- Consumer 150

- Posts

- The Holiday That's Quietly Becoming a Retail Benchmark

The Holiday That's Quietly Becoming a Retail Benchmark

It’s Thursday and today we’re diving into the $34B Mother’s Day spending spree in the US, DoorDash’s $3.9B acquisition of Deliveroo to fuel its global expansion, rising tariffs turning Mother’s Day flowers into a luxury, and the plant-based milk market surging to $32B worldwide.

Good morning, ! It’s Thursday and we’re diving into the $34B Mother’s Day spending spree in the US, DoorDash’s $3.9B acquisition of Deliveroo to fuel its global expansion, rising tariffs turning Mother’s Day flowers into a luxury, and the plant-based milk market surging to $32B worldwide.

First time reading? Join the investors and executives shaping the future of consumer markets. Subscribe here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

Mother’s Day, A Steady Growth Opportunity for Retail and Gifting Sectors

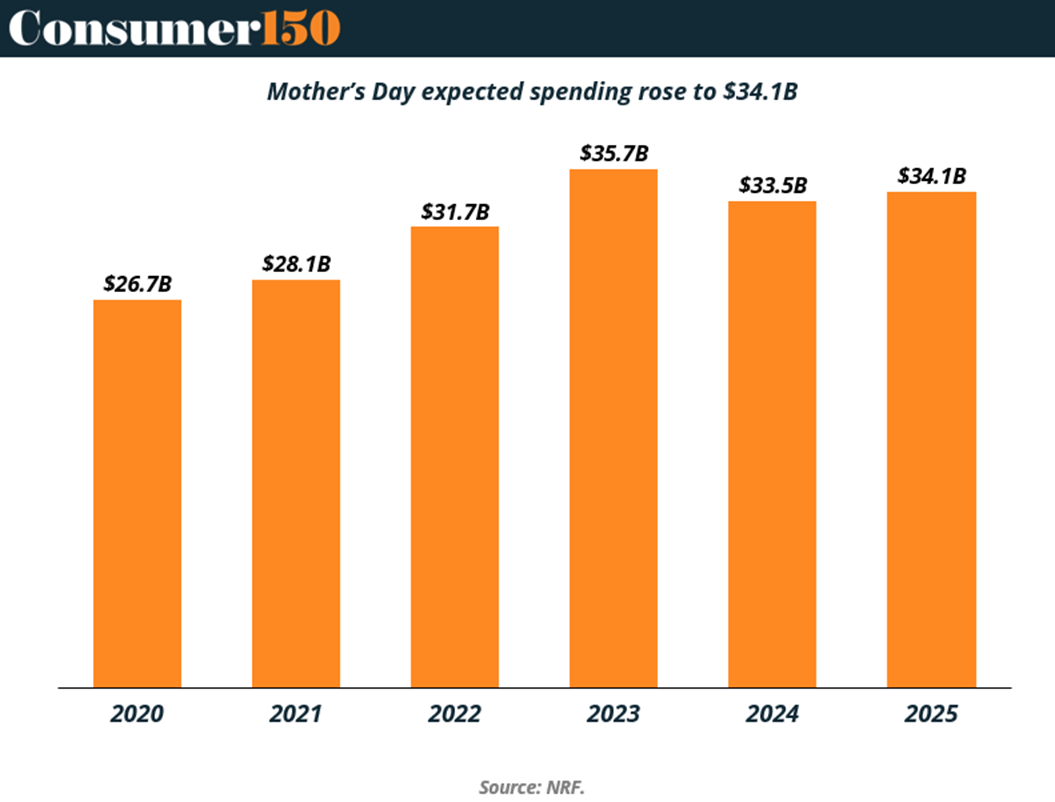

Mother’s Day is no longer just a sentimental holiday, it’s a multi-billion-dollar economic event with growing significance for retail, e-commerce, and gifting-focused businesses. In 2025, U.S. consumers are expected to spend $34.1 billion on Mother’s Day-related purchases, up from $26.7 billion in 2020, marking a nearly 28% increase over five years. This steady growth positions the holiday as a key barometer for discretionary spending, particularly in personal services, specialty retail, and experiential gifting.

Per capita spending is also trending upward, reaching an expected $259 per shopper in 2025, well above the $196.50 reported in 2019. This reflects a broader shift toward premiumization and personalization, with more consumers opting for higher-ticket items, curated bundles, and experience-based gifts.

Timing is everything: 70% of shoppers make their Mother’s Day purchases at least two weeks in advance, creating a tight, predictable window for marketing and fulfillment. Retailers that align product drops, digital campaigns, and inventory around this shopping pattern stand to benefit most.

Bottom line: Mother’s Day spending offers more than seasonal upside, it’s a strategic lens for evaluating consumer resilience, retail readiness, and brand momentum across key categories. (Read or Listen to the Full Article)

TREND OF THE WEEK

Plant-Based Milk: Growing Globally, Shrinking Locally

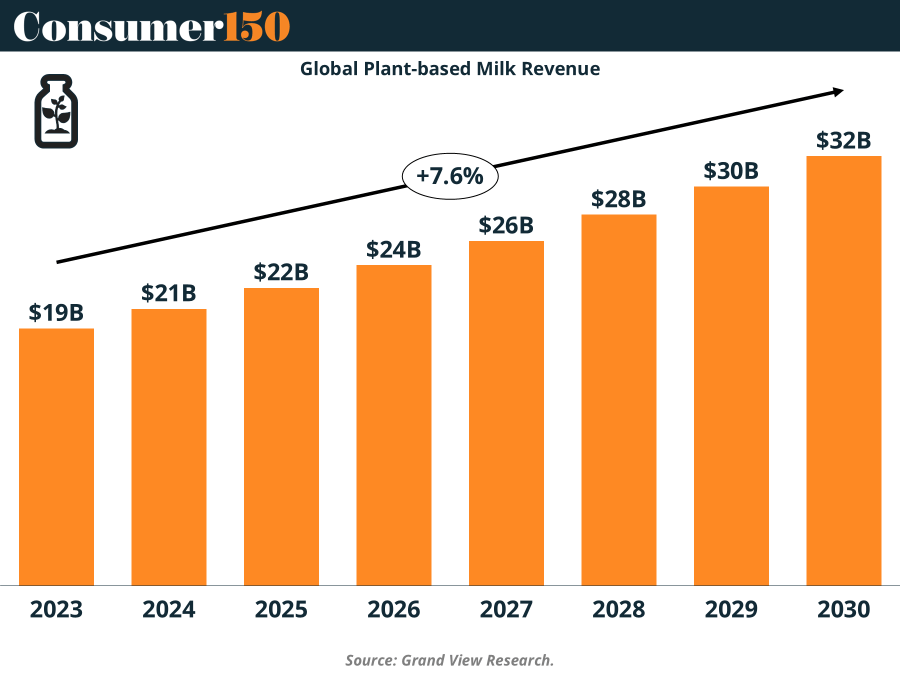

Globally, plant-based milk is on a tear—climbing from $19B in 2023 to an expected $32B in 2030, thanks to health trends, vegan diets, and eco-marketing. But in the U.S., the alt-milk party just hit a wall: total sales are down, and almond, soy, and even oat milk are losing steam. The new winner? Lactose-free dairy, growing despite being 3.7% more expensive. Maybe the next milk war won’t be about plants—it’ll be a rematch with better enzymes. (More)

PRESENTED BY KEEPCART

Prevent coupon abuse, protect your profits

KeepCart: Coupon Protection partners with D2C brands like Quince, Blueland, Vessi and more to stop/monitor coupon leaks to sites/extensions like Honey, CapitalOne, RetailMeNot, and more to boost your DTC margins

Overpaid commissions to affiliates and influencers add up fast - Get rid of the headache and revenue losses with KeepCart.

ECOMMERCE

D2C’s Double Act: Digitally Native Brands Grow, But Established Giants Still Rule

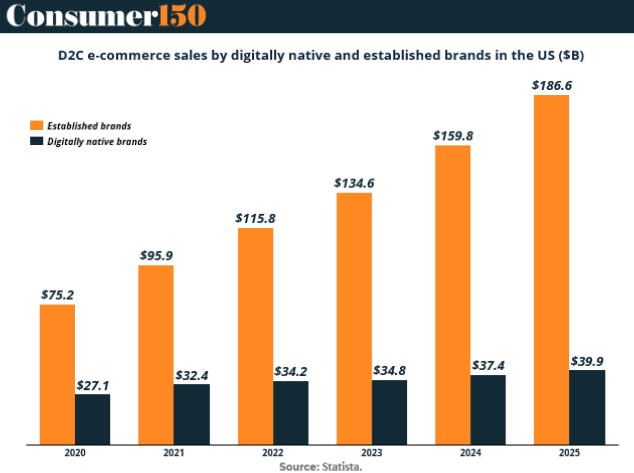

Direct-to-consumer (D2C) e-commerce is booming in the U.S. but it’s the established brands that are raking in the lion’s share of dollars. D2C sales from legacy players like Nike and Levi’s are projected to hit $186.6B by 2025, more than 4.5x higher than digitally native brands, which are expected to reach $39.9B.

Yet the digitally native crowd, think Warby Parker, Glossier, and Allbirds, isn’t standing still. Their sales are growing steadily, from $27.1B in 2020 to $39.9B in 2025, carving out relevance with community-building, personalization, and agility that incumbents struggle to replicate. Still, scale and trust remain the most for legacy names, who are rapidly optimizing D2C channels post-pandemic.

For investors and strategics, the story here is hybridization. Winning the D2C race means combining the nimbleness of startups with the infrastructure of big retail. The brands that bridge that divide will be the ones setting the tone in 2025 and beyond.

DEAL OF THE WEEK

Big Bite in the UK: DoorDash Acquires Deliveroo for $3.9B

DoorDash is skipping the side dishes and going straight for the main course with its $3.9B all-cash acquisition of Deliveroo, gobbling up a 44% premium over the April 4 close. This cross-continental play adds Deliveroo’s footprint in nine countries, including the UK and Singapore, and boosts DoorDash’s reach to over 1 billion consumers globally. CEO Tony Xu’s global ambitions are clear: it’s not just about food—it’s about ecosystem control. With this move, DoorDash doesn’t just scale—it sharpens its knife for a potential duopoly with Uber Eats across major markets. Deal is set to close by Q4, pending regulatory digestion. (More)

PRESENTED BY SCOTTS TENNIS

EXPERIENCE | Where Tennis Meets Strategy

Two luxury events, one clear takeaway:

Elite experiences are becoming a new channel for high-level networking and brand alignment in the PE ecosystem. Check out two we highly recommend:

The Stuttgart Experience (June 12–15) places you at the center of the BOSS Open with VIP access, fine dining, and a once-in-a-lifetime ProAm match alongside Tommy Haas.

Off the court, expect curated cultural perks—private museum tours (Porsche, Mercedes-Benz), and a tailored shopping session at the BOSS flagship in Metzingen.

The Mallorca Championships (June 25–28) double down on tennis and tranquility. Watch world-class players from premium seats, tour behind-the-scenes with tournament insiders, and cruise the Balearic coast by private boat.

The itinerary includes a visit to the Rafa Nadal Academy and a rare audience with Toni Nadal—plus a stay at the 5-star Kimpton Mallorca.

More than a hospitality package, each experience creates space for meaningful conversations, strategic connections, and lasting impressions—on and off the court.

To learn more or reserve your spot, email: [email protected]

Presented by The Gift Card Cafe

Gift cards aren’t lazy. They’re dominant.

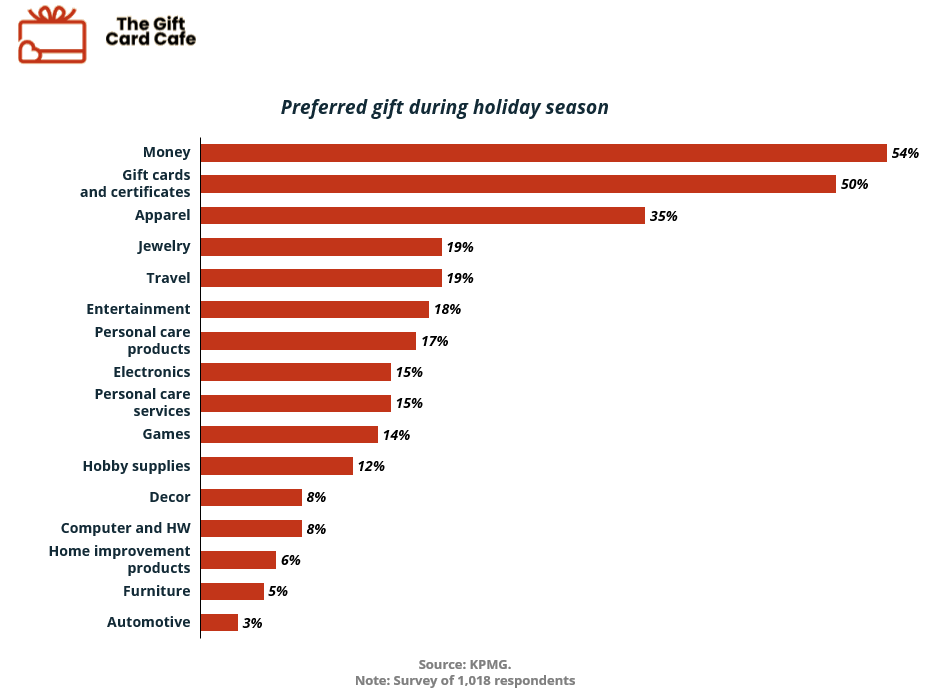

50% of consumers prefer gift cards over actual products this holiday season — putting them just behind cash (54%) and well ahead of apparel (35%), per KPMG. That’s not a fluke. It’s a shift in values: flexibility > surprise.

For retailers, this is permission to stop hiding gift cards near checkout. Make them premium. Beautiful. Front-and-center. Add reminders, bundles, and yes, seasonal FOMO.

Gift cards are now currency with branding — a loyalty play wrapped in festive packaging. If cash is king, gift cards are the heir apparent. (More)

CONSUMER TECH

Your House Now Has a Boss (Three, Actually)

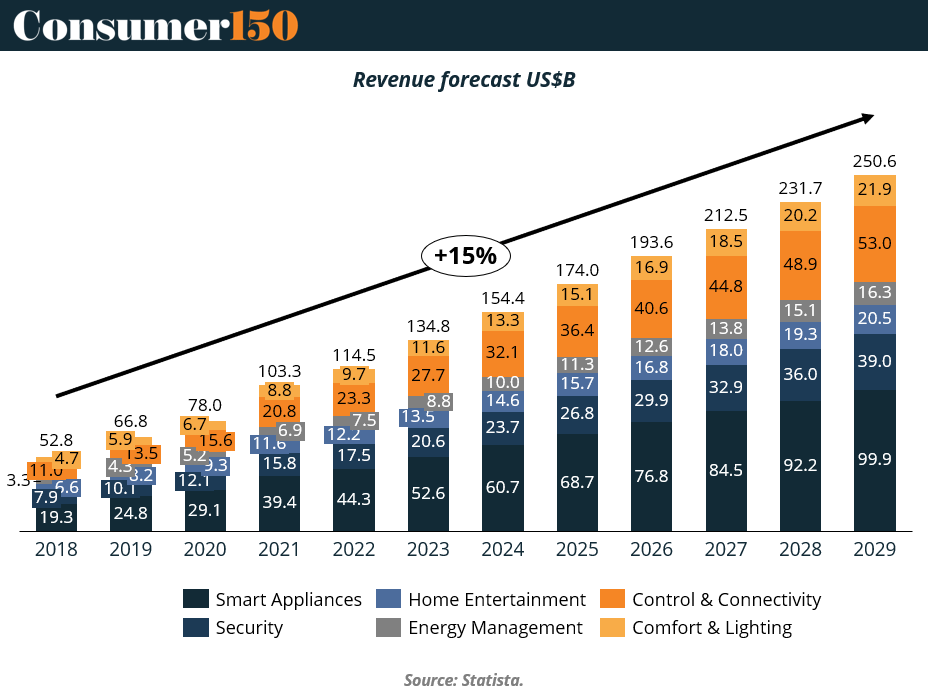

Smart home revenue is projected to hit $250.6B by 2029, growing 15% annually. But this isn’t a gadget arms race—it’s a war over who controls your living room. Amazon (30% share) leads the pack with Alexa, followed by Google (20%) and its Nest ecosystem, and Apple (6%), playing the long game with privacy-led HomeKit. The battleground? User lock-in, not new devices. Only 63% of tech sales in 2024 came from recent product launches (vs. 75% in 2021). Meanwhile, household adoption keeps rising, especially for smart appliances and security systems, which are set to double by decade’s end. The future of consumer tech isn’t about what you buy—it’s about who you’re married to. (More)

TOGETHER WITH LEVANTA

Grow smarter: Reallocate ad spend, boost ROAS with affiliates

Ad spend keeps climbing. ROAS? Not so much.

The smartest Amazon sellers aren’t spending more—they’re spending smarter.

The Affiliate Shift Calculator models what could happen if you reallocated a portion of your ad budget into affiliate marketing.

Built for sellers doing $5M+ on Amazon.

SEASONAL INSIGHTS

Roses Are Red, Tariffs Are Steep

This Mother's Day, flowers are the new luxury good. A 10% tariff on imported stems has added $25 million in costs to the U.S. floral market, with Colombian and Ecuadorian blooms (80% of U.S. supply) now facing up to 16.8% tariffs. Toss in 145% duties on Chinese vases, bad weather in the Netherlands hiking tulip bulb prices 25%, and you’ve got florists charging $20+ per bouquet—and still sweating margins. Demand, oddly enough, hasn’t wilted.

The industry’s pivot? Smaller bouquets, more local sourcing, and a growing headache over policy. The takeaway: What was once a gesture of affection is now a case study in macro meets microeconomics.

CONSUMER BEHAVIOR

Health-First Hydration: LATAM’s Functional Beverage Boom

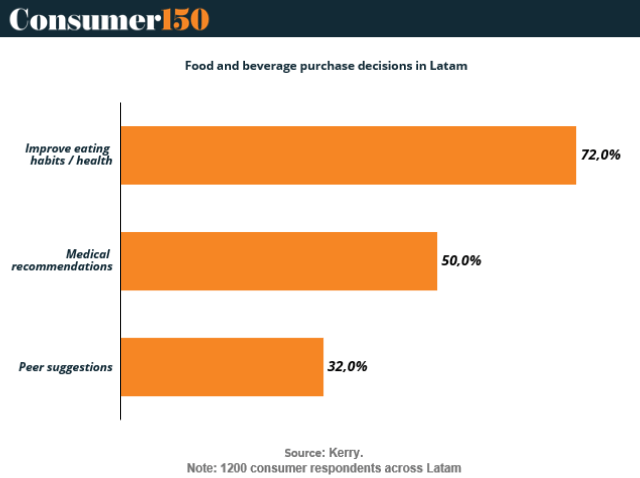

In Latin America, the beverage aisle is undergoing a health-driven makeover. According to a survey by Kerry, 72% of consumers cite improving eating habits and health as their top motivator for food and beverage purchases, followed by medical recommendations (50%) and peer suggestions (32%). What’s more, functional beverages are becoming part of daily rituals, from energy-boosting morning sips to calming nighttime blends.

This shift isn’t just about flavor, it’s about function, transparency, and trust. Consumers increasingly demand drinks that align with their wellness goals, backed by science and clean ingredient labels. For brands, this means innovation isn’t optional, it’s the new baseline.

Expect targeted formulations that support immunity, cognition, digestion, and more to gain shelf space as the LATAM market matures into a wellness-led consumption cycle. (More)

INTERESTING ARTICLES