- Consumer 150

- Posts

- 23andMe Redux, Breakage Drops, and Price Sensitive Shoppers

23andMe Redux, Breakage Drops, and Price Sensitive Shoppers

Rising rates and cautious buyers have turned the 2021 deal spree into a 2024 game of selective, cash-flow-first acquisitions.

Good morning, ! It’s Thursday and we’re diving into the hospitality and leisure M&A landscape, the online used cars market, and the mobile AR digital goods spending.

Want to reach 350,000+ executive readers? Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

Hospitality M&A Checks Out Early in 2024

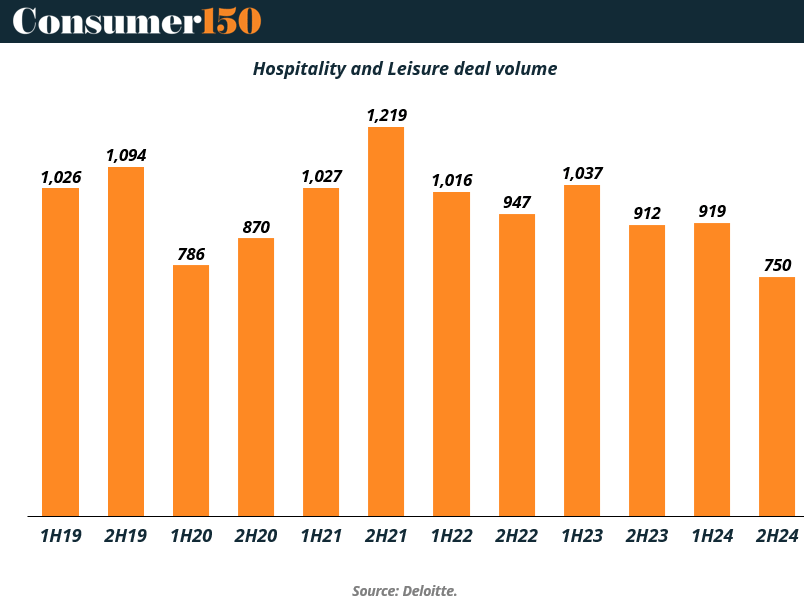

After a post-pandemic high, M&A in hospitality and leisure is running low on fuel. According to Deloitte, deal volume in 2H24 dropped to 750, the lowest since early 2020. That’s down 18.4% from 2H23 and a sharp 38% drop from the sector’s 2H21 peak of 1,219 deals.

This isn’t just cyclical fatigue—it reflects tighter capital markets, rising interest rates, and fewer willing sellers. Strategic buyers are pausing, while private equity waits on price resets. Despite the drop, deal volume remains higher than 2020 lows, signaling some baseline activity in distressed or opportunistic plays.

Back in 2021, pent-up demand and cheap capital fueled a deal frenzy. But the air has cleared. As travel normalizes and consumer demand softens in certain leisure verticals, buyers are becoming more selective, favoring assets with durable cash flows or experiential differentiation.

Bottom line: The days of blanket rollups and growth-at-any-price are behind us. Hospitality M&A is now a slower, smarter game—one where capital discipline and operational leverage matter more than momentum. (More)

PRESENTED BY VIRTUIX

Final Chance to Own a Piece of Virtuix

Virtuix is redefining the future of immersive entertainment — and time is running out to join in. Its flagship “Omni” treadmill lets users physically walk and run in 360 degrees through virtual worlds, with real-world applications across gaming, fitness, and military training.

✅ $18M+ in product sales

✅ 400K+ registered players

✅ 4X revenue growth in the last fiscal year

✅ Backed by $40M+ from top investors, including Shark Tank’s Kevin O’Leary

With over $2.7M raised in this round, investor demand is accelerating — but the raise closes June 20.

This is your final chance to back one of the most exciting players in the VR space.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

ECOMMERCE

The Digital Drive: Used-Car Sales Shift Gears Online

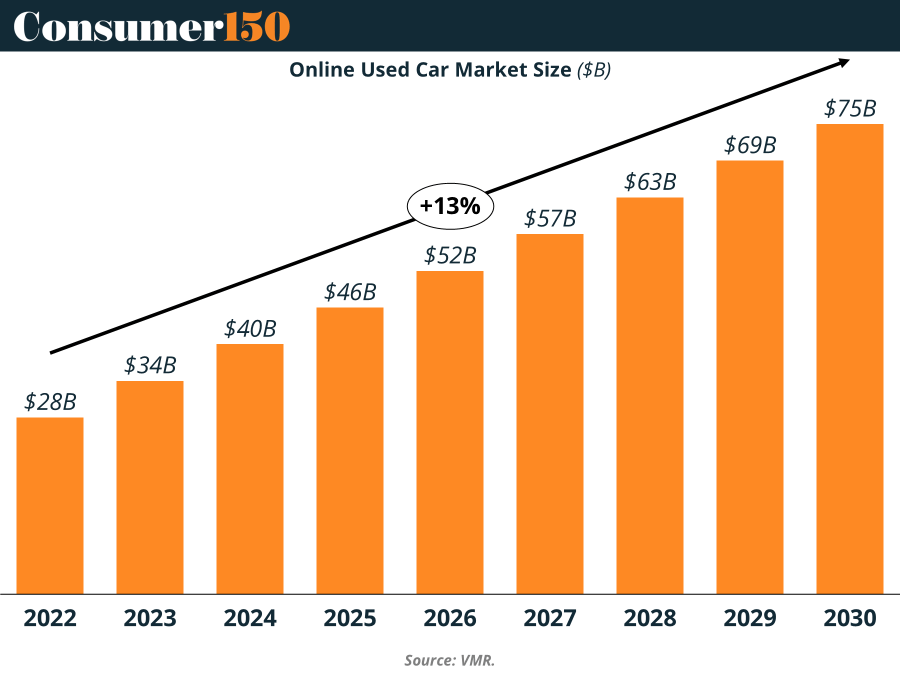

The online used-car market isn’t just accelerating — it’s rewriting the rules of the road. Sales are growing at a 13% compound annual rate, expected to hit $75B by 2030. Once plagued by the "lemons" problem, transparency tools like vehicle history reports and price comparison platforms now let buyers avoid costly surprises. 95% of used-car searches begin online, with 70% leveraging third-party marketplaces. This has forced price convergence and turbocharged dealer profits — McKinsey pegs a $22B market uplift across North America and Europe.

Bottom line: This isn’t a pandemic bump — it’s a structural shift. As digital-first car buying becomes the norm, expect continued investment across logistics, data, and inspection infrastructure. (More)

DEAL OF THE WEEK

Headline Back to the Genome

Anne Wojcicki has reclaimed her genetic empire. Her nonprofit, TTAM Research Institute, will acquire 23andMe’s assets for $305M, besting Regeneron’s previous winning bid in bankruptcy court. The deal covers the company's DNA testing business, telehealth unit Lemonaid, and, most critically, its enormous genetic data trove. For Wojcicki, it’s not just a buyback—it’s a redemption arc. After taking the company public via SPAC in 2021 (peak valuation: $6B), 23andMe nosedived into Chapter 11, struggling with monetization and a massive data breach. TTAM’s mission? Reboot the vision of consumer genomics… just without shareholders breathing down its neck. (More)

TOGETHER WITH STACK INFLUENCE

Outrank Your Competitors on Amazon—Fast!

Stack Influence automates micro-influencer collaborations to significantly boost external traffic and organic rankings on Amazon. Trusted by top brands like Magic Spoon and Unilever, it's your secret to dominating page one.

The Gift Card Cleanout Trend

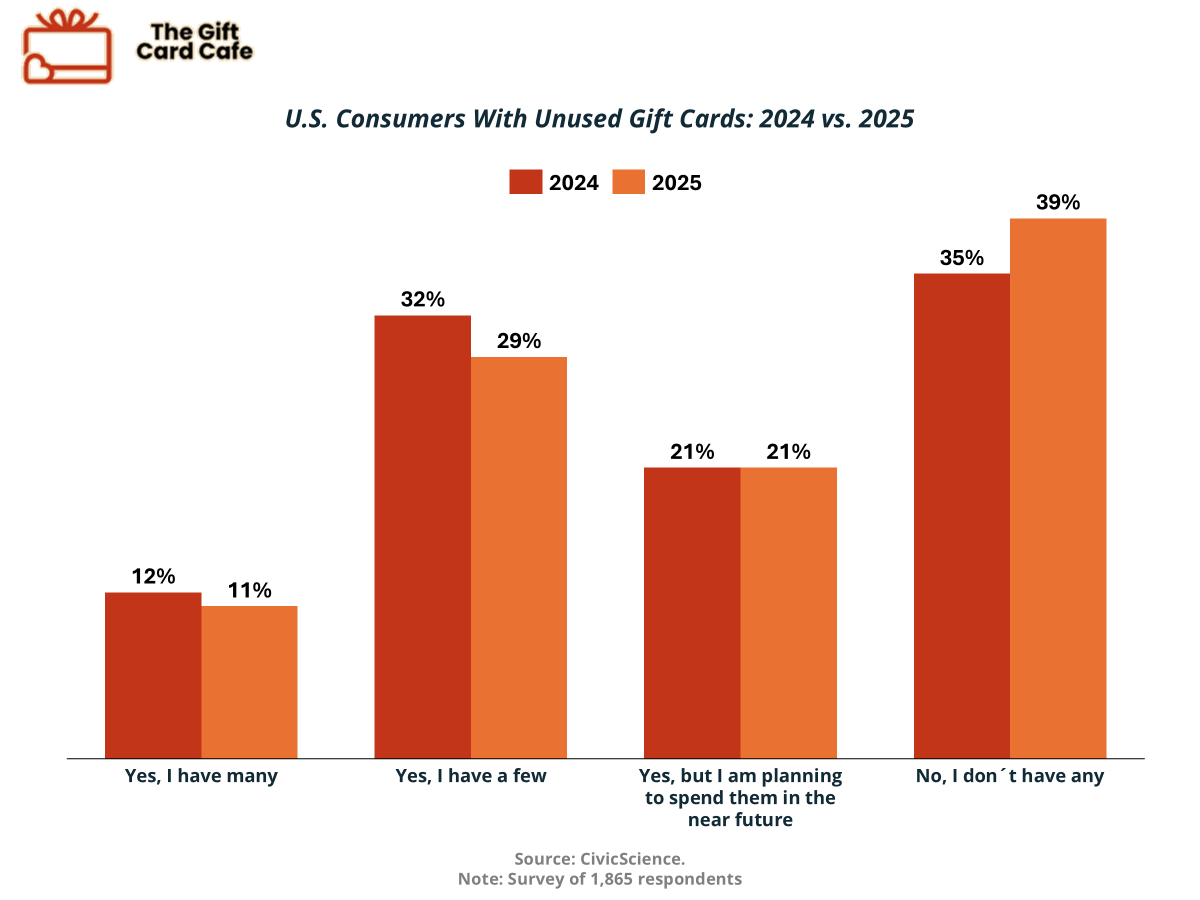

Gift cards are finally leaving wallets—and not just for birthday emergencies. In 2025, 39% of Americans reported no unused gift cards, up from 35% in 2024. Meanwhile, the share of those sitting on just “a few” cards dipped from 32% to 29%. Translation: consumers are either spending quicker or stockpiling less. Yes, 11% still hoard “many” cards, but the broader shift suggests rising awareness and maybe a Marie Kondo moment for retail credit. If you’re a brand, the takeaway is simple: breakage is down, redemption is up—plan your margin math accordingly. (More)

CONSUMER TECH

AR Gains Altitude—But Growth Remains Measured

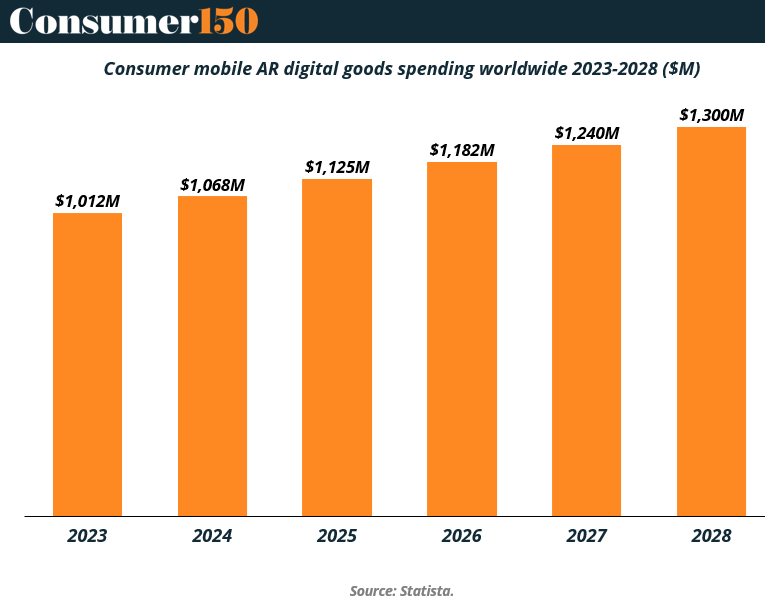

Spending on mobile AR digital goods is rising steadily—but not explosively. According to Statista, global consumer spend will climb from $1.01B in 2023 to $1.3B by 2028, marking a 28% growth over five years. That’s a CAGR of just over 5%, notable but not meteoric for a tech segment often hyped as “next-gen.”

The moderate trajectory reflects AR’s slow-burn adoption curve. Despite high-profile launches (like Apple Vision Pro and Snap's AR retail partnerships), monetization remains concentrated in gaming and digital collectibles—still niche in terms of consumer wallet share.

For investors and strategics, this is a signal: AR’s retail and lifestyle potential is real, but still waiting on a killer use case and platform-wide scale. Until then, growth will likely remain linear—not exponential.

Why it matters: AR is gaining traction, but it's still an add-on, not a primary channel. Brands banking on immersive commerce should prepare for a marathon, not a sprint.

CONSUMER BEHAVIOR

Experiences Over Things, Apps Over Impulse

Consumers are choosing joy over junk — and doing it with the help of apps.

A research from Paysafe and GetYourGuide paints a clear picture: experience-driven spending is eclipsing material purchases. U.S. spending on experiences surged 32% over pre-pandemic levels, compared to just 21% on goods and a meager **5% on discretionary items.

Globally, Millennials and Gen Z lead this shift. Nearly 57% express financial optimism and an appetite for meaningful experiences. Meanwhile, 55% of consumers now use budgeting apps to prioritize joy over impulse buys.

Businesses that embrace this mindset—by delivering frictionless checkouts and immersive brand experiences—will drive customer loyalty. As Harvard Business Review noted: managing the entire customer experience delivers massive rewards: higher satisfaction, lower churn, and stronger revenues.

Bottom line: It’s not about the product anymore. It’s about the story it helps tell. (More)

INTERESTING ARTICLES

"The secret of change is to focus all of your energy not on fighting the old but on building the new"

Socrates