- Consumer 150

- Posts

- Hotels & Leisure M&A Report 2025: Strategic Consolidation Amid Selective Optimism

Hotels & Leisure M&A Report 2025: Strategic Consolidation Amid Selective Optimism

The global travel, leisure, and hospitality (TLH) M&A landscape in 2025 stands at a crossroads between resilience and recalibration.

Introduction: A Market in Transition

Following a decade of volatility shaped by macroeconomic pressures, shifting consumer behavior, and rapid digital transformation, the industry is undergoing a structural reset.

While aggregate deal volumes have softened, deal values remain robust, signaling a pivot toward quality over quantity. Investors are showing a greater appetite for strategic, high-conviction transactions that emphasize technology integration, luxury positioning, and experiential differentiation.

According to KPMG and PitchBook data, the first half of 2025 (H1’25) witnessed $10.8 billion in M&A activity within the TLH sector — a 17.3% increase in deal value year-over-year (YoY) despite an 18.8% decline in transaction count. This divergence highlights how dealmakers are prioritizing precision and long-term value creation over pure expansion

Strategic acquirers, rather than private equity firms, have taken the lead, pursuing consolidation plays that deliver operational efficiency, scale, and alignment with evolving traveler expectations.

1. Historical Context: The Evolution of Hotel & Resort M&A (2016–2025)

The M&A trajectory in the Hotel and Resorts market over the past decade reveals alternating cycles of exuberance and restraint. The period following 2016 was marked by a surge in capital investment — exceeding $40 billion — before tapering during the pandemic years as global travel restrictions and financial uncertainty suppressed deal activity.

From 2016 to 2025, capital invested fluctuated between $10 billion and $40 billion annually, while deal counts followed a generally upward trend after 2020. Notably, 2022 and 2023 represented high-water marks for activity, reflecting the post-pandemic rebound and renewed investor confidence in hospitality recovery. However, 2024 and 2025 show a measured contraction — consistent with a market reorienting toward strategic, high-value deals rather than broad-based acquisition sprees.

This transition illustrates how M&A in hospitality has matured. Instead of chasing volume, acquirers are pursuing differentiated assets: luxury resorts, technology-driven platforms, and scalable management companies. The macroeconomic backdrop — particularly interest rate volatility and inflationary pressure — has tempered speculative capital flows, fostering a more disciplined environment focused on strategic synergies and sustainable returns.

2. Strategic Recalibration: From Aggressive Expansion to Tactical Optimization

The data from H1’25 underscores a decisive strategic shift. While overall M&A volume declined, deal value increased significantly YoY, a sign that participants are zeroing in on higher-value opportunities. Compared with H2’24, total deal value fell 43.3%, and volume dropped 12.8%, reflecting a cooling period following an exceptional year of pent-up post-pandemic deal activity.

This recalibration is not a retreat but rather a reallocation of capital. Strategic investors accounted for nearly 75% of total deal activity, while private equity involvement declined — constrained by elevated borrowing costs and tighter credit markets. The most prominent transactions, including Hyatt’s $2.6 billion acquisition of Playa Hotels & Resorts, and Apollo’s $1 billion joint acquisition of the Madrid Open and Miami Open tennis tournaments, reveal a distinct focus on scale, brand consolidation, and cross-market leverage.

This trend — fewer deals but with greater strategic intent — marks a defining characteristic of the 2025 M&A environment. Dealmakers are targeting luxury and experiential travel, AI-powered operational efficiencies, and gaming industry convergence, forming the three pillars shaping the new phase of TLH consolidation.

3. The Strategic vs. Private Equity Dynamic

The balance between strategic acquirers and private equity (PE) provides a key lens into current market behavior.

The previous chart demonstrates that while PE value contributions have remained relatively stable, strategic buyers dominate in both volume and aggregate deal value. For instance, in 2H23, strategic acquirers closed 330 deals with a combined investment approaching $30 billion, compared to just 82 PE-led transactions worth roughly one-third that value.

By 1H25, the number of strategic deals fell to 275, yet the average transaction size increased, suggesting that buyers are being more selective and targeting premium, synergistic assets. Meanwhile, PE activity, though resilient, has shifted toward minority stakes and partnership-driven deals as leverage constraints and cost of capital limit large-scale buyouts.

This dynamic highlights an important inflection point: strategic acquirers are leveraging balance sheet strength and brand portfolios to expand vertically, while PE firms recalibrate their hospitality strategies toward asset-light investments and platform scalability.

4. Sectoral Dynamics: Hospitality & Leisure by Subsector

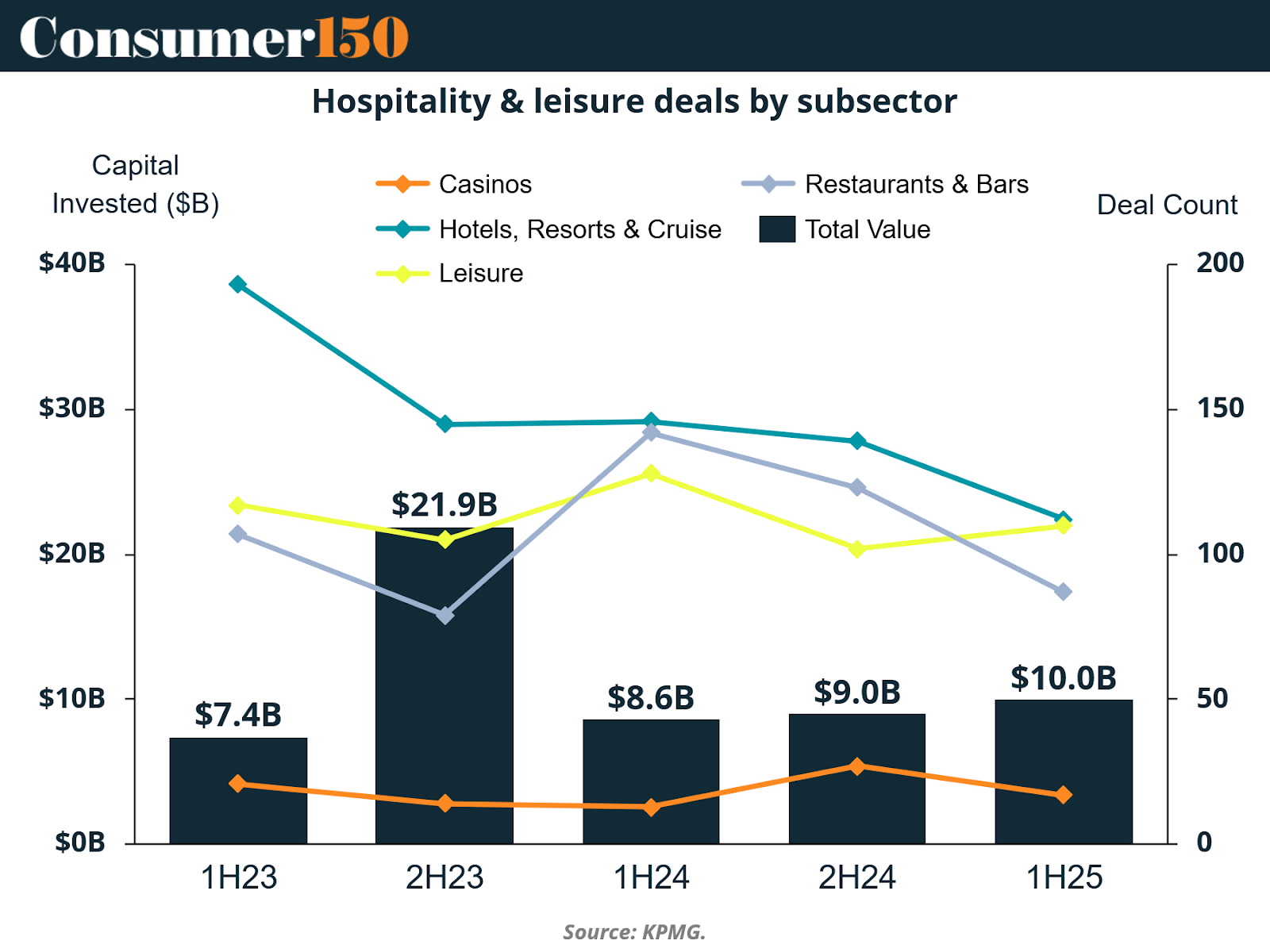

Beyond headline figures, the composition of deal activity across subsectors paints a more nuanced picture of where capital is flowing.

Here, Hotels, Resorts & Cruises continue to dominate deal value, maintaining near-constant levels around the $30 billion mark, while Casinos and Restaurants & Bars demonstrate more subdued investment profiles. Interestingly, the Leisure segment (which includes experiential travel, outdoor recreation, and wellness tourism) has held steady in deal activity even amid macro volatility, signaling investor confidence in lifestyle-oriented experiences.

Notably, the 2H23 peak of $21.9 billion in total subsector M&A coincided with heightened strategic interest in cross-sector synergies — particularly where hospitality intersects with entertainment and gaming. The 1H25 total of $10 billion represents a moderation but not a collapse, reflecting normalization following the exceptional rebound years of 2022–2023.

Across subsectors:

Casinos and gaming attract strategic consolidators seeking scale in mobile and regulated markets.

Hotels and resorts see continued focus on luxury repositioning and tech enablement.

Restaurants and leisure deals increasingly reflect lifestyle convergence — blending hospitality with health, wellness, and experience-driven concepts.

5. Valuation Trends: Selectivity and Scale in Deal Pricing

From a valuation perspective, median deal sizes in the Hotel and Resorts segment have stabilized around $25–35 million, while median post-valuations fluctuate sharply depending on macroeconomic cycles. Peaks in 2016, 2018, and 2023 align with liquidity surges and investor optimism, whereas troughs in 2017, 2021, and 2024 correspond to tighter financial conditions.

The pattern reinforces the theme of valuation discipline. Buyers are no longer paying inflated premiums for growth potential alone; they are prioritizing cash flow stability, brand equity, and technology integration. The data shows a narrowing gap between deal size and post-valuation — suggesting that assets are being priced more realistically in line with performance expectations.

Moreover, valuation resets in 2024–2025 have opened windows for opportunistic acquisitions, particularly for well-capitalized strategic buyers. As financing conditions stabilize through late 2025, renewed appetite for mid-market acquisitions is expected, particularly among global hotel groups expanding their digital and experiential capabilities.

6. Key Drivers of Current M&A Activity

The evolution of TLH dealmaking in 2025 is being shaped by three interrelated drivers:

a. Digital Transformation and AI Integration

Technology remains the defining differentiator in hospitality dealmaking. With labor shortages persisting globally, hotel operators and travel platforms are embracing AI, automation, and robotics to enhance efficiency and guest satisfaction.

Marriott’s partnership with RobotLAB and LG exemplifies this shift, deploying robots to streamline service delivery and reduce dependency on human labor.

Acquirers now evaluate targets based on digital readiness — encompassing AI-enabled property management systems, data-driven revenue optimization, and personalized guest engagement. M&A deals increasingly include provisions for technology integration roadmaps, demonstrating that digital transformation is not merely an operational upgrade but a core strategic rationale for acquisition.

b. Luxury and Experiential Travel

The luxury travel segment is forecast to expand at a compound annual growth rate (CAGR) of 8.4% through 2033, driven by affluent travelers seeking bespoke, sustainable, and immersive experiences. This segment has been central to 2025 deal activity.

Transactions like Hyatt’s acquisition of Playa Hotels & Resorts and Marriott’s purchase of CitizenM exemplify this trend, emphasizing brand elevation, differentiated service offerings, and portfolio diversification.

Luxury and experiential travel M&A are fueled by several forces:

Demand for authenticity: Consumers seek cultural and destination immersion, motivating hotel chains to acquire boutique and regional brands.

Sustainability imperatives: ESG considerations drive investors toward eco-friendly resorts and energy-efficient properties.

Experience monetization: Operators are leveraging branded experiences, events, and wellness offerings to boost margins and foster brand loyalty.

c. Gaming and Leisure Convergence

The boundary between hospitality and entertainment continues to blur. Gaming and leisure companies are merging to capitalize on integrated destination models that combine accommodation, gaming, and experiences.

The $6.3 billion Apollo–IGT–Everi deal in 2025 underscores this momentum, marking one of the largest cross-sector transactions in recent years. Similarly, Scopely’s $3.5 billion acquisition of Pokémon Go developer Niantic’s assets reinforces how gaming IP is being woven into tourism and leisure ecosystems.

This convergence is reshaping investment theses. Resorts now compete not only on amenities but also on content and engagement ecosystems, where gaming, entertainment, and hospitality intersect to create diversified revenue streams.

7. Thematic Consolidation: What’s Driving Corporate Strategy

Across both global and regional markets, consolidation remains the overarching theme. Three structural imperatives are shaping M&A strategy:

Operational Efficiency: Scale remains vital for weathering macroeconomic uncertainty. Larger hotel groups are centralizing procurement, marketing, and technology systems to drive margin expansion.

Brand Portfolio Diversification: Multibrand operators like Marriott and Hilton continue to acquire niche or lifestyle brands to capture different traveler demographics and price points.

Geographic Realignment: With varying regional recovery trajectories, investors are reallocating capital toward North America and APAC markets where leisure travel demand remains resilient.

In 2024, North America led global deal value with over $20 billion in transactions, representing a 41% YoY increase. Europe, meanwhile, saw the highest number of transactions (236) but with lower average values, reflecting smaller-scale consolidations and management buyouts.

8. Financing Dynamics: Capital Discipline and Dry Powder Deployment

High interest rates and global capital market volatility have constrained debt-financed acquisitions. As a result, cash-rich corporates and alternative asset managers have taken the lead in funding hospitality M&A. Private equity, traditionally a major force in hotel and leisure transactions, saw an 85% YoY decline in sponsored deals in H1’25. This contraction reflects both macro headwinds and shifting strategic priorities within PE portfolios.

However, the dry powder overhang remains substantial. Institutional investors are poised to re-enter the market as monetary conditions ease. Expect a resurgence of mid-market deal flow in H2’25 and 2026, particularly in emerging markets where valuations remain attractive.

Financing innovation is also on the rise. Structured equity, sale-leaseback arrangements, and co-investment partnerships are increasingly common, offering flexible mechanisms for capital deployment without excessive leverage. These structures align with the sector’s renewed emphasis on capital efficiency and long-term value preservation.

9. Regional Outlook: North America, Europe, and Asia-Pacific

North America

The U.S. hospitality market remains the global bellwether. Led by mega-deals such as Ryman Hospitality’s $865 million acquisition of JW Marriott Phoenix Desert Ridge Resort & Spa, the region’s M&A activity reflects confidence in premium asset performance and domestic travel resilience.

Luxury and upper-upscale segments are outperforming mid-tier properties, prompting consolidation among top-tier operators. Despite rising construction and labor costs, U.S. investors continue to favor assets with strong brand equity and predictable cash flows.

Europe

Europe’s hotel M&A landscape is characterized by fragmented ownership and localized consolidation. Transactions in 2024–2025, such as Vinci’s acquisition of a 50% stake in Edinburgh Airport and Ares Management’s hotel portfolio purchase from Landsec, underscore the interplay between infrastructure and hospitality investment. European operators are also prioritizing sustainability, aligning M&A activity with green certifications and energy-efficiency mandates.

Asia-Pacific

In the APAC region, M&A momentum remains steady. Investors from Singapore, South Korea, and Japan continue to expand regionally, targeting resorts in Indonesia, Thailand, and Vietnam. With tourism recovery accelerating and digital adoption surging, APAC’s hotel M&A pipeline is expected to grow through 2026, particularly in the luxury resort and eco-tourism categories.

10. Outlook for H2 2025 and Beyond

As the second half of 2025 unfolds, sentiment across the TLH sector is cautiously optimistic. The Apollo–IGT–Everi megadeal signals renewed confidence, while a broader set of mid-tier transactions is expected to follow as financing conditions stabilize.

Dealmakers are focusing on three growth frontiers:

AI-driven hospitality ecosystems, where automation and predictive analytics redefine guest experiences.

Luxury and experiential expansion, emphasizing authenticity, wellness, and sustainability.

Cross-sector convergence, integrating gaming, travel, and digital engagement platforms into unified business models.

While geopolitical risk, inflation, and potential policy shifts remain headwinds, the underlying demand for travel and leisure — particularly in the luxury and experience segments — continues to underpin sector growth. In this environment, selectivity, innovation, and technology alignment will separate market leaders from laggards.

11. Conclusion: Smart Capital, Smarter Deals

The global Hotels & Leisure M&A market in 2025 exemplifies a new phase of maturity. Investors are no longer chasing volume but targeting strategic depth — deals that deliver digital transformation, experiential differentiation, and sustainable profitability.

Compared to earlier cycles dominated by rapid expansion and speculative investment, today’s dealmakers are pragmatic. They understand that success in hospitality requires agility, technology integration, and a commitment to brand experience. The year’s data — rising deal values amid declining volumes — reflects a disciplined optimism that will likely define dealmaking through 2026.

In summary:

Strategic buyers dominate as PE retreats temporarily.

Luxury, gaming, and AI integration drive thematic consolidation.

Capital efficiency and sustainability underpin valuation frameworks.

North America and APAC lead in both volume and innovation.

As capital re-enters the market, the next 18 months will test how well these strategic recalibrations can translate into durable value. In an era of smart hotels and smarter deals, the hospitality industry’s M&A playbook is being rewritten for a digital, experience-driven future.

Sources & References

Dr. Karl Popp. (2025). The Changing Landscape of Hotel Industry Mergers and Acquisitions: Trends, Impacts, and Future Outlook. https://www.drkarlpopp.com/karl-michael-popps-blog/hotel-industry-mergers-and-acquisitions

Hotel Dive. (2025). AI, luxury travel set to catalyze global hospitality M&A: report. https://www.hoteldive.com/news/global-hospitality-travel-merger-acquisition-activity/759314/

Hotel Management Network. (2025). Travel & Tourism M&A in 2025: Resilience and Strategic Transformation. https://www.hotelmanagement-network.com/sponsored/travel-tourism-ma-in-2025-resilience-and-strategic-transformation/

KPMG. (2025). M&A trends in travel, leisure and hospitality. https://kpmg.com/us/en/articles/mergers-acquisitions-trends-travel-leisure-hospitality.html

Umbrex. (n/d). How the Travel Agency & Tour Operator Industries Work. https://umbrex.com/resources/how-industries-work/travel-hospitality/how-the-online-travel-agencies-tour-operators-industry-works/

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.