- Consumer 150

- Posts

- The Rise of eCommerce in Africa: Market Dynamics, Growth Drivers, and Investment Outlook

The Rise of eCommerce in Africa: Market Dynamics, Growth Drivers, and Investment Outlook

Africa's digital transformation has ignited a remarkable surge in eCommerce activity, catalyzing a revolution in how people shop, pay, and engage in commerce.

With its rapidly growing population, increasingly connected youth, and dynamic fintech innovations, the continent is experiencing an unprecedented shift in consumer behavior. This article delves into the state of Africa’s eCommerce industry, examining its current size, growth potential, primary enablers, sectoral trends, and investment opportunities while addressing the systemic challenges that lie ahead.

1. Market Size and Growth Trajectory

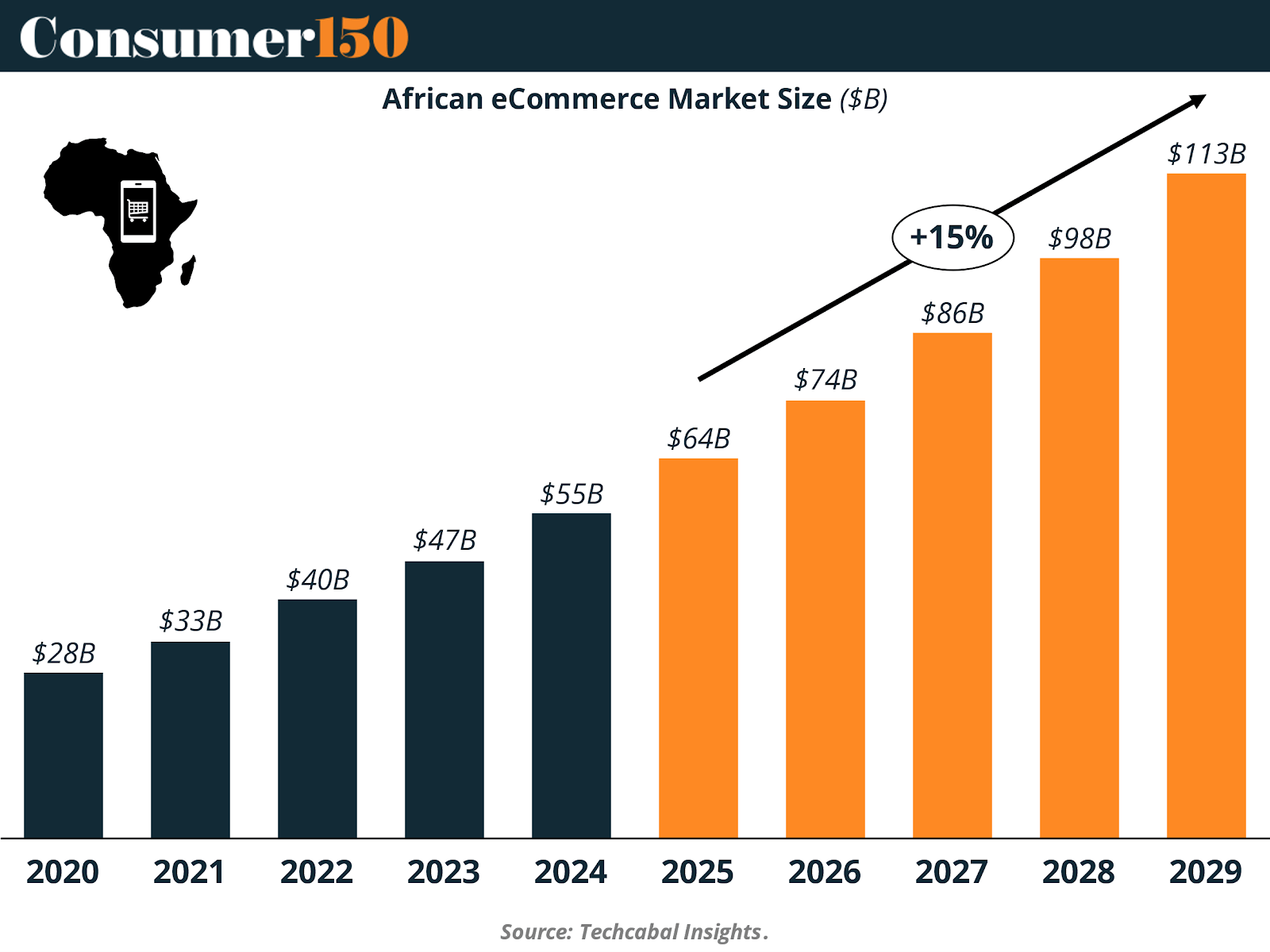

The African eCommerce landscape has evolved significantly over the past decade. In 2020, the continent's online retail sector generated $27.97 billion in revenue. By 2024, this figure had nearly doubled to $55 billion. Projections indicate that the market will reach a staggering $112.73 billion by 2029, reflecting a robust compound annual growth rate (CAGR) of 15% from 2025 to 2029.

This explosive growth signals not only the sector’s vitality but also its resilience, even in the face of macroeconomic and infrastructural challenges. While global markets experience varying degrees of digital retail penetration, Africa’s vast untapped consumer base makes it one of the last frontiers of high-potential eCommerce expansion.

Key Regional Markets

While eCommerce is spreading across the continent, four countries stand out as regional leaders:

Nigeria: Africa's most populous nation offers scale and a youthful digital-first population.

South Africa: With mature infrastructure and a strong middle class, it is a testing ground for innovation.

Egypt: Strategic location and a tech-adept urban population support rapid digital commerce.

Kenya: A fintech powerhouse where innovations like M-Pesa fuel the broader eCommerce ecosystem.

2. Drivers of Growth

Several interrelated factors are propelling the expansion of eCommerce across Africa.

a. Mobile and Internet Penetration

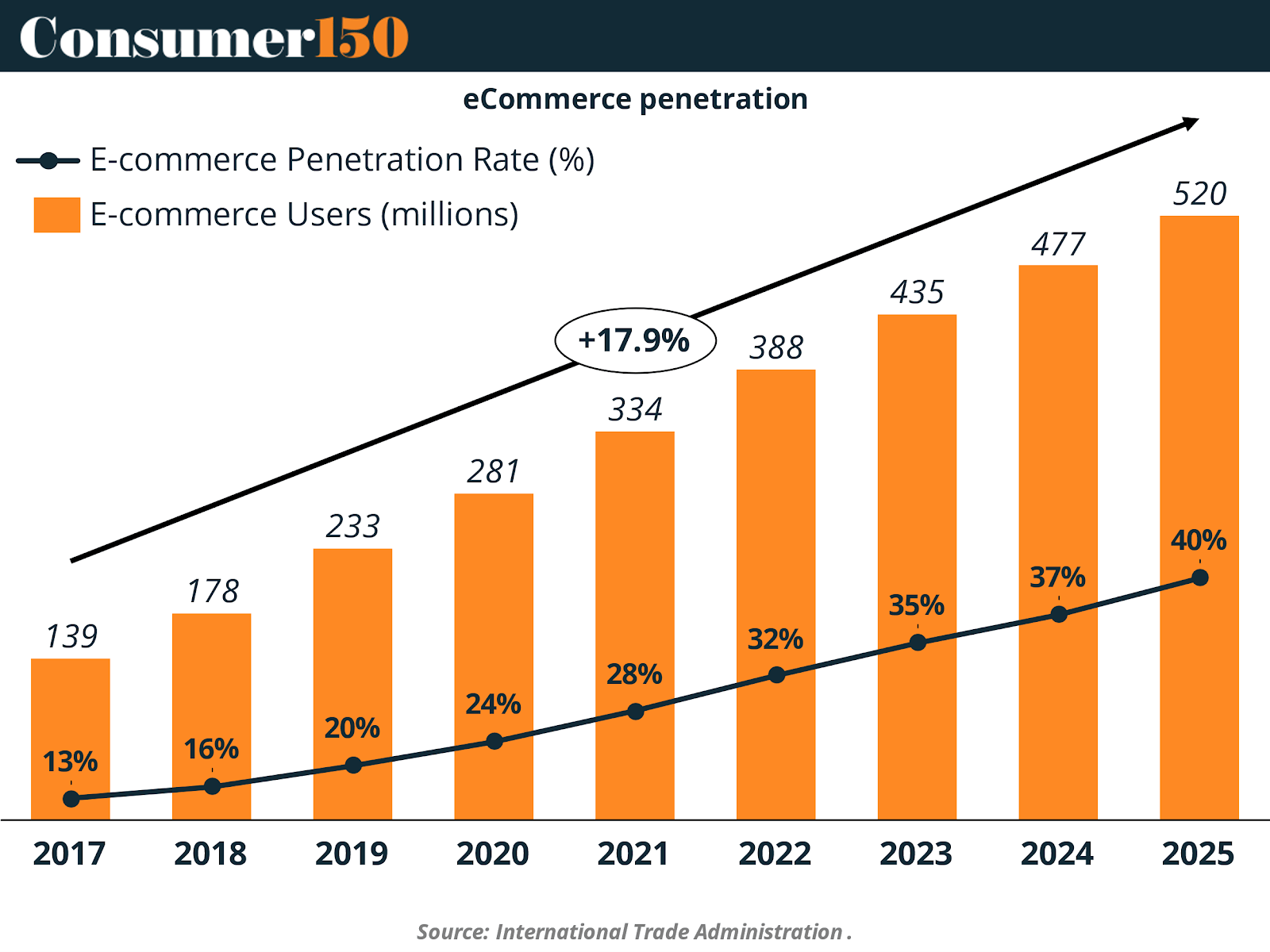

The continent’s digital growth has been underpinned by the exponential increase in internet and mobile phone access. Internet penetration has climbed from just 13% in 2017 to a projected 40% by 2025. This expansion is attributed largely to mobile broadband and the increasing affordability of smartphones. In a region where desktop access is limited, mobile-first experiences dominate, forcing retailers to design mobile-optimized platforms.

b. Smartphone Affordability

The influx of low-cost smartphones from Asian manufacturers has enabled millions of Africans to come online for the first time. These devices have democratized access to eCommerce platforms and social media marketplaces. This accessibility has been transformative, empowering even rural populations to engage in digital commerce.

c. Fintech and Mobile Payments

Africa leads globally in mobile money adoption. Services such as M-Pesa (Kenya) and MTN Mobile Money (West Africa) have brought digital payment solutions to the unbanked and underbanked, solving a major friction point in online transactions. The ease, security, and ubiquity of mobile wallets have enabled more people to transact online with confidence.

d. Urban Middle Class Expansion

Africa’s urban population is growing rapidly, and with it, a burgeoning middle class with rising disposable incomes. Urbanization is closely linked with improved infrastructure and access to goods and services, thereby supporting sustained eCommerce adoption. Consumers in cities like Lagos, Nairobi, and Johannesburg are increasingly opting for digital purchases across fashion, electronics, and household goods.

e. COVID-19 as a Catalyst

The COVID-19 pandemic significantly altered consumer behavior. Lockdowns and health concerns forced many to try online shopping for the first time. Although some of this behavior normalized post-pandemic, much of it has persisted, especially in metropolitan areas, providing a lasting boost to eCommerce adoption.

3. Challenges and Structural Barriers

Despite rapid growth, the African eCommerce market faces several systemic hurdles.

a. Post-Pandemic Normalization

After the sharp acceleration caused by COVID-19, growth has stabilized. The return to physical retail has cooled some of the earlier momentum, especially in regions where trust in eCommerce remains fragile or logistics are unreliable.

b. Currency Volatility

Frequent currency devaluations in countries like Nigeria and Zimbabwe can affect purchasing power, distort pricing strategies, and make international imports expensive, thus impacting merchant margins and consumer affordability.

c. Low Average Revenue Per User (ARPU)

ARPU remains low compared to global averages, which limits the revenue potential per customer. While the number of users is growing, smaller basket sizes and limited purchasing frequency reduce profitability for retailers, especially in price-sensitive segments.

d. Infrastructure and Logistics Gaps

From poor road networks to inefficient postal systems, infrastructure deficits hinder last-mile delivery, especially in rural and peri-urban areas. The lack of formal addressing systems adds another layer of complexity, forcing firms to innovate with GPS and mobile-based delivery coordination.

e. Regulatory Fragmentation

Africa's 54 countries have varying regulations on data privacy, taxation, customs, and digital trade. This fragmentation creates challenges for cross-border eCommerce and increases compliance burdens for international and pan-African operators.

4. Sector-Specific Revenue Trends

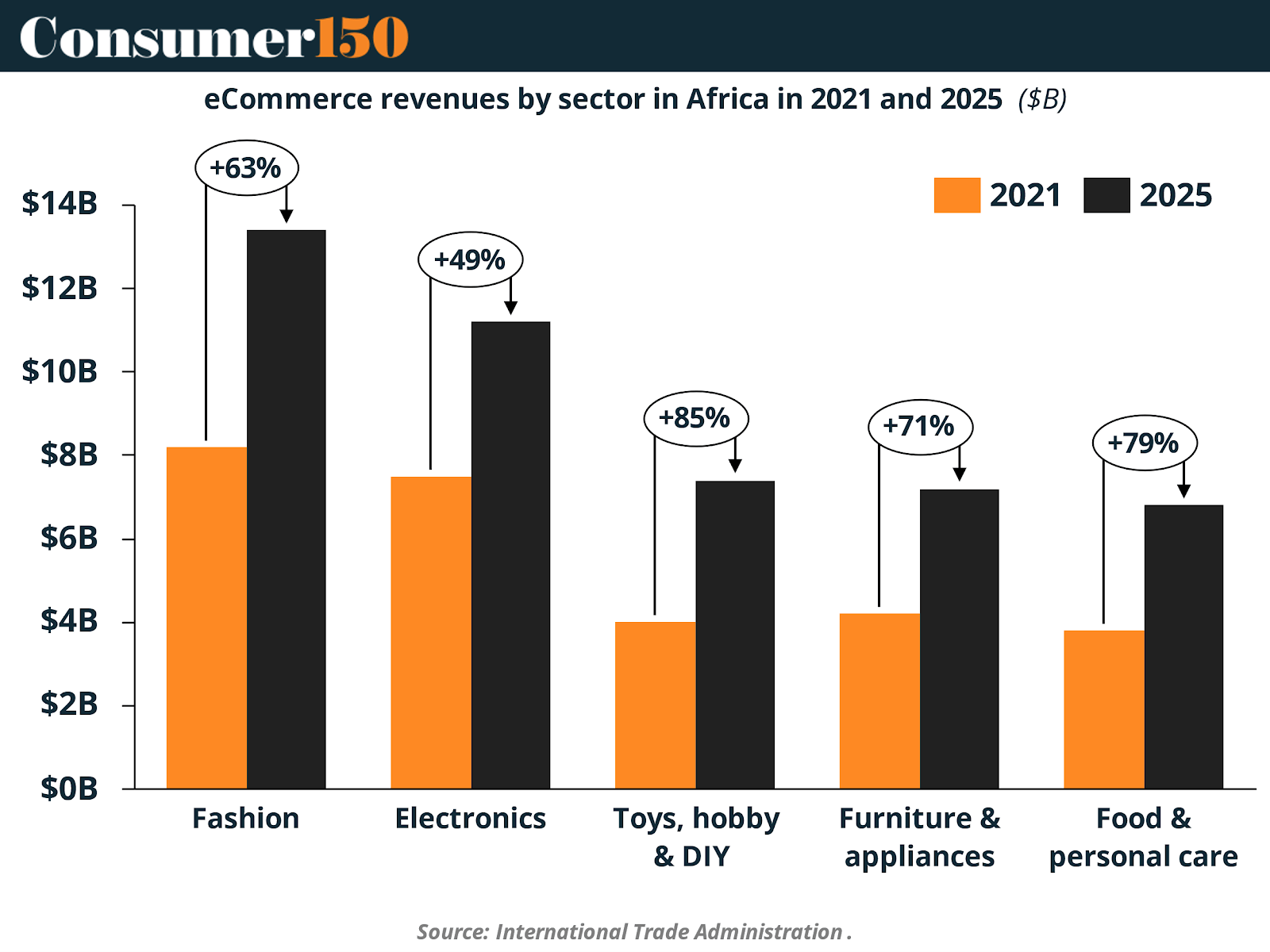

Between 2021 and 2025, all major eCommerce verticals are expected to post double-digit growth. Here’s a breakdown of sector-specific revenue projections:

Sector | 2021 Revenue | 2025 Revenue | CAGR (2021–2025) |

Fashion | $8.2B | $13.4B | 10.3% |

Electronics & Media | $7.5B | $11.2B | 8.4% |

Toys, Hobby & DIY | $4.0B | $7.4B | 13.1% |

Furniture & Appliances | $4.2B | $7.2B | 11.4% |

Food & Personal Care | $3.8B | $6.8B | 12.3% |

The Toys, Hobby & DIY segment is set to be the fastest-growing, possibly reflecting rising interest in lifestyle, education, and home-improvement content among Africa’s young and urban population.

5. User Growth and Penetration

The user base for eCommerce in Africa has increased exponentially, from 138.9 million in 2017 to an estimated 519.8 million in 2025. This translates to a user penetration rate of 40%, a remarkable leap from 13% in 2017.

What makes this even more notable is that much of this growth is organic, driven by improved accessibility, rather than expensive customer acquisition campaigns. The rise in user penetration reflects both technological diffusion and cultural shifts in shopping behavior.

6. Investment Landscape and Opportunities

Africa’s eCommerce ecosystem is attracting growing interest from venture capital, private equity, development finance institutions, and corporate investors. Key investment hotspots include:

a. Logistics and Last-Mile Delivery

With logistics cited as a top challenge, startups focusing on warehousing, route optimization, fleet management, and decentralized delivery hubs present strong investment potential. Solutions that integrate mobile technology with localized delivery strategies are especially promising.

b. Fintech Infrastructure

Fintech remains a linchpin of eCommerce scalability. Startups creating digital wallets, escrow systems, BNPL (Buy Now Pay Later) models, and cross-border payment platforms are unlocking new monetization channels and market access.

c. Vertical Marketplaces

Niche eCommerce platforms catering to specific industries (agritech, fashion, health) or demographics (women-led businesses, artisans, B2B wholesale) are gaining traction and offer focused, defensible business models.

d. Public-Private Collaborations

Governments, telecoms, and multilateral agencies are recognizing the strategic importance of digital commerce. Investments in fiber infrastructure, regulatory reforms, and digital ID systems are enabling more efficient and scalable operations.

7. Future Outlook

Africa’s eCommerce market is poised for sustained growth through 2029 and beyond. However, to fully realize its potential, the ecosystem will require concerted efforts from the private sector, regulators, and development partners.

Key Trends to Watch:

Cross-border harmonization: The African Continental Free Trade Area (AfCFTA) could reduce friction and unlock scale.

Localization of supply chains: Reducing reliance on imports through local manufacturing and warehousing will improve margins and delivery times.

Voice and vernacular commerce: With a multilingual population, localized platforms that support audio and native language navigation will see increased adoption.

AI and personal commerce: Personalization algorithms are likely to become more prominent as platforms mature and user data deepens.

Conclusion

Africa’s eCommerce sector stands at a critical inflection point. The convergence of a young, digital-savvy population, rising smartphone and internet penetration, and robust fintech innovations provides a fertile foundation for growth. Although challenges in infrastructure, regulation, and income disparity remain, the structural tailwinds are undeniable.

For investors, entrepreneurs, and policymakers, Africa represents a rare blend of scale, growth, and greenfield opportunities. By addressing systemic barriers and fostering inclusive digital ecosystems, Africa’s eCommerce transformation can catalyze broader economic development and usher in a new era of connected commerce.

Sources & References

Ecofin. (2024). Africa’s E-Commerce Market Expected to Double in Five Years. https://www.ecofinagency.com/homepage/2310-46060-africa-s-e-commerce-market-expected-to-double-in-five-years-report

Fintech Weekly. (2025). How Digital Banks Are Leapfrogging Traditional Banking in Africa. https://www.fintechweekly.com/magazine/articles/digital-banks-africa-fintech-growth

GSMA. (2023). E-commerce in Africa: Unleashing the opportunity for MSMEs. https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-for-development/wp-content/uploads/2023/10/E-CommerceInAfrica_R_WebSingles-1.pdf

Health cap Africa. (2025). Fintech Revolution in Africa. https://healthcap.co/fintech-revolution-in-africa/

International Trade Administration. (2025). The rise of eCommerce in Africa. https://www.trade.gov/rise-ecommerce-africa

Techcabal. (2024). The Future of African Commerce for 2025 and Beyond. https://insights.techcabal.com/the-future-of-african-commerce-for-2025-and-beyond/

Tech in Africa. (2025). E-commerce in Africa: 2025 Market Analysis and Trends. https://www.techinafrica.com/e-commerce-in-africa-2025-market-analysis-and-trends/

The Stat trade Times. (2025). E-commerce in Africa, unlocking new paths for economic growth. https://www.stattimes.com/ecommerce/e-commerce-in-africa-unlocking-new-paths-for-economic-growth-1354446

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.