- Consumer 150

- Posts

- U.S. Father’s Day Spending Trends

U.S. Father’s Day Spending Trends

Alongside Mother’s Day and Valentine’s Day, Father’s Day has firmly established itself as one of the top retail events in the U.S.

While Mother's Day often garners more attention—topping $33.5 billion in 2024—Father’s Day has shown consistent and meaningful growth over the past decade.

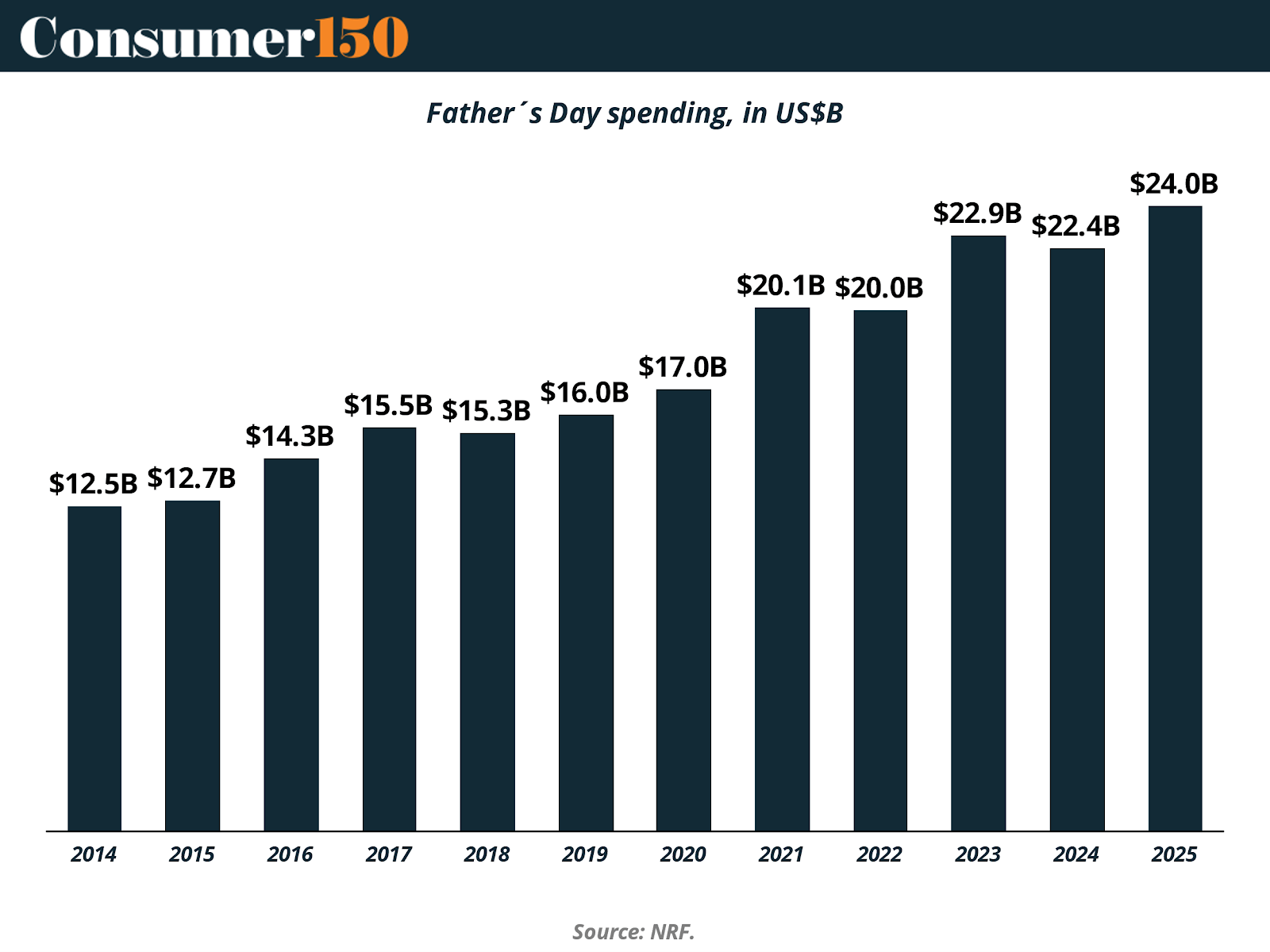

According to the National Retail Federation (NRF), consumer spending for Father’s Day has nearly doubled, rising from $12.5 billion in 2014 to a record $22.9 billion in 2023. Although 2024 saw a modest dip to $22.4 billion (–2.2%), this remains well above pre-pandemic levels and reflects a durable upward trend.

In 2025, spending is projected to hit a new high of $24 billion, according to the NRF and Prosper Insights & Analytics—reaffirming the holiday’s long-term momentum.

The largest year-over-year jump came in 2021, with an 18.2% surge to $20.1 billion, likely driven by post-lockdown enthusiasm and a renewed focus on meaningful celebrations. While annual growth has not been strictly linear, the trajectory is clear: Father’s Day is gaining ground as both a cultural and commercial occasion.

These shifts present key opportunities for brands—especially in personalized, experiential, and practical gift categories—as consumer expectations continue to evolve.

Per Capita Spending on Father’s Day: A High-Value Consumer Signal

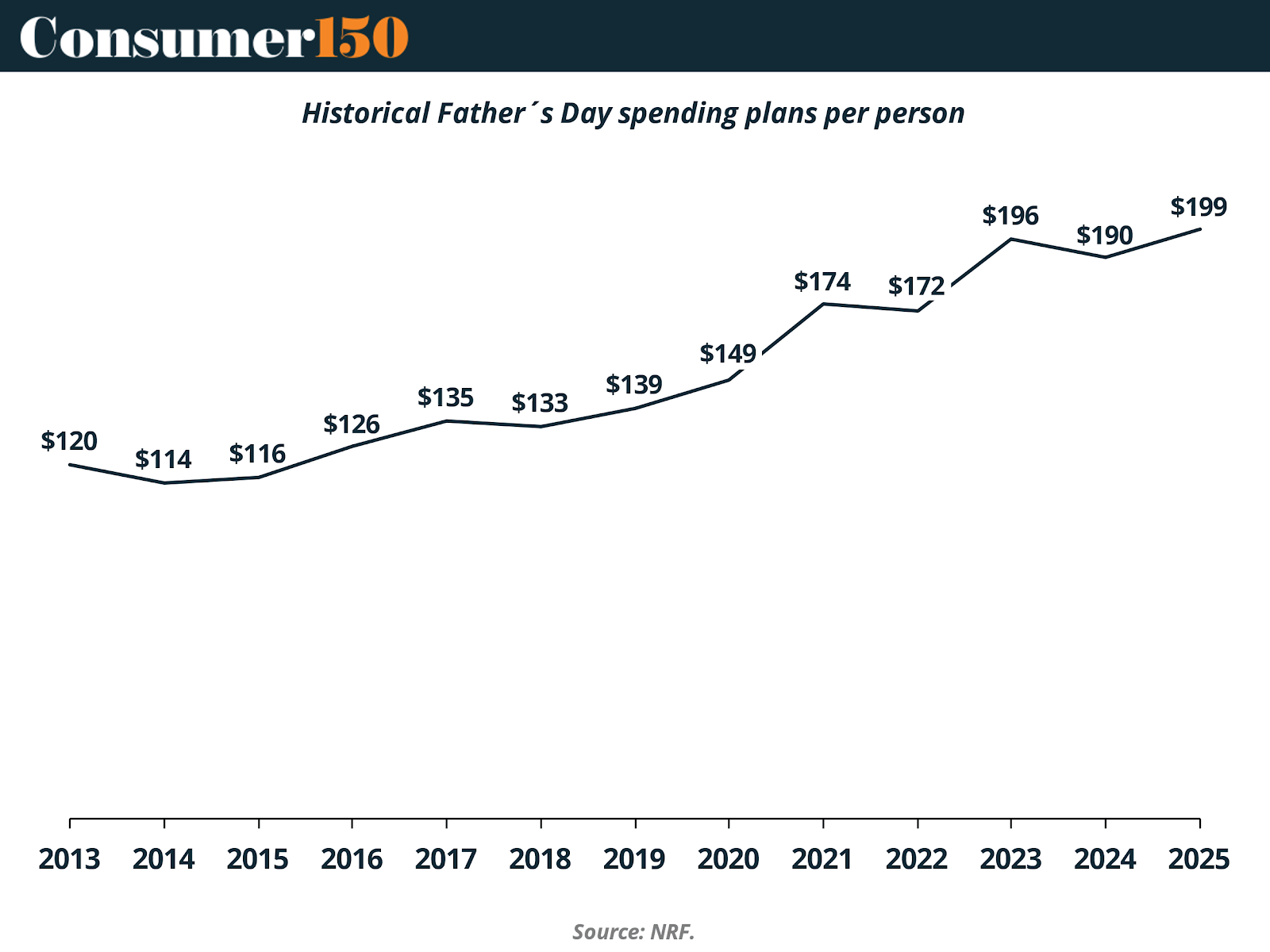

Father’s Day has grown into one of the most significant retail occasions of the year, blending heartfelt celebration with robust consumer spending. According to the National Retail Federation, the average spending per person for Father’s Day has shown a steady upward trend over the past decade, rising from $119.84 in 2013 to $199.38 in 2025, an increase of over 66% in just twelve years. This growth highlights the holiday’s increasing economic impact and the evolving importance consumers place on honoring fatherhood through meaningful gifts.

The most notable surge in spending occurred post-pandemic, with average expenditures jumping from $148.58 in 2020 to $174.10 in 2021, and reaching a new record high of $199.38 in 2025, surpassing the previous peak of $196.23 in 2023. Although 2024 saw a slight dip to $189.81, the rebound in 2025 underscores Father’s Day as a firmly established and highly anticipated retail event.

Furthermore, generational shifts are evident, with consumers aged 25 to 34 continuing to lead the way in spending. In 2024, this group averaged $275.67 per person, a figure expected to remain strong in 2025. Their willingness to invest in personalized and experiential gifts reflects broader changes in how modern fatherhood is celebrated.

Beyond the numbers, consumer preferences are evolving, with increasing demand for tech gadgets, personalized items, and unique experiences that go beyond traditional gifts. Online shopping continues to gain prominence, becoming a critical channel for Father’s Day purchases. This report will explore these trends in detail, providing insights into spending patterns, gift categories, marketing strategies, and the opportunities they present for retailers aiming to capitalize on this growing market.

Breakdown of Consumer Spending by Category

While overall spending on Father’s Day has increased significantly, a deeper look into how consumers allocate their budgets reveals meaningful insights for businesses looking to tailor their offerings. According to data from the National Retail Federation, the 2024 Father’s Day expenditure in the United States reached notable levels across several categories, highlighting shifting consumer values and preferences.

Key Categories of Spending

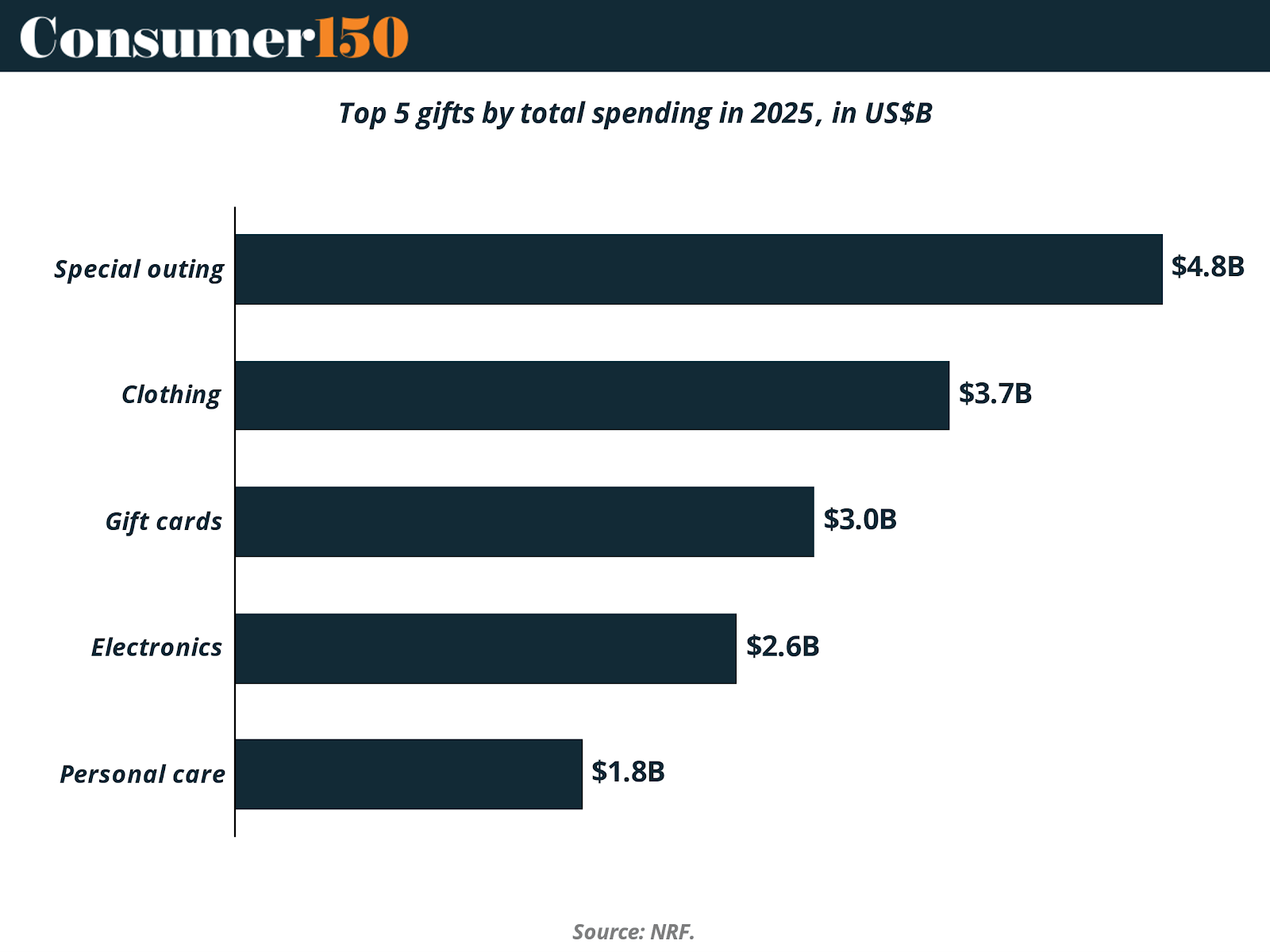

As illustrated in the chart below, “Special outings” such as dinners, concerts, and other shared experiences once again topped the list, rising to $4.8 billion in 2025. This reinforces the broader trend toward experiential gifts, particularly among younger consumers who prioritize shared memories over material goods.

The second-largest category remained clothing, now totaling $3.7 billion, followed by gift cards ($3B) and electronics ($2.6B). The continued prominence of electronics and tech-related gifts suggests a stable appetite for high-ticket items such as smartwatches, headphones, or home devices, consistent with preferences seen across other major holidays.

Meanwhile, personal care products grew modestly to $1.8 billion, continuing the shift toward functional, wellness-oriented gifts.

Highlights and implications

• Experience over possessions: The fact that special outings ranked first again, with spending rising to $4.8B, highlights a cultural shift from material to experiential gifting. Businesses in hospitality, dining, and entertainment can leverage this by offering exclusive packages or limited-time experiences.

• Omnichannel tech buys: With $2.6B spent on electronics (up from $2.4B), retailers and DTC brands in this category should focus on seamless online experiences and highlight features like express shipping, bundling, or customization.

• Gift cards and personalization: The $3B spent on gift cards (vs. $2.9B) indicates a consumer desire to let recipients choose their own gifts. Brands should consider integrating gift card options into personalized experiences (e.g., "build your own gift pack").

• Niche growth potential: While smaller in total spend and unchanged in rank, categories like automotive accessories, books, and greeting cards continue to offer opportunities for differentiation through storytelling, branding, and targeting niche audiences.

• Function meets sentiment: The continued growth in categories like personal care, rising to $1.8B, reflects a growing consumer preference for gifts that are both thoughtful and practical. Brands can position items like grooming kits, home tools, or wellness products not just as necessities, but as high-impact gifts that enhance everyday life.

Headline Purchase Incidence: What Shoppers Are Choosing

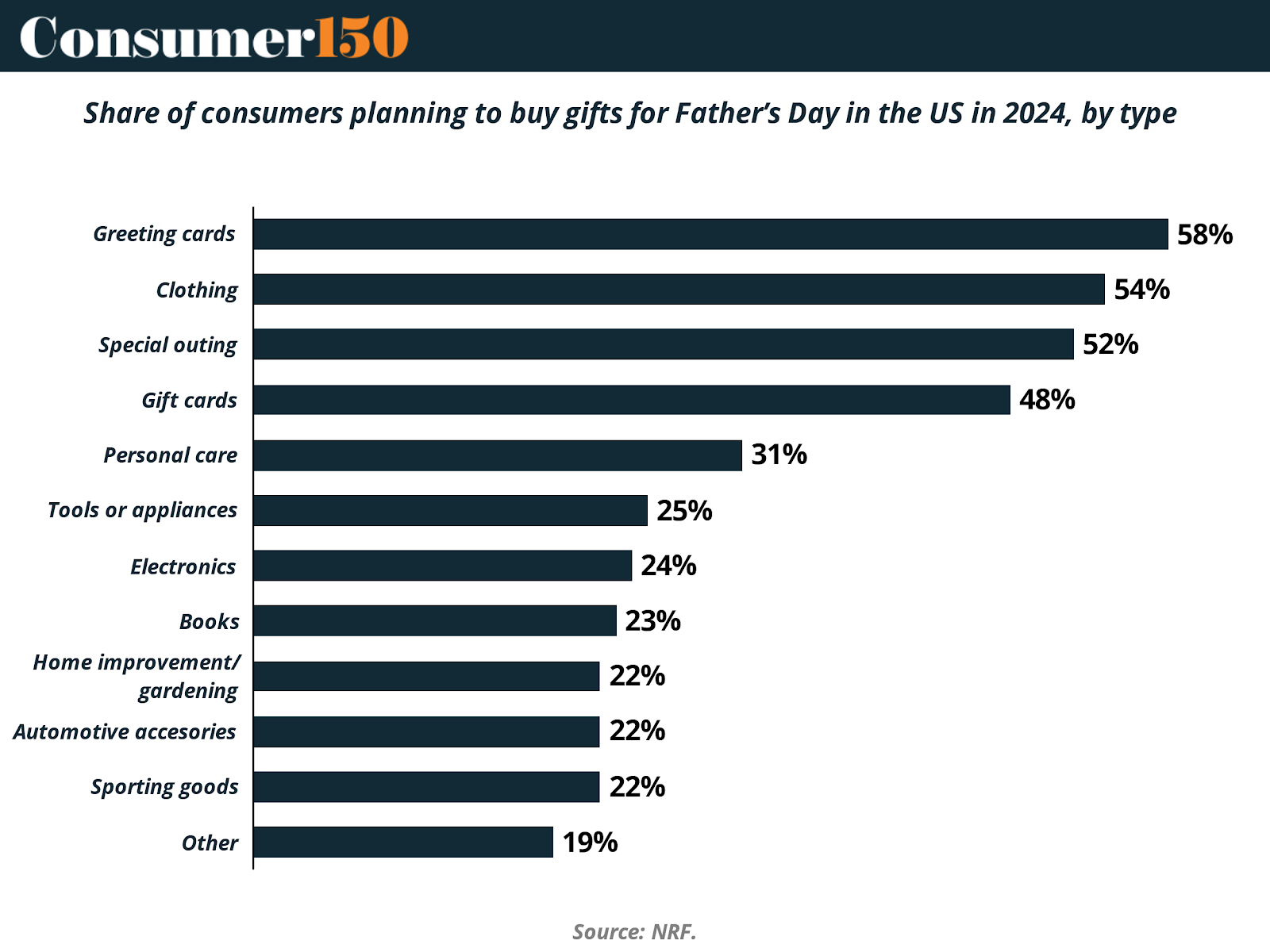

Beyond dollar value, looking at the share of consumers planning to buy each type of gift adds important context to the broader spending landscape. While special outings top the list in spending, the most widely chosen gift was actually greeting cards, purchased by 58% of consumers. This underscores how low-cost, high-sentiment items still hold significant cultural weight, often accompanying bigger-ticket gifts or used as standalone tokens of appreciation.

Clothing and special outings were nearly tied in terms of popularity, with over half of consumers planning to purchase them. Interestingly, gift cards, while third in overall spending, were selected by 48% of respondents, suggesting they serve a dual role as both fallback and flexible option.

Meanwhile, categories like personal care (31%), tools/appliances (25%), and electronics (24%) had a more selective audience, often reflecting targeted, interest-driven gifting. And although categories such as automotive accessories, sporting goods, and books drew smaller shares (around 22%–23%), their presence speaks to the diversity in consumer intent and the opportunities for brands to speak to niche audiences.

In short, while spending totals reveal the economic weight of each category, percentage-based data reveals cultural resonance and gift selection behavior. Together, they illustrate a Father’s Day landscape that is not only broad in scope, but increasingly attuned to both practicality and personalization.

The 2025 data reinforces these patterns, with greeting cards (58%), clothing (55%), and special outings (53%) remaining the top choices by percent purchasing, confirming that consumers continue to blend emotion, utility, and experience in their gifting behavior.

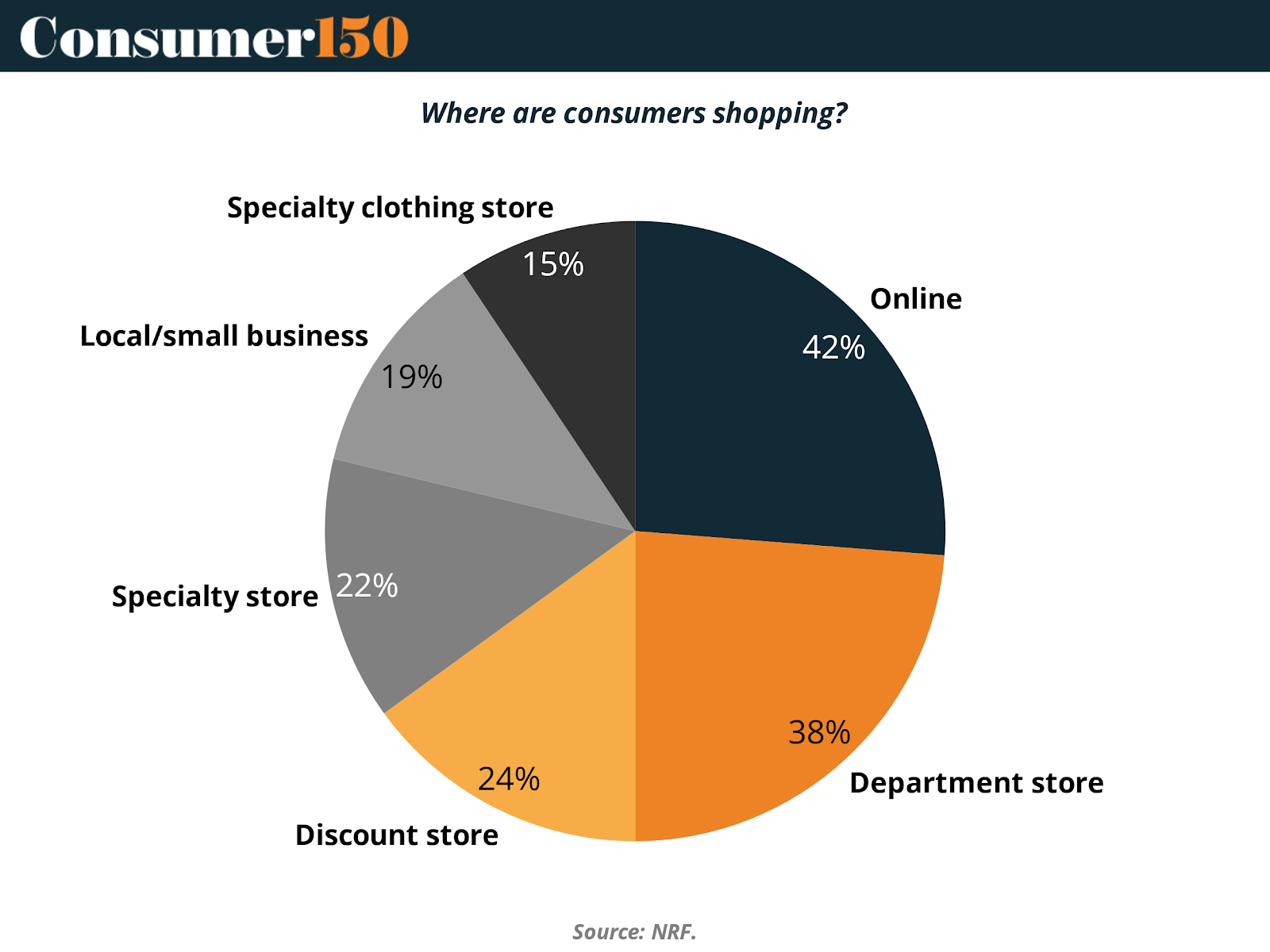

Where Consumers Are Shopping: A Channel-Driven View

Consumer spending around Father’s Day is not just about what people buy, but also where they choose to shop. According to NRF’s 2024 Father’s Day Spending Survey, shopping preferences remain highly diversified, reflecting broader shifts in retail behavior, consumer expectations, and channel dynamics.

Online shopping continues to lead, with 42% of consumers turning to e-commerce platforms for Father’s Day purchases. This trend underscores the continued dominance of digital channels, where convenience, broad assortment, and ease of price comparison play a critical role. For many shoppers, particularly younger demographics and urban consumers, online platforms also offer the added benefit of curated gift guides and next-day delivery options, making them ideal for both planners and last-minute buyers.

Department stores remain a stronghold, cited by 38% of consumers as a preferred shopping destination. These stores benefit from their one-stop-shop appeal, combining variety and in-person experience with promotions and loyalty programs that drive seasonal foot traffic. Many department stores also bridge the gap between physical and digital, offering click-and-collect services or exclusive in-store events that enhance the customer journey.

Discount stores (24%) and specialty stores (22%) maintain significant relevance, especially among value-oriented consumers or those seeking gifts that align with specific interests or hobbies. Their targeted assortments and perceived affordability make them appealing across a wide income spectrum.

Notably, nearly one in five consumers (19%) are supporting local or small businesses, highlighting an ongoing shift toward more intentional, community-driven spending. This segment has seen increased interest post-pandemic, driven by consumers’ desire to support independent retailers and find unique, meaningful gifts. Similarly, specialty clothing stores (15%) represent a popular choice, particularly for shoppers opting for classic Father’s Day categories like apparel and accessories.

These insights reinforce the importance of an omnichannel strategy that combines the scalability of digital commerce with the experiential strength of physical retail. Brands and retailers that can personalize their messaging, streamline fulfillment, and adapt their assortments to different retail environments will be best positioned to capture share during this high-intent seasonal moment.

For business leaders, the data offers a clear takeaway: the future of retail around holidays like Father’s Day is hybrid, highly segmented, and deeply influenced by evolving consumer values. Flexibility in channel presence, strong merchandising, and seamless digital-to-physical integration are not optional, they’re strategic imperatives.

Conclusion

Father’s Day is no longer a peripheral calendar event, it has become a high-impact economic catalyst within the broader U.S. retail ecosystem. With annual expenditures rising from $12.5 billion in 2014 to over $24 billion in 2025, the holiday now represents a significant commercial opportunity across sectors, particularly for those willing to innovate and adapt to shifting consumer dynamics.

From a financial standpoint, the nearly 60% increase in per capita spending over the last decade reflects not only inflationary pressures but also increased consumer willingness to invest in quality, personalized, and experience-driven gifts. This trend is especially pronounced among younger demographics, whose spending behaviors are reshaping seasonal demand curves and creating opportunities for premiumization, cross-selling, and brand storytelling.

Moreover, the diversification of shopping channels, led by e-commerce but reinforced by department stores, discount retailers, and local businesses, signals a maturing omnichannel market. Businesses that successfully align pricing strategies, product assortment, and promotional timing across these channels can extract greater lifetime value from both new and returning customers.

From a strategic perspective, Father’s Day offers more than just a short-term sales bump. It presents a scalable testing ground for digital engagement strategies, customer segmentation, fulfillment agility, and last-mile logistics, each of which contributes to long-term operational resilience. Categories such as electronics, personal care, and experience-based gifting now function as leading indicators of consumer sentiment and discretionary spending, offering valuable insight into broader economic health.

In summary, Father’s Day spending trends reveal a retail landscape that is increasingly data-driven, margin-aware, and customer-centric. For business leaders and investors alike, the holiday represents a growing financial lever, one that, if approached with foresight and precision, can generate outsized returns not just during Q2, but throughout the fiscal year.

Sources & References

How Much Money Is Spent on Father’s Day?

National Retail Federation – Father’s Day Data Center

National Retail Federation – Father’s Day Annual Survey 2025

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.