- Consumer 150

- Posts

- How Temu is shaking up consumer e-commerce markets

How Temu is shaking up consumer e-commerce markets

Temu’s rise isn’t just a retail story—it’s a global market reset. With its data-fueled pricing, social virality, and manufacturing control, the platform is rewriting how consumers discover, shop, and expect value online.

Good morning, ! This week we’re diving into the disruption of Temu in eCommerce consumer markets, online marketplaces stand as the main products discovery for consumers in 2025, Samsung expands in audio market with a $350M M&A, and Free delivery and returns place on top of click-trough drivers.

Want to advertise in Consumer 150? Check out our self-serve ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

Inside Temu’s Plateau, Playbook, and Pivot

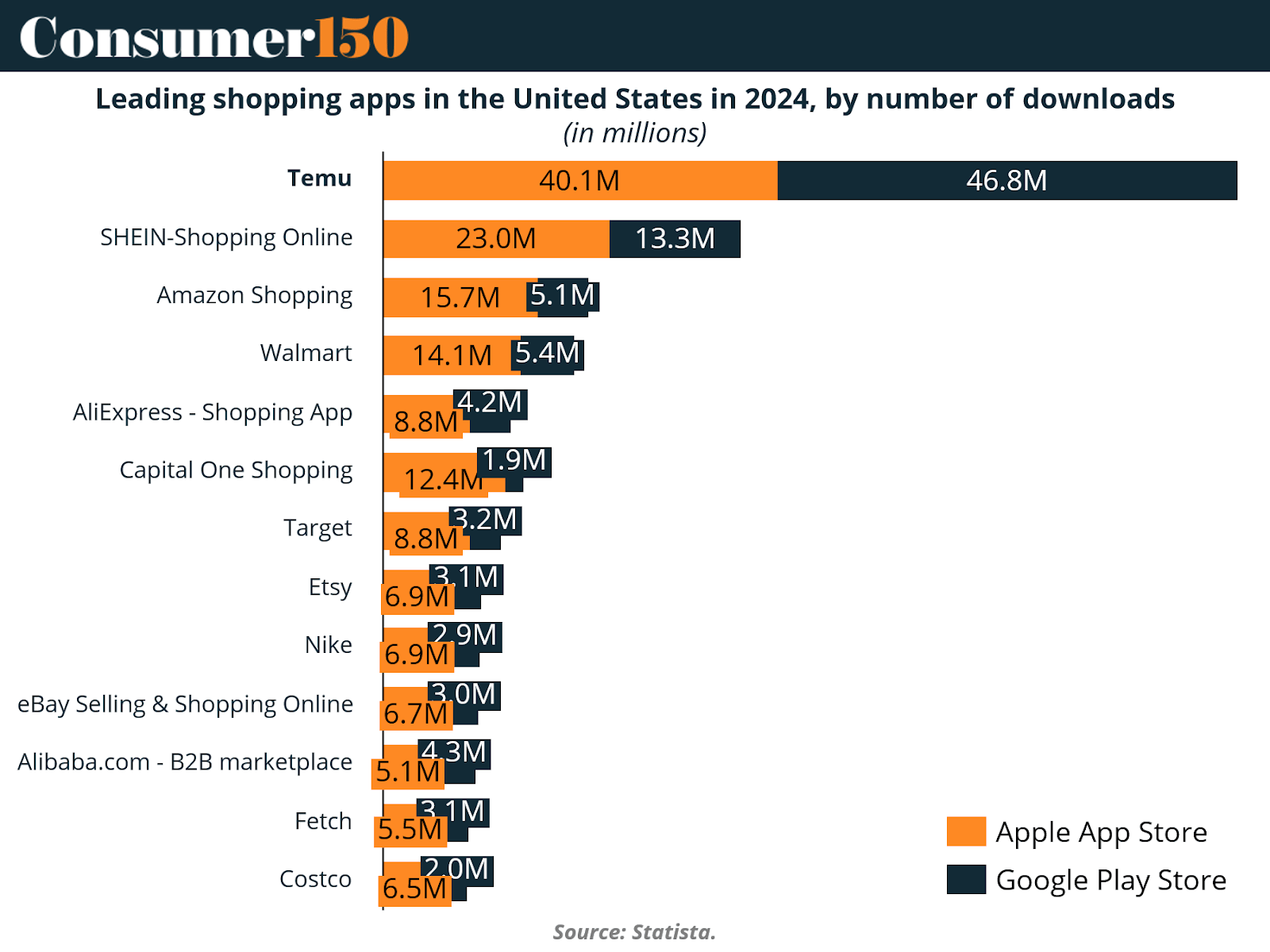

Temu’s rocket ride is leveling off. After peaking at 73M app downloads/month in mid-2024, growth slipped 5.7% by Aug 2025—a ceiling, not a crash. The U.S., its biggest market, now demands retention over reach. Less TikTok blitz, more warehouse buildout. Think early Amazon—except Bezos never burned Super Bowl ad money before turning a profit.

Its “Shop like a billionaire” slogan hides a vertically-integrated engine that tells factories what to make based on clicks. In return, Temu gets deep discounts and a near-frictionless supply loop. It’s not retail—it’s algorithmic consumption at scale.

Users spend 22 minutes per session—double Shein, triple Amazon. Gamified spins, bonuses, and referrals turn shopping into Candy Crush commerce. By early 2024, Temu topped 500M+ visits/month—addiction as strategy.

Now tariffs are biting. Temu’s pivot: U.S. warehouses and local sellers to survive the post-subsidy era. But with PDD’s profits dipping, the big test begins: can Temu stay irresistible when the shipping isn’t from Shenzhen?

TREND OF THE WEEK

Nominal Lies, Real Growth Is Back

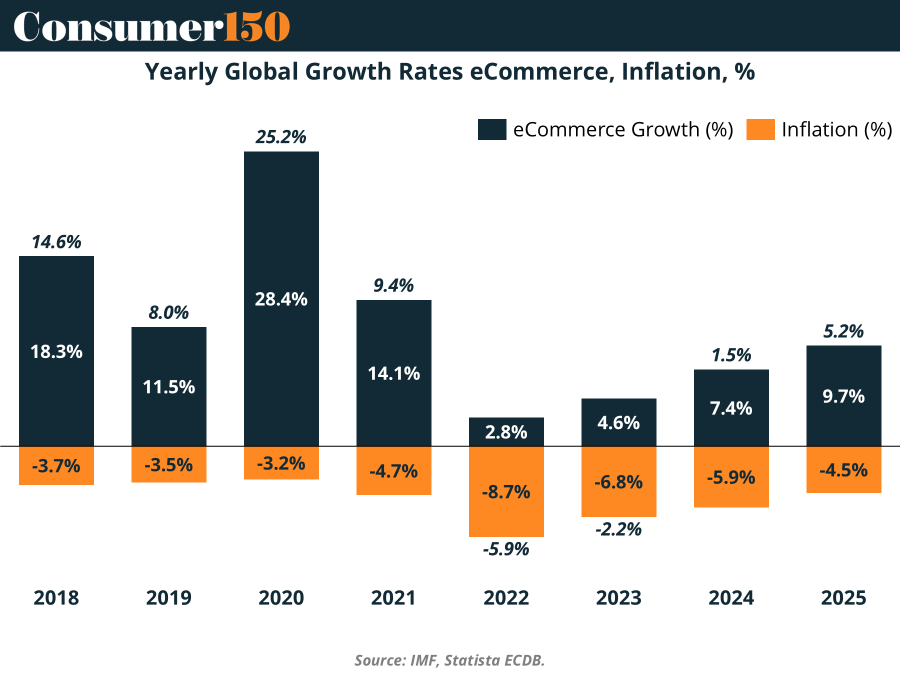

After two years of getting punched in the gut by inflation, eCommerce is finally growing again in real terms. Adjusted for inflation, the global eCommerce market saw negative real growth in both 2022 (-6.0%) and 2023 (-2.2%)—a rare double dip for an industry that used to defy gravity. But now, with inflation cooling and consumer appetite recovering, real growth is back in the black for 2024 and 2025. The gap between nominal and real growth—widened by pandemic-era pricing—has started to narrow, signaling a return to fundamentals: not just selling more, but actually selling better. For digital-first brands and legacy retailers alike, this shift matters. It means the tide is turning, and topline boosts might start reflecting actual volume instead of just inflated receipts. (More)

PRESENTED BY MISO ROBOTICS

Elon Musk: “Robots Will…Do Everything Better”

And it’s already happening. Just look at fast food. Miso’s kitchen robots already fried 4m+ baskets of food for brands like White Castle. With 144% labor turnover and $20/hour minimum wages, they’re not alone. Partnered with NVIDIA and Uber’s AI team, Miso’s new robot sold out initial units in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

ECOMMERCE

The New Discovery Map

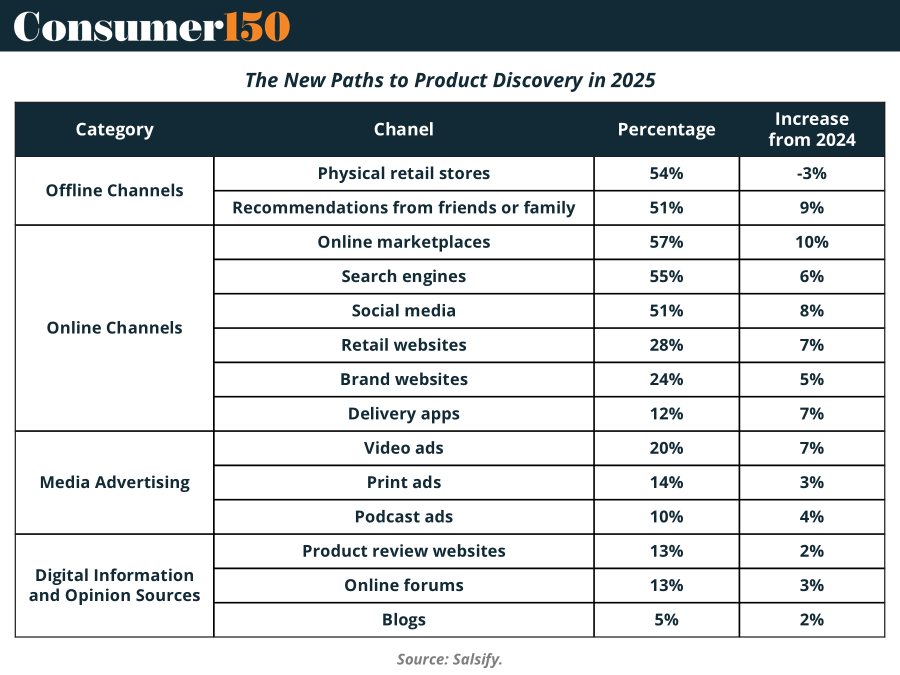

In 2025, shoppers aren’t wandering the mall—they’re clicking through online marketplaces (57%, +10%), search engines (55%, +6%), and social media (51%, +8%). The offline stalwarts—physical stores (54%) and friends & family (51%, +9%)—still matter, but the momentum is digital. Even delivery apps (12%, +7%) are emerging as discovery tools. For brands, the playbook is clear: optimize for marketplaces, invest in SEO, and lean hard into social commerce where TikTok, Instagram, and YouTube rule discovery. Ignore these shifts, and your product risks being invisible in the very places shoppers are now looking first. (More)

DEAL OF THE WEEK

Samsung Reloads with $350M Harman Audio Acquisition

Samsung is turning the volume back up on M&A with its largest deal since 2016: a $350M acquisition of Masimo’s audio division through its U.S. subsidiary Harman. The move brings premium names like Bowers & Wilkins, Marantz, and Denon into Samsung’s orbit — a calculated expansion into high-end audio amid intensifying Chinese competition in mainstream consumer electronics.

Why now? Harman has quietly become one of Samsung’s most profitable segments, posting $900M+ in 2023 operating profit, and a 50% YoY jump in Q1 2025. The new portfolio reinforces Harman’s positioning in luxury home and automotive sound, with B&W already embedded in BMW’s flagship sedans. This also reasserts Samsung’s intent to move upmarket while doubling down on auto-tech and audio ecosystem plays.

Samsung last spent big in 2016, acquiring Harman for $8B. With this follow-up, it signals a return to global dealmaking — and not just in audio. The firm has also recently placed bets in AI, robotics, and medtech. Investors, take note: Samsung is shopping again. (More)

TOGETHER WITH COW SWAP

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Gift Card Corner: B2B Gift Cards Go Global

The corporate gift card market is quietly becoming one of the fastest-growing segments in fintech. Valued at $315.8B in 2024, the global B2B gift card market is forecast to almost double to $629.7B by 2031, expanding at a 10.4% CAGR.

What’s driving this surge? Digital transformation. Companies are increasingly using digital gift cards to streamline employee rewards, channel partner incentives, and customer loyalty programs. As cashless economies take hold and e-commerce globalizes, these cards have evolved from corporate tokens into tools for engagement, data collection, and retention.

North America still leads in adoption—propelled by mature digital payment systems and a culture of employee recognition—but Asia-Pacific is catching up fast, powered by smartphone proliferation and mobile-first business ecosystems.

The shift is also technological: AI, blockchain, and analytics are reshaping personalization, fraud prevention, and multi-currency redemption. For investors and strategics, this means the next decade of corporate gifting will be defined not by plastic, but by platforms.

Bottom line: The B2B gift card is no longer a perk—it’s infrastructure for modern workforce and customer engagement. (More)

CONSUMER BEHAVIOR

The Click-to-Confidence Equation

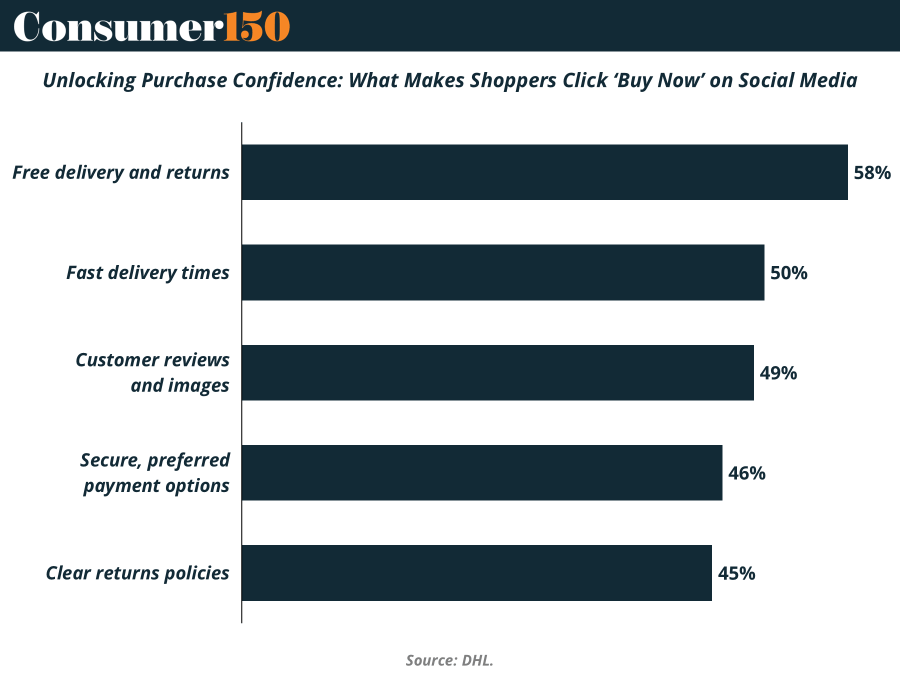

What makes someone scroll past memes and actually hit “Buy Now” on social media? The answer: free delivery and returns—cited by 58% of shoppers as their top decision driver. Coming next: fast delivery (50%) and customer reviews with images (49%), proving convenience and transparency are non-negotiable. Rounding out the list: secure payments (46%) and clear returns policies (45%), both rooted in trust. The takeaway: social commerce is less about hype and more about reducing friction. Brands that nail delivery, transparency, and trust will convert casual scrollers into confident buyers. (More)

INTERESTING ARTICLES

"The secret of business is to know something that nobody else knows."

Aristotle Onassis