- Consumer 150

- Posts

- What Happened to Big-Ticket Spending?

What Happened to Big-Ticket Spending?

It’s Thursday and today we’re diving into the U.S. consumer spending on durable goods, Africa’s eCommerce is both growing and diversifying its basket, as we get closer to Mother’s day Gift Cards spending gains more and more, and the retail industry is witnessing a quiet AI revolution in how consumers shop.

Good morning, ! It’s Thursday and we’re diving into U.S. consumer spending on durable goods, Africa’s eCommerce is both growing and diversifying its basket, as we get closer to Mother’s day Gift Cards spending gains more and more, and the retail industry is witnessing a quiet AI revolution in how consumers shop.

First time reading? Join the execs and operators shaping the future of consumer markets. Subscribe here.

Want to advertise in one of Media 150’s 5 newsletters? Fill out this form.

— The Consumer 150 Team

TREND OF THE WEEK

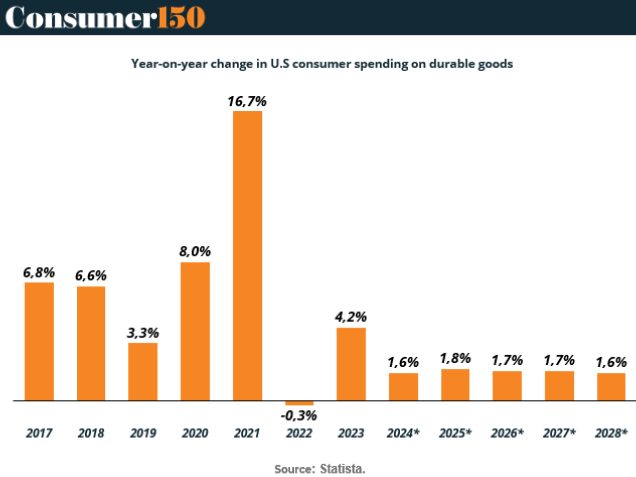

Durables Plateau: The New Normal for Big-Ticket Spending

U.S. consumer spending on durable goods has come back to earth ard. After a pandemic-era peak of +16.7% in 2021, growth in the category flatlined in 2022 (-0.3%) and is now forecast to hover around +1.6% , 1.8% annually through 2028..

Why the cool-down? Durable goods—from appliances to furniture saw a pull-forward of demand during lockdowns, aided by stimulus cash and a homebound population. Now, that surge has created a vacuum, with replacement cycles stretched, interest rates high, and wallets cautious. Even the 2023 rebound (+4.2%) looks like a one-time rebalancing rather than a sustained bounce.

For brands in the space, the message is clear: growth will be incremental, not exponential. Expect more focus on value, financing options, and upgrade incentives as consumer enthusiasm shifts from buying more to buying smarter. (More)

PRESENTED BY BUILD WEALTH

WSJ Bestselling Author Walker Deibel’s BuildEnergy Fund Leverages 4-Decade Track Record (Over 80% Subscribed!)

BuildEnergy Fund I is officially open to accredited investors! This $100 million cashflowing fund offers family office terms and 30%+ IRR to its investors.

Why invest? Walker Deibel, the serial entrepreneur, WSJ bestselling author, and founder of Build Wealth sees this fund as hitting all facets of his Growth Predictor Framework:

Experienced Operating Team – A 4-decade / 6-fund track record of strong returns, including IRRs averaging 50%

Attractive Returns – Prior fund is already cash flowing 15% cash-on-cash, and estimated 35% IRR only 18 months in.

Institutional-Level Terms – Direct access to a $5M family office buy-in structure, reflecting a 7% immediate paper gain on a minimum $50,000 investment.

Focused Sector Approach – A strategic, supply / demand imbalance play, acquiring $100 million roll-up of oil wells during a buyer’s market.

If you’re an accredited investor, you can get access to the data room here:

For questions, reach out to Mike Brown, Head of Investor Relations: [email protected]

ECOMMERCE

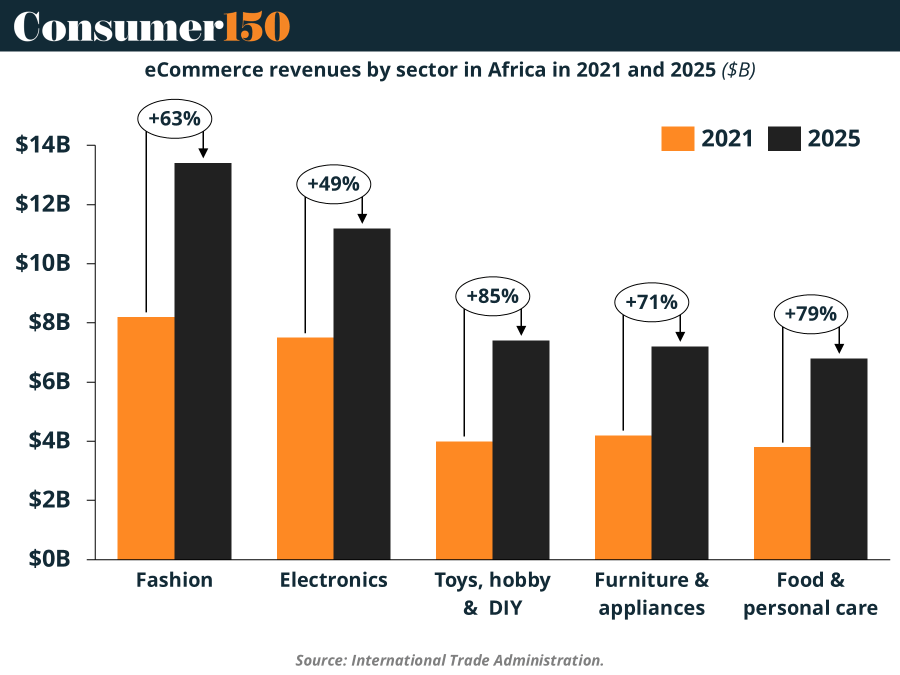

Africa’s Digital Basket Is Getting Full

Africa’s eCommerce isn’t just growing—it’s diversifying. While electronics and fashion lead in share of wallet, categories like personal care, appliances, and furniture are posting the fastest growth. This signals a shift from “essential browsing” to full-fledged digital lifestyle consumption. Mobile access is still the unlock: smartphones and mobile money have done what decades of card-based infrastructure couldn’t. Add a booming urban middle class and sustained post-COVID digital habits, and Africa’s consumers are now buying far more than just phones and shoes. Grocery, still lagging, is next on the runway—ripe for disruption if logistics can catch up. In short, this isn’t just more users online—it’s more categories going digital. (More)

DEAL OF THE WEEK

Consumer Health Move: Sanofi’s $11B OTC Exit Sets Stage for Targeted M&A Surge

Sanofi just inked a €10 billion ($11.4B) deal to sell a 50% controlling stake in its consumer health unit Opella to private equity firm Clayton, Dubilier & Rice, one of the largest European pharma carve-outs in recent memory.

Why now? Sanofi is sharpening its focus as a “pure-play biopharma, joining a long line of drugmakers slimming down to double down on prescription innovation. With the cash infusion, the French giant plans to pursue bolt-on acquisitions, bolster its dividend, and expand its share buyback program. Recent deals, like its $600M upfront investment in Dren Bio’s bispecific antibody, hint at the M&A playbook going forward: clinical-stage, high-potential, and tightly aligned with R&D goals.

For investors, this isn’t just about portfolio cleanup, it’s a signal. Expect Sanofi to move fast on smaller, strategic assets while keeping its sights off mega-mergers. In a market that rewards focus and firepower, Sanofi just boosted both. (More)

TOGETHER WITH REPUBLIC

Private Markets Aren’t Just for the 1% Anymore.

Institutions invest billions into private markets because they may provide superior market positions and steady cash flow, even in a shaky market–now you can too.

For the first time ever, elite private assets are available to all investors for as little as $500 with Hamilton Lane Private Infrastructure Fund.

*Source: Hamilton Lane data, Bloomberg as of January 2024. Past performance is not a guarantee of future returns.

All securities come with specific risks not limited to a total loss of your investment. Past performance is not indicative of future results. Please review the risks specific to this investment on the HLPIF deal page hosted on Republic.com/hlpif

GIFT CARD CORNER

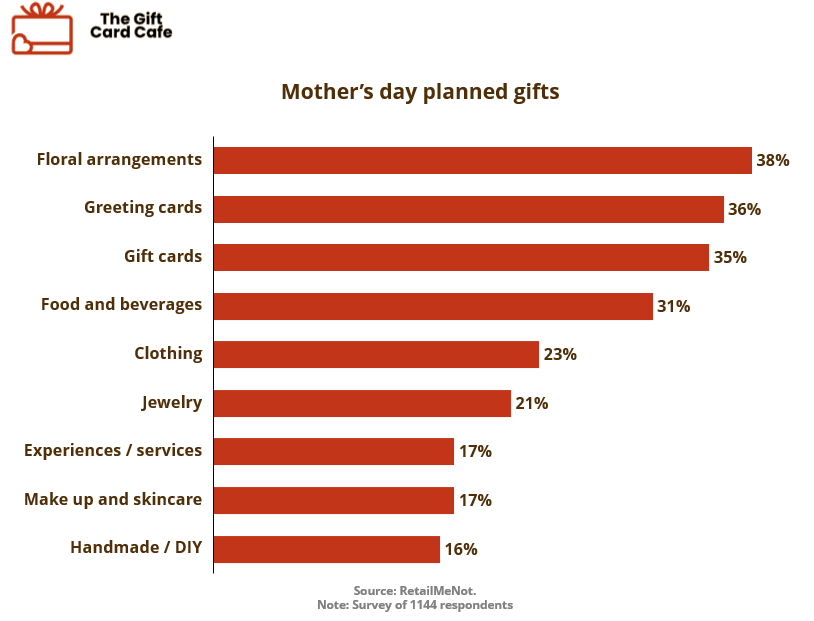

Gift Cards Climb the Charts for Mother’s Day

Move over, bouquets, gift cards are gaining serious ground. While floral arrangements (38%) and greeting cards (36%) still top the list of Mother’s Day gifts, gift cards came in a close third at 35%, according to RetailMeNot’s survey of 1,144 respondents. That’s nearly 1 in 3 gift-givers opting for flexibility over florals.

What’s driving the shift? Personalization without pressure. Gift cards allow moms to choose what they want, when they want it, a compelling value prop in a world of unpredictable preferences and packed calendars. And as experiential gifting (17%) and handmade/DIY gifts (16%) lag, it’s clear that ease and versatility continue to win out.

Retailers and brands should take note: positioning gift cards as thoughtful, premium options, not fallback gifts, could be the key to capturing last-minute spend this season. (More)

CONSUMER TECH

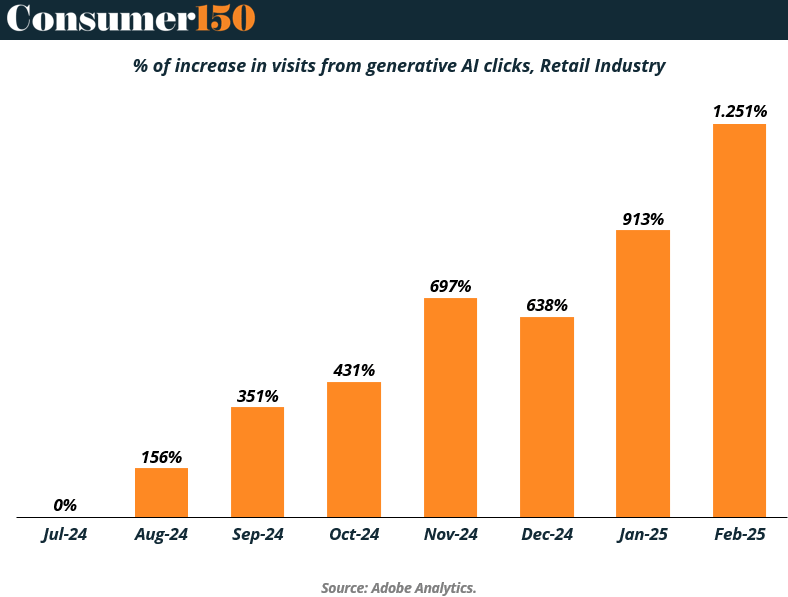

Your New Shopping Sidekick

The retail industry is witnessing a quiet revolution in how consumers shop, and it’s powered by generative AI. According to Adobe Analytics, retail visits originating from AI-generated clicks skyrocketed by 1,251% between July 2024 and February 2025. What started as a niche experiment in assistant-driven browsing is now quickly becoming standard operating procedure.

This isn’t just hype, it’s habit formation. As shoppers grow more comfortable letting AI tools surface products, compare deals, and even predict their preferences, the traditional buyer’s journey is being rewritten. From search to checkout, AI is increasingly influencing decision-making at every touchpoint.

For brands, this means optimizing for AI discoverability is no longer optional. If your product isn’t AI-friendly, it might as well be invisible.

Bottom line: AI is the new front door to retail. The question isn’t if consumers will rely on it, but how fast. (More)

SEASONAL INSIGHTS

Mother’s Day Spending Stays Elevated, But Growth Stalls

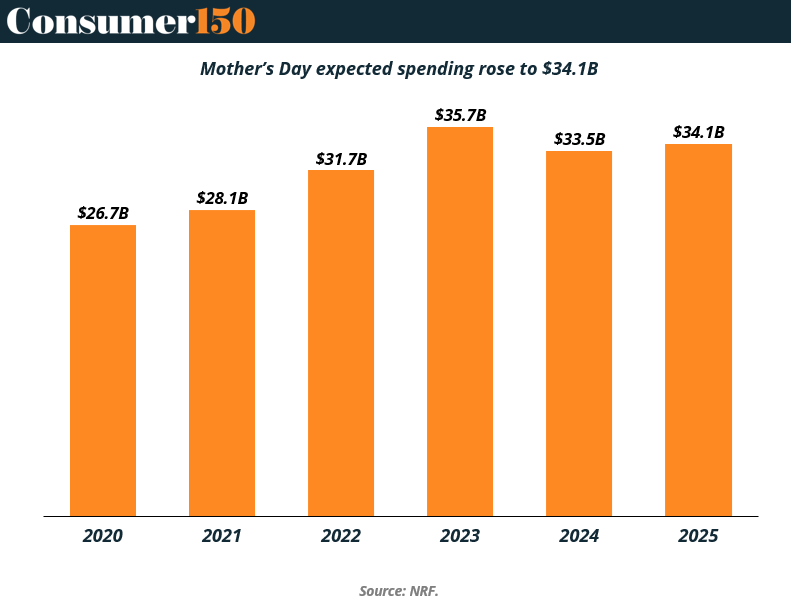

Consumers are still showing up for Mom, but the record-breaking momentum may have peaked. Mother’s Day spending in 2025 is projected to hit $34.1 billion, just shy of last year’s $35.7B high. That’s still a sizable increase from pre-pandemic levels ($26.7B in 2020), but it marks the second consecutive year of flat-to-declining growth.

The trend? Gifting fatigue meets economic caution. Even as shoppers continue to prioritize experiences, floral arrangements, and high-impact gestures, they’re doing so with slightly tighter wallets. It’s a reminder that peak sentiment doesn’t always equal peak spend, especially when inflation-adjusted values come into play.

Still, crossing the $30B line for three straight years proves Mother’s Day has become a retail tentpole, not just a seasonal spike.

CONSUMER BEHAVIOR

Splurge Season: Where Consumers Indulged in March

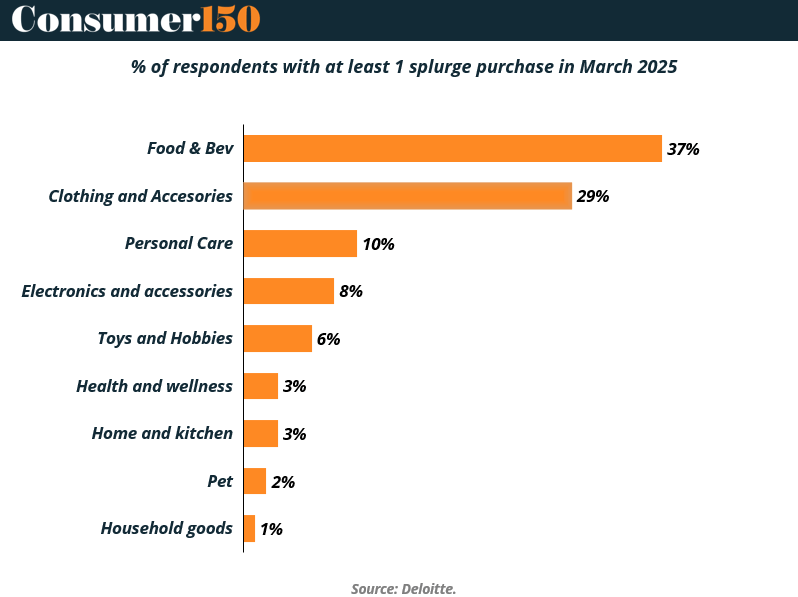

March 2025 painted a clear picture of where consumers are willing to treat themselves—and food came out on top. According to a survey by Deloitte, 37% of respondents reported at least one splurge purchase on food and beverages, followed by 29% on clothing and accessories. In a time of cautious spending, small indulgences are alive and well, just not in big-ticket categories.

Personal care (10%) and electronics (8%) made the cut, but items like health & wellness, home goods, and even pet products saw minimal splurge activity, each below 3%. The data suggests consumers are prioritizing immediate gratification and wearable self-expression over functional or delayed-utility items.

Call it affordable luxury or micro-splurging, but if you’re selling joy in a bottle or a new outfit for the weekend, March was your month. For everyone else: better luck in Q2. (More)

INTERESTING ARTICLES

"The biggest challenge after success is shutting up about it."

Criss Jami