- Consumer 150

- Posts

- The Future of E-commerce Payments: Embracing Digital Wallets, Flexibility, and Regional Nuances

The Future of E-commerce Payments: Embracing Digital Wallets, Flexibility, and Regional Nuances

The global e-commerce payment landscape is evolving rapidly, driven by shifting consumer preferences, technological innovation, and regional market dynamics.

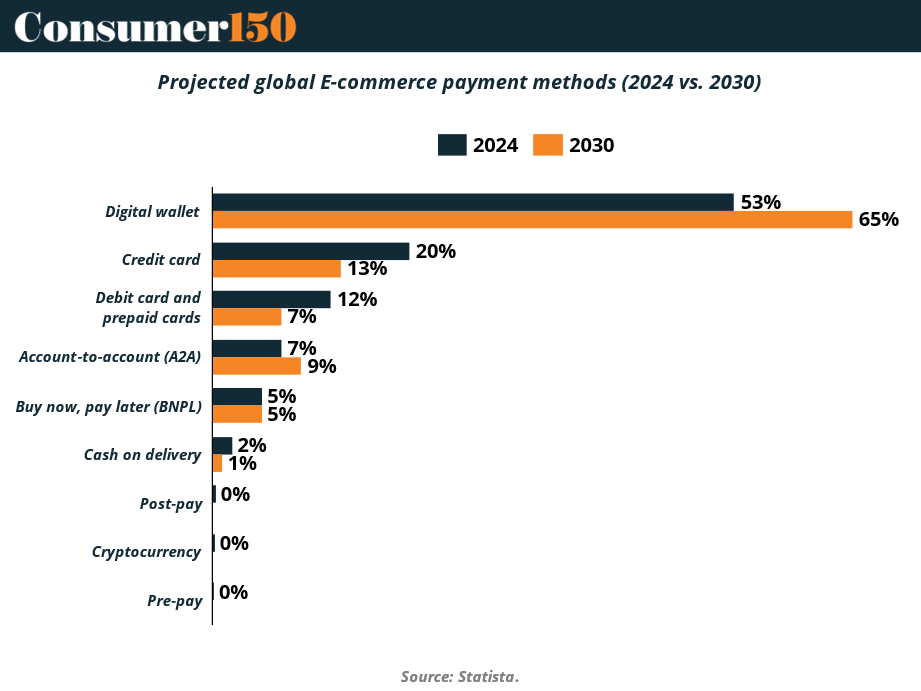

In 2024, digital wallets and mobile money have become the dominant payment methods worldwide, accounting for over half of all e-commerce transaction value. This trend is projected to intensify, with digital wallets expected to represent nearly 65% of global e-commerce payments by 2030, growing at a compound annual growth rate (CAGR) of 18.1%.

Digital wallets such as Apple Pay, Google Pay, and Alipay provide consumers with a seamless, fast, and secure checkout experience, eliminating friction points like manual card entry and lengthy authentication processes. Their convenience and security features have made them the preferred choice, especially among younger, mobile-first shoppers. For merchants, integrating digital wallets is no longer optional but a strategic imperative to reduce cart abandonment and boost conversion rates.

Traditional payment methods like credit and debit cards remain significant but are gradually losing market share. Credit cards, which accounted for 20% of e-commerce payments in 2024, are forecasted to decline to 13% by 2030, while debit and prepaid cards are expected to drop from 12% to 7% in the same period. This shift reflects consumers’ growing preference for faster, more secure, and mobile-optimized payment options that align with their digital lifestyles.

Beyond wallets and cards, alternative payment methods such as account-to-account (A2A) transfers and Buy Now, Pay Later (BNPL) solutions are gaining traction. A2A payments, which enable direct bank-to-bank transfers, are growing rapidly with a CAGR of 19.5%, increasing their share from 7% to 9% by 2030. BNPL services, allowing consumers to split purchases into interest-free installments, currently represent about 5% of e-commerce transaction value and are projected to reach $540 billion by 2030, growing at a CAGR of 12.3%. These flexible payment options cater to consumers’ desire for greater financial control and affordability, especially for higher-value purchases.

However, legacy payment methods like cash on delivery and post-payment options are steadily declining, with cash on delivery dropping from 2% to 1% of total transactions and experiencing a negative annual growth rate of 5.6%. Cryptocurrencies, despite their hype, remain niche, accounting for less than 0.2% of total e-commerce transaction value.

Regional variations further nuance this global picture. For example, in Asia, the adoption of digital wallets is accelerated by the integration with super-apps like WeChat Pay and Alipay, which combine social, messaging, and payment functionalities into one platform. In Latin America, mobile money and local payment methods dominate due to limited credit card penetration and the popularity of alternative financing options. Meanwhile, in North America and Europe, BNPL has surged in popularity, particularly among younger consumers and for categories like electronics and fashion.

The rise of mobile commerce (m-commerce) is another critical driver shaping payment trends. Over 70% of global online retail sales in 2025 are expected to be made via mobile devices, fueled by smartphone proliferation, improved mobile payment solutions, and expanding 5G networks. Digital wallets now account for more than half of mobile transactions globally, supported by biometric authentication technologies such as facial recognition and fingerprint scanning that enhance security while streamlining checkout.

For merchants and brands, these developments underscore the importance of offering a broad, flexible range of payment options tailored to diverse consumer preferences and regional realities. Payment experience has become a key differentiator in the competitive e-commerce landscape, directly impacting conversion rates, customer satisfaction, and loyalty. Moreover, trust and security remain paramount, as consumers increasingly demand transparent, secure, and seamless payment processes.

In addition to payment methods, emerging technologies like AI and payment orchestration platforms are revolutionizing commerce by enabling smarter fraud prevention, unified backend operations, and simplified management of multiple payment providers. Businesses that embrace these innovations while prioritizing consumer convenience and security will be best positioned to thrive in the evolving e-commerce ecosystem.

In summary, the future of e-commerce payments is digital, mobile, and flexible. Digital wallets, A2A payments, and BNPL solutions are reshaping consumer expectations and purchasing behaviors globally. Brands that adapt quickly to these trends, while respecting regional differences and investing in secure, seamless payment experiences, will lead the market and foster stronger consumer relationships in the decade ahead.