- Consumer 150

- Posts

- Consumer Switching Behavior: Price, Trust, and the New Value Equation

Consumer Switching Behavior: Price, Trust, and the New Value Equation

Consumer loyalty is undergoing a structural reset. Recent research highlights that switching behavior is no longer driven by isolated triggers, but by a layered perception of price fairness, transparency, and total value delivery.

While competitive pricing remains the most visible catalyst, the data suggests that erosion of trust now rivals price as a primary cause of brand abandonment.

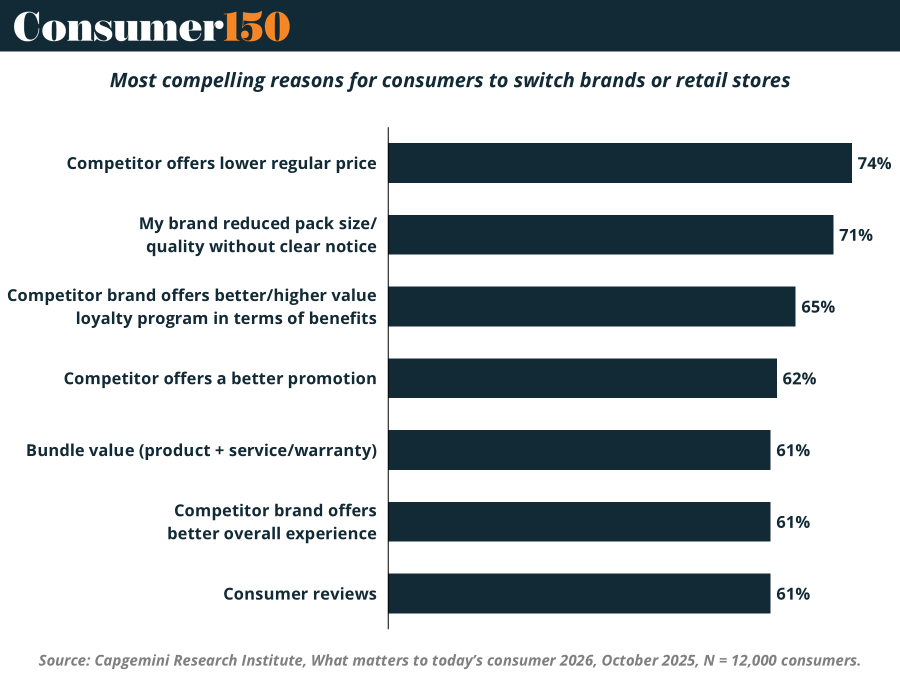

At the top of the list, 74% of consumers report switching brands or retailers when a competitor offers a lower regular price. This underscores the persistence of price sensitivity in an inflation-aware environment, where consumers increasingly benchmark “everyday value” rather than relying on promotions alone. Importantly, the emphasis on regular price—not discounts—signals a shift away from deal-driven behavior toward expectations of consistently fair pricing.

However, the second most compelling reason for switching is more revealing: 71% of consumers say they leave when their preferred brand reduces pack size or quality without clearly notifying them. This finding elevates shrinkflation from a cost-management tactic to a reputational risk. Consumers are not necessarily rejecting smaller packs or reformulated products outright; rather, they are reacting to what they perceive as covert value extraction. In this context, transparency has become a core component of brand trust, and its absence directly accelerates churn.

Beyond pricing and transparency, the data points to the rising importance of value reinforcement mechanisms. 65% of consumers switch for better or higher-value loyalty programs, suggesting that rewards are no longer viewed as incremental perks, but as a fundamental part of the purchase equation. Loyalty programs that deliver tangible, easily understood benefits—rather than abstract point accumulation—are increasingly influencing where consumers concentrate their spending.

Promotions remain influential, with 62% citing better offers from competitors as a switching driver, but their relative position in the ranking suggests diminishing standalone power. Promotions appear most effective when they reinforce an already compelling value proposition, rather than compensate for weak pricing or eroding trust.

Experience-led factors form a second tier of decision-making, yet still impact more than six in ten consumers. Bundle value, whether through product-service combinations or extended warranties, reflects growing consumer interest in risk reduction and convenience. Similarly, overall brand experience and consumer reviews each drive switching for 61% of respondents, highlighting how peer validation and post-purchase satisfaction now play a critical role in pre-purchase decisions.

Taken together, these findings suggest that consumer switching behavior is best understood as a value integrity test. Consumers evaluate brands not only on what they charge, but on how honestly value changes are communicated, how consistently benefits are delivered, and how credible the brand appears relative to alternatives.

For brands and retailers, the implication is clear: loyalty is no longer preserved by habit. It must be continuously earned through transparent pricing strategies, explicit communication around product changes, and value systems that extend beyond the shelf price. In markets where comparison is effortless and alternatives are abundant, the brands that win will be those that treat trust as a measurable asset—because consumers increasingly do.