- Consumer 150

- Posts

- $325M Bets, Slowing Fashion Sales, and Why Social Is the Funnel Now

$325M Bets, Slowing Fashion Sales, and Why Social Is the Funnel Now

CAVU raises a $325M fund and fashion sales hit a global slowdown, while 52% of shoppers now buy directly on social platforms.

Good morning, ! This week we’re diving into the AI implementation in Retail checkout, the new $325M fund by CAVU, social platforms are no longer the top of the funnel, now are the funnel. Fashion retail sales are slowing down in the US, China and Europe.

Want to advertise in Consumer 150? Check out our ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

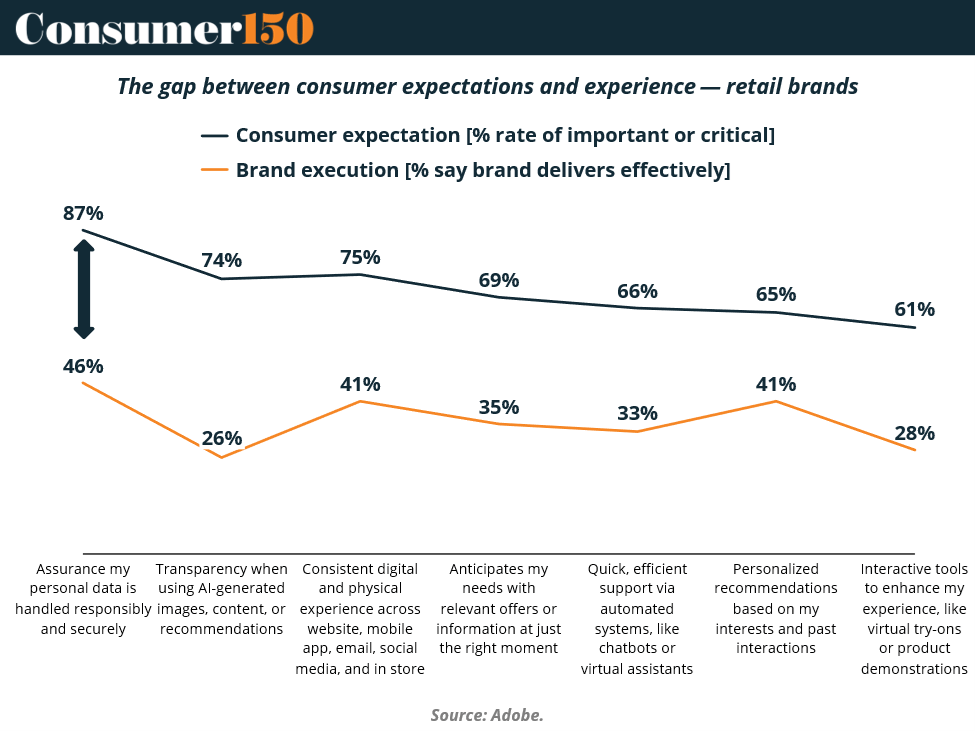

The Checkout Is Now a Trust Test

AI at checkout has quietly become the most powerful—and risky—moment in consumer commerce. By 2026, personalization engines won’t just suggest products; they’ll shape pricing, promotions, and even payment choices in real time. The upside is real: higher conversion rates, larger average order values, and fewer abandoned carts.

But the data shows a hard ceiling: consumer trust. Shoppers increasingly expect relevance, but recoil when AI feels opaque, manipulative, or unfair—especially when prices change without explanation. In fact, short-term gains from aggressive personalization often get offset by higher churn and lower lifetime value.

The takeaway is blunt: the checkout isn’t a growth hack—it’s a credibility check. Brands that prioritize transparency, consistency, and user control see durable gains. Those that don’t may optimize their way into losing the customer.

TREND TO WATCH

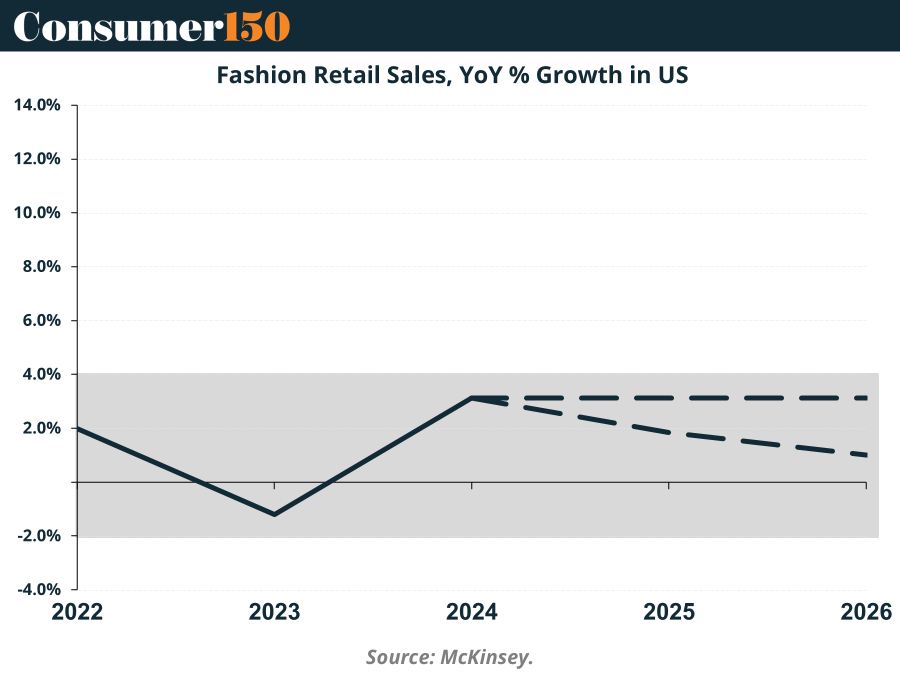

Fashion’s new trend: surviving instead of scaling.

Welcome to the “meh decade” for fashion. Across the U.S., Europe, and China, retail sales growth is trending down, and margin pressure is becoming a permanent houseguest. Shoppers are hitting pause — swapping $400 blazers for $40 joggers and favoring wellness over wardrobe. Even affluent buyers are chasing private labels and value plays.

The once-high-flying luxury segment? Still breathing, but barely — with brands betting on experiential retail to pull consumers back in. Meanwhile, AI is being hailed as both savior and scapegoat: promising smarter merchandising, but also bringing execution risk front and center. (More)

ECOMMERCE

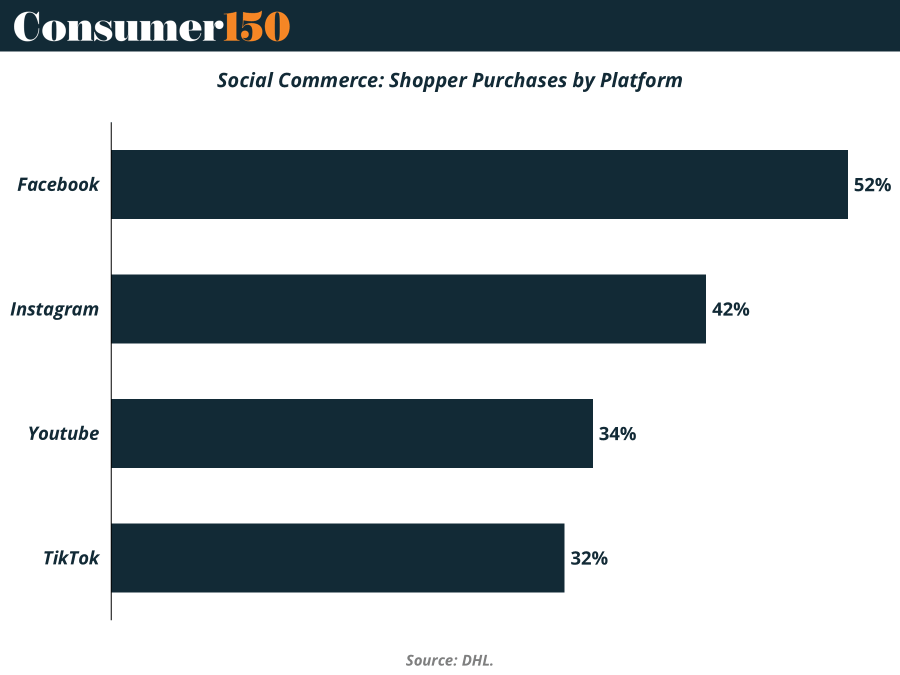

Scrolling Is the New Checkout

Social platforms are no longer top-of-funnel—they’re becoming the funnel. New data shows Facebook leading social commerce adoption, with 52% of shoppers purchasing directly on the platform. Scale, familiarity, and embedded shopping tools still matter.

Instagram follows at 42%, where inspiration quickly turns into intent. Shoppable posts and creator-led discovery are compressing the gap between “like” and “buy,” especially in mobile-first markets.

YouTube (34%) proves that depth still converts. Reviews, tutorials, and livestreams build trust at scale, while TikTok (32%) accelerates impulse-driven purchases through algorithmic discovery and creator authenticity.

The bigger signal: social commerce is becoming behavioral, not experimental. With most shoppers expecting to buy primarily on social within five years, brands must optimize for native checkout, creator partnerships, and mobile-first design—or risk missing where transactions actually happen. (More)

DEAL OF THE WEEK

CAVU Goes Full Wellness Warrior

Consumer VC is dead. Long live Consumer VC. While generalists flee the category, CAVU Consumer Partners just bagged $325M for Fund V, proving there’s still plenty of juice in better-for-you plays. CAVU is betting that clean-ingredient brands will continue their march from Whole Foods shelves to M&A headlines. First capital out the door? Recess, a magnesium-infused beverage targeting stressed-out Zoomers.

With past exits like Poppi and OSEA, the firm has become a cultural early-warning system for what Big CPG will buy next. And with lawmakers banning Red 40 and brominated vegetable oil, even Congress seems to be joining the clean-label movement. (More)

Gift Cards Go Wallet-Native

Gift cards are shedding their reputation as a dusty, once-a-year present. The data shows they’re becoming wallet-native, living inside Apple Wallet and Google Wallet—and that shift is changing how often they get used. Digital gift cards now represent 60%+ of total sales, and visibility is doing the heavy lifting. If a balance shows up every time a consumer opens their wallet, redemption becomes habitual, not aspirational.

For brands, the upside is structural. Wallet-stored cards enable push notifications, location-based reminders, and tap-to-redeem checkout, all of which reduce breakage and drive repeat spend. Unlike plastic cards or buried emails, wallet-native gift cards stay top of mind.

Why it matters: This isn’t just a UX upgrade. Wallet integration turns gift cards into everyday currency, boosting engagement, redemption, and incremental revenue with minimal friction. (More)

CONSUMER BEHAVIOR

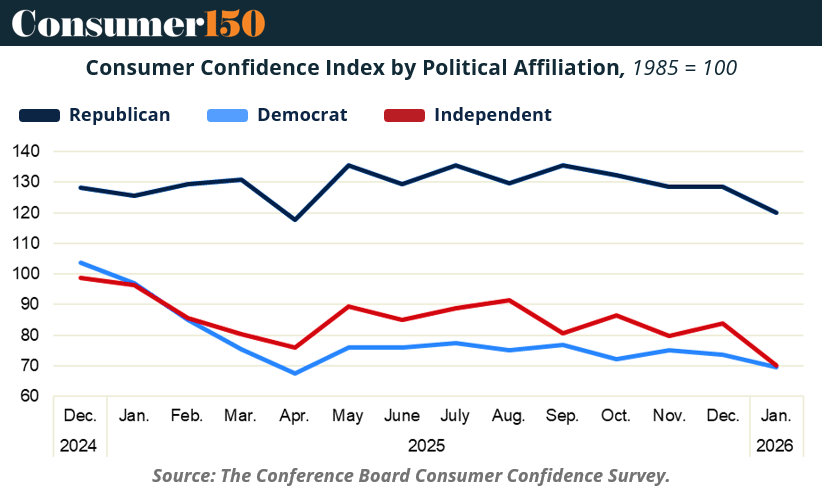

Independents Have Left the Chat

Consumer confidence collapsed in January—but one political group drove most of the carnage. Independents posted the steepest drop, outpacing declines among both Democrats and Republicans. This isn't just noise: confidence by party affiliation tends to signal which messages are resonating (or not) across the aisle. While partisans might stick to their economic narratives, Independents tend to float with actual conditions—and right now, they’re floating downstream with bricks in their pockets.

The broader Consumer Confidence Index hit 84.5, its lowest point since 2014, and well below the recession-warning line of 80. But if you want a leading indicator of consumer vibes, ignore the red vs. blue drama and watch the gray zone—they’re the first to blink when something’s off. (More)

INTERESTING ARTICLES

PUBLISHER PODCAST

No Off Button: The "Karmic Banker" theory of business

Champions don’t step away—they keep building. No Off Button is where Aram sits down with founders, operators, and creators who never needed an off switch to create real value. No startup mythology. Just the people who compound through discipline, relationships, and execution.

This week’s guest is Greg Topalian, Chairman of Clarion Events North America and founder of LeftField Media. Greg built New York Comic Con—the largest pop culture event in North America—without ever quitting his job. An intrapreneur by design, he scaled passion-driven communities inside large institutions, managed a $100M+ events portfolio, and learned the business fundamentals the hard way—selling food off a Sysco truck.

The conversation dives into intrapreneurship, enthusiast markets, and Greg’s “Karmic Banker” philosophy: the best operators give first, build relationships early, and let value compound over time.

Why it matters: this is a reminder that long-term wins come from operational grit, leverage, and human connection—not flashy exits.

"It is not the strength of the body that counts, but the strength of the spirit."

J.R.R. Tolkien