- Consumer 150

- Posts

- Why Consumer Sentiment Is Dropping—and What It Means for Spending

Why Consumer Sentiment Is Dropping—and What It Means for Spending

For the average American, economic data might feel far removed from daily life.

But consumer sentiment—the way people feel about their financial situation and the broader economy—has real-world consequences. It affects how we spend, save, borrow, and even vote.

And right now, that sentiment is falling fast.

Confidence Has Collapsed—Again

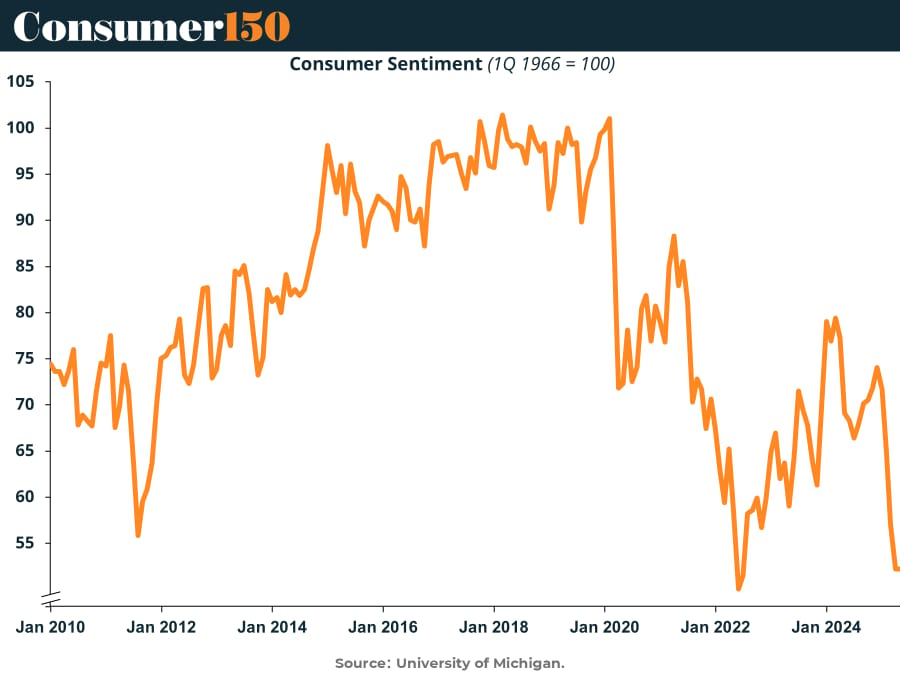

Over the last few years, confidence in the economy has seesawed. There was a bit of a bounce in late 2023 and early 2024, but consumer sentiment has since plunged sharply, nearing the lows last seen during the early 2022 inflation surge.

This chart shows just how deep the recent drop has been. People are feeling less optimistic than they have in over a decade—even compared to the uncertainty of the early pandemic.

Why does this matter? Because when people feel unsure, they tend to hold back on spending, especially on big-ticket items like cars, appliances, and vacations. Businesses feel that hesitation too, and that can trigger a cycle of slower growth.

Inflation Looks Tame—But That’s Not the Whole Story

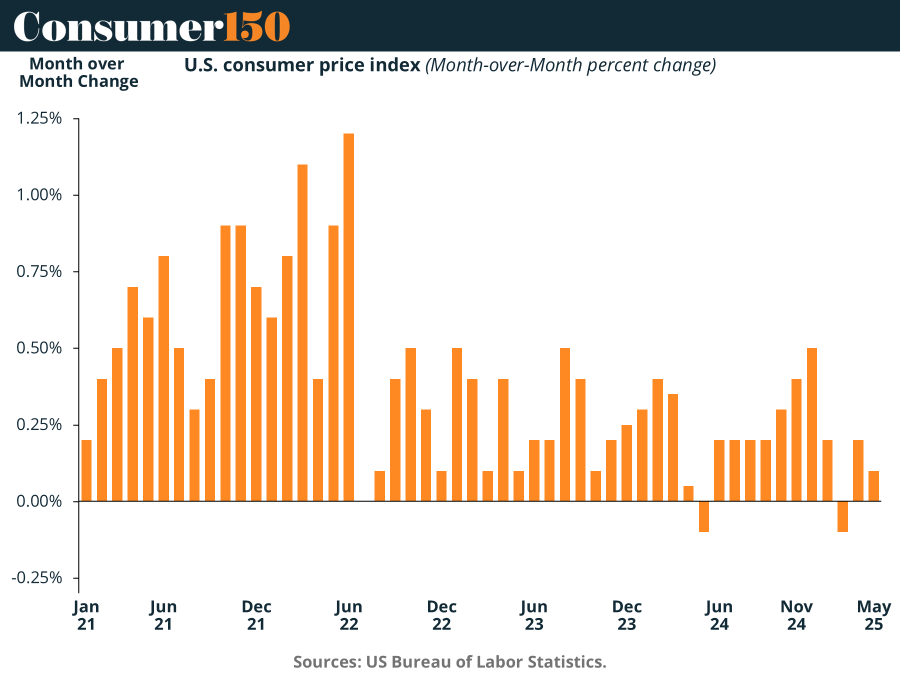

If we look at the actual inflation numbers—what the government tracks with the Consumer Price Index (CPI)—it seems like inflation has cooled down a lot since its 2022 peak.

Prices aren't rising nearly as fast as they were during the height of the inflation surge. In fact, many months this year have shown flat or even slightly negative price growth.

So why are people still so nervous?

Expectations Are Rising—And That Changes Behavior

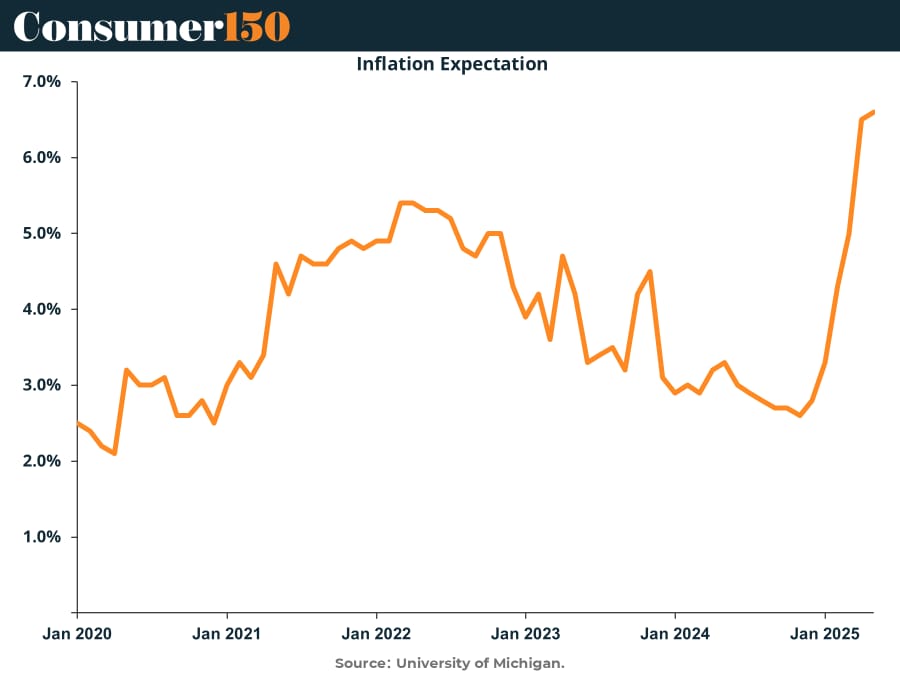

Here’s the kicker: people don’t shop based on past inflation—they shop based on what they think is coming.

And expectations just jumped. Despite tamer CPI data, consumers now expect inflation to surge again—climbing above 6% in recent surveys. That could mean people are bracing for higher grocery bills, rent, or gas prices.

This fear of future price hikes causes people to change how they spend. Some may rush to buy before prices go up; others may cut back completely.

The Fed Has Stopped Hiking—but the Damage May Already Be Done

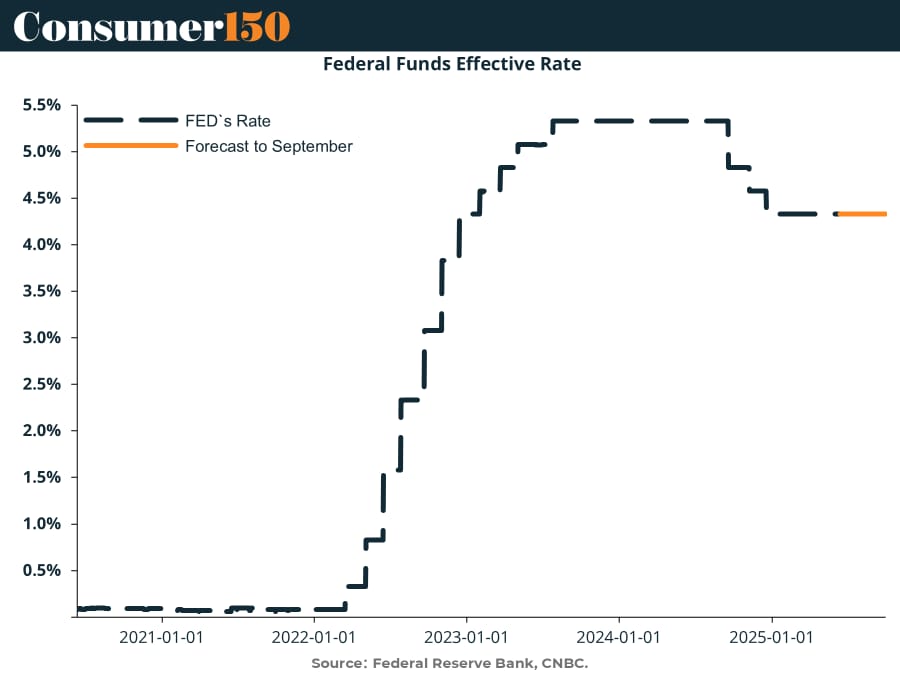

The Federal Reserve raised interest rates aggressively between 2022 and 2023 to fight inflation. It worked—somewhat. But those high rates have been hanging around for a while, and that’s wearing people down.

You can see from the chart that the Fed's rate hikes have paused, and may even slightly drop later this year. But the current rate is still high compared to where we were just a few years ago.

High rates make it more expensive to use credit cards, finance a car, or buy a home. They also hit small businesses. Even if inflation seems under control, the cost of borrowing and living is still pressuring consumers.

The Bottom Line: It’s Not Just the Numbers—It’s the Feeling

If you’re wondering why you or people around you seem cautious lately, you're not alone. Even as some parts of the economy look healthy on paper, consumer behavior is shifting in response to how people feel about their money and the future.

Understanding sentiment helps explain why retail sales may be slowing, why younger consumers are cutting back, or why big brands are having a harder time justifying price hikes.

In this kind of environment, the story isn’t just about what’s happening—it’s about what people believe is going to happen next.

Sources & References

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, June 30, 2025.

Insurance150. (2025). When High Rates Stop Talking: Rethinking Monetary Signals in a Fractured Market. https://insights150.com/p/when-high-rates-stop-talking-rethinking-monetary-signals-in-a-fractured-market-442e

Surveys of Consumers, University of Michigan, University of Michigan: Inflation Expectation© [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/MICH/, June 30, 2025.

University of Michigan, University of Michigan: Consumer Sentiment [UMCSENT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UMCSENT, June 30, 2025.