- Consumer 150

- Posts

- The $1B Beauty Bet, AI PC Busts, and Checkout Fatigue

The $1B Beauty Bet, AI PC Busts, and Checkout Fatigue

We’re digging into how personalization is reshaping consumer loyalty, why AI PCs are failing to win buyers, the $1B bet Elf is making on Hailey Bieber’s Rhode, and what abandoned carts say about price sensitivity in 2025.

Good morning, ! It’s Thursday and we’re digging into how personalization is reshaping consumer loyalty, why AI PCs are failing to win buyers, the $1B bet Elf is making on Hailey Bieber’s Rhode, and what abandoned carts say about price sensitivity in 2025.

Want to reach 350,000 executive readers? Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

Small Deals, Big Momentum in Consumer M&A

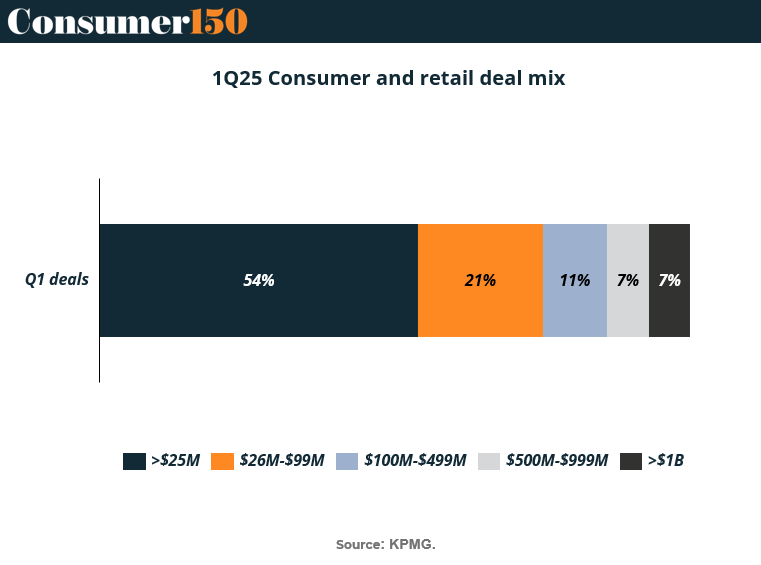

The 1Q25 consumer and retail deal mix signals a clear trend: smaller is stronger. According to KPMG, 54% of all deals came in under $25M, while deals over $500M made up just 14% of activity. Mega-deals aren’t dead, but they’re taking a back seat to bolt-ons, tuck-ins, and strategic early-stage bets.

This reflects a risk-adjusted shift in investor behavior. With interest rates still elevated and valuations recalibrating, acquirers are favoring capital-light, integration-ready plays that offer fast synergies and less execution risk. It's also a sign of growing interest in micro-brand ecosystems, niche DTC plays, and private-label scale-ups—especially in categories like wellness, functional food, and tech-enabled retail.

The presence of 7% of deals over $1B shows there’s still appetite for transformative moves—but the center of gravity has clearly moved down-market.

Bottom line: Don’t underestimate the sub-$100M segment. That’s where the real velocity—and the next wave of roll-up strategies—is building. (More)

PRESENTED BY BOXABL

The Father-Son Duo Rethinking Homebuilding

Home construction has been slow, costly, and inefficient for centuries. So in 2017, Paolo and Galiano Tiramani founded BOXABL to change that.

Where traditional homes take 7+ months to build, new homes can roll off BOXABL’s assembly line nearly every 4 hours. Equipped with plumbing, electrical, and HVAC, they’re ready to be delivered and lived in.

They have already built more than 700. That gained the attention of one of America’s top homebuilders, who also became investors.

Now, the Tiramanis are preparing for Phase 2, where modules can be configured into larger townhomes, single-family homes, and apartments.

And until 6/24, you can join as an investor for just $0.80/share.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

ECOMMERCE

The Checkout Cliff

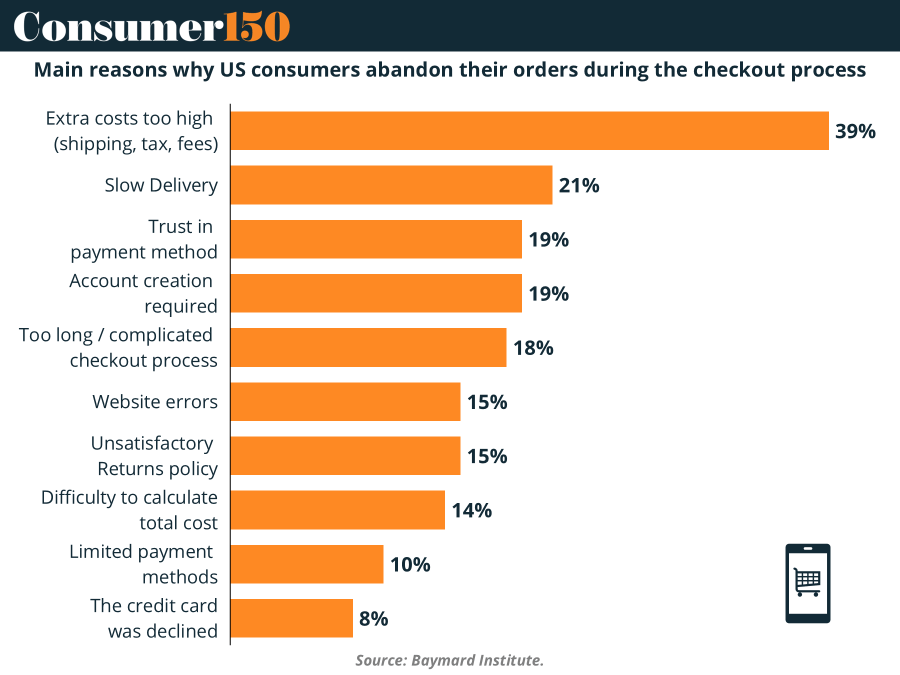

Nearly 70% of shopping carts are abandoned, and it’s not because consumers are indecisive—it’s because they're price sensitive and impatient. Top of the list? Extra costs like shipping and tax, which drive away 39% of users. This is classic elasticity behavior: even minor unexpected fees trigger a sharp drop-off in conversions. Want to avoid this? Bake the fees into your base price—what economists call price-inclusive framing.

Meanwhile, slow delivery, forced account creation, and clunky checkouts alienate younger consumers raised on 1-click dopamine. If it’s not fast, it’s canceled. In the age of TikTok and same-day Prime, friction equals failure. (More)

DEAL OF THE WEEK

Elf Beauty Bets $1B on Rhode—and the Future of Celebrity Brands

In a rare billion-dollar move, Elf Beauty has agreed to acquire Hailey Bieber’s Rhode for $1B, marking one of the most high-profile beauty deals since the pre-2022 M&A boom. The structure: $800M in cash and stock, plus a $200M earn-out, contingent on performance.

Launched in 2022, Rhode has achieved $212M in net sales with just 10 SKUs and a DTC-only model until recently. The brand’s first Sephora retail debut last week signals broader ambitions—and Elf is now backing that global rollout. Bieber will stay on as founder, expanding her role to CCO and strategic advisor.

Why this matters: In a cautious M&A landscape, Elf’s conviction signals renewed appetite for digitally native, community-first brands that can scale beyond celebrity. Rhode’s $400M in EMV in 2024 and 3.75% engagement rate underscore its earned attention—and now Elf wants to convert that into global shelf space and dollar share.

Bottom line: This deal isn’t just a beauty play—it’s a signal that substance-backed celebrity brands with operating discipline are back on the strategic radar.(More)

TOGETHER WITH BOXABL

A New Chapter in Home Construction

And it has 40,000+ investors excited about BOXABL. Their houses fold up and deliver, then set up in hours. How? They brought assembly-line manufacturing to housing, rolling new homes off the line in ~4 hours. Now, BOXABL’s preparing for Phase 2, combining modules into larger homes and apartments – and until 6/24, you can join.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

GIFT CARD CORNER

The Gift Card Glow-Up

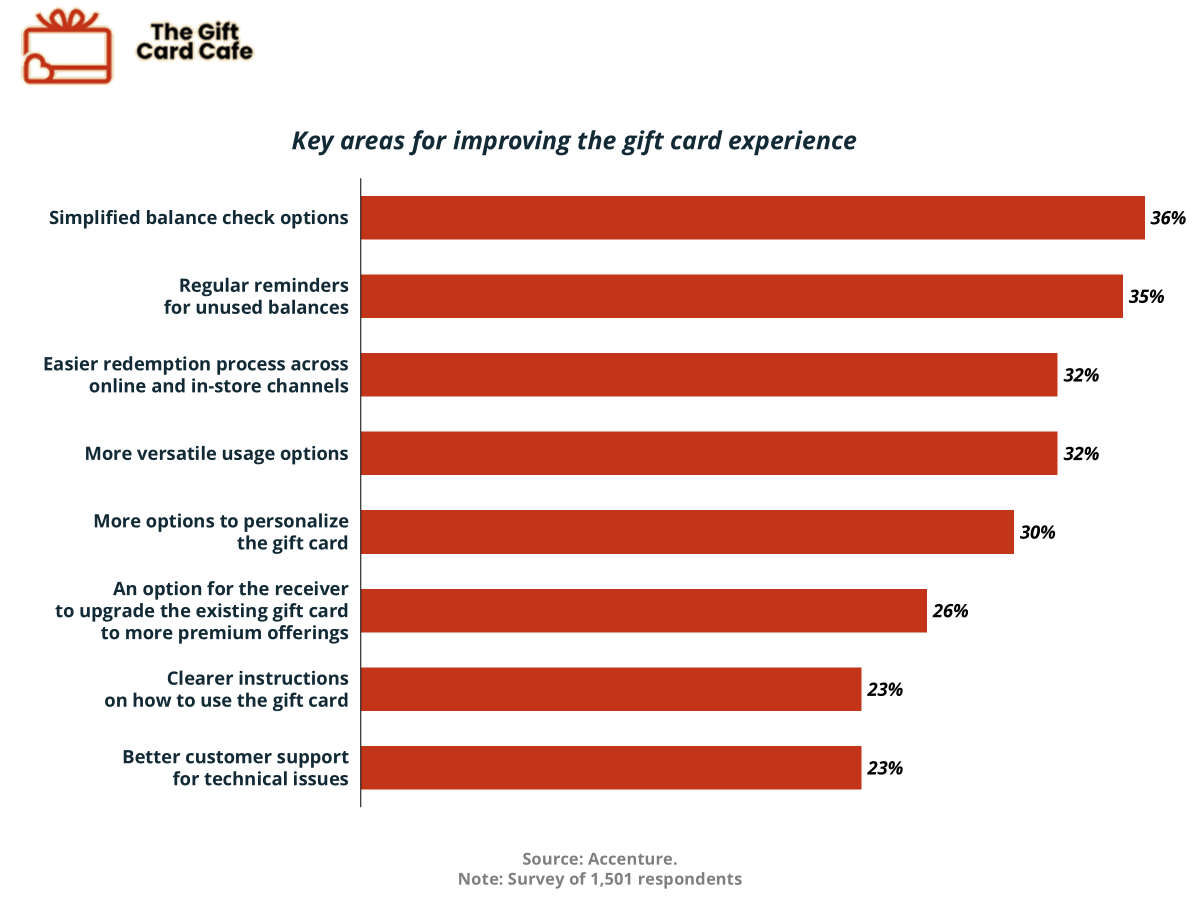

Gift cards: loved by CFOs, loathed by romantics. But the age of the last-minute plastic apology is over. Retailers are engineering a full glow-up—starting with frictionless redemption (think app integrations, balance reminders, and real-time tracking). The real innovation? Personalization at scale. Starbucks nails it: letting users add custom messages and visuals via its app, then redeem seamlessly across its digital and physical footprint. This isn’t just UX—it’s brand retention in disguise. The lesson: make gift cards feel less like IOUs and more like insider passes to curated experiences. (More)

CONSUMER TECH

AI PCs? Consumers Aren’t Buying the Hype (Yet)

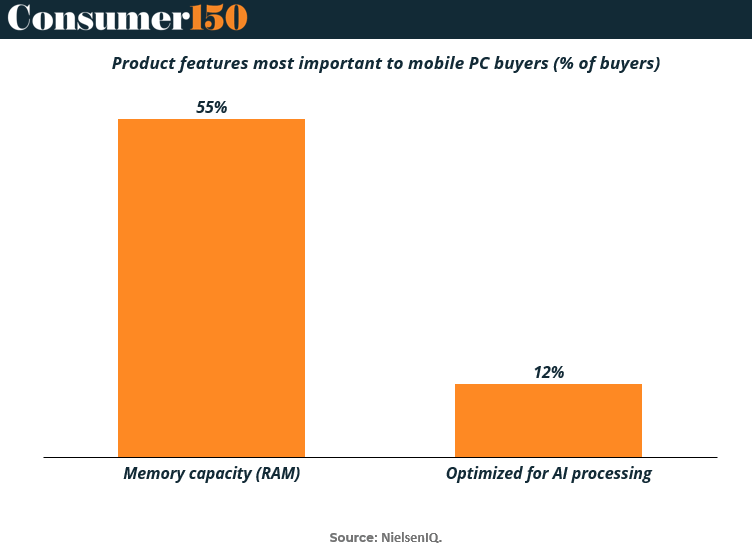

Despite the industry’s full-court press on AI-enabled laptops, buyers are signaling they still care more about the basics. According to NielsenIQ, 55% of mobile PC buyers rank memory capacity (RAM) as their top priority, while just 12% consider AI optimization important.

That’s a wide gap—and a reality check for OEMs betting on near-term consumer pull for AI-powered hardware. While chipmakers like Intel and Qualcomm are pushing “AI PCs” as the next frontier, the average buyer remains focused on speed, multitasking, and reliability—core functions powered by RAM, not neural engines.

For now, the AI hype cycle is outpacing consumer demand. Expect commercial and creative verticals to drive early adoption, but broad-based appeal will likely lag until use cases go mainstream and performance gains are tangible.

Bottom line: If you're backing AI PCs, don’t confuse PR buzz with purchase intent. Memory still sells. (More)

CONSUMER BEHAVIOR

The Science of Stickiness

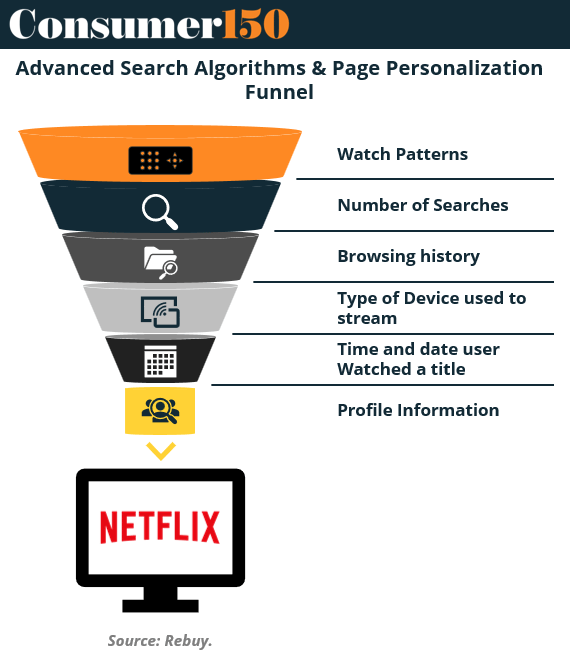

Personalization is no longer a UX flex—it’s a survival tactic. Fueled by behavioral economics, consumer-facing brands are going full Pavlov: narrowing choices, stoking emotional resonance, and creating habit loops that feel less like features and more like subconscious defaults. Netflix masters the algorithm, Spotify owns the emotional connection, and both prove that a "for you" experience isn’t about taste—it’s about psychological ownership. Still, Q1 2024 churn shows even the best can overfit. Personalization keeps users engaged, but filter bubbles and privacy fatigue are real risks. TL;DR? A well-personalized product feels like a friend. A badly done one feels like surveillance. (More)

INTERESTING ARTICLES

"Don’t be afraid to give up the good to go for the great"

John D. Rockefeller