- Consumer 150

- Posts

- From $976B to $4.3T: Where Consumer Dollars (and Risks) Are Moving

From $976B to $4.3T: Where Consumer Dollars (and Risks) Are Moving

This week we’re unpacking how D2C is scaling at a 14.6% CAGR toward an $880B market.

Good morning, ! This week we’re unpacking how D2C is scaling at a 14.6% CAGR toward an $880B market, why 47% of ecommerce traffic now comes direct, the $976B gift card market racing toward $4.3T amid rising fraud, a cross-border bet on heritage fashion, and how 2026 consumers are demanding co-authorship, proof, and control over the brands they buy from.

Sponsor spotlight: Affinity helps deal teams capture relationship signals automatically and map firm-wide connections—so you can source and move faster. Book a demo →

TREND OF THE WEEK

D2C Isn’t a Channel, It’s Becoming the Model

The Direct-to-Consumer (D2C) market is scaling from a niche experiment to a structural force in global retail. At a projected 14.6% CAGR, the D2C market is expected to grow from $225.5B in 2024 to $880.1B by 2034, redefining brand value through customer ownership, data leverage, and gross margin expansion.

Why it matters: Unlike wholesale, D2C gives brands real-time data on conversion, churn, and LTV—accelerating personalization and inventory precision. Apparel and beauty are leading, but food, electronics, and home are following close behind. North America still dominates, but APAC is the fastest-growing, fueled by mobile-first habits and social commerce.

Social platforms are now storefronts. Nearly half of consumers buy via TikTok, Instagram, or other social channels—pushing brands to integrate creator content and native checkout. Tech is central to scale: AI-powered personalization and subscription models are locking in LTV and reducing CAC volatility.

But rising competition and higher digital ad costs are testing margins. Winners will be those with operational discipline, not just digital flair. Investors should look beyond top-line growth and focus on unit economics, retention dynamics, and defensibility.

Bottom line: In 2035, D2C won’t be a growth lever—it will be the default. The brands building defensible D2C engines now are tomorrow’s compounders. (More)

PRESENTED BY AFFINITY

Affinity is the CRM built for private equity teams. Emails and calendar activity are captured automatically, with firm-wide relationships mapped to target companies and intermediaries so deal teams can see existing connections without manual data entry.

A firm's network is its edge. Relationship intelligence turns that network into action with purpose-built AI that maps firm-wide connections to accelerate deal sourcing, strengthen diligence, and deepen portfolio oversight.

By centralizing relationship context across the deal lifecycle, firms can act earlier, stay aligned, and avoid paying fees for connections they already have.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

When Roles Only Exist on Paper (Value Creation)

What breaks teams before it shows up on a dashboard? According to Shiv Narayanan, Founder of leading PE growth consultancy, How To SaaS, dysfunction rarely starts with a blowup, it creeps in through misaligned incentives, ghost roles, and busyness masquerading as strategy.

In this week's featured episode, Narayanan outlines familiar yet dangerous failure modes: Marketing and sales running parallel instead of together, “leaders” without true ownership, and teams producing at full tilt without knowing why. The diagnosis is blunt: these aren’t tool problems, they’re structural ones. And AI? It just accelerates the direction you’re already going.

The conversation is worth a listen for anyone scaling a firm, running GTM at a portco, or trying to make cross-functional teams actually function. One key quote stuck with us: “Tools don’t fix lack of clarity. They make confusion scale.”

ECOMMERCE

Traffic Isn’t Bought, It’s Earned

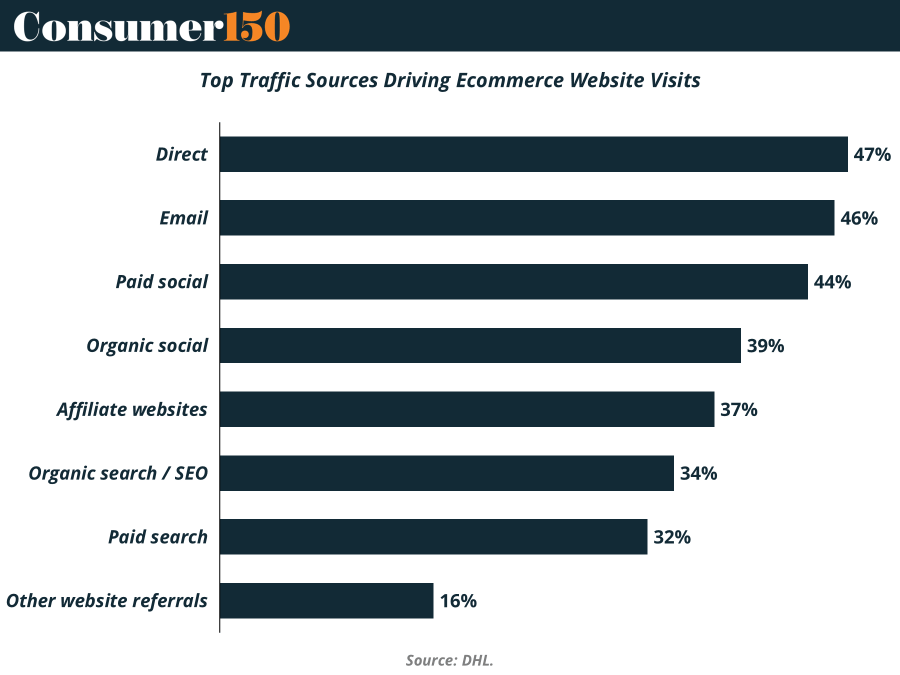

The data makes one thing clear: ecommerce traffic is less about clever ad buying and more about brand gravity. Direct traffic leads at 47%, meaning nearly half of visits come from customers who already know where they’re going. That’s not performance marketing—it’s memory.

Right behind it is email marketing at 46%, quietly doing what it always does: delivering high-ROI, repeatable demand without auction-based pricing. Together, these owned channels outperform every paid lever.

Paid social (44%) and organic social (39%) still matter, but mostly as discovery engines, not closers. Affiliate traffic (37%) adds high-intent volume, while search—both SEO (34%) and paid (32%)—plays more of a supporting role than many brands assume.

The takeaway: sustainable growth comes from retention, recognition, and relationships. Ads amplify. Brands endure. (More)

DEAL OF THE WEEK

Marubeni Bets on British Heritage with Jacobson Group Buy

Japanese conglomerate Marubeni is doubling down on global lifestyle plays with its U.S. consumer arm, MCPU, acquiring the UK’s Jacobson Group—home to iconic footwear brands like Gola, Lotus, Ravel, and Frank Wright. The terms remain undisclosed, but the strategic intent is clear: build a scalable multibrand platform rooted in heritage and global reach.

This is MCPU’s second move after last year’s acquisition of RGB Brands (Dearfoams, Baggallini), and the Jacobson deal gives it both European DNA and established U.S. distribution through retailers like Nordstrom, Bloomingdale’s, and Urban Outfitters. RGB will take over operations, signaling Marubeni’s platform model: centralize logistics, decentralize brand identity.

Why it matters: Gola’s brand resonance is rising in the U.S., and Marubeni’s play is to ride that wave while unlocking growth via infrastructure and market synergies. In a fragmented fashion space, this is a vertically integrated bet on scaling legacy brands across borders. (More)

Gift Cards Are Hot, and So Are the Scams

Gift cards may be a $976.8B market on their way to $4.3T by 2033, but they’ve also become a prime target for fraudsters. UK watchdogs and fraud reporting agencies are warning of a sharp rise in gift card scams, with over £18.5M lost in 2023-24 and a 25% jump in reported incidents . Methods range from in-store tampering and phishing emails to social engineering schemes where consumers are tricked into buying cards as untraceable payment methods.

As traditional bank transfer scams get harder to pull off, criminals are pivoting to gift cards for their anonymity and liquidity. And while most attention is on consumers, retailers and issuers face growing reputational risk.

Why it matters: The market’s continued growth depends not just on volume, but trust. With both physical and digital formats now nearly evenly split—51% vs 49% market share respectively—retailers, platforms, and issuers need robust software to detect tampering, verify authenticity, and flag abnormal activity. That’s where third-party solutions like Gift Card Corner become critical infrastructure. Fraud is no longer a niche problem—it’s the cost of scale. (More)

CONSUMER BEHAVIOR

2026: The Year Consumers Demand to Be Co-Authors

In 2026, consumer behavior is no longer about reacting to trends—it’s about redefining the terms of engagement. Six behavioral forces are converging around a single demand: agency with accountability.

The New Algorithmic Contract

Consumers now expect hyper-personalization—but not at the cost of transparency. AI must co-create, not dictate. Retailers like IKEA are leading with tools that enable real-time consumer choice, not hidden algorithmic nudges.Unfiltered Authenticity

Glossy brand perfection has peaked. Consumers crave earned imperfection—experiences that feel live, not staged. Think offline pop-ups, unscripted moments, and narrative styles rooted in context over polish.Rewired Wellness

Wellness has shifted from “aspirational” to functional and measurable. Products like GLP-1s and NAD+ supplements speak to a growing desire for biological agency—science-backed tools for immediate relief and performance.Value Reinterpreted

It’s not just about price—it’s about confidence. Brands that simplify decision-making and deliver on emotional ROI (like peace of mind or respite) are winning over those competing purely on cost.The Experience Reset

The “experience economy” is maturing. Consumers now seek memorable meaning, not momentary spectacle. Premium rituals, cultural depth, and intentional leisure are outperforming viral flash.Proof Over Promise

Sustainability without evidence no longer sells. Tools like Digital Product Passports are becoming trust enablers. Visibility and verification now shape brand loyalty more than ideals alone.

Why it matters:

These aren’t fads—they’re durable shifts that will reshape value creation in every consumer category. Brands that optimize for clarity, co-authorship, and credibility will lead. Those clinging to one-way persuasion or opaque systems? Irrelevant by 2027. (More)

INTERESTING ARTICLES

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Do not be embarrassed by your failures, learn from them and start again."

Richard Branson