- Consumer 150

- Posts

- Less Cutting, More Curating: The New Spend Discipline

Less Cutting, More Curating: The New Spend Discipline

It’s Thursday and we’re diving into the digital wallets takeover on eCommerce payments, clothing tops as the most likely to purchase retail category during summer season, despite the economic environment.

Good morning, ! It’s Thursday and we’re diving into the digital wallets takeover on eCommerce payments, clothing tops as the most likely to purchase retail category during summer season, despite the economic environment, U.S. consumers are showing remarkable spending discipline across essential categories and Southeast-asian consumers are shifting from quantity to quality.

First time reading? Join the execs and operators shaping the future of consumer markets. Subscribe here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

Steady Spend, Strategic Cuts

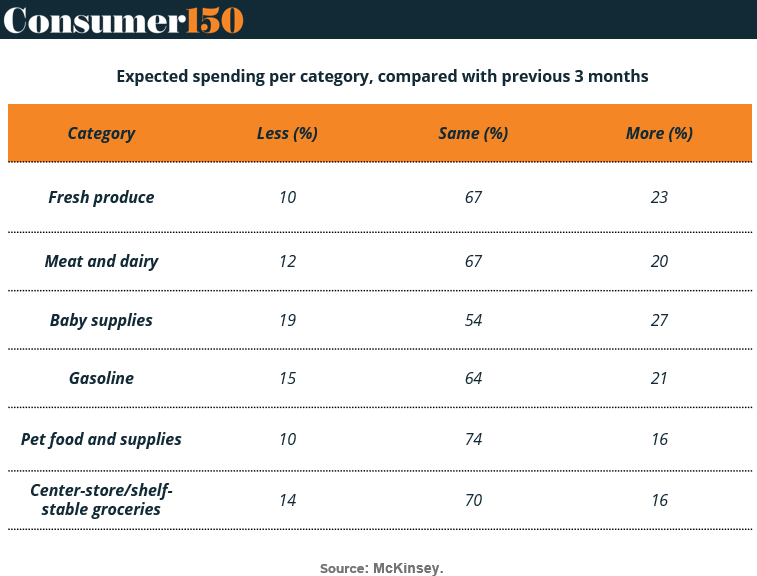

Despite persistent economic uncertainty, U.S. consumers are showing remarkable spending discipline across essential categories. According to McKinsey, the majority plan to keep spending levels unchanged in the next three months, 67% for fresh produce and meat/dairy, 70% for shelf-stable groceries, and 74% for pet food.

The outlier? Baby supplies, where 27% of consumers expect to spend more, and nearly 1 in 5 are cutting back, suggesting both elevated need and rising price sensitivity in a non-deferrable category.

Meanwhile, categories like gasoline (21% more), fresh produce (23% more), and meat/dairy (20% more) still show moderate spending growth, hinting at inflationary pressure rather than true volume increase.

Bottom line: Consumers aren’t retreating, they’re recalibrating. For investors and operators, the key is to distinguish between nominal growth and real demand. Pricing power matters less than value clarity when wallets stay flat. (More)

PRESENTED BY KEEP CART

Prevent coupon abuse, protect your profits

KeepCart: Coupon Protection partners with D2C brands like Quince, Blueland, Vessi and more to stop/monitor coupon leaks to sites/extensions like Honey, CapitalOne, RetailMeNot, and more to boost your DTC margins

Overpaid commissions to affiliates and influencers add up fast - Get rid of the headache and revenue losses with KeepCart.

ECOMMERCE

Swipe Right on Digital Wallets

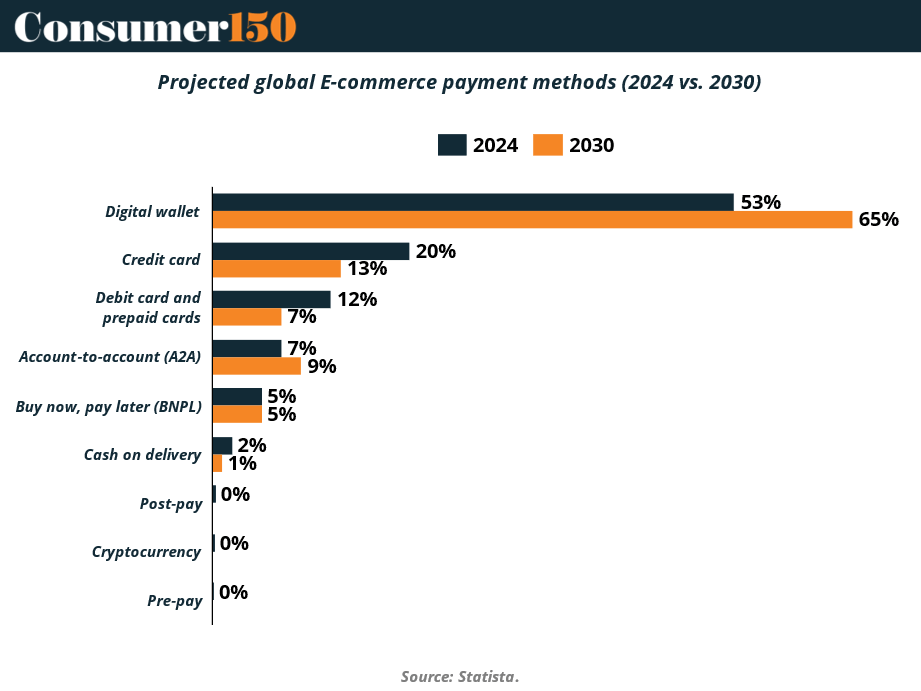

Digital wallets are eating the checkout page. In 2024, they already make up 53% of global e-commerce payments, and by 2030, that number will hit 65%, according to Statista. Credit cards and debit cards? Drifting toward irrelevance, down to a combined 20%.

BNPL and A2A are also quietly climbing the ranks, favored for flexibility and directness. Meanwhile, crypto remains a rounding error and cash on delivery is going the way of DVDs.

Why it matters: Frictionless checkout isn’t just a UX trend, it’s a conversion engine. For merchants, not offering wallets means paying a silent tax on abandoned carts. For investors, the shift points to platform-native payment infra plays and regional wallet leaders as critical value drivers. (More)

DEAL OF THE WEEK

Dick’s Grabs Foot Locker in $2.5B Bid for Sneaker Supremacy

In a bold retail play, Dick’s Sporting Goods is acquiring Foot Locker for $2.5B, marking its first international expansion and a major reshuffling of the sneaker and sportswear landscape. The deal gives Dick’s access to 2,400 stores across 20 countries, including the Champs Sports and atmos banners, while Foot Locker gains stability after years of mall exposure and earnings pressure.

Foot Locker shareholders will receive either $24 in cash or 0.1168 shares of Dick’s stock, a 66% premium to Foot Locker’s 60-day average. The market reaction was split: Foot Locker soared +80%, while Dick’s tumbled -14%, as analysts questioned integration challenges and the logic of merging two Nike-reliant chains.

Still, Dick’s is betting big on operational synergy, omnichannel upgrades, and capturing more share of Nike’s wholesale pipeline. The combined entity would command serious shelf power in sneaker culture, a space increasingly defined by drops, hype, and brand alignment.

Bottom line: Investors should watch execution closely. If Dick’s can modernize Foot Locker without losing its edge, or Nike’s favor, it may have just bought itself a global growth engine. (More)

TOGETHER WITH PACASO

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

$217M Later, We’re Still Gift-Wrapping Scams

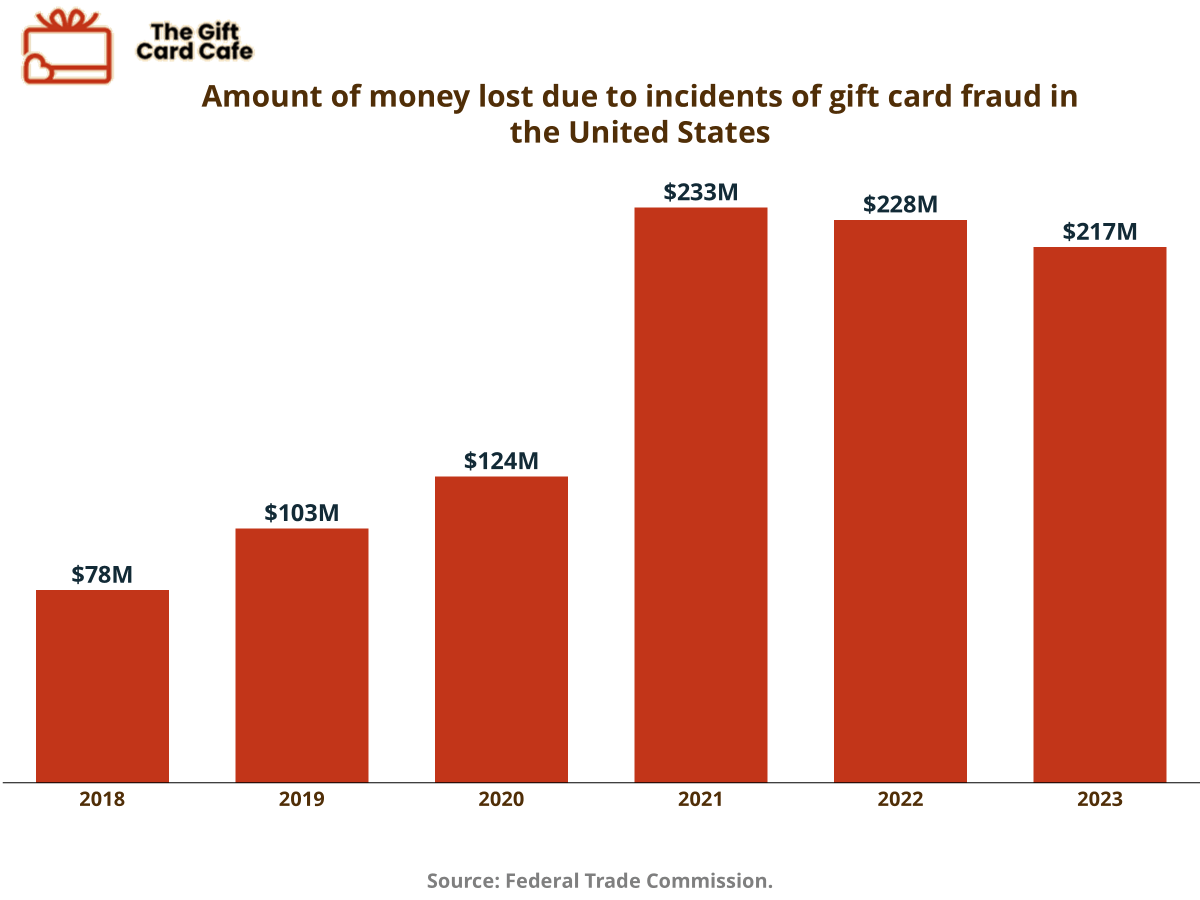

Americans lost $217 million to gift card scams in 2023—up there with robocalls on the Mount Rushmore of modern consumer headaches. The tactic is simple and brutal: scammers lift activation details from display racks, wait for a shopper to load the card, and drain the funds before the recipient ever says thanks.

Lawmakers are pushing back with legislation for secure packaging and mandatory warnings, but retailers argue it’s regulatory overreach that unfairly singles them out. The truth? The scam is evolving faster than CVS can restock PlayStation cards.

Until there’s a fix, this is your periodic reminder: treat gift cards like cash—because scammers already do. (More)

CONSUMER TECH

Durables Plateau: Regional Shake-Up in $813B Market

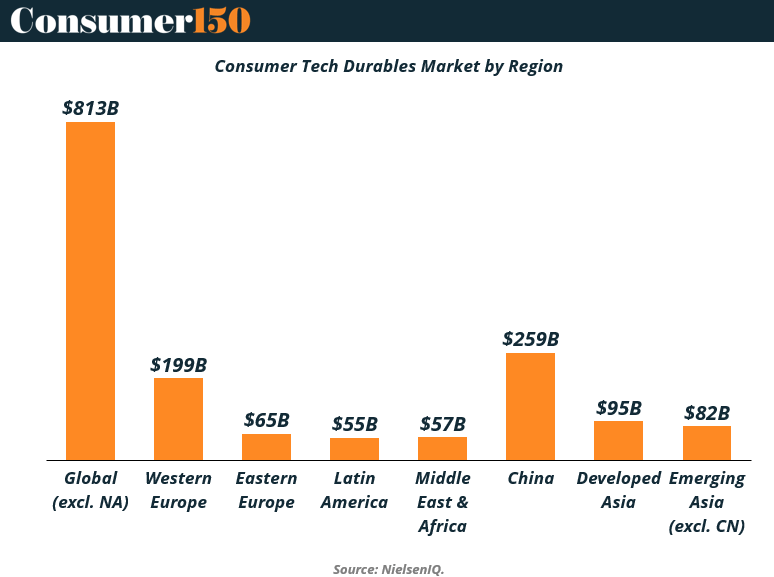

The global Consumer Tech Durables market (ex-North America) hit $813B in 2023, but beneath the surface, regional momentum is shifting fast. Only the Middle East & Africa posted real growth (+7.8%, $57B), while developed and emerging Asian markets both saw steep declines (-7.1% and -5.5%, respectively).

China, the largest national market at $259B, shrank 5.0%, while Western Europe fell 1.4% despite its significant $199B share. Even Eastern Europe (-0.4%) and Latin America (+0.8%) remained effectively flat.

What’s clear: saturation has arrived. Developed regions face replacement cycles and margin compression, while growth is migrating toward underpenetrated zones like the Middle East and parts of Africa. For consumer tech brands, the playbook must evolve, from pushing premium SKUs in mature markets to designing localized, cost-conscious products for next-gen consumers elsewhere.

Bottom line: Investors should watch the geographic pivot. Winning in 2025 won’t be about size, it’ll be about adaptability, localization, and channel agility in regions that are still scaling up. (More)

SEASONAL INSIGHTS

Summer Staples: What’s In the Cart This Season

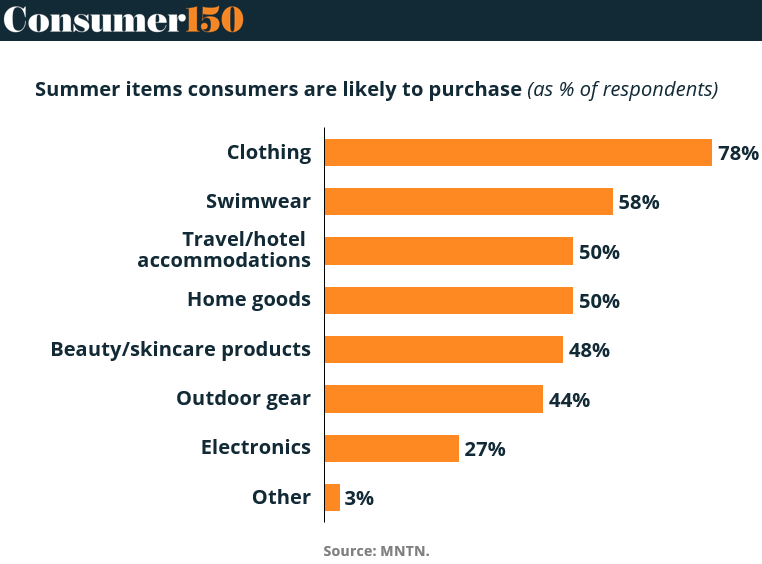

Summer 2023 is all about the wardrobe, and the itinerary. According to a survey by MNTN 78% of consumers plan to purchase clothing this season, with swimwear close behind at 58%. But this isn’t just a fashion story. 50% also expect to spend on travel and hotel accommodations, suggesting a dual-priority summer: style and experience.

Other high-intent categories include home goods (50%) and beauty/skincare products (48%), reinforcing the seasonal focus on self-care and space upgrades. Interestingly, electronics lag far behind at just 27%, signaling a pause on big-ticket indoor buys as consumers shift spending outdoors.

Bottom line: This summer is skewing tactile and experiential. Brands that lean into seasonality, offering bundles, travel-adjacent SKUs, and style refreshes—stand to capture share. Investors should watch apparel, personal care, and hospitality-linked players for seasonal upside. (More)

CONSUMER BEHAVIOR

Premium Sips in Southeast Asia

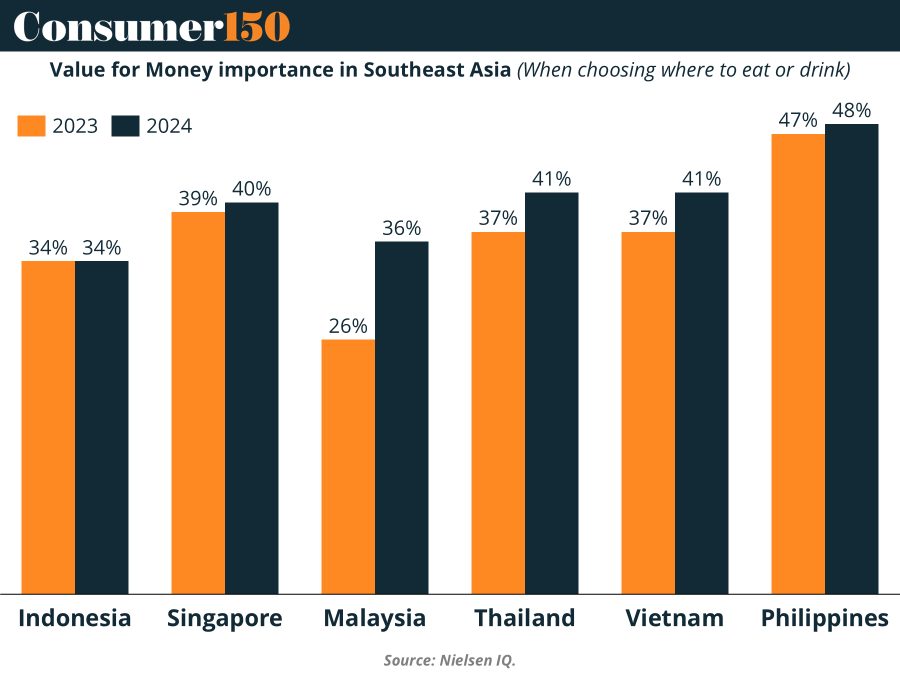

In Southeast Asia, consumers are shifting from quantity to quality in their beverage choices. A significant 77% prefer fewer, higher-quality drinks over cheaper options, with Indonesia (83%) and Vietnam (80%) leading this trend. Brands can capitalize by emphasizing brand reputation, authentic storytelling, and premium positioning. Collaborations with venues to enhance menu visibility and staff recommendations can further influence choices. Additionally, leveraging social media to highlight brand heritage and quality can effectively engage consumers. (More)

INTERESTING ARTICLES

"I find that the harder I work, the more luck I seem to have."

Thomas Jefferson