- Consumer 150

- Posts

- Mother’s Day, A Steady Growth Opportunity for Retail and Gifting Sectors

Mother’s Day, A Steady Growth Opportunity for Retail and Gifting Sectors

Mother’s Day has evolved far beyond a simple celebration of maternal bonds, it has become a pivotal event on the consumer calendar, one that increasingly captures the attention of investors and retailers alike.

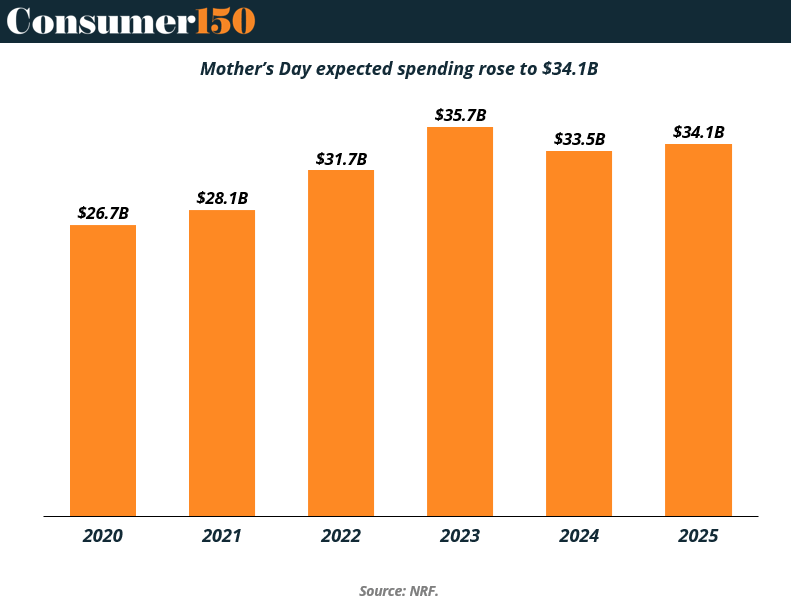

As shown in the chart above, total expected spending around Mother’s Day in the U.S. has grown substantially over the past five years, rising from $26.7 billion in 2020 to an anticipated $34.1 billion in 2025.

Even amid inflationary pressures and shifting consumer priorities, spending on Mother’s Day gifts, experiences, and services has remained resilient. The holiday provides a reliable annual bump for sectors such as jewelry, personal services, specialty retail, dining, and e-commerce, making it a valuable indicator of consumer sentiment and discretionary spending behavior.

The post-pandemic surge in 2023 to $35.7 billion reflected pent-up demand for personalized and meaningful celebrations, while the slight dip in 2024 and moderate rebound in 2025 suggests stabilization rather than volatility.

For investors, this consistency underscores the long-term value of companies that capitalize on seasonal gifting trends, particularly those that can innovate around experiences, curated products, and direct-to-consumer models. As generational preferences shift and omnichannel retail matures, Mother's Day remains a timely lens through which to assess the health and agility of consumer brands.

Investor takeaways for investors

Consistent Upward Trend: Since 2020, Mother's Day spending has grown by nearly 28%, showcasing its strength as a recession-resilient event on the retail calendar.

2023 Peak and Market Recalibration: The record $35.7B in 2023 likely reflects a post-pandemic splurge; the subsequent dip in 2024 and partial rebound in 2025 signal a market adjusting to more sustainable growth.

Opportunities in Experience-Driven Spending: As consumers shift from goods to experiences, investors should watch companies offering spa packages, travel, dining, and experiential gifting.

E-commerce and Personalization Edge: Brands that offer customizable or subscription-based gifts through digital platforms continue to outperform during gifting holidays.

Indicators of Consumer Health: Mother's Day spending trends provide early insight into Q2 consumer behavior, strong numbers can hint at robust seasonal sales performance.

Sector Winners: Specialty retail, luxury goods, florists, greeting cards, and personal services are traditional beneficiaries, consider ETFs or equities with exposure in these verticals.

Generational Dynamics: Millennials and Gen Z increasingly drive spend with an emphasis on ethical gifting and sustainability—favor companies aligning with these values.

What Consumers Plan to Buy: Strategic Insights from Mother’s Day Gifting Trends

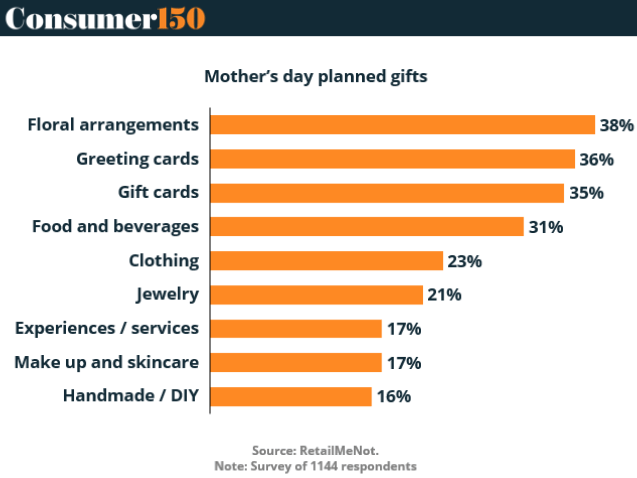

Mother’s Day is not only a time for heartfelt gestures but also a key barometer of consumer preferences and evolving retail trends. The data above, drawn from a survey of over 1,100 respondents, sheds light on the most popular gift categories planned for this year. While traditional items like floral arrangements (38%), greeting cards (36%), and gift cards (35%) remain dominant, there’s a notable expansion into food experiences, clothing, personal care, and DIY gifts.

This diversification underscores how consumers are blending classic expressions of appreciation with more personalized and practical items, a shift that reflects broader consumer behavior across the retail landscape.

For investors, this presents a multi-faceted opportunity. The persistence of traditional gifts supports steady demand for long-standing players in floriculture, paper goods, and gift card services, while the growing interest in experiential, wellness, and handmade products opens doors for niche brands, online platforms, and direct-to-consumer disruptors.

This chart offers a snapshot of consumer intent that can guide short-term investment plays and longer-term portfolio adjustments in sectors influenced by holiday-driven demand cycles.

Investor takeaways from chart

Resilient Core Categories: Flowers, greeting cards, and gift cards continue to dominate, indicating strong returns for businesses with reliable seasonal inventory and logistics.

Experience and Wellness Growth: Though smaller in share, experiences/services (17%) and skincare (17%) point to emerging categories with growth potential, particularly among younger demographics.

Food and Beverage Momentum: At 31%, edible gifts show strong engagement—favorable for gourmet brands, meal kits, and local food delivery services.

Clothing and Jewelry Still in Play: Apparel (23%) and jewelry (21%) maintain relevance, benefiting both luxury and mid-tier retailers with strong Mother’s Day campaigns.

Handmade & DIY Appeal: The 16% interest in handmade gifts highlights consumer appetite for personalized and sustainable products—investors should watch platforms like Etsy and artisanal marketplaces.

Omnichannel Readiness Matters: Retailers that provide seamless online and in-store experiences stand to gain most, particularly in highly giftable categories like flowers and cards.

Brand Discovery Window: Holidays like Mother’s Day often serve as a consumer's first interaction with a brand; strong execution can yield long-term loyalty and retention.

Per Capita Spending on Mother’s Day: A High-Value Consumer Signal

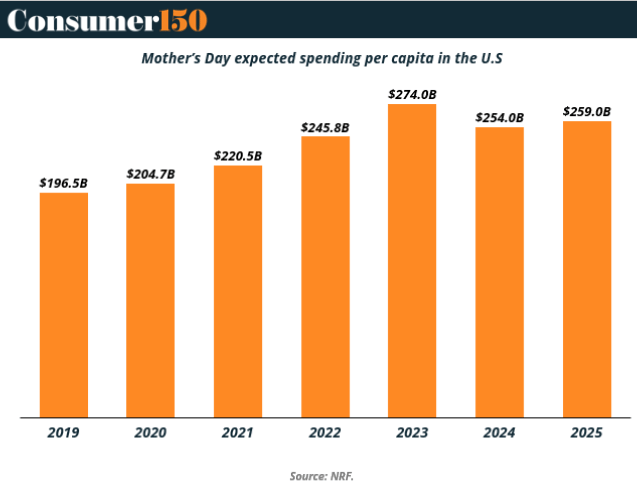

Beyond total dollar figures, per capita spending on Mother’s Day offers a sharper lens into individual consumer behavior, highlighting not just how much Americans are spending, but how much they’re willing to spend per person. As the chart illustrates, this figure has grown from $196.5 in 2019 to an anticipated $259.0 in 2025, with a notable post-pandemic peak of $274.0 in 2023.

The upward trend, even with slight year-over-year adjustments, demonstrates that consumers are consistently assigning greater value to this occasion. Whether it's due to emotional connections, the normalization of higher price points, or the rising popularity of premium and experience-based gifting, the consistent rise in individual spend suggests deeper wallet share opportunities for targeted retail and service providers.

For investors, rising per capita spending should be viewed as a signal of pricing power and premiumization potential in Mother’s Day-adjacent sectors. Consumers aren’t just spending more overall, they’re spending more per person, which favors businesses offering higher-ticket items, bundled services, or curated gift experiences.

This metric is particularly valuable when analyzing brand elasticity and the effectiveness of upselling strategies. In a climate where consumer spending is being closely watched, Mother’s Day trends provide a useful proxy for discretionary confidence and brand differentiation.

Investor takeaways for investors

Strong Growth Since 2019: A 32% increase in per capita spend over six years highlights robust consumer commitment to Mother’s Day purchases, even amid inflationary pressures.

Post-Pandemic Premiumization: The $274 peak in 2023 indicates a consumer mindset shift toward higher-value, meaningful gifting—favorable for luxury and experience-led brands.

Slight Corrections, Still Elevated: Though 2024 saw a dip, the 2025 rebound to $259 shows stabilization at a higher baseline, suggesting these spending levels are becoming the norm.

Ideal for High-Margin Offerings: Jewelry, spa services, tech gadgets, and upscale food/gift packages are well-positioned to capture increased per-customer spending.

Experience + Tangible Gifting Mix Wins: As consumers spend more per recipient, hybrid offerings (e.g., gift + experience, subscription boxes) are emerging as strong investment themes.

DTC Brands and E-commerce Benefit: Higher per capita spend supports the unit economics of direct-to-consumer models, especially those that personalize or bundle products.

Consumer Sentiment Proxy: Tracking per capita spend around gifting holidays like this provides early clues about discretionary spending strength in the broader economy.

Timing Is Everything: Understanding the Gift Buying Window for Mother’s Day

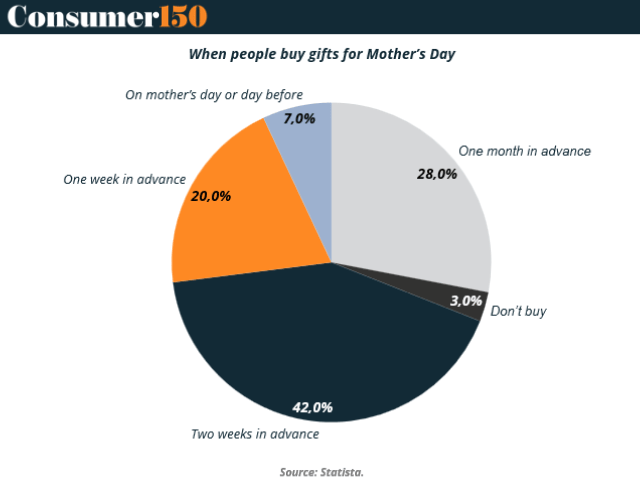

While what consumers buy for Mother’s Day is important, when they buy may be just as critical for retailers and investors. According to the chart above, a majority of shoppers (42%) make their purchases two weeks in advance, while another 28% do so a month ahead. That means 70% of gift-buying decisions are locked in well before Mother’s Day weekend, creating a tight but predictable window for marketing, inventory, and promotional planning.

Meanwhile, 20% buy one week prior, and only 7% wait until the last minute, on Mother’s Day itself or the day before. This pattern highlights the importance of proactive targeting, inventory visibility, and early promotional campaigns for brands hoping to maximize seasonal revenue.

For investors, the strategic implications are clear: the brands best positioned to capture value during Mother’s Day are those with efficient early demand generation, digital campaign agility, and strong mid-season fulfillment capabilities. It also reinforces the relevance of digital-first and omnichannel brands that can deliver value quickly, both logistically and emotionally, through streamlined experiences.

Whether it's flowers, services, or digital gift cards, being visible during the two-week lead-in is paramount. Understanding consumer timing habits can also inform broader holiday marketing strategies across the calendar year, offering repeatable, scalable insights across sectors.

Investor Takeaways:

Two Weeks Out Is Prime Time: 42% of consumers make purchases during this window—retailers must front-load advertising and stock availability accordingly.

Extended Planning Window: 28% of consumers shop one month in advance, which supports early-season product drops and soft marketing launches.

Short-Term Opportunities Exist: While smaller, the 7% of last-minute shoppers still present an important segment for digital gift cards, express delivery, and local services.

One-Week Surge Still Matters: With 20% buying during the week before, brands should maintain stock and run targeted re-engagement ads during this phase.

Customer Acquisition Efficiency: Knowing when shoppers convert allows brands to time their digital spend, reducing CAC and maximizing ROAS.

Omnichannel Advantage: Retailers with both online and brick-and-mortar channels can accommodate both planners and procrastinators.

Signal for Broader Holiday Trends: This timing pattern is a repeatable model across holidays, investors should favor businesses that can optimize around fixed shopping windows

Conclusion

Mother’s Day continues to serve as a dependable anchor point in the annual consumer spending cycle—one that blends emotional significance with economic opportunity. The steady rise in total and per capita spending highlights the event’s resilience across market conditions, making it a reliable litmus test for discretionary behavior and retail agility. Even as economic headwinds persist, the willingness of consumers to allocate more per recipient each year demonstrates pricing power and a clear trend toward premiumization.

For investors, the holiday’s value lies not just in its revenue spike, but in the strategic signals it provides across multiple dimensions: early gift-buying timelines that support targeted marketing strategies; evolving preferences toward experiences, wellness, and personalization; and sectoral winners that consistently benefit from holiday-driven demand. Companies positioned in specialty retail, gifting platforms, e-commerce, luxury services, and omnichannel logistics are especially well-aligned to capture value during this period. As such, Mother’s Day spending trends should be viewed not only as a seasonal opportunity, but as a forward-looking indicator of consumer sentiment, brand relevance, and operational execution in the broader retail landscape.

Sources & References

NRF. Mother’s Day Data and Trends. https://nrf.com/research-insights/holiday-data-and-trends/mothers-day

NRF. Mother’s Day Spending. https://nrf.com/media-center/press-releases/mother-s-day-spending-expected-to-reach-34-1-billion

Statista. When consumers typically purchase Mother’s Day gifts. https://www.statista.com/statistics/1383340/planned-shopping-period-for-mothers-day-usa/

eMarketer. US Mother’s Day digital habits. https://www.emarketer.com/content/us-mothers-2024

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.