- Consumer 150

- Posts

- China Is Back, Free Delivery Converts, and Sony Makes a Bold Move

China Is Back, Free Delivery Converts, and Sony Makes a Bold Move

Domestic travel hits 142M trips and free delivery drives 55% of cross-border conversions, while Sony spins off TV hardware to TCL.

Good morning, ! This week we’re covering the great China`s tourism sector comeback, latest data shows that Free Delivery is the highest conversion lever for eCommerce purchases. Sony is restructuring its TV hardware division into a joint venture with TCL. Under the new agreement, TCL will hold a 51% majority stake, while Sony maintains a 49% minority interest.

Sponsor spotlight: In Affinity’s survey of nearly 300 private capital professionals, deal sourcing is still priority #1 for 2026—but bandwidth is the constraint. The 2026 Predictions report shows how firms are tightening data ecosystems and automating sourcing workflows to surface better opportunities faster. Read the Report →

TREND OF THE WEEK

China Tourism Reopens the Wallet

China’s holiday travel engine is back on offense, with volume doing the heavy lifting and pricing power quietly improving. During the 2026 New Year holiday, domestic trips hit 142M, up 5.2% versus 2024, while total tourism spending reached RMB 84.8B, up 6.3%. Per capita spend rose a modest 1.1%, confirming that the recovery is being driven primarily by traffic growth, not consumer splurge.

That pattern shows up clearly in the broader holiday data. Across major holidays, tourist traffic increased 5.7% year over year to 501M, while total spending climbed 7.0% to RMB 677B. Average spend per tourist edged up just 1.2%, reinforcing a steady but disciplined consumer. More people are traveling. They are not meaningfully trading up.

For hotels, the mix matters. RevPAR recovery since late 2025 has been driven by higher ADR, not occupancy, signaling improving pricing leverage amid resilient leisure demand and expanding policy support such as spring and autumn school holidays and employee travel incentives.

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

ECOMMERCE

Cross-Border, Minus the Friction

Cross-border demand isn’t the problem. Friction is. New data shows the biggest conversion lever is still free delivery (55%), a reminder that international shoppers remain price-sensitive the moment shipping appears.

Trust follows closely behind. Secure payments and buyer protection (50%) aren’t “nice-to-haves”—they’re table stakes when shoppers leave their home market.

Then comes operational anxiety. Free returns (46%) rank nearly as high as price, reflecting fear of expensive or confusing international logistics. Showing prices in local currency (45%) further reduces checkout hesitation, especially amid FX volatility.

Finally, clarity matters more than speed. Transparent customs fees (41%) and delivery by a known logistics provider (40%) outperform vague promises.

Bottom line: Cross-border success isn’t about shipping farther. It’s about localizing trust, pricing, and expectations—and removing every excuse to abandon cart. (More)

DEAL OF THE WEEK

Sony Hands the Factory Keys to TCL

Sony is spinning off its TV hardware business into a new joint venture with TCL, giving the Chinese manufacturer a controlling 51% stake while Sony retains 49%. Binding agreements are targeted by March 31, with operations slated to begin in April 2027, pending approvals.

The logic is blunt. Premium TVs have become a margin grind, and Sony’s Bravia line has struggled to compete with TCL and peers on cost and scale. The JV flips the equation. TCL brings manufacturing efficiency, supply chain control, and display innovation, while Sony contributes its image processing, audio IP, and brand equity. Sony keeps its name on the box, but operational control shifts decisively to TCL.

For TCL, this is a brand and technology upgrade. Access to Sony’s picture processing and the Bravia halo accelerates its push upmarket. For Sony, it is a retreat from capital intensive hardware without fully abandoning the category.

Why it matters: This deal signals where consumer electronics is headed. Iconic brands are choosing partnership over pride to survive price wars. Expect cheaper Bravia TVs, tighter margins, and more brand licensing disguised as innovation when the first jointly developed models arrive in 2027. (More)

Gift Cards as a Discovery Engine (Not Just a Checkout Tool)

Gift cards are quietly becoming one of retail’s most efficient customer discovery tools. Unlike paid media, gift cards bring in new shoppers with zero upfront acquisition cost—the revenue arrives before the customer does.

More importantly, redemption behavior tells a powerful story. Industry data consistently shows that gift card recipients spend 20–50% more than the card’s face value, turning redemption into a high-margin moment rather than a discount event. For brands, that means higher AOV, full-price conversion, and exposure to new categories.

Gift cards also act as peer-driven acquisition. When a loyal customer gives a card, they’re effectively endorsing the brand to a warm, pre-qualified audience—often first-time buyers. That dynamic mirrors referral marketing, but with prepaid intent baked in.

The takeaway: gift cards aren’t just about convenience or holidays. They’re a scalable way to acquire customers, drive exploration, and grow lifetime value—all while protecting margin. (More)

CONSUMER BEHAVIOR

The New Loyalty Stress Test

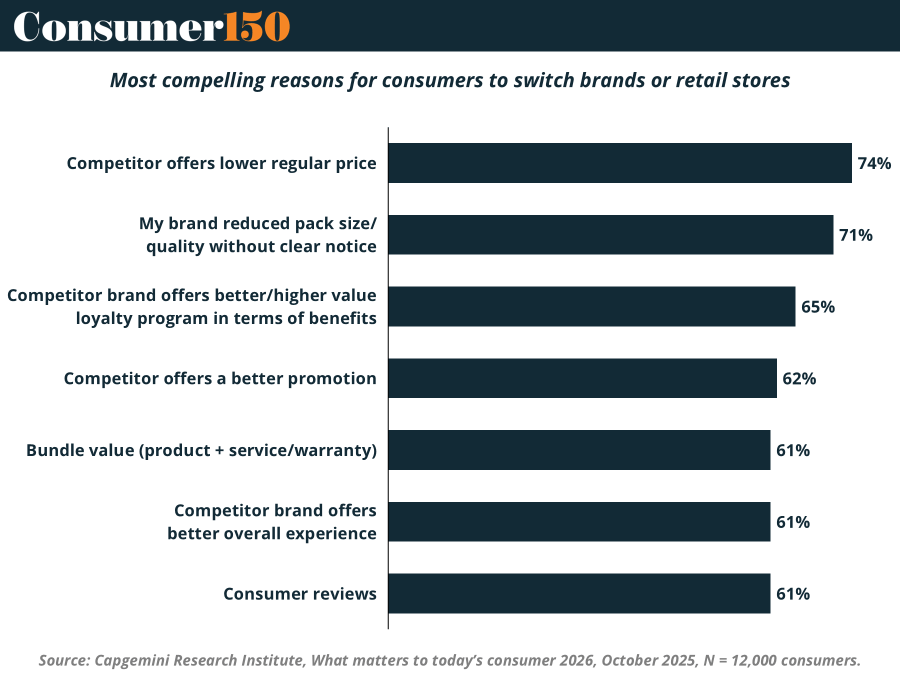

Consumer loyalty is getting audited—and most brands are failing the value integrity test. Yes, price still matters: 74% of consumers will switch for a lower regular price, not a flashy promo. But the bigger red flag? Trust erosion. A striking 71% walk when brands quietly shrink pack sizes or downgrade quality. That’s shrinkflation crossing from margin management into reputational risk.

Meanwhile, loyalty programs have graduated from nice-to-have to table stakes. 65% of consumers now switch for clear, tangible rewards, not abstract points with a PhD-level redemption chart. Promotions still work (62%), but only when they reinforce a credible everyday value story.

Bottom line: Consumers aren’t disloyal—they’re forensic. Brands win by pricing fairly, communicating changes explicitly, and treating trust like a balance-sheet asset. (More)

INTERESTING ARTICLES

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou