- Consumer 150

- Posts

- Africa’s eComm Doubles—But Delivery’s Still Catching Up

Africa’s eComm Doubles—But Delivery’s Still Catching Up

It’s Thursday and we’re diving into the $113B African eCommerce bull run, single retailers dominate Gift Cards space.

Good morning, ! It’s Thursday and we’re diving into the $113B African eCommerce bull run, single retailers dominate Gift Cards space, summer camps are expected to take a large share in US parents' budget this season, and nearly a third of U.S. consumers use BNPL on a semiannual basis.

First time reading? Join the execs and operators shaping the future of consumer markets. Subscribe here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

From Cairo to Cape Town: Clicks Are Rising

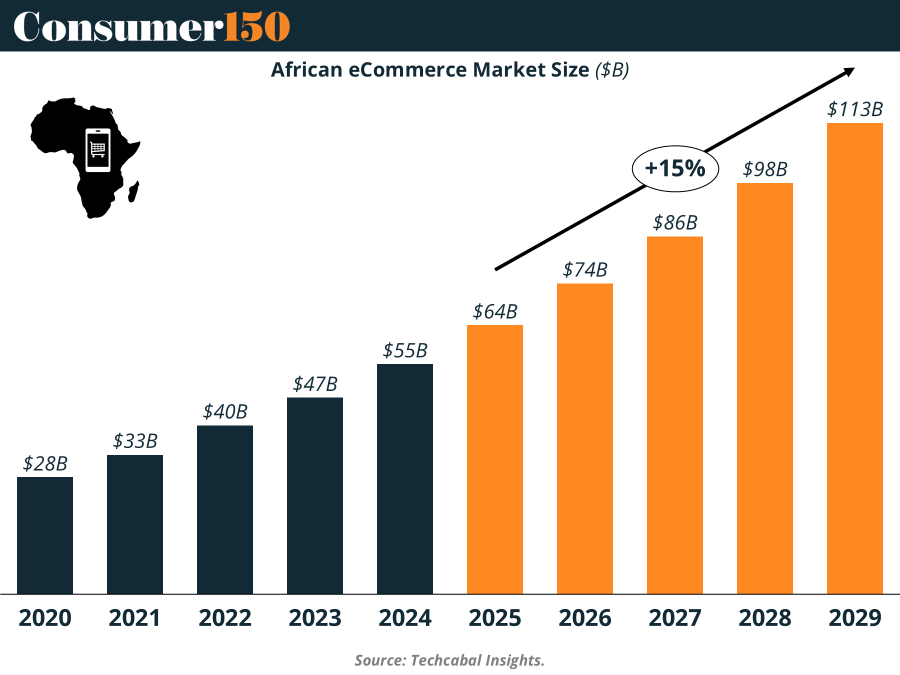

Africa’s eCommerce market has more than doubled since 2020, now clocking in at $55B with sights set on $112B by 2029. The rocket fuel? A potent mix of cheap smartphones, mobile wallets (shoutout M-Pesa), and a young, urbanizing population glued to their screens. Nigeria, South Africa, Egypt, and Kenya are the four horsemen of this online retail renaissance. But before anyone screams “emerging market gold rush,” remember: logistics gaps, currency volatility, and a low ARPU reality check enthusiasm. Still, with mobile penetration hitting 40% and verticals like Toys/DIY and Food & Personal Care leading the charge, the continent is delivering real clicks-per-capita growth. (Read or Listen to the Full Report)

TREND OF THE WEEK

More Mix, Less Madness

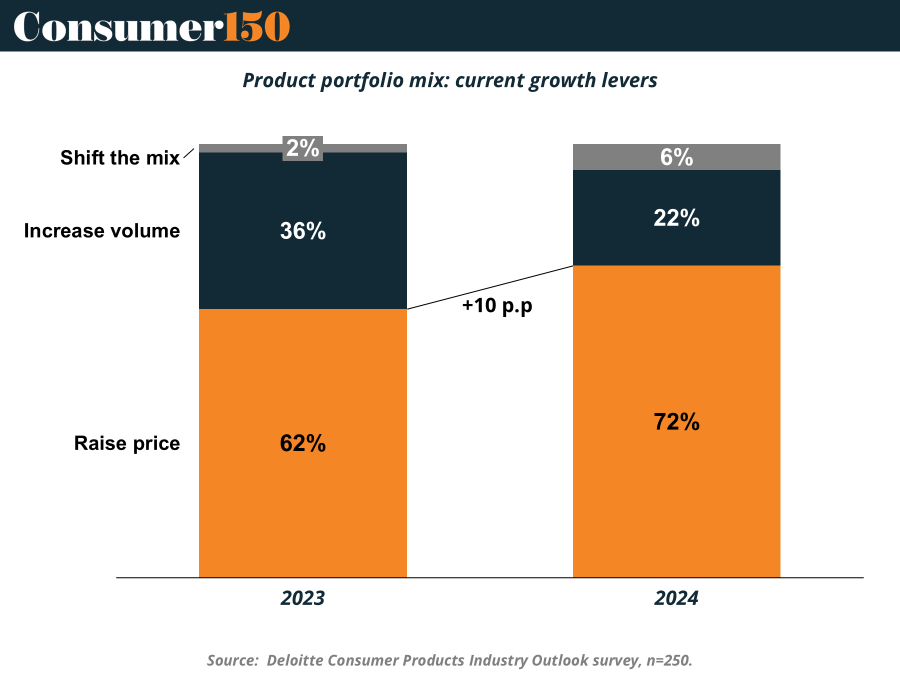

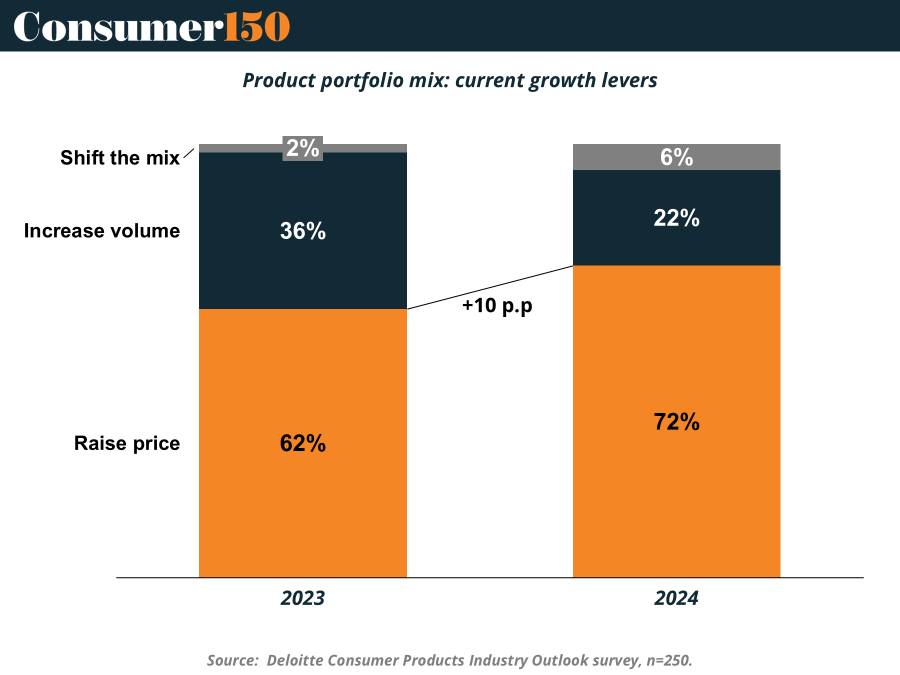

The days of chasing volume growth like it’s Black Friday every day are over. According to Deloitte’s latest outlook, 72% of consumer product execs are now betting on product mix optimization as their top growth lever for 2025. That’s up from 62% last year—and an even steeper climb among profitable growers, where 79% are doubling down on mix. Why? Because blunt-force marketing tactics aren’t cutting it anymore. Instead, winners are curating portfolios, upgrading margins through premiumization, and ditching the low-ROI promo treadmill. Just 22% still think unit growth is king, and a mere 6% are leaning on price hikes. Translation: If you're not refining your product lineup, you’re playing the wrong game. (More)

PRESENTED BY PACASO

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

ECOMMERCE

Fashion Wins Online, But Food and Tools Aren’t Far Behind

The U.S. eCommerce battlefield in 2024 is led by Fashion, pulling in $162.9B—well ahead of Food ($125.6B) and Electronics ($120.1B). But the broader story here is diversification. Categories like Beverages ($111.6B) and DIY & Hardware ($108.6B) are quietly approaching parity with more traditional digital categories, signaling that utility and replenishment are gaining ground in online channels.

Furniture lags at $74.5B, likely weighed down by logistics friction, while Media ($37.7B) and Beauty & Personal Care ($28.4B) sit at the bottom—unsurprising in a market where digital subscriptions and in-store sampling still dominate.

Investor takeaway: Fashion still drives the clicks, but the biggest growth opportunities may lie in lower-profile, high-frequency verticals. Watch for platforms leaning into consumables, DIY ecosystems, or home delivery infrastructure to scale LTV and basket size. (More)

DEAL OF THE WEEK

Telegraphing a New Future

RedBird Capital is buying the UK’s Telegraph Media Group (TMG) for £500M, marking the biggest print media deal in a decade. But this isn’t about ink—it’s about algorithms and audience expansion. RedBird plans to inject capital into TMG’s digital engine, with AI and data tools leading the charge. Their endgame? Grow subscriptions, spin up verticals like travel and events, and export British journalism across the Atlantic, especially into the U.S. market where RedBird has deep media roots. Minor stakes will go to UAE-backed IMI and UK print veterans, but RedBird’s calling the shots. If this sounds like a PE firm trying to Netflix-ify the Financial Times’ older cousin—you’re not wrong. (More)

TOGETHER WITH STACK INFLUENCE

Outrank Your Competitors on Amazon—Fast!

Stack Influence automates micro-influencer collaborations to significantly boost external traffic and organic rankings on Amazon. Trusted by top brands like Magic Spoon and Unilever, it's your secret to dominating page one.

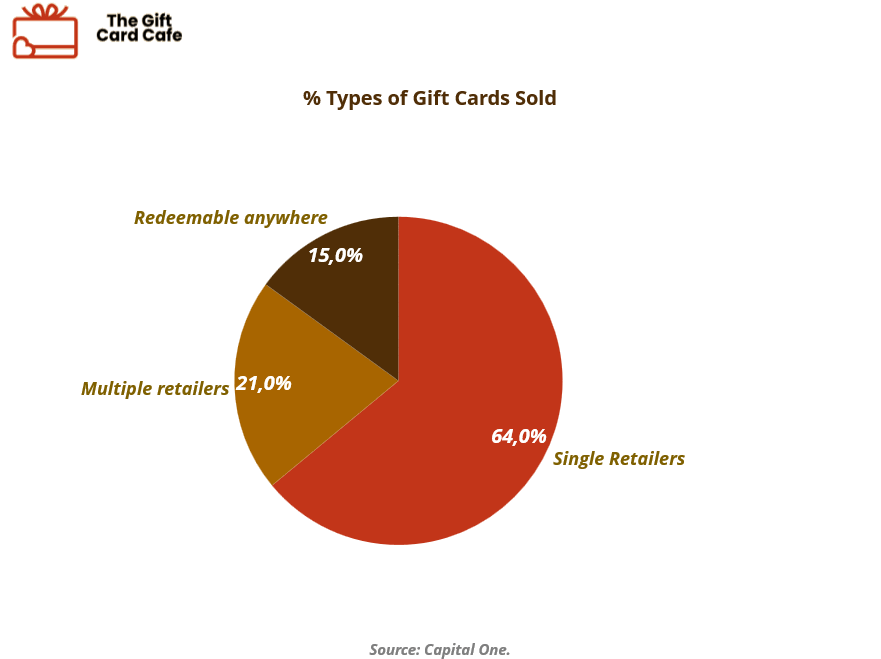

Single-Brand Cards Still Reign Supreme

Despite the rise of flexible payment options and digital wallets, 64% of all gift cards sold are still for single retailers, according to Capital One. That’s more than triple the share of cards redeemable across multiple retailers (21%) and over 4x those usable anywhere (15%).

This dominance signals something important: consumers aren’t just gifting money—they’re endorsing specific brands. While multi-retailer and open-loop cards offer flexibility, they lack the brand affinity, curated utility, and margin-boosting potential of single-retailer cards.

Why it matters: For retailers, this is more than a sale—it’s an acquisition strategy. Every branded gift card is a pre-paid invitation to drive traffic, upsell, and build loyalty. Investors should track which companies are maximizing their gift card programs, particularly in Q4 when category share often dictates seasonal winners. (More)

CONSUMER TECH

Electronic Glut, Economic Gash

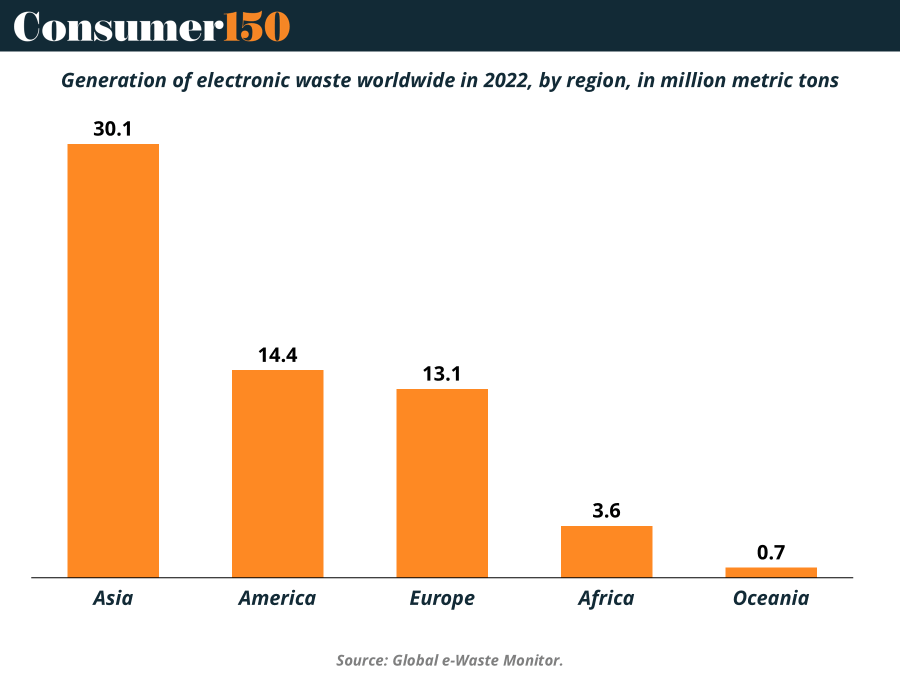

In 2022, we set a new global record: 62 million tonnes of electronic waste—an 82% jump since 2010. Asia’s on top (30.1 Mt), but everyone’s in the same landfill-bound boat. Less than a quarter of this junk is properly recycled, leaving $62B in precious metals behind and creating $78B in societal costs. That’s not waste—it’s economic malpractice. Worse, the recycling rate is dropping, not rising. Without serious intervention, your next phone upgrade may come with an invisible bill: your ecosystem’s tab. (More)

SEASONAL INSIGHTS

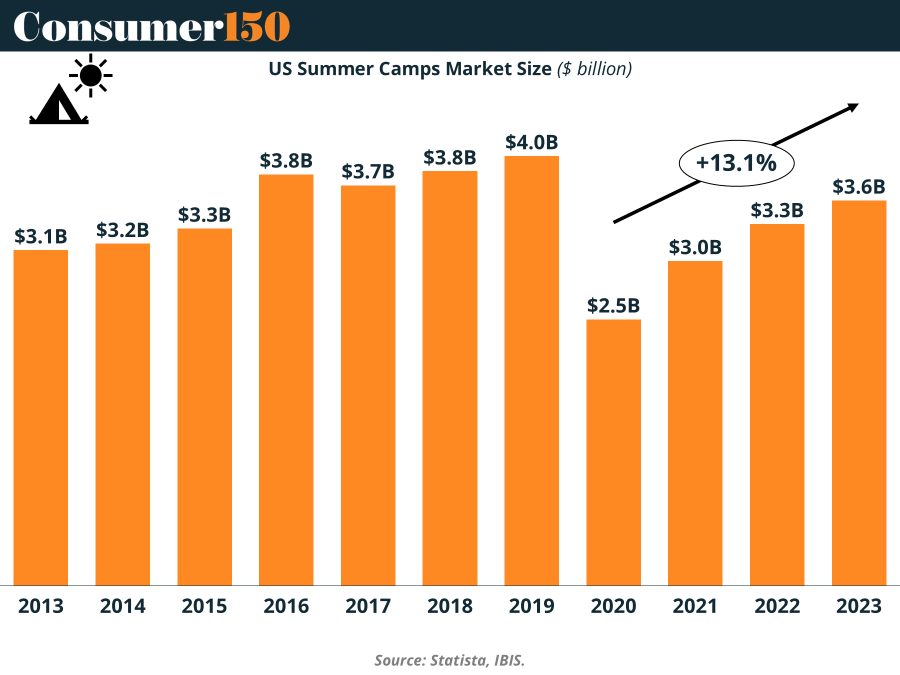

The $2,000 Summer Babysitter

Summer camp used to be where kids made lanyards and friends. Now it’s where parents’ paychecks go to die. With average sleepaway costs hitting $173/day, families are staring down a seasonal cash crunch. Some are going into debt just to send their kids somewhere during office hours. Others are adjusting work schedules or enlisting relatives to patch together a care plan. Post-COVID return-to-office policies have made summer childcare less optional, more financial triage. If you think $2,000 for one kid sounds wild, remember that’s a per-child, per-month estimate for many. (More)

CONSUMER BEHAVIOR

BNPL Is Mainstream, But Not Yet a Habit

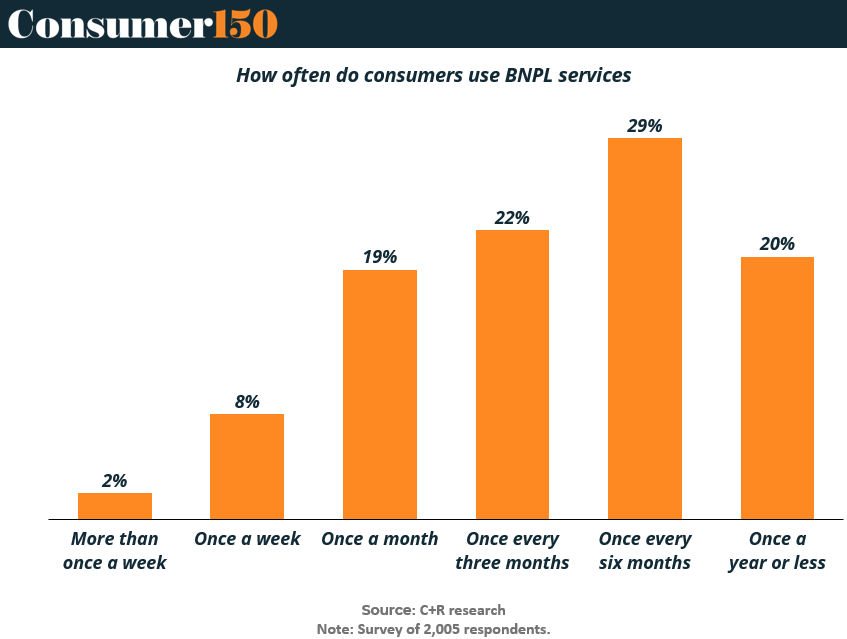

Buy Now, Pay Later (BNPL) usage is no longer niche, but it’s not quite habitual either. According to a recent C+R Research survey, 29% of U.S. consumers use BNPL every six months, while another 22% use it quarterly. Only 10% are in the “weekly or more” camp, underscoring that while penetration is broad, intensity is still relatively low.

This suggests BNPL has crossed the adoption threshold, but not the behavioral one. It’s more of a convenience tool than a credit dependency, for now. Interestingly, 1 in 5 consumers uses BNPL just once a year or less, reflecting either selective use for big-ticket purchases or lingering caution.

Why it matters: For consumer fintechs and retailers, this is a double-edged insight. The ceiling for growth is high, but frequency, not just sign-ups, will be the key metric going forward. Embedded finance strategies that tie BNPL into loyalty ecosystems or subscription models may be the next unlock. (More)

INTERESTING ARTICLES

"Success usually comes to those who are too busy to be looking for it"

Henry David Thoreau