- Consumer 150

- Posts

- The $461B Global Coffee Market | Frappuccino M&A | LATAM Prepaid Cards

The $461B Global Coffee Market | Frappuccino M&A | LATAM Prepaid Cards

Freeman Spogli joins the $461 billion party of Global Coffee Market, appliances saw a 135% year over year growth in the Amazon Prime Day.

Good morning, ! This week we’re examining the Global Coffee Market, the consumer confidence index in the OECD countries, and the awareness of generative AI in consumer shopping.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge! Share link.

— The Consumer 150 Team

DATA DIVE

The Brew Behind the Billions

Coffee isn’t just a morning ritual — it’s a $461B global market, with demand rising across formats and regions. While roast coffee dominates (70% of market value), instant formats still hold their own in high-growth regions like Asia and Latin America. South America produces over half the world’s coffee, led by Brazil’s climate rebound. Meanwhile, Vietnam’s robusta engine and Colombia’s arabica edge show how both volume and quality shape trade flows. Price-wise? After a +26.8% spike from 2020 to 2025, inflation has cooled — but coffee remains sensitive to shocks, from climate to currency. Sip accordingly. (More)

TREND OF THE WEEK

Resilient Spending: Health as a Line Item

Consumers may be slashing spending across the board, but one category is still hitting the gym. Per new data, health and wellness is the least-impacted discretionary category, with spending only modestly reduced compared to other sectors. That’s not just a vibe—it’s a strategy. In fact, 79% of Gen Z cite mental health and 76% cite physical health as top life priorities. And nearly half of U.S. adults are still regularly buying supplements and vitamins, per KPMG. So, if you’re a brand not tied to this space? You might want to start showing up like you are. (More)

PRESENTED BY LEVANTA

Get Featured by Publishers Driving Holiday Amazon Sales

This holiday season, top publishers are hand-selecting Amazon brands for gift guides, newsletters, reviews, and more — sending high-intent shoppers directly to storefronts.

Levanta is partnering with these publishers to connect them with a select group of 7–9 figure brands ready to scale.

ECOMMERCE

eCommerce Corner: Prime Day’s Power Categories

Amazon Prime Day 2025 didn’t just break records—it reshuffled the eCommerce priority board. According to Adobe, Appliances led all category growth, up a staggering 135% YoY, followed by Electronics (+95%), and Tools & Home Improvement (+85%).

While Apparel and Toys saw more modest lifts (+45% and +35%, respectively), the spike in big-ticket categories suggests consumers are no longer just looking for impulse buys—they’re timing major purchases around discount events.

Strategically, this signals a shift in the role of eCommerce: from convenience channel to conversion engine for high-consideration goods. Retailers investing in bundling, financing, and content-rich PDPs (product detail pages) are poised to ride this momentum.

Why it matters: For investors and operators, Prime Day is no longer about unit volume—it’s about margin. The winners are brands that can anchor demand in durable goods while optimizing the checkout experience for big-ticket conversions. (More)

DEAL OF THE WEEK

Philz Joins the Frappuccino Wars

Freeman Spogli just dropped $145M to acquire Philz Coffee, the cult-favorite San Francisco chain with a 77-store footprint and a caffeine-fueled expansion plan; landing in the $461.3B Coffee Market. No layoffs, no closures—just a pipeline of new store openings over the next 24 months and a mysterious thank-you bonus for staff. The PE firm brings deep foodservice cred (see: El Pollo Loco, First Watch) and gets a CEO in Mahesh Sadarangani, who’s rolling 100% of his after-tax proceeds back into the biz. For Freeman, this isn’t a sleepy coffee bet—it’s a swing at scaling a brand that’s long punched above its weight. Philz’s pour-over purism meets private equity discipline. (More)

TOGETHER WITH PACASO

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

LATAM's Prepaid Boom: Not Just for Teen Allowances Anymore

Prepaid cards and digital wallets are having a moment in Latin America—and no, it's not just for sending your nephew birthday money. With 13.9% annual growth, the sector is on pace to hit $95B by 2025. Countries like Argentina and Brazil are leading the charge, fueled by fintech startups and smartphone ubiquity. In Mexico, the government is going all-in, using prepaid cards for social programs. Meanwhile, Colombia’s Rappi is bundling payment cards into its SuperApp, and Chile is pushing prepaid for e-commerce. The result? A prepaid-fueled leap toward financial inclusion—and a turf war brewing between Visa, Mastercard, and scrappy local fintechs.

The bottom line: For consumer brands and platforms, prepaid is becoming the fastest on-ramp to engage LATAM’s rising digital middle class—especially the unbanked. Ignore this market at your own wallet’s peril. (More)

CONSUMER TECH

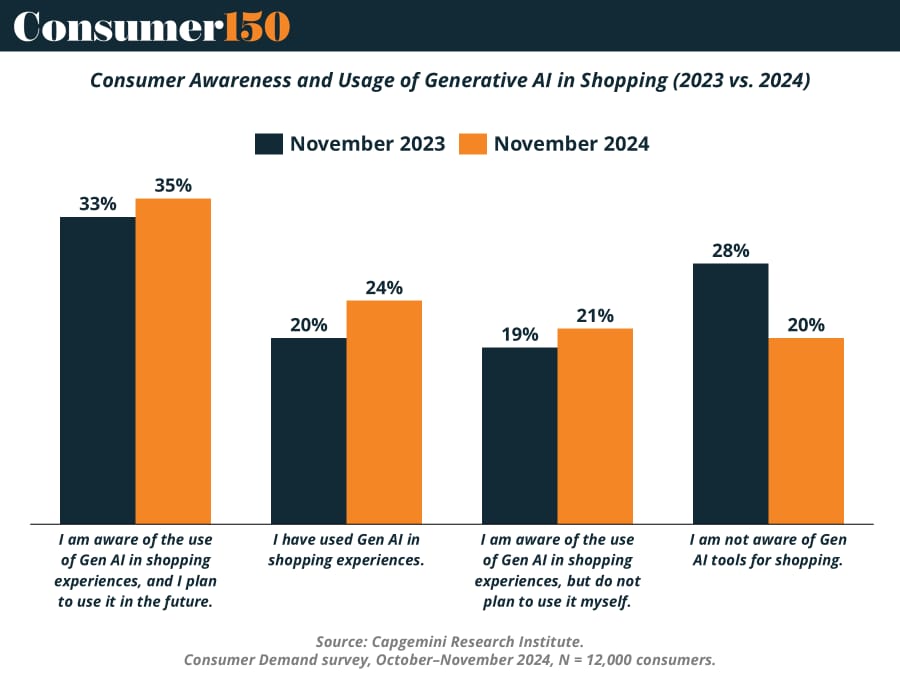

1 in 4 Shoppers Use Gen AI. You In?

Generative AI is becoming your favorite store associate — even if you haven’t noticed. A new Capgemini survey finds 24% of consumers now use Gen AI during shopping, up from 20% a year ago. That includes everything from virtual try-ons to smart product recs. Another 35% plan to jump in, signaling a steady shift from curiosity to checkout.

Retailers aren’t sitting still: they’re embedding AI into search, personalization, and customer service. Still, 20% of shoppers remain unaware of the tech altogether. But that gap’s closing fast.

The takeaway? The Gen AI conversation has evolved. It’s less “What is this?” and more “What can it do for me?” Whether that leads to trust or tool fatigue will define the next wave. (More)

CONSUMER BEHAVIOR

Confidence Check: Consumers Are Still Playing Defense

Consumer confidence across OECD countries remains stuck in a low-grade malaise. While sentiment crept upward in early 2025, it’s still below the 100 baseline—meaning more people feel uneasy than upbeat. The culprits? High food and energy prices, simmering political discontent, and growing uncertainty around trade policies. As a result, consumers are prioritizing essentials, delaying big purchases, and pushing for digital transparency.

Think: more budgeting apps, fewer checkout tricks. In short, this is no post-COVID euphoria—it’s a grit-your-teeth recovery, with savings, caution, and fairness driving behavior. (More)

INTERESTING ARTICLES

"You build great companies by solving real problems."

Marcos Galperin