- Consumer 150

- Posts

- The Direct-to-Consumer Market: Why Owning the Customer Is Becoming the Defining Retail Advantage

The Direct-to-Consumer Market: Why Owning the Customer Is Becoming the Defining Retail Advantage

The direct-to-consumer (D2C) model is no longer a peripheral experiment in retail—it is rapidly becoming a core strategic pillar for consumer brands and a critical lens through which investors should evaluate long-term value creation.

As traditional wholesale and third-party retail channels face margin compression, data opacity, and slower innovation cycles, D2C models are reshaping how brands grow, compete, and compound enterprise value.

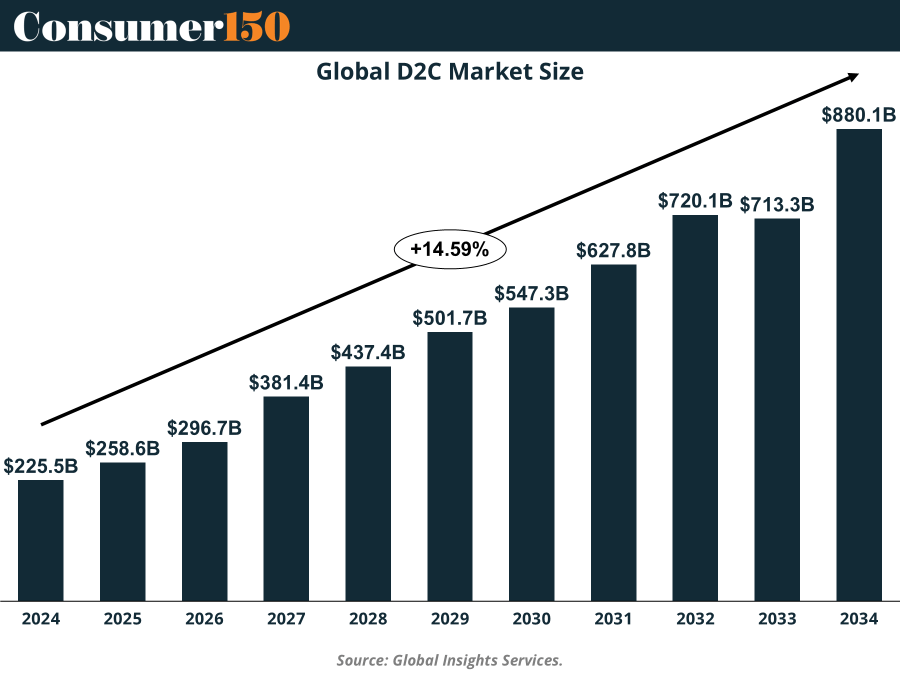

Recent market data underscores the magnitude of this shift. According to Global Insight Services, the global D2C market is projected to expand from approximately $225.5 billion in 2024 to $880.1 billion by 2034, reflecting a compound annual growth rate of roughly 14.6%. This growth is not cyclical—it reflects a structural realignment in how consumers discover, evaluate, and purchase products, and how brands capture economic value from those relationships.

A Structural Shift Away from Wholesale Dependence

At its core, the D2C model enables brands to bypass traditional retail intermediaries and sell directly to end consumers through owned digital and physical channels. This shift delivers three fundamental advantages: superior data ownership, tighter control over brand narrative, and materially higher gross margin potential over time.

Brands that own their customer relationships can observe behavior in real time—tracking conversion paths, pricing elasticity, repeat purchase cycles, and cohort-level lifetime value. In contrast, brands reliant on wholesale distribution often operate with delayed, incomplete, or aggregated data, limiting their ability to iterate quickly. The performance gap between these models is widening as personalization, speed, and responsiveness become decisive competitive factors.

The apparel and footwear segment currently leads the D2C market, accounting for roughly 30% of total volume, driven by influencer-led discovery, social commerce integration, and fast product iteration. Beauty and personal care follow closely, benefiting from high purchase frequency and strong community engagement. Home goods, electronics, and food & beverage round out the ecosystem, each leveraging D2C strengths in different ways—from customization to replenishment models.

Geography, Resilience, and the New Supply Chain Logic

From a regional perspective, North America remains the dominant D2C market, supported by advanced logistics infrastructure, high internet penetration, and a digitally fluent consumer base. Europe follows, with particularly strong momentum in the UK and Germany, where sustainability, transparency, and regulatory alignment favor direct engagement models. Asia-Pacific represents the fastest-growing region, with China and India benefiting from mobile-first commerce, social selling, and an expanding middle class.

However, D2C growth is unfolding amid a complex macro environment. Tariffs, geopolitical tensions, and energy-driven supply chain disruptions are forcing brands to rethink sourcing and manufacturing strategies. Many D2C leaders are responding by localizing production, diversifying suppliers, and investing in supply chain resilience—moves that may pressure near-term margins but strengthen long-term defensibility. For investors, this underscores the importance of evaluating operational execution alongside top-line growth.

D2C E-Commerce: The High-Velocity Engine Within the Market

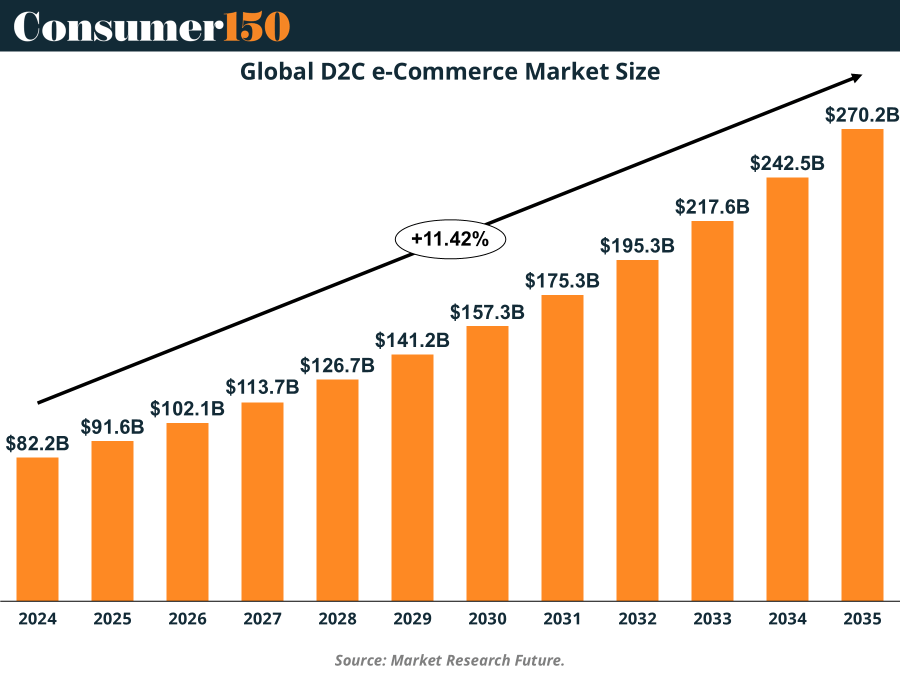

Within the broader D2C universe, e-commerce represents the highest-velocity growth engine. Market Research Future estimates that D2C e-commerce will grow from approximately $82 billion in 2024 to $270.2 billion by 2035, delivering a CAGR of 11.4%. While this growth rate is modestly lower than the overall D2C market, it reflects scale maturity rather than deceleration.

What distinguishes D2C e-commerce is its operational leverage. Digital-native brands can test pricing, messaging, bundling, and promotions in real time—adjusting strategies based on immediate performance data rather than quarterly sell-through reports. This agility is particularly valuable in volatile demand environments, where rapid recalibration can protect margins and inventory turns.

Social commerce has further amplified this dynamic. Platforms such as Instagram and TikTok have evolved from marketing channels into full transaction environments, particularly among Millennials and Generation Z. Nearly half of consumers now report having purchased directly through social platforms, reinforcing the strategic importance of influencer partnerships, creator-led content, and native checkout experiences.

Technology, Personalization, and the Economics of Loyalty

Technology is increasingly the economic backbone of successful D2C strategies. Artificial intelligence and machine learning are enabling more precise personalization—from product recommendations and dynamic pricing to predictive replenishment and customer service automation. Over 70% of consumers now indicate a preference for brands that leverage technology to enhance the shopping experience, reinforcing the link between digital investment and revenue durability.

Subscription models further strengthen this relationship. Across categories such as apparel essentials, beauty, food, and health, subscriptions are driving predictable cash flows and higher customer lifetime value. Data suggests subscription services have grown more than 30% in recent years, offering brands both revenue stability and deeper behavioral insights.

Sustainability is also evolving from a marketing narrative into a measurable competitive advantage. More than 70% of consumers express a preference for brands with credible environmental practices, and D2C models are uniquely positioned to communicate sourcing, production, and impact transparently. For investors, sustainability alignment increasingly correlates with brand resilience and long-term relevance, particularly among younger cohorts.

Competitive Intensity and Investor Implications

Despite its growth, the D2C market is not without challenges. Customer acquisition costs are rising as digital advertising becomes more competitive. Logistics complexity, data privacy regulation, and consumer price sensitivity add further pressure. The market is also becoming increasingly crowded, raising the bar for differentiation.

Yet, leading brands are responding through scale, innovation, and strategic partnerships. Nike continues to deepen its D2C focus through digital platforms and flagship experiences. Warby Parker is investing in domestic manufacturing and personalization technology. Beauty brands like Glossier are embedding sustainability and community engagement directly into their operating models.

For consumer investors, the takeaway is clear: D2C exposure should not be evaluated solely on revenue growth. The most attractive opportunities lie with brands that demonstrate disciplined unit economics, data-driven decision-making, operational resilience, and credible paths to profitability. Ownership of the customer relationship—rather than simple channel presence—is becoming the defining asset.

The Long-Term Outlook

Looking ahead, the D2C market is poised to remain one of the most dynamic segments within global consumer retail. Growth will increasingly be driven by artificial intelligence, subscription monetization, augmented reality product visualization, and deeper integration of commerce within social and mobile ecosystems.

By 2035, D2C will not be a category—it will be the default operating model for consumer brands seeking relevance, resilience, and sustained value creation. For investors, understanding which companies are building durable D2C engines today will be critical to identifying tomorrow’s category leaders.

Sources & References

Global Insights Services. (2025). D2C (Direct to Consumer) Market Analysis and Forecast to 2034. https://www.globalinsightservices.com/reports/d2c-direct-to-consumer-market/

Inbeat. (2025). 77 Direct-to-Consumer (DTC) Brand Statistics & Trends to Track in 2025. https://inbeat.agency/blog/direct-to-consumer-dtc-brand-statistics-trends

Market Research Future. (2025). D2C Ecommerce Market. https://www.marketresearchfuture.com/reports/d2c-ecommerce-market-35564