- Consumer 150

- Posts

- 45% Cutbacks: Where Consumers Are Saving (and Why Your App Must Be Perfect)

45% Cutbacks: Where Consumers Are Saving (and Why Your App Must Be Perfect)

Paramount launches a $108B hostile bid for WBD and retailers pivot to app optimization, while 45% of consumers slash non-essential spending to navigate inflation.

Good morning, ! This week we’re diving into European Consumers Confidence performance, retailers are becoming obsessed with app experience, inflationary pressures are forcing 45% of consumers to reduce spending on non-essential categories like dining out, entertainment, and leisure activities.

Want to advertise in Consumer 150? Check out our self-serve ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

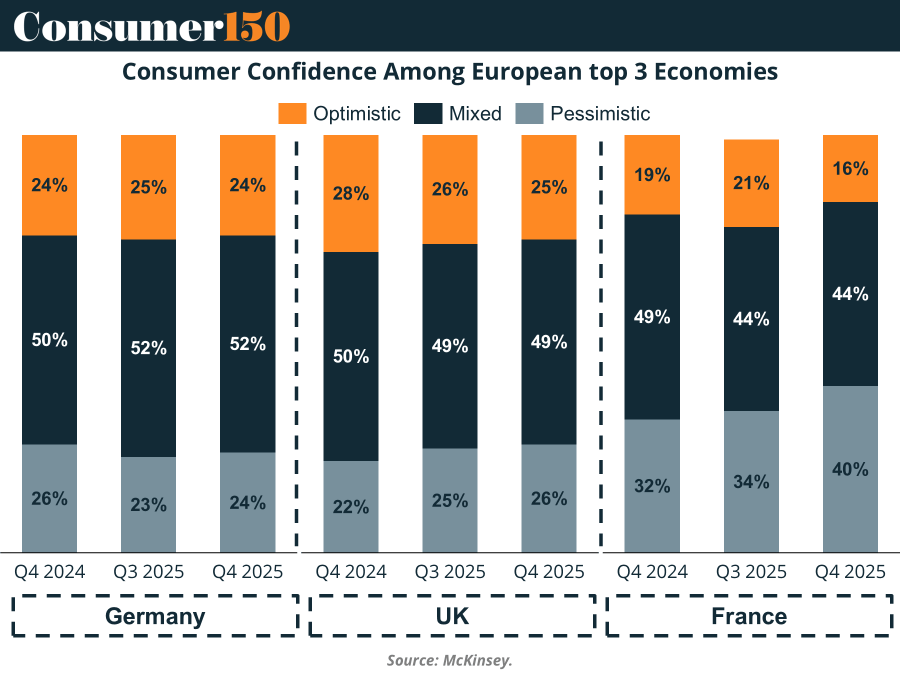

Europe Feels “Meh” — Again

Consumer confidence across Europe is holding steady, which is a polite way of saying: no one feels great, but they’ve stopped panicking. Across Germany, UK, and France, about half of consumers report “mixed” feelings, while a steady 24–28% are optimistic—except in France, where optimism just fell off a cliff. The French pessimism spike (up to 40%) is likely driven by political unrest. Meanwhile, inflation remains the top concern across the board, but with price increases slowing, households are still splurging—just with side-eye caution.

Bottom line: Europeans are mostly neutral, not reverse. And in today’s macro environment, that’s practically cheer. (More)

PRESENTED BY RAD INTEL

The AI Infra Layer Powering Fortune 1000 Growth

RAD Intel is already embedded across Fortune 1000 marketing stacks, functioning as the infra layer that verifies customers, cuts waste, and accelerates revenue. The metrics match what M&A teams underwrite: rapid ARR growth, rising enterprise penetration, strong retention, and efficient sales payback.

$60M+ raised. 5,000%+ valuation lift in four years*. 14,000+ investors. Nasdaq ticker $RADI reserved. Leadership has closed $9 Billion+ in M&A deals.

With AI infra acquisitions hitting $55B this year, decision-layer platforms like RAD are commanding premium attention.

ECOMMERCE

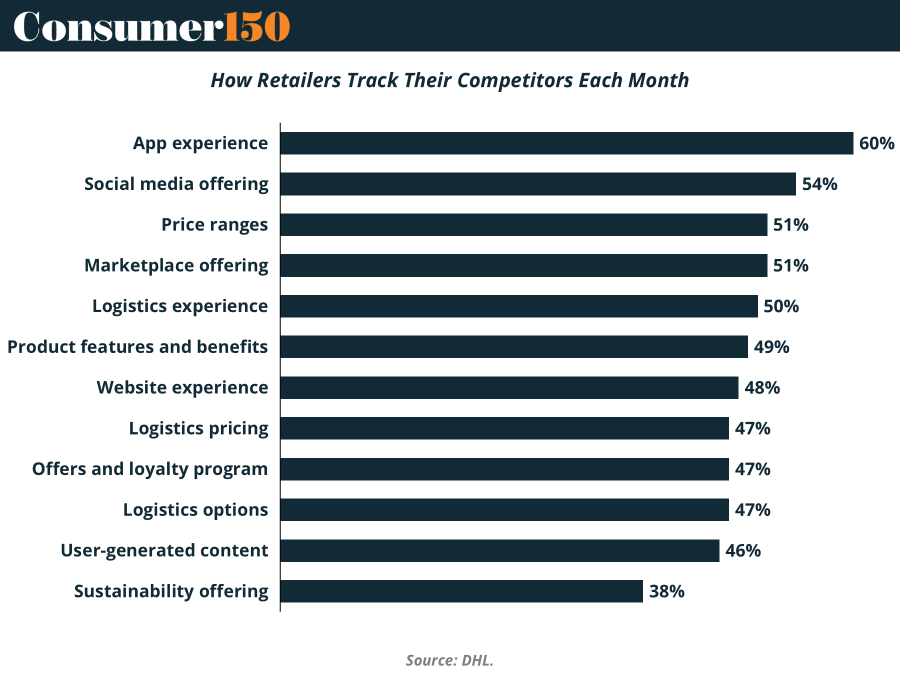

Retailers Are Watching the Right Screens

New data shows retailers are becoming obsessed with app experience—and with 60% tracking mobile performance monthly, it’s clear the battleground has shifted to consumers’ home screens. Social media offerings (54%) remain the fastest-moving competitive signal, while price ranges and marketplace offerings (both 51%) act as real-time proxies for value perception. On the operations side, logistics experience (50%) and website experience (48%) dominate attention as retailers scramble to keep conversions from slipping. Meanwhile, user-generated content (46%) is becoming a trust engine, even as sustainability offerings (38%) sit at the bottom of the priority list. The throughline: retailers are laser-focused on anything that accelerates speed, strengthens engagement, or cuts friction. (More)

DEAL OF THE WEEK

Paramount’s $108B Power Play for Warner Bros. Discovery

In one of the boldest M&A maneuvers the media sector has seen, David Ellison’s Skydance-backed Paramount has launched a hostile $108.4B takeover bid for Warner Bros. Discovery (WBD), aiming to derail Netflix’s earlier $82.7B agreement to acquire WBD’s studio and streaming assets. The all-cash offer of $30/share, backed by $40.7B from Middle Eastern sovereign wealth funds and Jared Kushner’s Affinity Partners, bypasses WBD’s board and goes straight to shareholders.

Unlike Netflix’s mixed cash-stock bid, Paramount promises a quicker close, more regulatory clarity (CFIUS-exempt), and full ownership of WBD’s TV networks (CNN, TNT, etc.)—not just the Hollywood crown jewels. If successful, the deal could create a studio-streaming rival with ~200M global subs, closing the distance to Disney and avoiding Netflix’s near-monopoly at 43% SVOD market share.

Why it matters: This is more than a deal—it’s a battle for Hollywood’s future. Netflix wants dominance. Paramount is pitching preservation. And shareholders now hold the script. (More)

TOGETHER WITH GLADLY.AI

Can you scale without chaos?

It's peak season, so volume's about to spike. Most teams either hire temps (expensive) or burn out their people (worse). See what smarter teams do: let AI handle predictable volume so your humans stay great.

2026: The Year Gift Cards Go Fully Pro

Gift cards have moved far beyond plastic stocking stuffers. In 2026, they’re set to become core infrastructure for loyalty, budgeting, and digital commerce.

According to Javelin Strategy, stored value products—digital and physical—are thriving as consumers seek financial stability in an inflationary environment. Unlike credit cards, gift cards maintain face value. That predictability is driving new behaviors: self-use is surging, with shoppers loading balances to manage budgets or tap into cash-back offers.

Corporate demand is also accelerating. Prepaid products are now standard in employee engagement programs, thanks to their flexibility and personalization. Meanwhile, the digital shift is unmistakable. Consumers can now track, reload, and spend across platforms, blending loyalty programs with real-time payment tools.

The old "breakage" model—counting unused balances as revenue—is out. The new playbook focuses on reload, repeat, and retention. Digital-first players like Prezzee are winning by making gift cards both a payment method and a relationship-builder.

Bottom line: Gift cards aren’t just surviving—they’re evolving into one of the most dynamic, data-rich tools in consumer engagement. Expect 7.5–8% annual growth as the category continues to blur the line between gift and wallet. (More)

CONSUMER BEHAVIOR

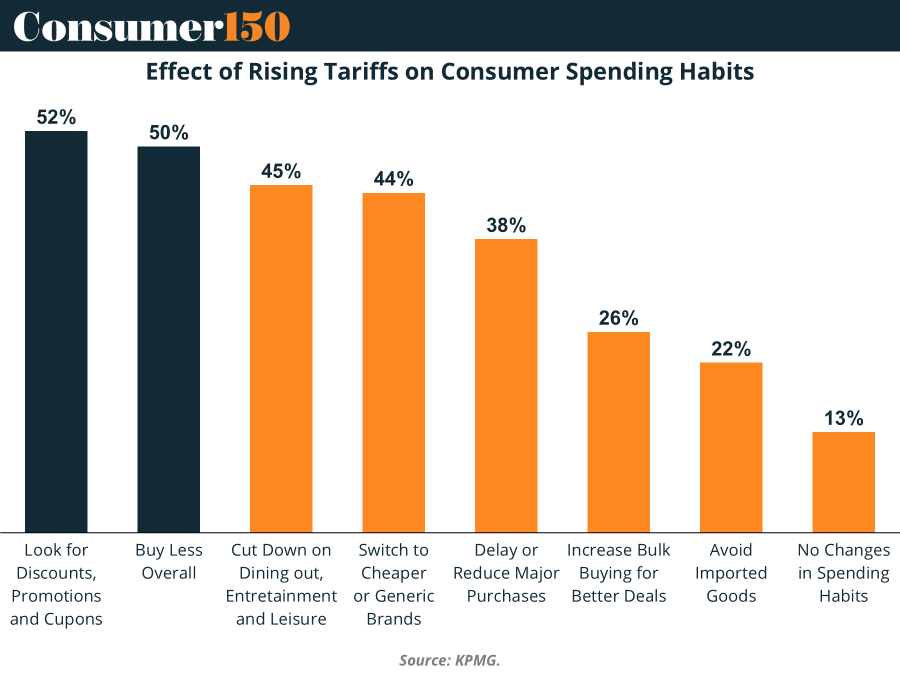

Nights Out & Brand Loyalty? Drawn-Colored

Rising costs are reshaping lifestyle choices: 45 % of consumers plan to cut back on dining, entertainment, and leisure. On top of that, 44 % intend to swap brand‑name goods for cheaper or generic alternatives. As tariffs bite, more than half of consumers (52 %) say they’re now more likely to scour for discounts, promos, or coupons — the most common reaction in the survey. Nearly as many (50 %) will simply buy less overall. In effect: small sacrifices in everyday habits become the default.

With tariffs pushing up prices, it seems shoppers aren’t quitting consumption — they’re just finding scrappier ways to stay afloat. Expect tighter wallets and more coupon‑clipping in the quarters ahead. (More)

INTERESTING ARTICLES

"Action is the foundational key to all success."

Pablo Picasso