- Consumer 150

- Posts

- Returns, Runways & Room Service: The Leisure Economy Decoded

Returns, Runways & Room Service: The Leisure Economy Decoded

Leisure, fashion, and e-commerce now share one story: disciplined growth and smarter spending. The post-pandemic consumer economy is learning to balance indulgence with intention.

Good morning, ! This week we’re diving into the Leisure, Travel and Hospitality PE market, consumer considerations when purchasing online goods, U.S expenditure on apparel and footwear, and how e-commerce businesses structure delivery and returns.

Want to advertise in Consumer 150? Check out our self-serve ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

Hotel & Leisure M&A: Quality Over Quantity

In H1’25, TLH M&A deal value surged 17.3% YoY to $10.8B, despite a near 19% drop in transaction count. The message? The market’s moved on from the land grab phase. Strategic acquirers now dominate, chasing luxury assets, tech platforms, and experiential brands. Case in point: Hyatt's $2.6B buyout of Playa and Apollo’s $1B tennis double fault (Madrid + Miami Opens). PE, once king, is sitting courtside—crunched by debt markets and pivoting to minority stakes. TL;DR: If your hotel pitch doesn’t include AI, luxury vibes, or a metaverse tie-in, take a number.

TREND OF THE WEEK

Dressed for Success, Not for Speed

Over the past 30 years, U.S. consumer spending on apparel and footwear has stitched together a quiet success story: a 2.86% CAGR, bouncing back post-pandemic and headed toward a $596.8B expected value for 2025 year end. Not flashy, but consistent. The pandemic drop in 2020 was sharp—but the rebound has been just as brisk, buoyed by premiumization, service expansion, and your average American finally dry-cleaning again. This isn’t a rocket ship—it’s a reliable escalator. For investors, that means share gains > category expansion. Want to win? Think direct-to-consumer channels, repairs, and sustainability. The catch? Real consumption (volume) isn’t growing quite as fast. So while the dollars are rising, don’t confuse it for a fashion boom.

PRESENTED BY BELAY

You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.

ECOMMERCE

Free Delivery Isn’t Free

The final mile is turning into the final battlefield. As margins tighten and competition spikes, how e-commerce players handle delivery and returns is now a core profitability lever. Globally, 42% of businesses offer so-called free delivery—translation: shipping costs quietly baked into product prices. Another 25% still charge outright, while 14% chase the Amazon Prime effect through subscription models. Scale dictates generosity: large firms (46%) can afford “free” while smaller players (33%) can’t. The twist? B2B and manufacturers are joining the subscription game to lock in repeat buyers. The takeaway: “free shipping” is no longer about generosity—it’s about psychological pricing, disguised cost recovery, and customer stickiness. (More)

DEAL OF THE WEEK

Greek Yogurt, American Dream

Chobani just secured $650 million in equity funding from unnamed “industry thought leaders,” boosting its valuation to $20 billion. The money is earmarked for two major builds: a $1.2 billion megafacility in Rome, NY (its largest ever) and a production boost in Idaho. While it's still the #1 yogurt brand in the U.S., Chobani’s ambitions stretch well beyond dairy. After splurging $900M on La Colombe and buying Daily Harvest, Chobani is assembling a ready-to-eat food empire to match its creamy legacy. With $3.8B in projected 2025 sales (up 28% YoY), this raise is less a survival play and more a signal: Chobani is going full Whole Foods aisle. (More)

TOGETHER WITH THAT STARTUP GUY

Founders need better information

Get a single daily brief that filters the noise and delivers the signals founders actually use.

All the best stories — curated by a founder who reads everything so you don't have to.

And it’s totally free. We pay to subscribe, you get the good stuff.

The Wealth Gap in Wallet Waste

The more money consumers make, the more they forget to spend it—at least when it comes to gift cards.

According to Capital One Shopping, 55% of Americans earning $100K+ have unused gift cards, compared to just 35% of those earning under $50K. The pattern is consistent: higher income brackets are more likely to let gift cards expire or get lost in drawers, with usage rates dropping as income rises.

This isn’t just behavioral trivia—it’s commercial leakage. For issuers, breakage (unredeemed balances) can be a source of profit. But for retailers and brands relying on gift cards as customer acquisition tools or retention drivers, it’s a missed opportunity for engagement and upselling.

The takeaway: while gift cards are ubiquitous across demographics, redemption is not. Merchants targeting high-income consumers should rethink post-purchase nudges—reminders, digital tracking, and “use-it-soon” campaigns may convert idle balances into real transactions. (More)

CONSUMER BEHAVIOR

Consumers Are Growing Up

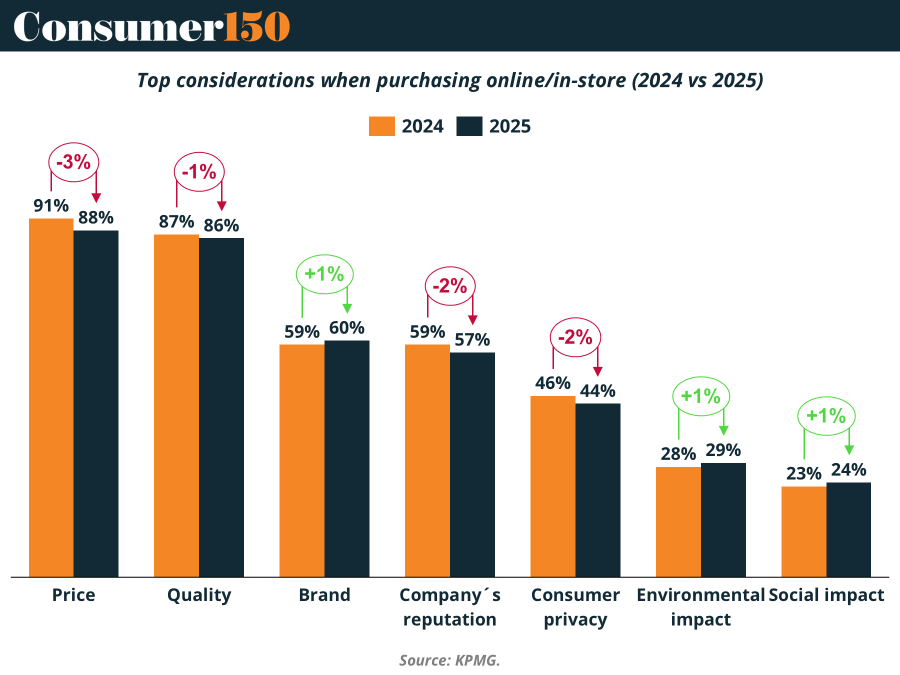

The 2025 KPMG Consumer Pulse shows shoppers are maturing past pure price-chasing. Price (88%) and quality (86%) still lead but both slipped — down 3% and 1%, respectively. Meanwhile, brand trust (+1%), environmental impact (+1%), and social impact (+1%) are inching upward. It’s a subtle but meaningful evolution: consumers aren’t just buying products, they’re buying principles.

The small gains in ethical factors, coupled with declining focus on company reputation (-2%), suggest today’s shoppers care less about corporate spin and more about authentic identity. The message for 2025? Compete on values, not just value. (More)

INTERESTING ARTICLES

"To succeed in business, to reach the top, an individual must know all it is possible to know about that business."

J. Paul Getty