- Consumer 150

- Posts

- AI at the Checkout: Where Personalization Meets Its Limits

AI at the Checkout: Where Personalization Meets Its Limits

How Revenue Optimization, Consumer Trust, and Agentic AI Are Redefining the Most Critical Moment in Commerce

I. Introduction

By 2026, artificial intelligence has moved from the margins of digital marketing into the most critical and sensitive moment of the consumer journey: the checkout. What was once a static transaction point is now a real-time decision engine, shaped by algorithms that determine product visibility, promotional relevance, pricing logic, payment options, and fraud controls. For consumer brands and retailers, AI-driven personalization at checkout has become one of the most powerful levers for revenue growth, directly influencing conversion rates, average order value, and repeat purchase behavior.

Yet this same shift has introduced a new and increasingly binding constraint: consumer trust. As personalization becomes more sophisticated, the boundary between helpful relevance and perceived manipulation has narrowed. Consumers have grown accustomed to tailored experiences, but they are far less tolerant of opacity, surprise pricing, or inferred intent that feels invasive. AI systems that optimize too aggressively—through dynamic pricing, hyper-targeted offers, or opaque recommendation logic—risk undermining the confidence required to complete a transaction. In this environment, personalization no longer fails because it is ineffective; it fails because it is perceived as unfair, intrusive, or misaligned with consumer expectations.

The economic implications are significant. Short-term gains in conversion or basket size can be quickly offset by higher churn, lower lifetime value, and erosion of brand equity. Trust, once treated as a soft brand attribute, has become a measurable economic variable—directly influencing data-sharing willingness, repeat purchase behavior, and long-term profitability. As a result, the performance ceiling of AI at checkout is increasingly defined not by technical capability, but by how consumers interpret and experience algorithmic decision-making in moments of high purchase intent.

This report examines where AI-driven personalization at checkout creates durable revenue and where it breaks trust, limiting its own effectiveness. Drawing on 2025 consumer and executive data, behavioral research, and industry benchmarks, the analysis maps the trust thresholds that shape AI performance across pricing, recommendations, and checkout experiences. The central question is no longer whether brands should use AI at the checkout—but how far they can push it before the economic upside collapses under the weight of eroded trust.

II. The Checkout Reality: Fragmentation, Integration Complexity, and AI Readiness

Before AI can meaningfully optimize the checkout experience, it must operate within a highly fragmented and specialized payments ecosystem. Modern checkout stacks are rarely unified systems; they are assemblages of wallets, gateways, fraud tools, bank rails, and regional payment methods, often stitched together through multiple third-party integrations.

Survey data on current payment stack capabilities illustrates this complexity. While a majority of organizations support digital wallets and account-to-account payments, fewer than half have real-time fraud screening fully integrated, and only roughly one-third report active AI-driven optimization within their payments stack. Many operate across multiple gateways and country-specific payment methods, increasing operational overhead and the risk of inconsistent checkout experiences.

This fragmentation has direct implications for AI at checkout. AI systems rely on clean, real-time signals to make accurate decisions about pricing, offers, payment routing, and risk. When data is split across disconnected services—or when integrations vary by market or channel—AI models are forced to operate with partial visibility. The result is not just reduced effectiveness, but uneven execution: personalization that works in one region and fails in another, or fraud controls that introduce friction inconsistently.

The complexity also increases failure risk. Each additional integration represents a potential point of latency, outage, or misalignment between systems. As AI logic is layered on top of these stacks, errors compound quickly—particularly at checkout, where milliseconds matter and consumers have little tolerance for friction.

For brands pursuing AI-driven checkout optimization, this reality reframes the challenge. The limiting factor is often not model sophistication, but integration maturity. Organizations that treat AI as a thin optimization layer over fragmented infrastructure are more likely to encounter trust and performance breakdowns later in the journey. Those that invest in consolidation, orchestration, and observability at checkout create the conditions under which AI can reliably deliver value.

III. The Stakes in 2026: Why AI at Checkout Matters

By 2026, the checkout has become the highest-stakes decision point in commerce. It is no longer just where transactions are completed, but where consumer expectations, algorithmic decision-making, and trust collide. As AI-driven systems increasingly shape what consumers see, what they are offered, and how prices are presented, the checkout experience has become a direct reflection of how well brands balance revenue optimization with fairness and transparency.

Consumer expectations have evolved rapidly. Shoppers now assume a degree of personalization—relevant product suggestions, streamlined payment flows, and offers that reflect context rather than noise. However, this expectation is paired with a growing sensitivity to how personalization is delivered. When AI-driven decisions feel unclear, inconsistent, or self-serving, consumers do not simply disengage from the moment—they reassess their trust in the brand. In this environment, the checkout acts as a truth test: it reveals whether personalization is perceived as helpful or exploitative.

The stakes are amplified by the economic backdrop heading into 2026. Margin pressure, rising acquisition costs, and slower volume growth have pushed brands to extract more value from existing traffic. As a result, AI-powered personalization at checkout has become a primary lever for improving conversion efficiency and basket economics. But this pressure also increases the risk of over-optimization. Systems designed to maximize short-term yield can inadvertently surface experiences that feel unfair, manipulative, or misaligned with consumer expectations—ultimately capping performance and accelerating churn.

Crucially, this tension is not theoretical. Data shows a widening gap between what consumers expect from personalized commerce experiences and what brands are currently delivering. This gap represents both untapped revenue potential and latent trust risk. Brands that close it through relevance, clarity, and control stand to capture durable gains. Those that ignore it may find that incremental conversion improvements come at the expense of long-term loyalty.

IV. When Personalization Converts: The Revenue Upside of AI at Checkout

By 2026, AI-driven personalization at checkout has moved from a marketing enhancer to a direct revenue lever. What differentiates leaders from laggards is not whether they use AI—but where and how decisively it intervenes in the purchase moment.

Across retail and consumer platforms, AI is now shaping real-time pricing logic, product recommendations, promotion eligibility, and payment orchestration. The data shows that organizations prioritizing AI at late-stage touchpoints consistently outperform those limiting AI to discovery or upper-funnel engagement.

Industry surveys on AI deployment across the purchase journey reveal a clear pattern:

AI adoption intensifies as consumers approach transaction completion. Use cases such as dynamic recommendations, contextual cross-sell, and checkout-level offer optimization rank among the most actively deployed or piloted capabilities—signaling that companies increasingly trust AI to influence revenue-critical decisions.

This is where incremental lift becomes measurable. Unlike awareness-stage personalization, checkout AI directly impacts:

Average Order Value (AOV) through intelligent bundling

Conversion rates via friction-aware incentives

Basket completion by adapting offers to real-time intent signals

The underlying data typically shows higher AI usage rates in commerce execution functions than in brand or content functions—reinforcing the idea that AI’s value is now proven where money changes hands.

However, this same concentration of AI decision-making also amplifies risk. As AI gains authority at checkout, mistimed offers, opaque pricing logic, or over-personalization can quickly erode consumer confidence—setting the stage for the trust trade-offs explored in the next section.

Key takeaway:

AI at checkout delivers its strongest revenue upside precisely because it operates at moments of maximum consumer intent—but that proximity to the transaction makes execution discipline non-negotiable.

V. Market Momentum: AI at Checkout Moves From Capability to Core Infrastructure

The acceleration of AI at checkout is no longer theoretical—it is being validated by rapid market expansion and sustained investment. Global spending on AI-powered checkout technologies is projected to grow from roughly $7 billion in 2025 to more than $138 billion by 2035, implying a 35%+ compound annual growth rate. This pace of growth signals a decisive shift: AI at checkout is moving from an optimization layer to core commercial infrastructure.

What stands out in this expansion is where value is concentrating. While hardware-enabled checkout experiences play a role in early adoption, the fastest growth is driven by software and services—the AI systems that govern real-time pricing decisions, promotion eligibility, payment orchestration, and fraud controls. These capabilities sit directly in the path of revenue, shaping not just whether a transaction is completed, but under what terms.

This investment pattern reflects a broader economic reality facing consumer brands. As traffic acquisition becomes more expensive and demand growth moderates, incremental revenue must increasingly come from better monetization of existing intent. Checkout-level AI offers one of the few levers with immediate, measurable financial impact—linking algorithmic decisions to conversion rates, basket size, and payment success in real time.

However, scale changes the risk profile. As AI-driven checkout experiences become standard rather than exceptional, consumers are exposed to more algorithmic decision-making at the moment of payment. Inconsistencies in pricing, unexplained offer logic, or uneven friction across sessions no longer feel like edge cases—they become signals about how a brand treats its customers. At this level of adoption, trust failures are no longer isolated UX issues; they translate directly into lost lifetime value and brand erosion.

The rapid growth of AI at checkout therefore creates a paradox. The same forces driving adoption—economic pressure, proven ROI, and operational leverage—also compress the margin for error. As AI becomes embedded in transaction infrastructure, the tolerance for experiences that feel unfair, intrusive, or opaque declines sharply. The next section examines where this expansion begins to collide with consumer trust—and why performance gains often flatten precisely when personalization goes too far.

VI. The Trust Threshold: When AI Assistance Feels Like Overreach

Consumer acceptance of AI-driven checkout experiences is uneven—and sharply shaped by perceptions of control at the moment of payment. Survey data on virtual shopping assistants that browse products and add items to carts highlights a generational divide that becomes economically relevant only once AI decisions surface at checkout.

Younger consumers tend to respond positively or neutrally to AI-assisted shopping behaviors, signaling comfort with algorithmic guidance as long as it reduces friction. However, resistance rises steadily with age, with older cohorts showing majority-negative reactions to systems that act autonomously. At checkout, this discomfort manifests not as abstract skepticism but as hesitation, abandonment, or refusal to complete a transaction.

The critical distinction is not whether AI is accurate, but whether it is perceived as acting with or without consumer consent at the point of purchase. When AI adjusts baskets, applies offers, or selects products without clear user control, the checkout becomes a site of tension rather than resolution. This is particularly damaging because checkout is where trust must peak, not fluctuate.

For brands, the implication is clear: checkout-level AI cannot assume uniform acceptance. Systems that optimize conversion through autonomous decision-making risk alienating high-value segments precisely when purchase intent is highest. Trust at checkout is not a soft UX variable—it is a gating factor that determines whether AI-driven gains convert into realized revenue or stall at the final step.

VII. The Shift to Agentic Commerce: When AI Moves From Optimization to Control

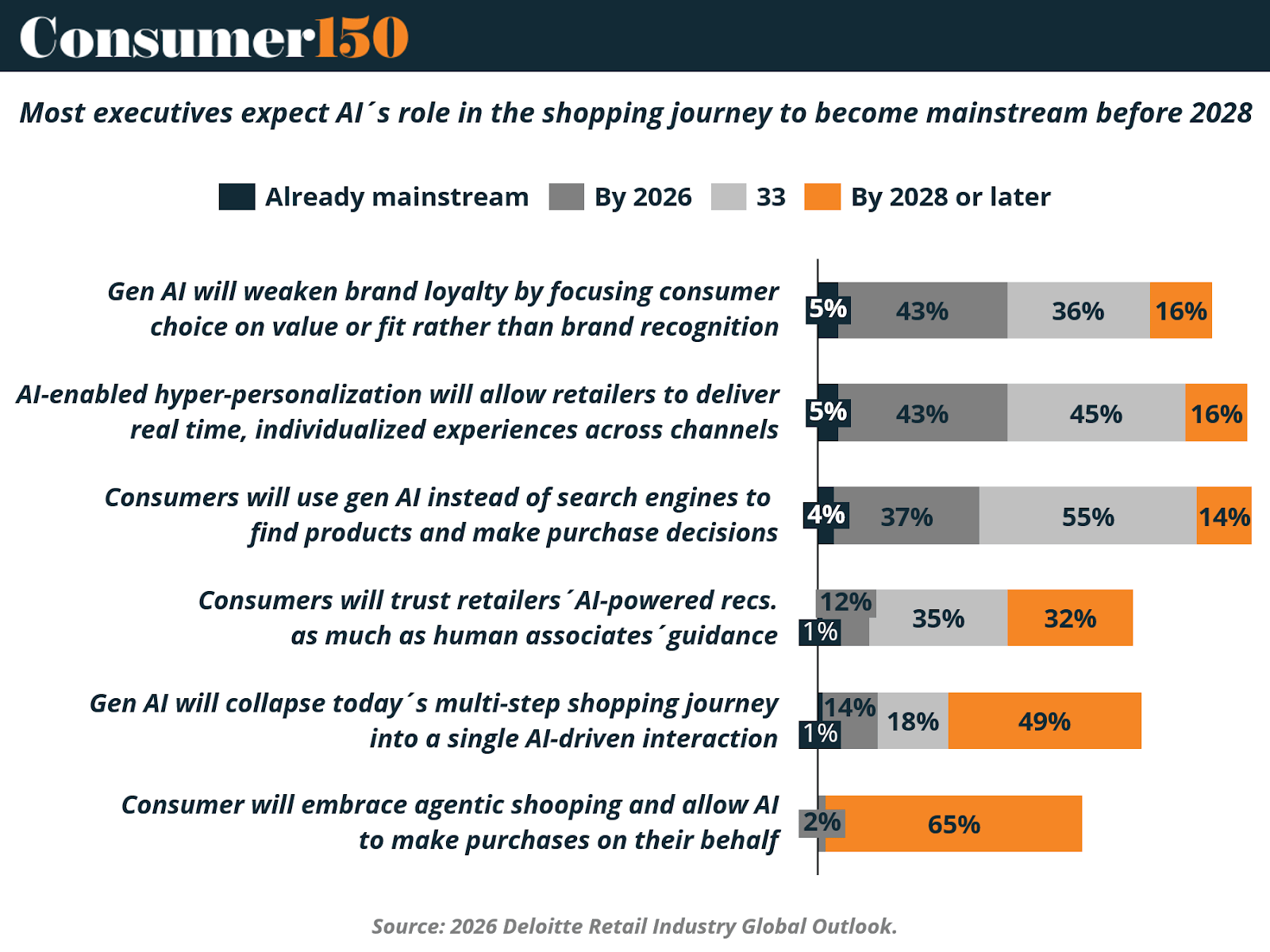

Retail executives increasingly expect AI to become mainstream across the shopping journey within the next two years—but the most consequential impact will be felt at checkout. Nearly 70% of retailers anticipate deploying agentic AI for key operational activities in the near term, accelerating the shift from AI-assisted decisions to AI-executed transactions.

In a checkout context, this evolution means AI systems are no longer limited to recommending products or surfacing promotions. They are increasingly responsible for deciding which offers apply, how prices are framed, which payment methods are shown, and whether a transaction proceeds without friction or intervention. Checkout becomes the enforcement layer where upstream AI decisions are finalized and monetized.

This transition creates a structural paradox. Even as consumer trust in autonomous AI remains uneven, executive expectations assume a rapid consolidation of the shopping journey into fewer, more automated interactions. As discovery and decision-making compress, checkout carries more—not less—responsibility. It becomes the moment where algorithmic authority is either legitimized or rejected by the consumer.

In this environment, the economic role of checkout intensifies. When AI-driven systems misjudge transparency, fairness, or control at the payment stage, the cost is immediate: abandoned carts, suppressed lifetime value, and degraded brand trust. Conversely, brands that design checkout AI to reinforce user agency—through clarity, choice, and explainability—retain control even as agentic systems expand elsewhere in the journey.

The future of AI at checkout, then, is not defined by how autonomous systems become, but by how effectively brands preserve trust at the moment when automation turns intent into revenue.

VIII. The AI Peril at Checkout: When Risk Materializes at the Point of Payment

As AI systems assume greater authority at checkout, the risks associated with automation become both more visible and more economically consequential. Unlike earlier stages of the shopping journey, errors at the payment moment are unforgiving: they directly block revenue, damage trust, or trigger regulatory exposure. Executive concerns about AI are therefore most acute where transactions are finalized.

Survey data highlights four primary areas of risk that converge at checkout. Loss of control and transparency emerges as a leading concern, reflecting unease with black-box algorithms making approval, pricing, or friction decisions without clear human oversight. At checkout, this opacity is especially damaging—consumers expect clarity and consistency when money changes hands, not unexplained outcomes.

Compliance and regulatory exposure represent an equally significant constraint. Checkout-level AI must operate within a rapidly evolving regulatory environment governing payments, data privacy, fraud prevention, and consumer protection. As AI systems dynamically route payments, assess risk, or personalize offers, ensuring adherence to AML, data usage, and fairness standards becomes operationally complex. Failures in this area carry immediate financial and reputational costs.

A third risk lies in false positives, particularly in fraud detection and payment authorization. AI models that over-index on risk can mistakenly block legitimate transactions, introducing friction precisely where intent is highest. At scale, even small increases in false declines translate into meaningful lost revenue and suppressed customer lifetime value.

Finally, these technical and regulatory risks converge into a broader threat: erosion of customer trust. When checkout experiences feel inconsistent, overly restrictive, or unjustified, consumers attribute the failure not to technology but to the brand. Unlike upstream personalization errors, checkout failures are remembered—and often final.

Taken together, these concerns underscore a critical reality. AI at checkout does not fail gradually; it fails discretely and visibly. Each declined payment, unexplained friction point, or opaque decision reinforces skepticism about automation at the moment when trust must be absolute. As adoption accelerates, the margin for error narrows.

The implication for brands is clear. The performance ceiling of AI at checkout is no longer determined by model sophistication alone, but by governance, transparency, and execution discipline. Systems that balance automation with explainability and human override can unlock durable gains. Those that do not risk converting technical efficiency into commercial fragility.

IX. Conclusion

AI at checkout has reached a decisive inflection point. What began as an optimization layer for promotions and fraud has evolved into a core decision system governing pricing, payment access, and transaction completion. The evidence is clear: when executed well, AI-driven checkout personalization delivers measurable gains in conversion, basket size, and efficiency. When executed poorly, it fails instantly and visibly—at the exact moment when trust must be absolute.

This report demonstrates that the limiting factor for AI at checkout is no longer technical capability or market readiness. Infrastructure is scaling, executive commitment is accelerating, and investment momentum is unmistakable. Instead, the binding constraint is trust under automation. As AI systems gain authority at the point of payment, consumer tolerance for opacity, inconsistency, and perceived unfairness declines sharply. The checkout has become a truth test for algorithmic decision-making—where consumers decide not just whether to buy, but whether to believe the system acting on their behalf.

The paradox facing brands is structural. Economic pressure demands deeper optimization of existing demand, pushing AI closer to the transaction. At the same time, over-automation without transparency erodes the very confidence required to complete that transaction. In this environment, incremental gains are fragile. Short-term lifts achieved through aggressive personalization or risk controls can be quickly offset by abandonment, suppressed lifetime value, and brand damage that compounds over time.

The winners in this next phase will not be those who deploy the most advanced models, but those who govern them best. Durable performance at checkout will depend on clarity over control, explainability over opacity, and precision over blanket automation. AI systems that reinforce consumer agency—by making decisions legible, consistent, and contestable—will expand their performance ceiling. Those that treat checkout as a black box optimization problem will find that growth stalls precisely where intent is highest.

AI at checkout is no longer optional, experimental, or peripheral. It is commercial infrastructure. And as with any infrastructure, its long-term value will be determined not by how aggressively it is used, but by how reliably it earns trust at scale.

Sources and References:

Adobe 2025 Retail Digital Trends: AI Adoption and Experience Personalization

Adobe 2025 Digital Trends Report – Retail and E-Commerce

AI-Powered Checkout Market Size, Growth, and Forecast (2025–2035)

Deloitte Retail Industry Outlook – Technology, AI, and Consumer Experience (2026)

The State of Checkout 2025 (Spreedly Survey Report)

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.