- Consumer 150

- Posts

- The Behavioral Economics of Personalization: Why Tailoring Experiences Is No Longer Optional

The Behavioral Economics of Personalization: Why Tailoring Experiences Is No Longer Optional

In today’s hyper-competitive economy, consumer attention is the most precious—and fleeting—commodity.

The challenge for consumer-facing businesses isn’t just acquiring users; it’s keeping them. This is where personalization, driven by behavioral economics, becomes a vital differentiator. By leveraging insights into human psychology and decision-making, brands can tailor experiences that create habit loops, foster emotional resonance, and ultimately boost engagement and retention.

Behavioral Economics: The Science Behind Personalization

Behavioral economics blends psychology with economic theory to understand how consumers actually make decisions—often irrationally. One of the most pertinent concepts is choice overload. When consumers are bombarded with options, they’re more likely to abandon the decision altogether. Personalization mitigates this by narrowing choices to those most likely to resonate, thus reducing cognitive fatigue and increasing satisfaction.

The principle of reciprocity—the human tendency to return favors—also plays a role. When brands deliver a customized experience that feels uniquely “for me,” consumers are more inclined to reciprocate with continued engagement or loyalty.

Netflix and the Algorithmic Hook

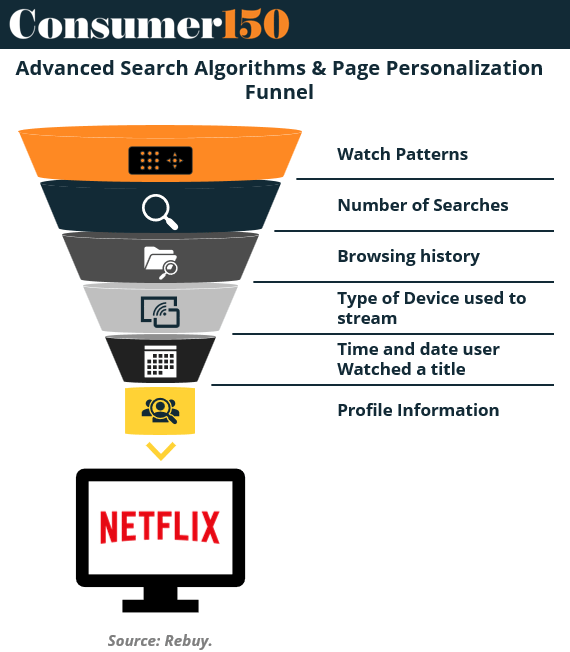

Nowhere is personalization more entrenched—and effective—than at Netflix. The streaming giant processes massive amounts of behavioral data, including watch patterns, search history, and even the time and device used to stream. This data feeds into an intricate personalization engine designed to deliver recommendations that feel effortlessly intuitive.

As illustrated, the personalization process is a funnel that narrows down user behavior into actionable insights. This granular approach ensures that every user’s home page on Netflix is unique, increasing the likelihood of continued engagement. According to Rebuy, this strategy is integral to Netflix’s ability to maintain relatively low churn rates compared to its competitors.

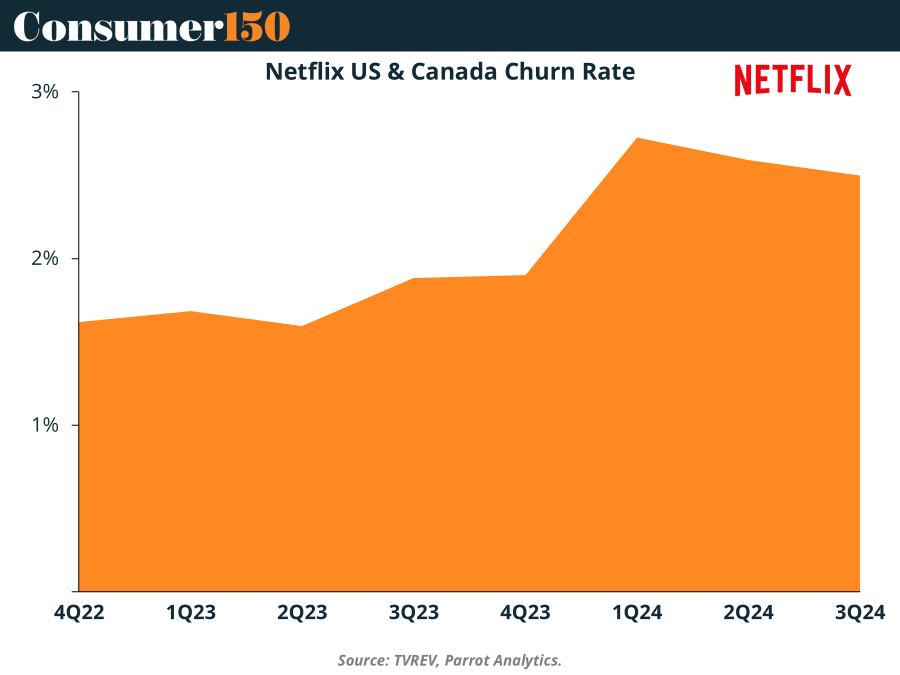

However, the recent uptick in churn in Q1 2024 suggests that even industry leaders can’t rest on algorithmic laurels.

The increase indicates potential fatigue or dissatisfaction, possibly due to generic content strategies or a lack of perceived value. This only underscores how critical continuous and evolving personalization efforts are to sustaining consumer loyalty.

Spotify: The Emotional Personalization Pioneer

Spotify offers another instructive case. While Netflix focuses on predictive algorithms, Spotify excels at emotional relevance. Through hyper-personalized playlists like Discover Weekly and Wrapped, the platform fosters a sense of emotional connection that transforms passive users into passionate advocates.

Spotify’s strategy taps into the endowment effect—a behavioral economics principle stating that people place higher value on things they feel ownership over. A playlist curated “just for you” feels owned, even if algorithmically generated. This psychological ownership boosts engagement and creates a stronger emotional tie to the platform.

Personalization as Risk Mitigation

From a business risk perspective, personalization reduces the volatility of user engagement. As highlighted in articles by TVREV and Pathmonk, consumers are neurologically wired to seek relevance and familiarity. Personalized interfaces and content remove friction points in the user journey and create the illusion of effortlessness—a key factor in retaining users long-term.

In subscription-based models, even marginal reductions in churn can have outsized financial impacts. For instance, Rebuy’s analysis shows that a 1% drop in churn can lead to a 12% boost in customer lifetime value. That’s a return on investment behavioral economics would deem a no-brainer.

Challenges and Ethical Considerations

Despite the clear benefits, over-personalization can backfire. When recommendations become too predictable or narrow, users may feel trapped in a “filter bubble.” Transparency in how data is collected and used is also critical. Ethical personalization—respecting user consent and data privacy—will be a defining trait of successful personalization strategies in the coming years.

Conclusion: Personalization is Economic Strategy

Personalization is no longer a feature—it’s a foundational business strategy grounded in behavioral economics. Companies like Netflix and Spotify demonstrate that understanding user behavior at both the macro and micro levels can drive not just engagement, but deep-rooted loyalty. In an age where customer acquisition costs are soaring and attention spans are shrinking, businesses that harness the power of personalized experiences will be the ones that thrive.

As consumer expectations evolve, personalization will cease to be a competitive advantage and become a basic expectation. The real winners will be those who not only meet this expectation but exceed it through empathy, data intelligence, and behavioral insight.

Sources & References

Medium. (2024). The Psychology Of Personalization: Understanding Customer Behavior. https://medium.com/%40ciente/the-psychology-of-personalization-understanding-customer-behavior-99449505a381

Rebuy. (2024). See What's Next: How Netflix Uses Personalization to Drive Billions in Revenue. https://www.rebuyengine.com/blog/netflix

Pathmonk. (2023). From Dopamine to Dollars: Exploring the Neurological Roots of Consumer Behavior. https://pathmonk.com/exploring-the-neurological-roots-of-consumer-behavior/

PM Repo. (2025). How Spotify’s Addictive Personalisation Engine Drives Monthly Active Users. https://www.thepmrepo.com/articles/how-spotifys-addictive-personalisation-engine-drives-monthly-active-users

TVREV. (2024). Hooked On Netflix: Analyzing The Streaming Giant’s Low Churn Rates. https://www.tvrev.com/news/hooked-on-netflix-analyzing-the-streaming-giants-low-churn-rates