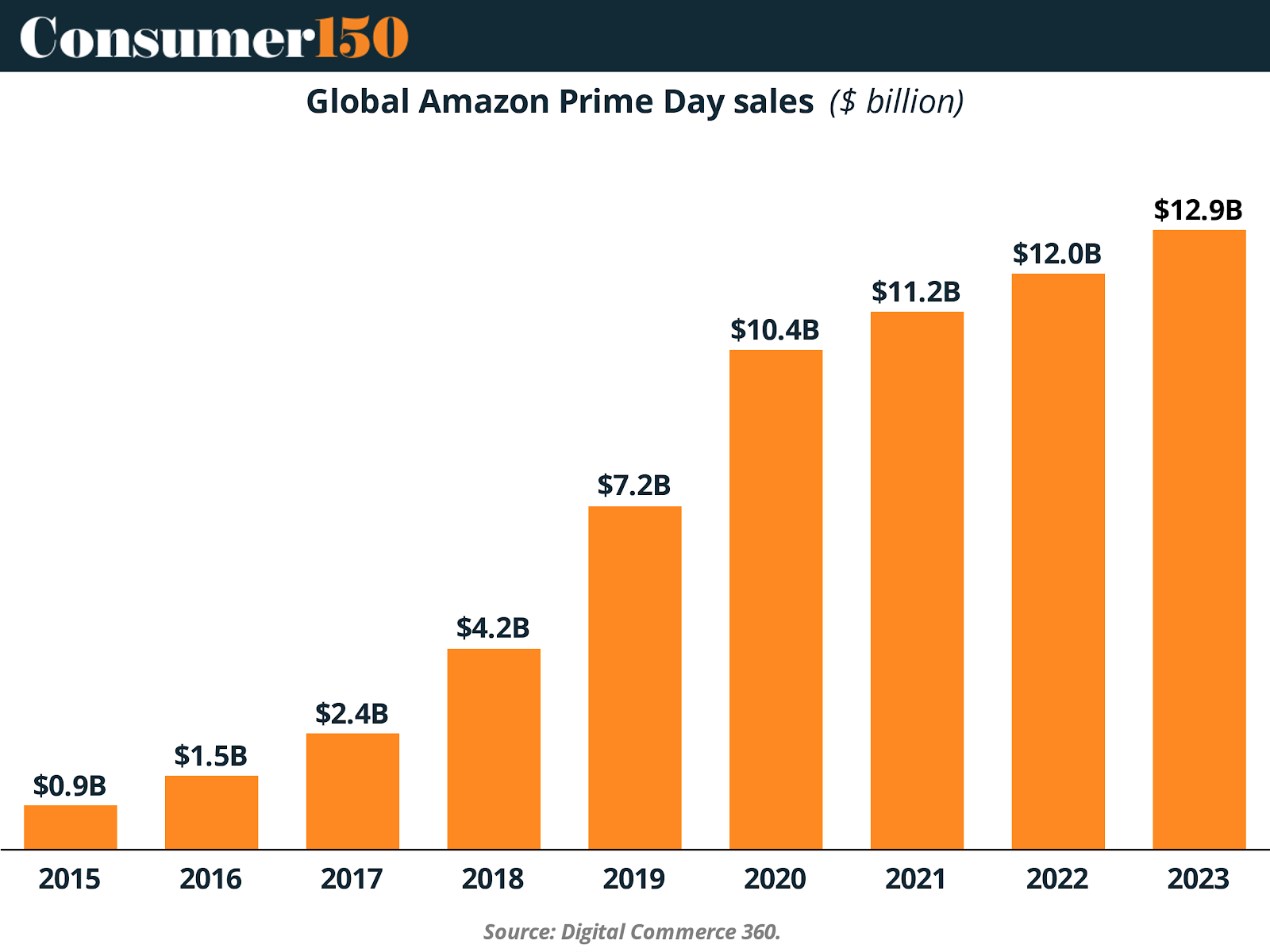

Amazon Prime Day has cemented itself as a major event in global retail, with sales consistently rising year over year. In 2023, global Prime Day sales reached a record $12.9 billion, up from $12.0 billion the year before. That’s a staggering 14-fold increase since the event's 2015 debut at $0.9 billion. While growth has naturally slowed from the explosive early years, the momentum remains strong — especially post-2020, when the pandemic accelerated e-commerce adoption. These numbers highlight not only Amazon’s dominance but also the increasing consumer appetite for time-limited, deal-driven shopping events.

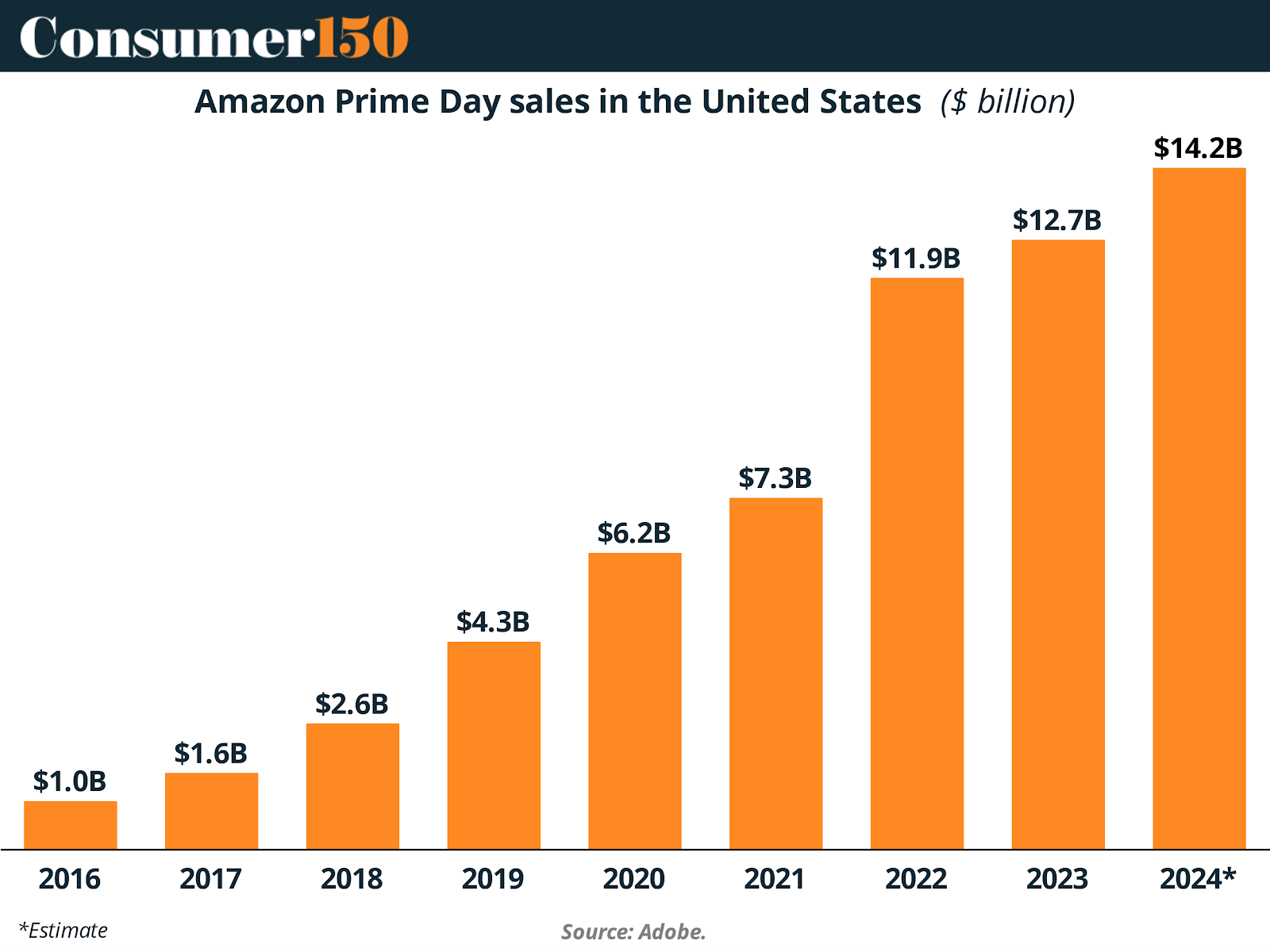

While global figures paint an impressive picture, the U.S. market remains the driving force behind Prime Day’s growth. U.S. sales alone surged from just $1.0 billion in 2016 to an estimated $14.2 billion in 2024, according to Adobe. That’s more than a 14x increase in under a decade, outpacing global growth and underscoring the maturity and scale of Amazon’s domestic consumer base. Notably, U.S. sales leapt by over 60% between 2021 and 2022, signaling both inflation-driven spending and increased shopper participation. With the 2024 estimate suggesting another year of double-digit growth, Prime Day is not just surviving — it’s thriving as a summer staple of American retail.

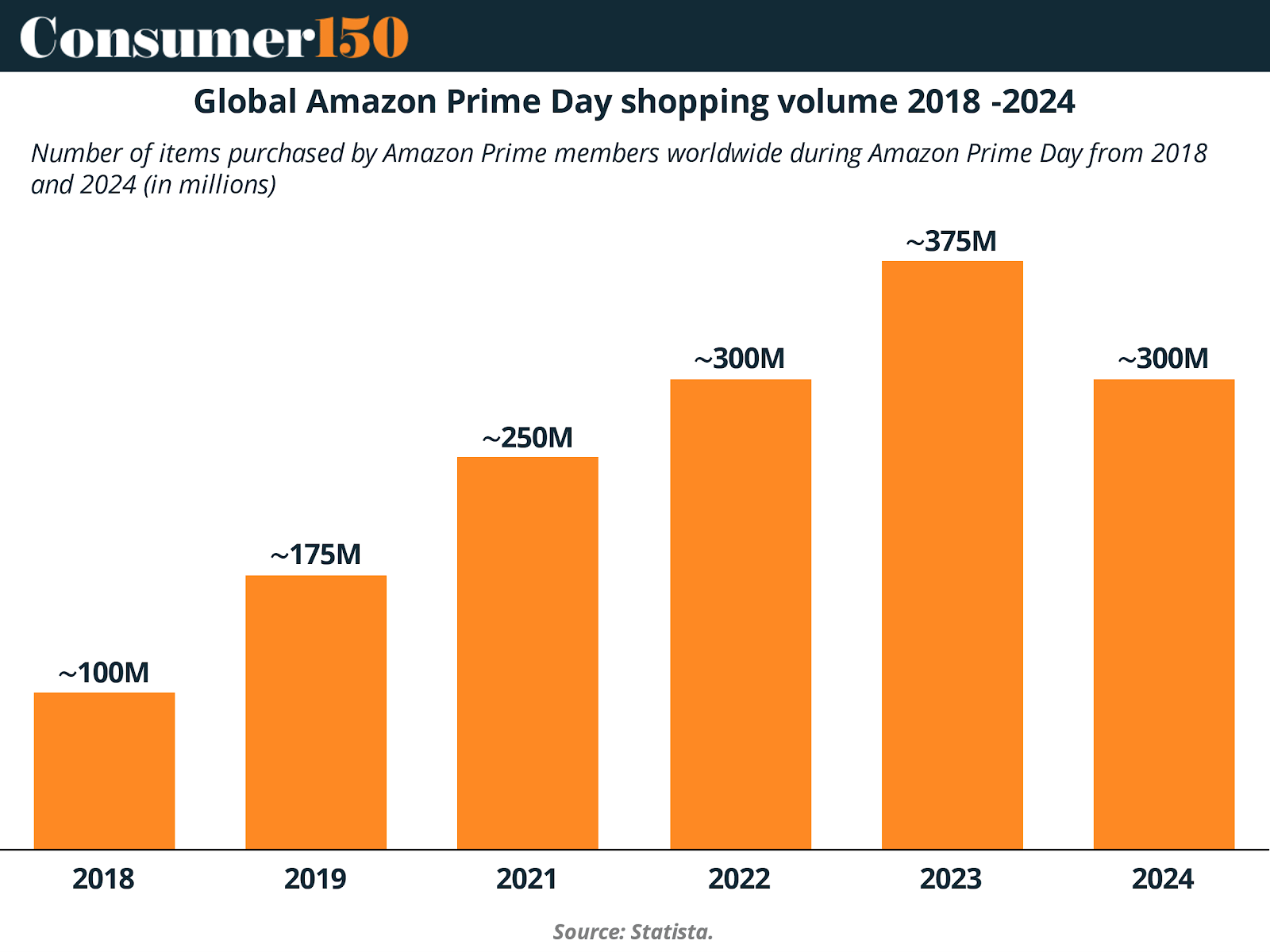

That growth in revenue has been fueled by a sharp rise in global shopping volume. The number of items purchased during Prime Day ballooned from roughly 100 million in 2018 to an estimated 375 million in 2023. While the 2024 projection (~300 million items) marks a dip from last year’s record high, the broader trend remains impressive: total unit volume has tripled in just five years. This surge reflects not just deeper Prime penetration, but also the widening appeal of Prime Day across categories and geographies.

Even as price inflation contributed to higher sales dollars, the sheer quantity of items moving through Amazon’s platform confirms that Prime Day is a volume-driven juggernaut.

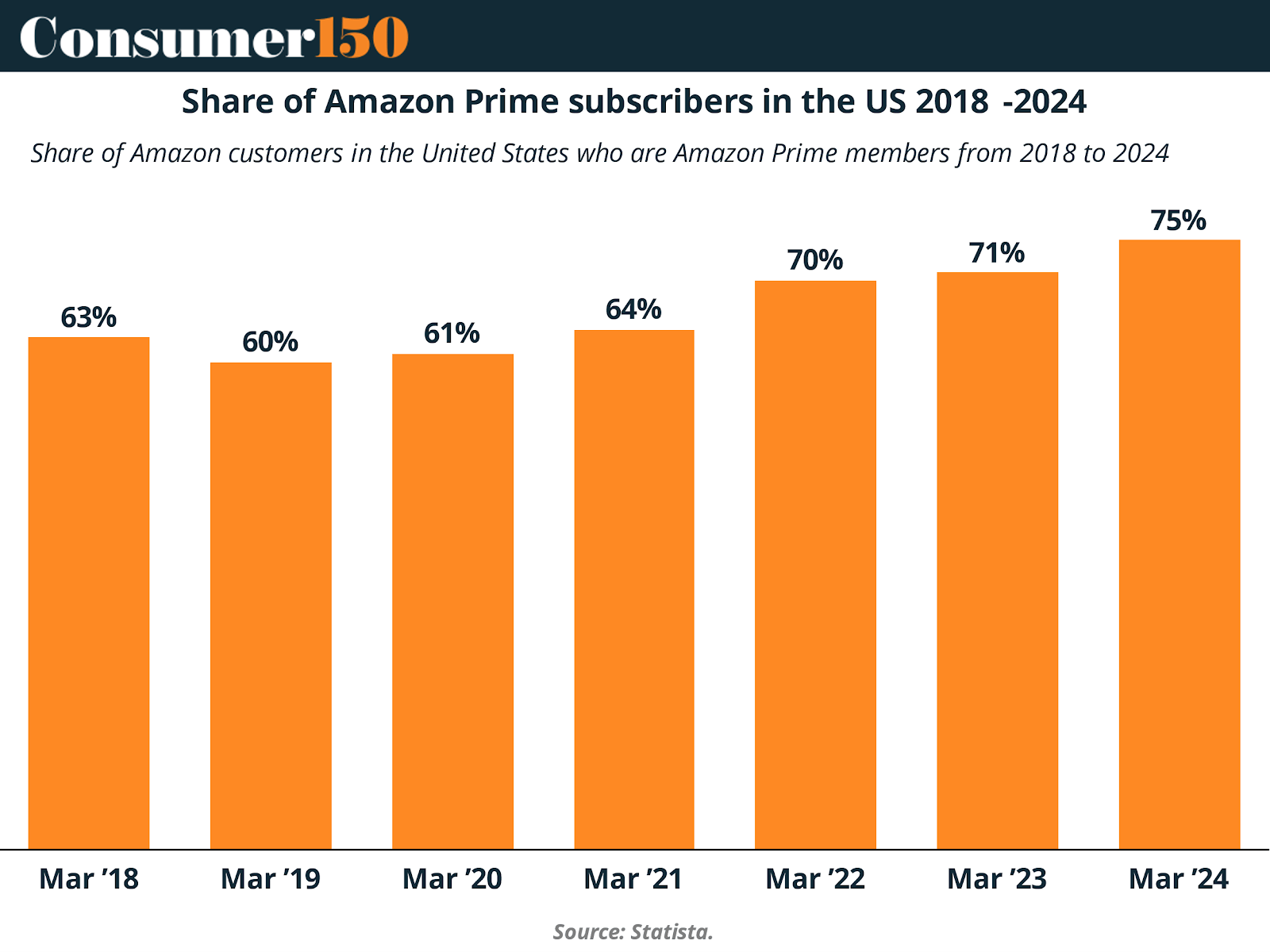

Underlying this growth in both spending and volume is the steady expansion of Amazon’s Prime membership base in the U.S. As of March 2024, 75% of Amazon customers in the U.S. are Prime members — up from 63% in 2018. The jump from 64% in 2021 to 70% in 2022 marked a pivotal shift, likely driven by pandemic-era demand and increased investment in Prime benefits like free same-day delivery and exclusive deals.

With three out of every four U.S. Amazon shoppers now part of the Prime ecosystem, the platform has effectively built a highly engaged base primed (literally) for event-based commerce like Prime Day. This penetration sets the stage for even greater loyalty-based monetization in years to come.

Prime Day 2025: A More Strategic, Older, and Value-Driven Shopper Base Emerges

Amazon Prime Day 2025 reflected a notable evolution in both who’s shopping and how they’re spending.

While total sales growth continued its upward march, this year’s trends point to a more mature customer base with focused purchase intent, higher cart values, and stronger brand loyalty compared to previous years. Below, we unpack the key takeaways shaping the U.S. Prime Day landscape in 2025.

Older Shoppers Now Dominate Prime Participation

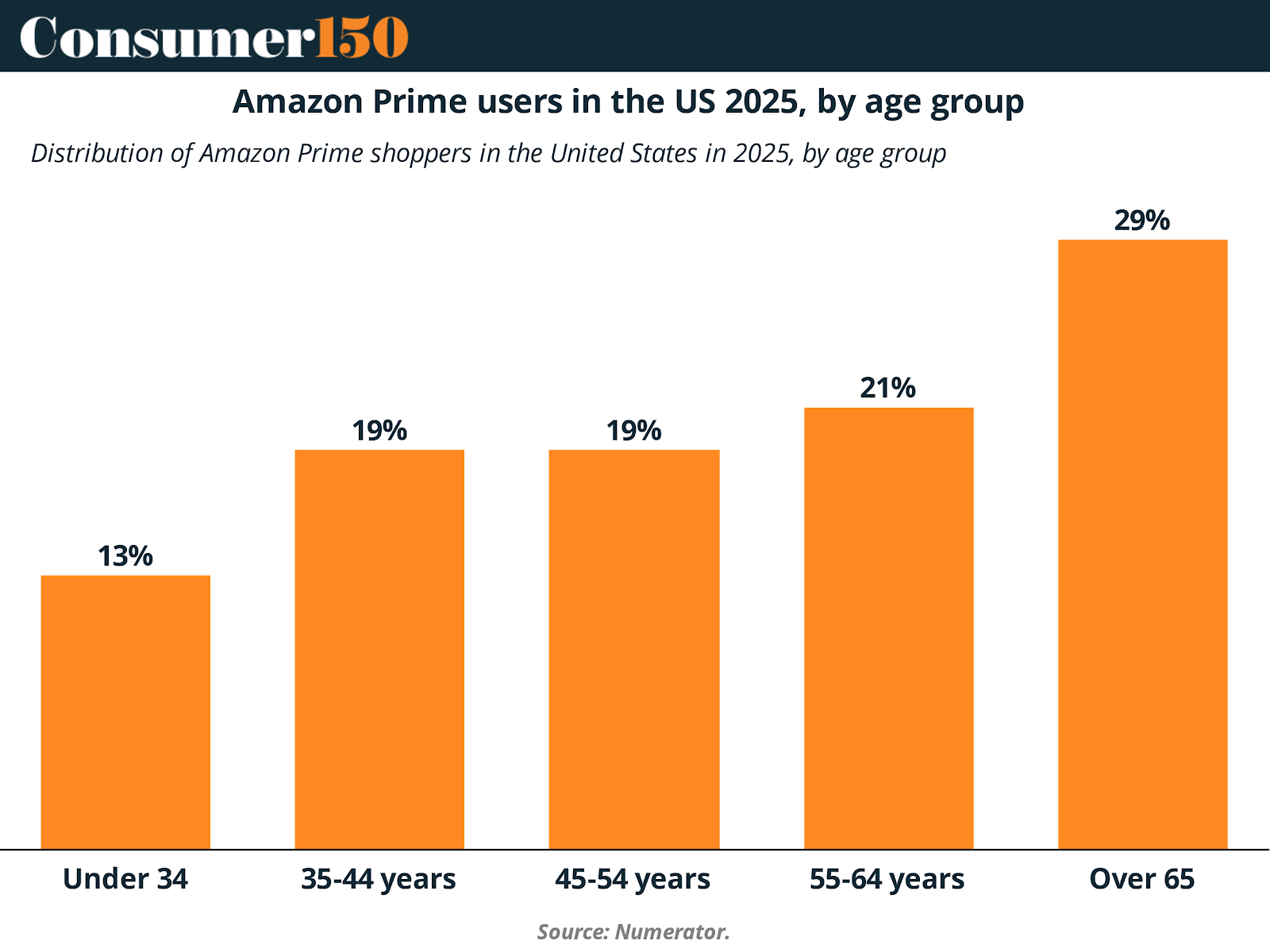

Contrary to common assumptions that younger generations dominate online shopping, Prime Day 2025 was powered by older consumers. Nearly one-third (29%) of U.S. Prime users are now over the age of 65, with shoppers aged 55–64 making up another 21%. In contrast, only 13% of Prime members fall under age 34. This demographic shift suggests that Amazon’s convenience, loyalty perks, and streamlined digital experience are particularly resonant with older, more settled consumers who have greater disposable income and spending stability.

Amazon Pulls Ahead with Higher Cart Values

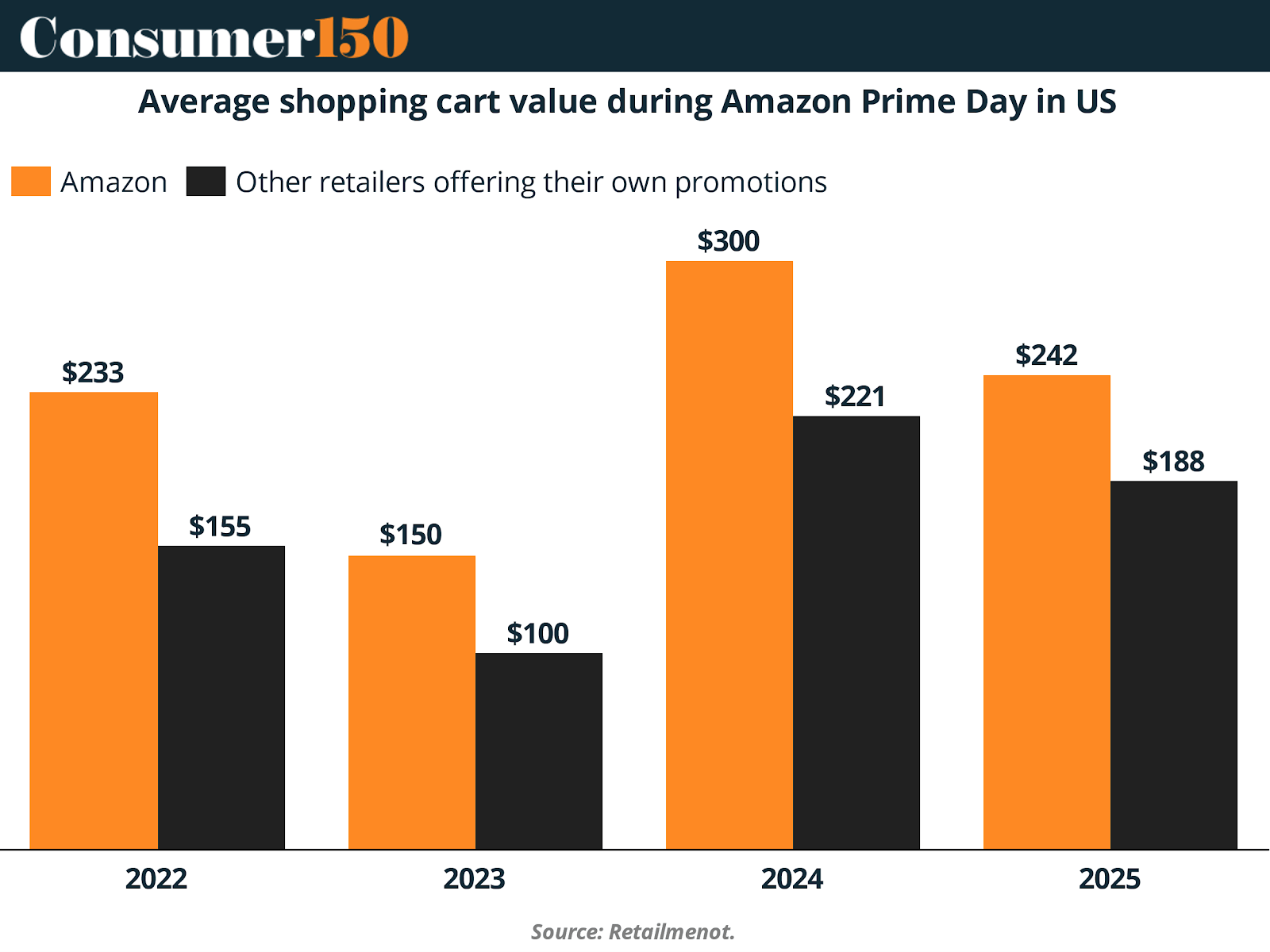

One of the clearest signs of Amazon’s dominance was seen in cart value. In 2025, the average shopping cart at Amazon reached $242 — a significant lead over the $188 average at competing retailers running parallel promotions. While cart sizes dropped from the $300 peak in 2024, this year’s figure remains well above pre-2023 levels. The gap between Amazon and competitors underscores its edge in both trust and assortment. When consumers commit to a Prime Day cart, they tend to go big — likely driven by bundled deals, limited-time urgency, and streamlined checkout experiences.

Shoppers Came with a Plan — and a Wishlist

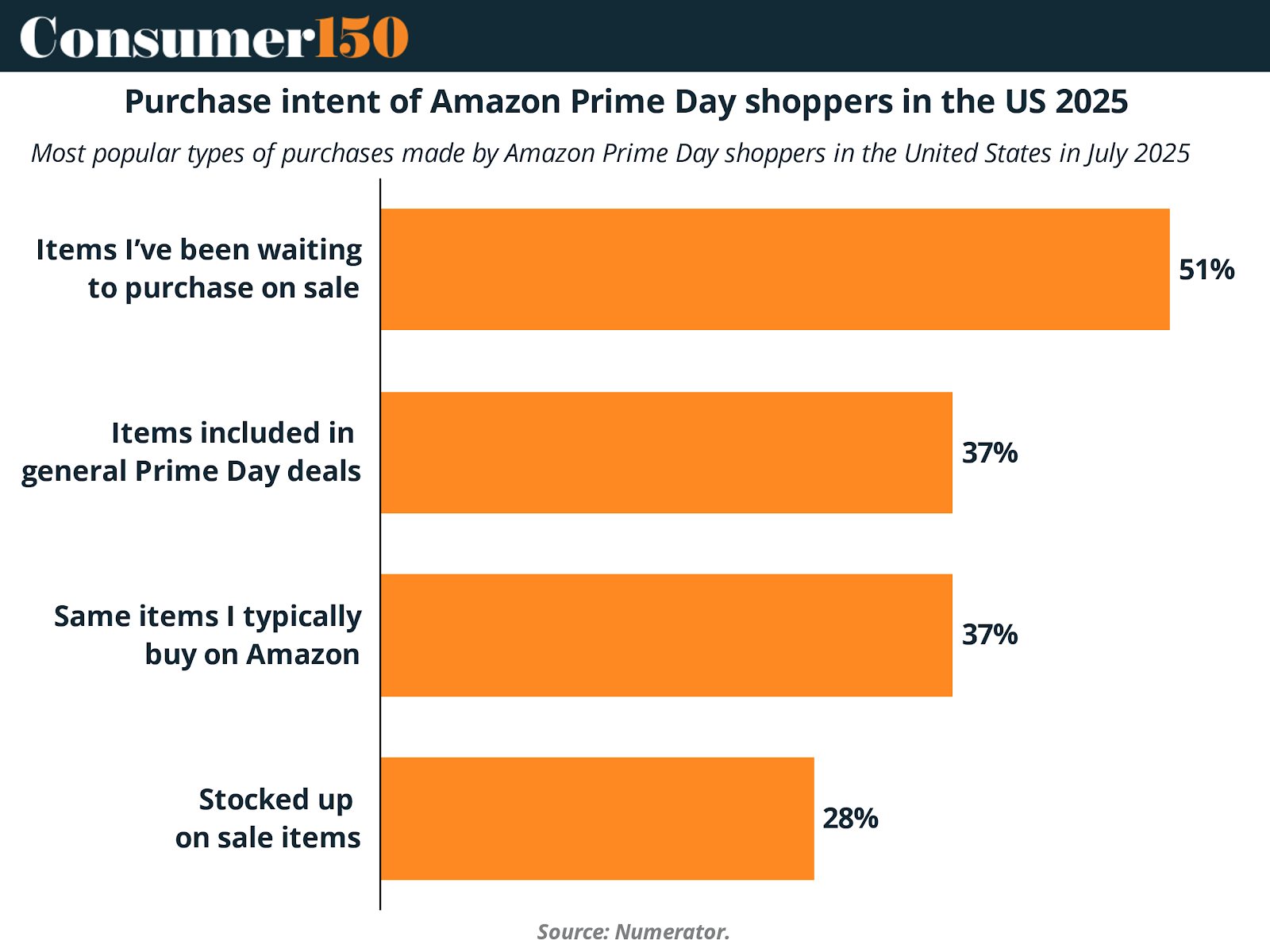

Prime Day shoppers in 2025 were highly intentional. A majority (51%) reported they were specifically waiting for certain items to go on sale — a marked shift from impulse deal-chasing behavior. Meanwhile, 37% shopped general Prime Day promotions, and another 37% simply stocked up on their usual Amazon purchases at lower prices. This signals a more strategic consumer mindset: Prime Day is no longer just a serendipitous deal-fest but a targeted savings event baked into household budgets and buying cycles.

Lower-Value Orders Still Widespread, But Bigger Buys Gaining Share

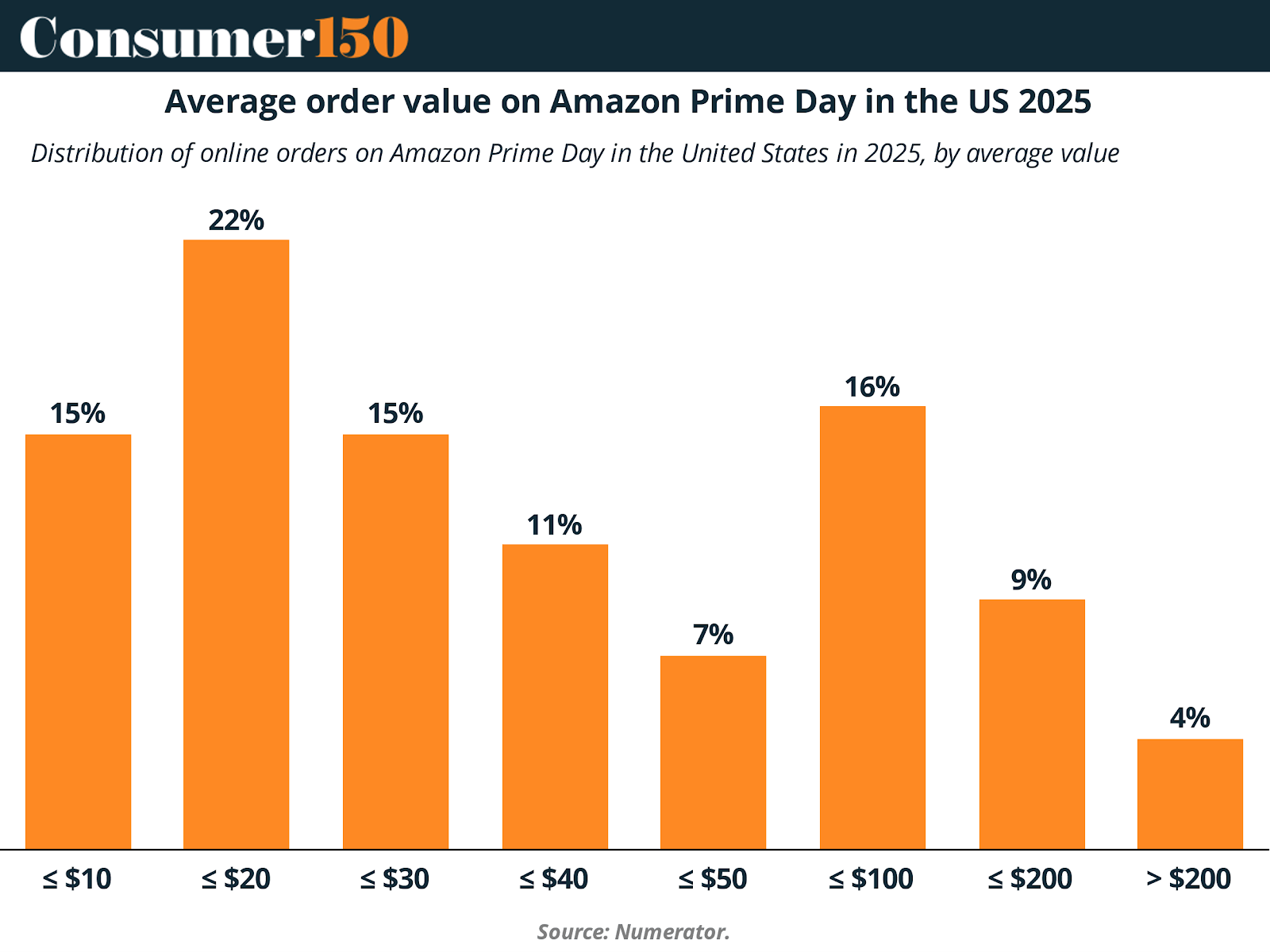

Despite the rise in overall cart value, order-level data reveals a nuanced picture. Most Prime Day transactions remained relatively small: 22% of orders were $20 or less, and 15% were below $10. That said, a growing share of orders exceeded $100 (16%) or even $200 (4%). The skew toward low-value orders reflects continued strength in replenishment categories and add-on impulse buys — but the steady presence of high-ticket transactions highlights growing trust in Amazon for bigger purchases during major promotional windows.

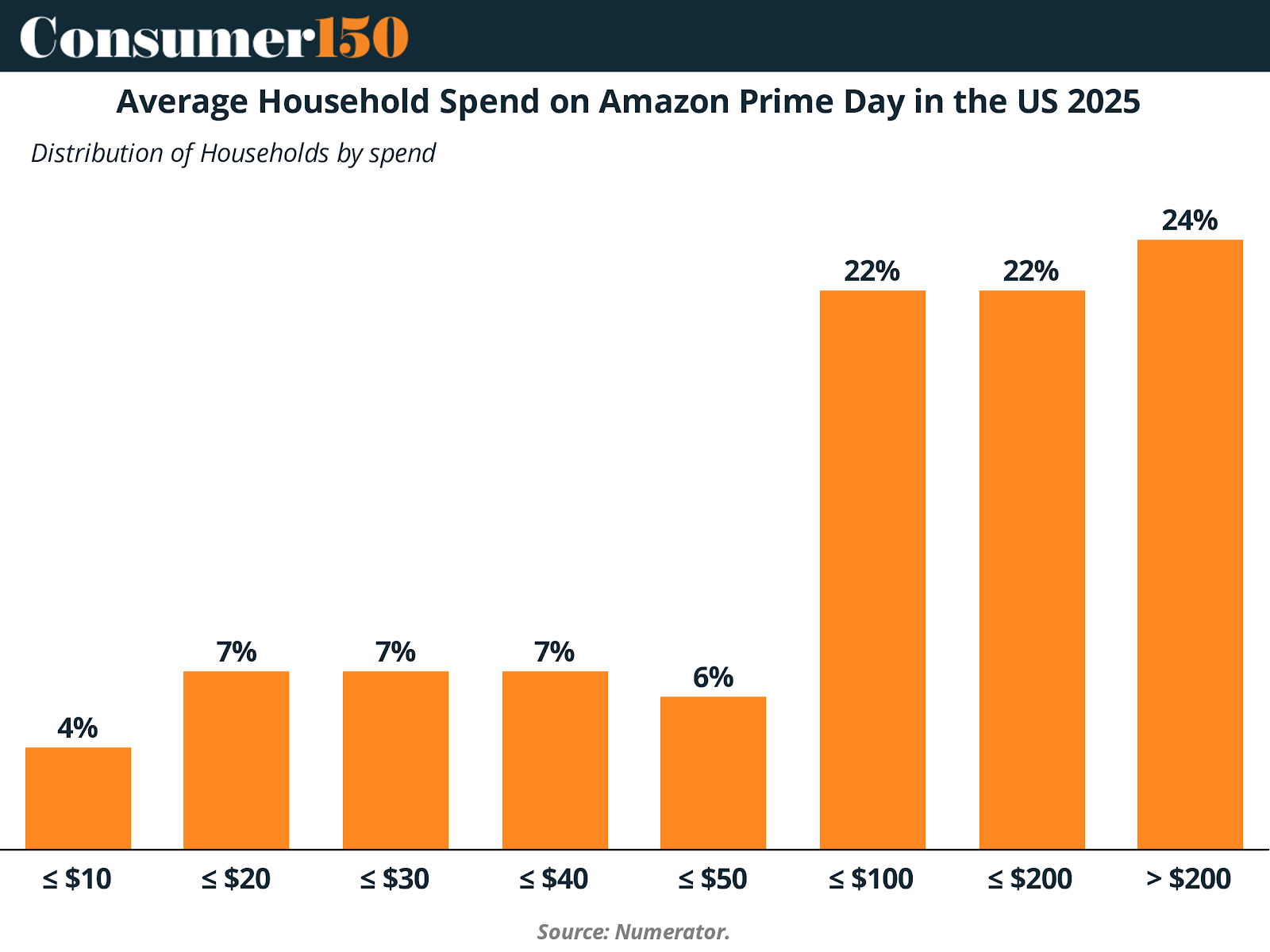

Household Spend Skews Higher — Especially Among Power Buyers

Looking at household-level spending, the trend is clear: Amazon is converting more shoppers into high-value buyers. Nearly one in four households spent over $200 during Prime Day 2025, with another 22% spending between $100 and $200. This means almost half of participating households surpassed the $100 mark. While smaller spends ($50 or less) still accounted for 30% of households, Amazon’s ability to lift basket sizes over time reflects growing customer confidence, better targeting, and increasingly relevant promotions tailored to different buyer tiers.

Conclusion

The story of Amazon Prime Day is no longer just one of rapid growth — it’s about strategic evolution. The 2025 edition reveals a platform that continues to scale, but now with a more deliberate, older, and value-focused customer base. High cart values, planned purchasing, and widening household participation all signal a maturing event that has earned its place in American shopping culture. As Amazon deepens its ecosystem and optimizes Prime’s loyalty drivers, Prime Day is poised to remain a dominant force — not just as a sales milestone, but as a case study in how digital retail continues to redefine consumer behavior.

Sources & References

Adobe Analytics. (2024). Adobe Analytics: Prime Day drove $14.2 billion online for U.S. retailers, growing 11 percent YoY. https://blog.adobe.com/en/publish/2024/07/18/adobe-analytics-prime-day-drove-billion-online-us-retailers-growing-yoy

Digital Commerce 360. (2025). Amazon Prime Day 2025 draws holiday-like US ecommerce sales. https://www.digitalcommerce360.com/article/amazon-prime-day-sales/

Numerator. (2025). PRIME DAY. https://www.numerator.com/prime-day/

Retailmenot. (2025). Shoppers Gear Up for Amazon Prime Day 2025 with a Cautious Eye on Tariffs and Budgets. https://www.retailmenot.com/blog/prime-day-shopping-and-spending.html

Statista. (2024). Number of Amazon Prime members in the United States from 1st quarter 2016 to 1st quarter 2024. https://www.statista.com/statistics/1223385/amazon-prime-subscribers-in-the-united-states/

Statista. (2024). Number of items purchased by Amazon Prime members worldwide during Amazon Prime Day in selected years from 2018 and 2024. https://www.statista.com/statistics/1029037/amazon-prime-day-items-purchased/

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.