- Consumer 150

- Posts

- European Consumers End the Year Cautious but Resilient

European Consumers End the Year Cautious but Resilient

As Europe moved into the final quarter of the year, consumer sentiment across the continent remained subdued but stable, reflecting a prolonged period of economic uncertainty rather than acute deterioration.

New ConsumerWise research highlights a familiar pattern: consumers remain wary of the macroeconomic environment, yet quietly confident in their own financial footing. This mix of caution and resilience continues to shape spending intentions across Europe’s largest economies.

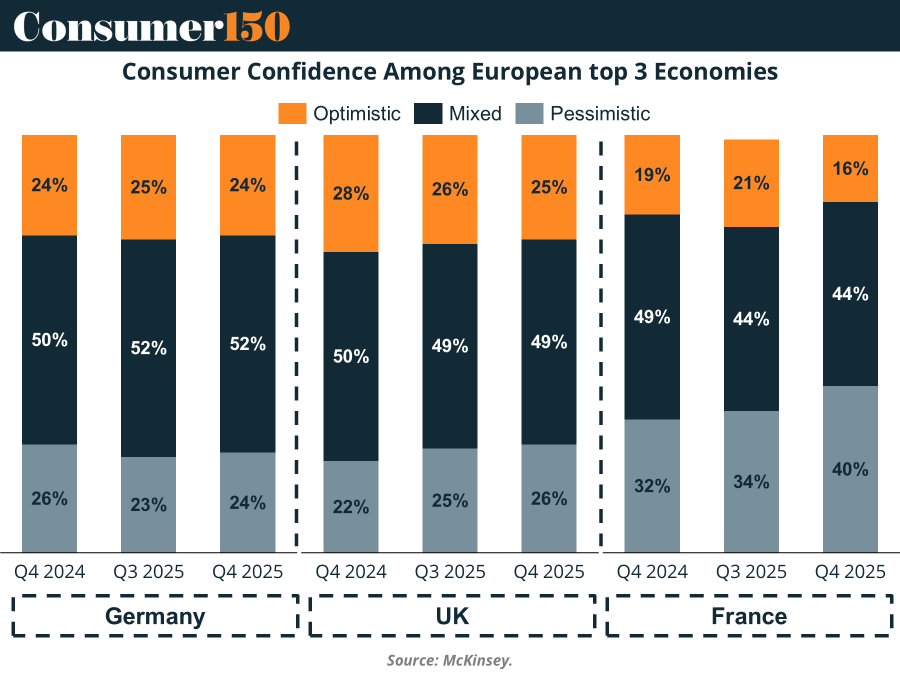

As McKinsey notes, across the EU-5—France, Germany, Italy, Spain, and the United Kingdom—about half of consumers reported mixed feelings about the economy in the fourth quarter. Roughly one-quarter felt optimistic, while the remainder expressed pessimism. This balance has changed little throughout 2025, suggesting that for many households, uncertainty has become normalized. Importantly, confidence in personal finances remained relatively strong, even as optimism about national economic performance lagged behind. This divergence, now a long-term trend also observed in the United States, helps explain why spending has not collapsed despite persistent concerns.

The chart highlighting Germany, the UK, and France underscores this stability, with only modest quarter-to-quarter shifts in sentiment for most markets. Germany remained largely steady, with mixed sentiment hovering just above 50 percent and optimism holding at around one-quarter of respondents. The United Kingdom showed a similar pattern, with nearly half of consumers reporting mixed feelings and just under 30 percent optimistic. In both countries, pessimism remained contained, suggesting limited fear of immediate economic deterioration.

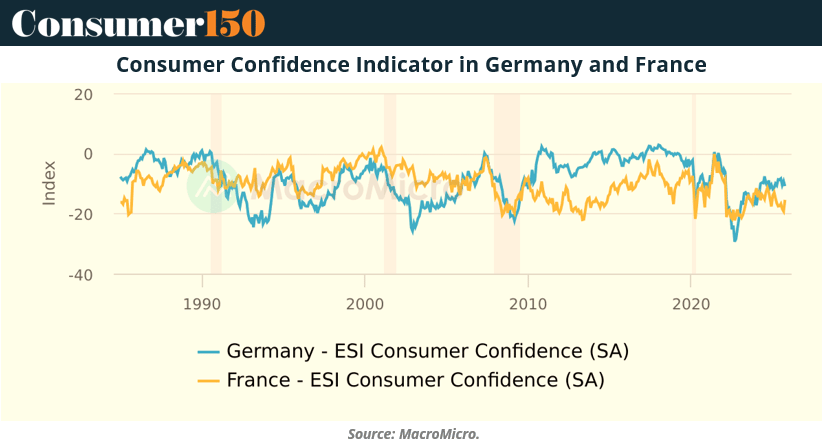

France, however, stands apart. Between the third and fourth quarters, optimism among French consumers dropped sharply from 21 percent to 16 percent, while pessimism surged from 34 percent to 40 percent. This pronounced swing is widely attributed to ongoing political discord, which appears to have compounded economic unease. Unlike its peers, France entered the holiday season with a more fragile consumer outlook, increasing the risk of subdued discretionary spending.

Inflation continued to dominate consumers’ hierarchy of concerns across Europe. Between 42 percent of German consumers and 52 percent of those in the UK ranked inflation as their top worry, a level unchanged from last year. Other anxieties—such as job security or the ability to make ends meet—remained elevated but stable. One notable shift was a decline in concern over climate change across all markets, most visibly in Italy, indicating that immediate cost pressures continue to crowd out longer-term issues in consumers’ minds.

Despite these concerns, European households reported little change in their savings behavior compared with a year ago. Most consumers in France, Germany, Italy, and Spain made no significant adjustments, in contrast to the United States, where households increasingly turned to savings measures amid financial strain. The United Kingdom again proved an exception: more consumers relied on credit cards for essentials, dipped into savings, and tracked expenses more closely, signaling mounting pressure on household budgets.

Spending intentions remained broadly flat across essentials and semidiscretionary categories. Seasonal increases—such as in toys and vehicles—were evident, but even these were muted compared with the strong fourth-quarter surges seen last year. Overall, the data suggest European consumers are neither retreating nor reaccelerating. Instead, they are navigating persistent price pressure with measured restraint, maintaining spending where possible while bracing for continued uncertainty.

Sources & References

McKinsey. (2025). An update on European consumer sentiment: Little change, lasting caution. https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/an-update-on-european-consumer-sentiment