- Consumer 150

- Posts

- Dad’s Day Goes Experiential, and Young Spenders Lead

Dad’s Day Goes Experiential, and Young Spenders Lead

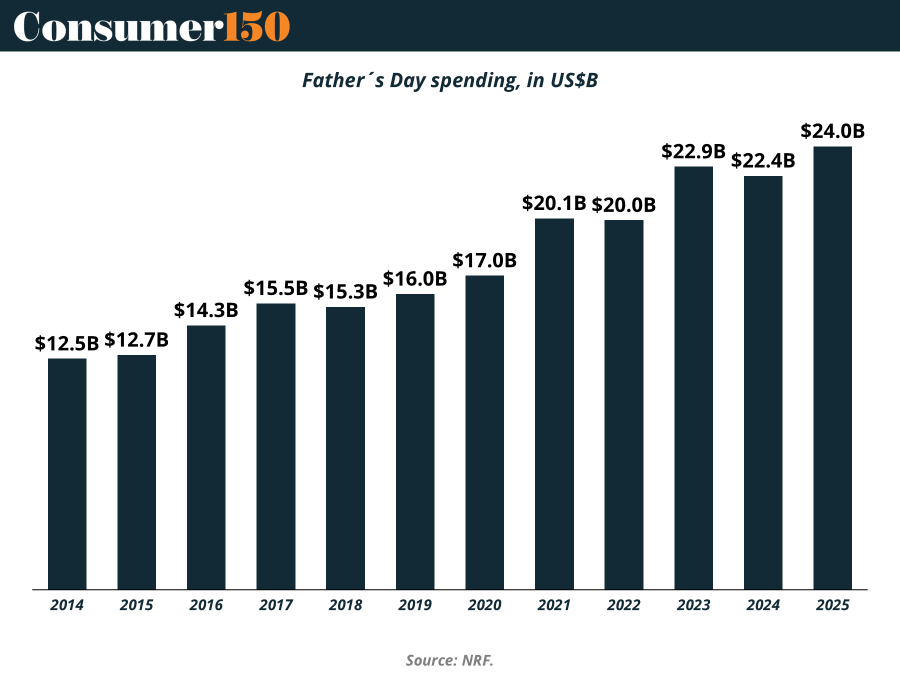

Younger shoppers are driving a shift from traditional gifts to high-emotion, high-ticket experiences—reshaping how brands should court the $24B Father’s Day wallet.

Good morning, ! It’s Thursday and we’re diving into consumer spending trends on Father`s day, the global number of ecommerce stores has tripled since 2019, and China has officially overtaken South Korea as the global leader in TV shipments.

Want to reach 350,000+ executive readers? Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

Dad Dollars: A $24B Opportunity in Cargo Shorts and Concert Tickets

Father’s Day is no longer just for power drills and polo shirts. In 2025, U.S. spending on Dad is projected to hit $24 billion, nearly double the 2014 total. But the real shift? Experiential gifts like dinners and events now top the charts at $4.8B, eclipsing clothing and gift cards. Per-person spending has soared to $199.38, with 25–34 year-olds leading the charge at a hefty $275.67 each. Even in a year where overall spend dipped slightly, personalized, tech-forward gifts held strong, and electronics alone raked in $2.6B. In short: if your product speaks to sentiment, utility, or dopamine, Father’s Day is open for business. (Read or Listen to the Full Report)

TREND OF THE WEEK

CEOs Are Losing Sleep Over AI Privacy

Data privacy isn’t just a consumer concern—it’s also a boardroom headache. According to Statista, 53% of CEOs in U.S. retail flag data security and privacy as the top challenge to implementing AI. That compares to 44% of managers and employees, hinting at a trust gap within organizations themselves. But here’s the kicker: younger consumers (ages 18–24) are the least resistant to data-sharing, while older demographics are far more hesitant. Translation? Retailers need AI strategies that build trust with the old, and speed up adoption with the young—all while keeping the data vault sealed shut. (More)

PRESENTED BY START ENGINE

StartEngine’s $30M Surge — Own a Piece Before June 26

Private markets are having a moment, thanks to companies like StartEngine.

The leading alternative investing platform is helping everyday investors like you access deals once reserved for VCs and insiders, including exposure to private market titans like OpenAI, Databricks, and Perplexity.¹

How’s it going? In Q1 2025, StartEngine pulled off $30M in revenue, its biggest quarter ever (based on unaudited financials).²

But StartEngine isn’t just a middleman. The company earns 20% carried interest on select pre-IPO offerings, unlocking value for shareholders when these deals succeed.³

How can you tap into this diversification play? By investing in StartEngine.

StartEngine has crowdfunded $85M+ to date, and you can join 45K+ shareholders before the company’s current round closes on June 26.

Reg A+ via StartEngine Crowdfunding, Inc. No BD/intermediary involved. Investment is speculative, illiquid & high risk. See OC and Risks on page.

ECOMMERCE

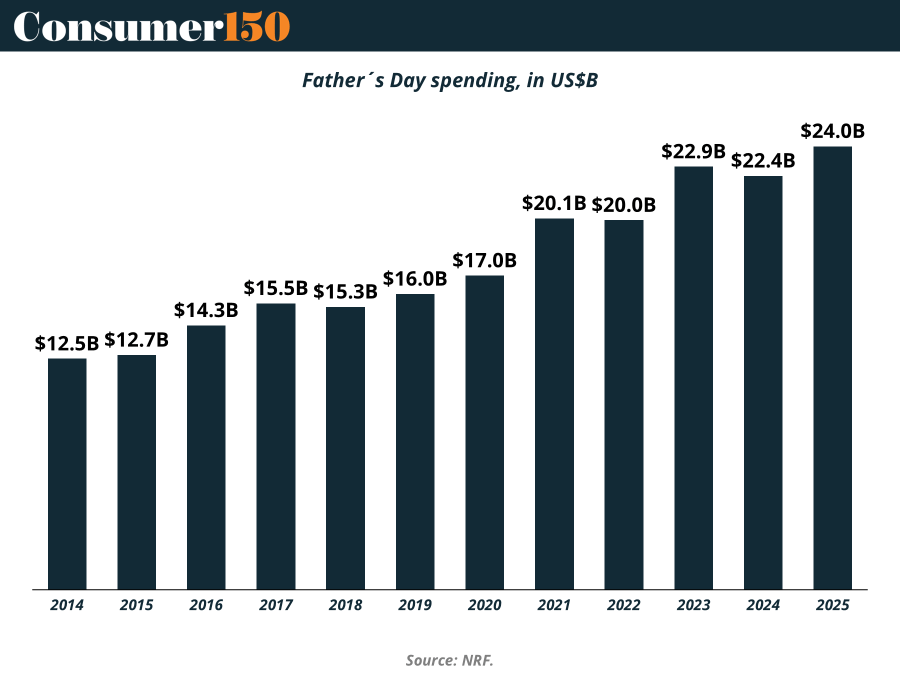

30.7 Million eCommerce Stores—and Counting

The number of eCommerce stores globally has more than tripled since 2019, surging from 9.2M to 30.7M in 2024 . The pandemic-induced boom of 2021 (+104%) was followed by steadier gains—yet the growth engine clearly isn’t stalling.

The eCommerce stack is fragmenting. Platforms like Shopify, Etsy, and niche marketplaces are fueling long-tail growth, while giants like Amazon consolidate power at the top. The result: a more crowded, more competitive digital retail landscape.

For investors, this matters. As the number of stores explodes, customer acquisition costs are rising and differentiation is harder. Scale, community, and owned data are becoming critical moats.

At the same time, the eCommerce ecosystem is maturing fast: B2B sales, cross-border commerce, and digitally native vertical brands are driving new waves of growth. The market is shifting from land grab to optimization—and only the most efficient models will thrive.

Bottom line: 30.7M stores is not saturation—it’s signal. The next phase of eCommerce won’t be about launching stores; it will be about scaling them profitably. (More)

DEAL OF THE WEEK

L’Oréal Drops Clinical Cash on Medik8

The French beauty giant is doubling down on its skincare strategy, acquiring a majority interest in UK-based Medik8. While financial terms weren’t officially disclosed, FT pegs the deal around €1B. The twist: Inflexion PE stays on board as a minority shareholder, and the current management sticks around.

That’s a familiar template—L’Oréal did the same with Galderma and Miu Miu’s beauty licence. With Medik8’s anti-ageing focus, influencer credibility, and in-house production, L’Oréal’s strategy is clear: own the shelf for science-backed skincare, from pharmacy to luxury. (More)

TOGETHER WITH STACK INFLUENCE

Outrank Your Competitors on Amazon—Fast!

Stack Influence automates micro-influencer collaborations to significantly boost external traffic and organic rankings on Amazon. Trusted by top brands like Magic Spoon and Unilever, it's your secret to dominating page one.

When Gift Cards Become a Governance Risk

A cautionary tale out of Richmond, B.C.: the city uncovered $295K in unreconciled gift card purchases following a forensic audit of its employee recognition program. Over three years, Richmond spent $446K on gift cards, but only $151K could be accounted for. The result? A police referral, a fired employee, and a citywide freeze on gift card use.

While corporate and public-sector gift card programs are booming, corporate demand is a key driver of the market’s projected 16% CAGR through 2033, this incident highlights a critical operational risk: lack of traceability. Physical and even digital gift cards can easily slip through internal controls if reconciliation processes aren’t airtight.

Why it matters: As companies lean more heavily on gift cards for employee incentives, marketing, and loyalty programs, the governance bar will only rise. Expect more scrutiny from auditors and boards—and growing demand for trackable, auditable gift card solutions.

Bottom line: Gift cards are big business. But without the right controls, they can become a big liability. (More)

CONSUMER TECH

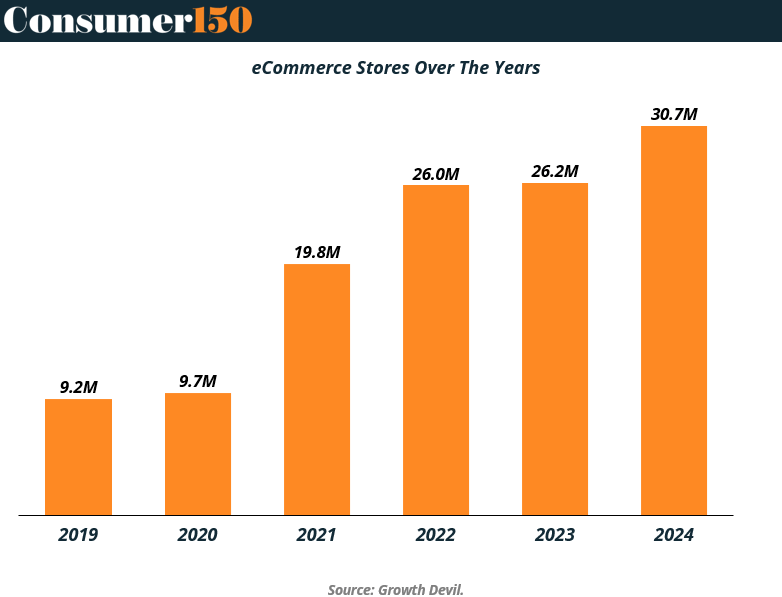

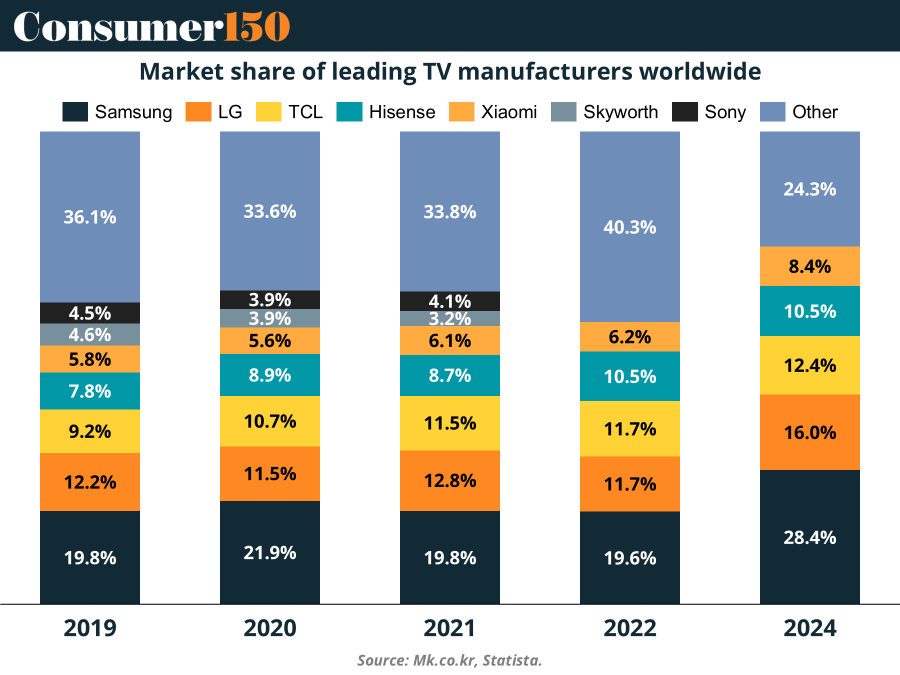

Battle for the Big Screen: China Pulls Ahead

Chinese TV Brands—TCL, Hisense, and Xiaomi—have officially overtaken Samsung and LG in global TV shipments for the first time (31.3% vs. 28.4%). It’s not just about volume: their revenue share is climbing fast too. The secret sauce? Cost-performance optimization and a relentless push into ultra-large TVs (75”+), where Hisense even leads in 98” and 100” categories.

Meanwhile, Samsung and LG still dominate the $2,500+ premium segment—holding a combined ~80% market share. But in the mass market, the momentum is clearly shifting.

As one industry observer puts it: expect price wars, government-backedChinese exports, and a race for AI-driven smart TVs. In this battle of scale vs. prestige, the gap is narrowing—fast. (More)

CONSUMER BEHAVIOR

The New Math of Consumer Loyalty

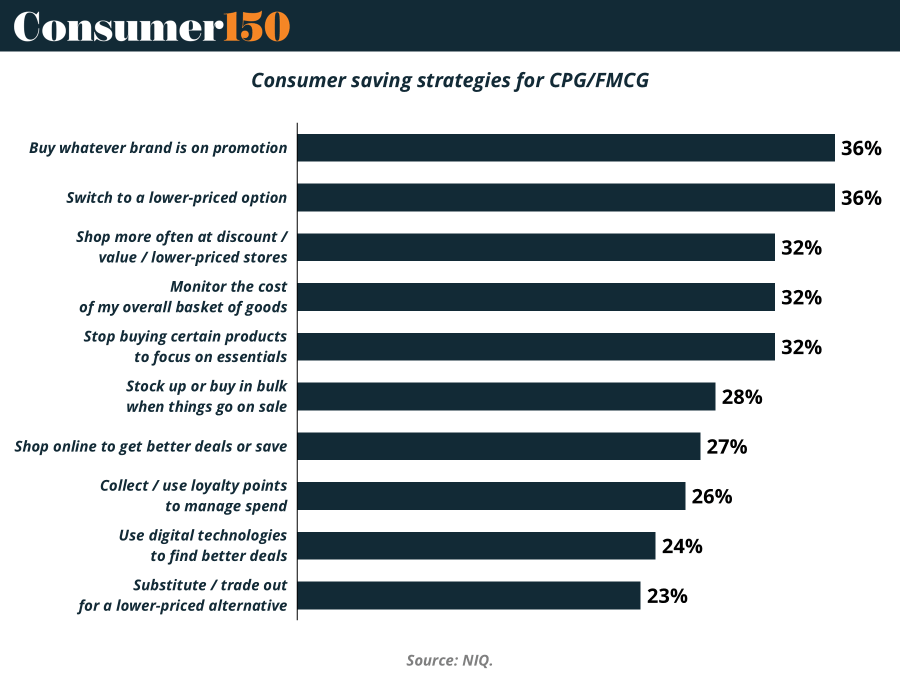

In 2025, loyalty isn’t dead—but it’s definitely conditional. According to NIQ’s latest outlook, 36% of global shoppers now choose whatever brand is on promotion, and another 36% are actively trading down to lower-priced options. That’s not price sensitivity—it’s full-blown value hacking. Meanwhile, 32% are shifting toward discount retailers, and nearly a quarter are using digital tools to sniff out the best deals.

For brands, this means less “how do we stand out?” and more “how do we show up—on sale, in cart, and in-app?” Bottom line: promotions are the new persuasion. (More)

INTERESTING ARTICLES

"Success is the sum of small efforts, repeated day-in and day-out"

Robert Collier