- Consumer 150

- Posts

- Online Used-Car Sales Hit Stratospheric Growth

Online Used-Car Sales Hit Stratospheric Growth

The shift toward buying used cars online isn’t just a consumer convenience trend—it’s a structural transformation of the auto market.

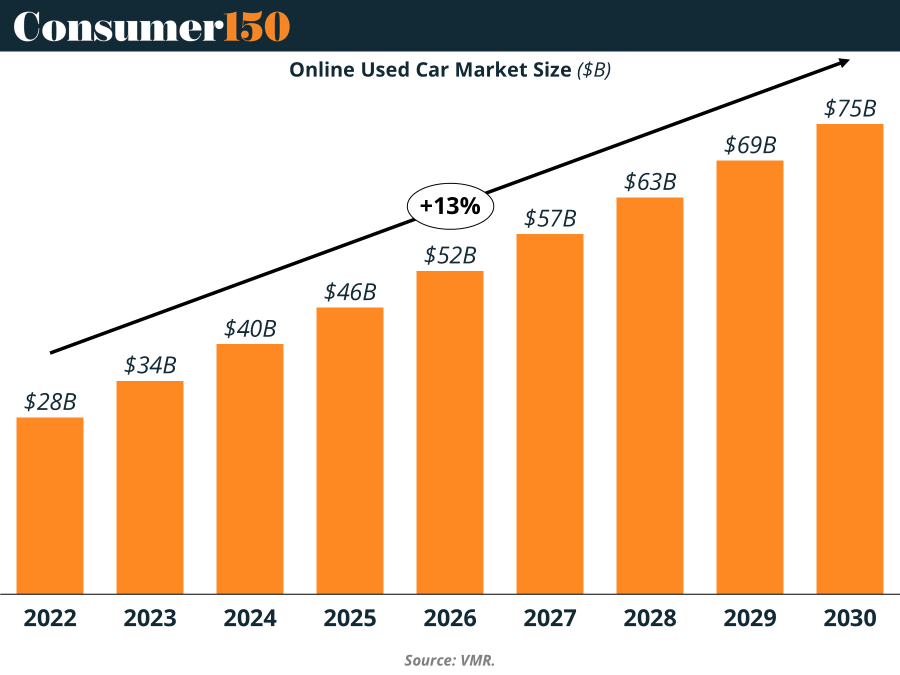

Online used-car sales volume is now growing at a ~13% compound annual rate, set to climb from $28 billion in 2022 to ~$75 billion by 2030.

This growth is being powered by increased transparency. Historically, used-car sales suffered from information asymmetry—the classic “lemons” problem. But the playing field is changing. Vehicle history reports, certified pre-owned programs, and mandatory disclosures now make condition, pricing, and history far more transparent to consumers. Today, more than 95% of used-car searches start online, and 70% of buyers use third-party marketplaces to compare prices. According to industry sources, prices for similar vehicles now converge more quickly across the market. For buyers, this means more accurate pricing and fewer surprises. For sellers, it means access to richer data, which they are using to optimize inventory turnover and profit margins—McKinsey estimates this is driving a $22 billion uplift across North America and Europe.

Dealerships and online platforms alike are racing to capture this demand. The pandemic dramatically accelerated consumer willingness to transact digitally. Platforms like Carvana saw record growth, while major players like CarMax invested heavily to offer full end-to-end digital car buying experiences. CarMax now credits 55% of its sales to online-influenced interactions, and 14% of its sales are entirely digital.

For traditional dealers, digital platforms present more opportunity than threat—but only if they evolve. Forbes notes that modern buyers expect three things: streamlined digital storefronts with clear vehicle specs and no-haggle pricing, integrated financing and paperwork processes, and remote delivery options with flexible return policies. Dealers who can meet these expectations are poised to benefit from both wider customer reach and improved margins.

Several market forces are driving this online shift. First, convenience: shoppers can now compare prices and specifications across hundreds of vehicles from the comfort of home, and complete financing at the same time. Second, transparency: the fixed, up-front pricing model used by most online platforms has proven popular, especially among younger buyers. Third, risk reduction: leading platforms offer strong consumer protections, such as seven-day money-back guarantees and 30-day returns. Finally, inventory breadth matters. Online platforms aggregate stock across multiple regions, enabling buyers to find the exact model and trim they want without being constrained by local lot inventory.

For stakeholders across the market, the implications are clear. Dealers must either invest in digital capabilities or risk losing share to online-native competitors. Consumers stand to benefit from better pricing and a more transparent process. And investors should watch for opportunities in the surrounding infrastructure—inspection services, logistics networks, and vehicle data platforms—that enable this market’s continued growth.

The chart tells the story: this is not a short-term spike—it is a durable channel shift. As digital-first experiences become the norm, the online used-car market is positioned to more than double in size within the decade.