- Consumer 150

- Posts

- $10B Lakers Deal, Gen Z Premiums, LatAm eComm I ConsumerM&A x CapLink Joint Venture

$10B Lakers Deal, Gen Z Premiums, LatAm eComm I ConsumerM&A x CapLink Joint Venture

Inside: our new CapLink alliance, details on the October Private Capital Summit, AI’s checkout stumble, and how a $10B Lakers sale rewrites franchise math.

Hi ,

This Thursday, we’re thrilled to announce a strategic partnership between Consumer M&A and CapLink Group, bringing together two trusted names in consumer-focused B2B media and executive events.

Together, we’re launching Consumer 150 x CapLink Group—a dedicated platform for consumer investors and operators who want direct access to the people, data, and conversations driving today’s M&A landscape.

From curated consumer leadership events and bespoke research, to precision-targeted advertising across our 400,000-strong subscriber base of investors and executives, we now offer a high-impact media stack built for consumer dealmakers.

Explore our first collaboration here (*disclosure, not a consumer event!)—but stay tuned for invitation-only events spotlighting bold operators, next-gen categories, and high-conviction investors shaping the future of consumer.

Be on the lookout for a consumer private equity event coming up during the US Open!

In our regular scheduled publishing, we’re diving into why Gen Z and Millennials are spending more—but smarter, how Argentina’s breakout e-commerce growth is reshaping LatAm priorities, what the $10B Lakers sale signals for sports investing, and why AI still isn’t convincing consumers at checkout.

Want to reach 400,000+ executive readers? Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

Home Team Advantage

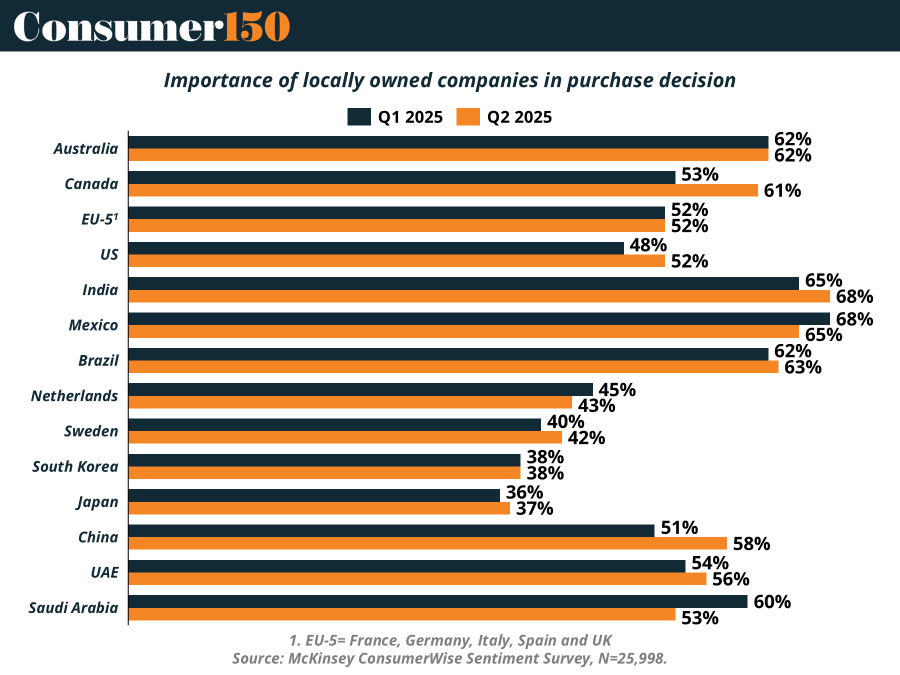

In 2025, local beats global—not just in rhetoric, but at checkout. 47% of consumers worldwide now say local ownership influences their buying decisions, per McKinsey’s latest ConsumerWise data. It’s more than a trend—it’s a reset. Markets like Mexico, India, and Brazil lead the charge, but the U.S. and Canada are catching up fast, posting double-digit jumps in just one quarter. The motive? Not just price or nostalgia. Consumers are tying their wallets to domestic values, trust, and cultural alignment. For global brands, the message is clear: act local or get left behind. (More)

PRESENTED BY KEEPCART

Influencer code protection made simple

KeepCart: Coupon Protection partners with D2C brands like Quince, Blueland, Vessi and more to stop/monitor coupon leaks to sites/extensions like Honey, CapitalOne, RetailMeNot, and more to boost your DTC margins

ECOMMERCE

LatAm eCommerce: Brazil Still Leads, but Others Are Catching Up

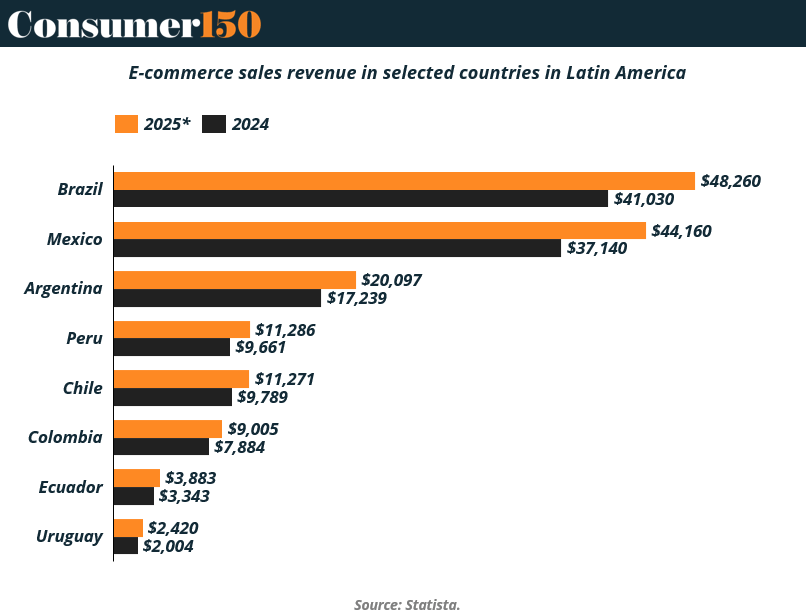

Latin America’s e-commerce engine keeps gaining speed. According to Statista, Brazil and Mexico will lead the region in 2025, with projected online sales of $48.3B and $44.2B, respectively. But the more telling story lies just below the surface.

Argentina is expected to notch a 17% YoY increase, reaching $20.1B, while Peru and Chile are neck-and-neck around $11.3B, both up more than 15%. Even Ecuador and Uruguay, smaller players in absolute terms, are growing steadily—up 16% and 21%, respectively.

Why this matters: Regional e-commerce is maturing beyond Brazil and Mexico. Infrastructure improvements, rising digital penetration, and platform expansion (Mercado Libre, Rappi, Shopee) are creating fertile ground for brands targeting tier-two growth.

Bottom line: Investors and operators fixated on Brazil may miss the bigger play—mid-size markets are heating up, and first movers will have the advantage in capturing share before competition crowds the field.

DEAL OF THE WEEK

The $10B Hand-Off: Buss Family Sells Lakers to Mark Walter

In a landmark transaction, the Buss family has agreed to sell majority ownership of the Los Angeles Lakers to billionaire investor Mark Walter, valuing the franchise at a record-setting $10 billion—the highest price ever for a U.S. sports team.

Walter, already a 26% stakeholder via his 2021 acquisition of Phil Anschutz’s share, secured a right of first refusal that now comes to fruition. While the Buss family retains a 15% minority stake, Jeanie Buss will remain governor of the team “for at least a number of years,” maintaining operational control during the transition.

Why it matters: This sale isn’t just an exit—it's a strategic baton pass. Walter, the Guggenheim CEO and owner of the Dodgers, Sparks, and part-owner of Chelsea FC, has a history of scaling sports franchises with precision. His acquisition signals a shift toward more corporate-style management at one of basketball’s most iconic, and most emotionally driven, franchises.

$10B doesn’t just set a benchmark—it resets expectations for team valuations and liquidity events in pro sports. For investors, it's another reminder: the sports franchise asset class is entering its institutional phase. (More)

The Private Markets Intelligence Summit of the Year

📍 October 15, 2025 | Well& by Durst, NYC

Join 300+ private markets leaders—GPs, LPs, operating partners, and advisors—for a single day of insights, strategy, and dealmaking at the New York Private Capital Summit.

This isn’t another networking event. It’s where strategy meets substance:

→ Keynotes from HarbourVest, Bloomberg, Australian Super

→ Deep-dives on secondaries, direct lending, GenAI, and ESG

→ Practical panels on fund formation, human capital, and tax strategy

→ A spotlight on emerging liquidity tools and NAV-based financing

With over 50 senior speakers from firms like Apollo, KKR, Carlyle, Neuberger Berman, and Warburg Pincus, the Summit is designed for decision-makers driving the next decade of private capital.

Reserve your seat before it sells out: Early Bird Access

Fix the Friction: What Consumers Want from Gift Cards in 2024

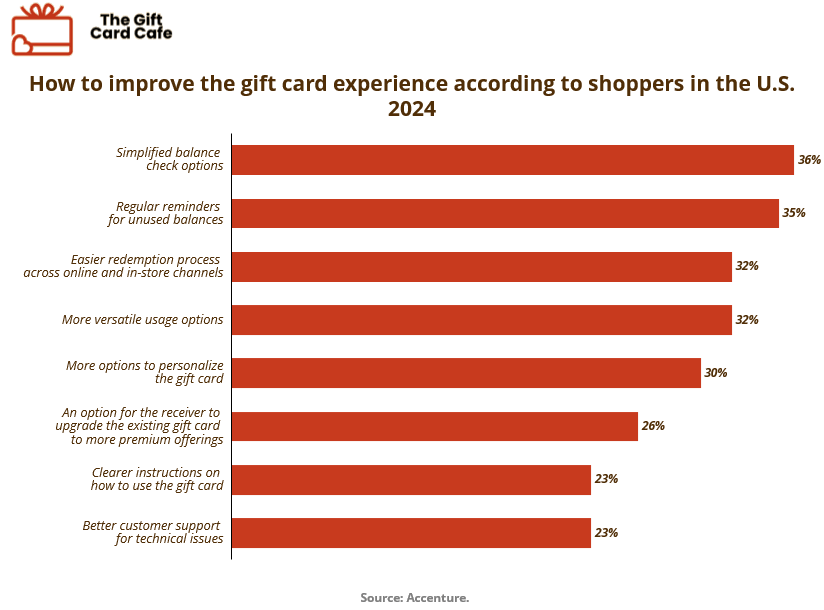

Gift cards may be popular, but the user experience still leaves much to be desired. According to Accenture, 36% of U.S. shoppers want simplified balance check options—the most requested improvement in 2024.

Other pain points follow closely: 35% of consumers ask for regular reminders for unused balances, and 32% call for easier redemption processes across online and in-store channels. The message is clear: consumers aren’t rejecting gift cards—they're asking for better infrastructure.

There’s also demand for versatility (32%), personalization (30%), and even upgrade paths to premium products (26%), signaling a broader shift toward gift cards as more than just passive payment tools—they’re becoming loyalty levers and brand experiences.

Bottom line: If brands want to capture the $1T+ gift card market, they need to treat the post-purchase journey with the same intensity as the sale. UX isn’t a nice-to-have—it’s a growth engine. (More)

CONSUMER TECH

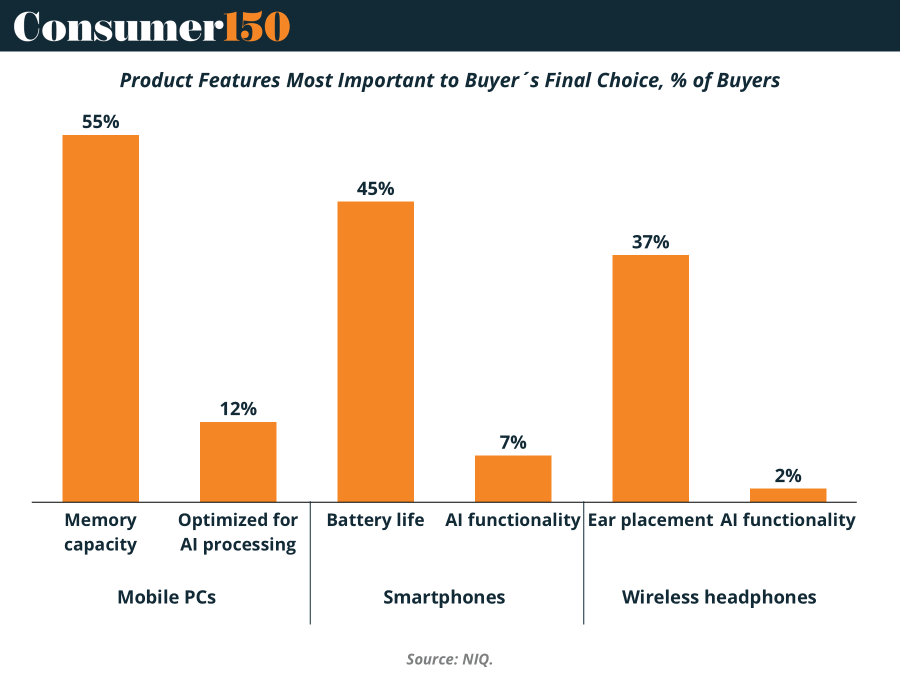

AI Is In the Box—Now What?

At CES 2025, AI was everywhere—from smart ovens to wellness wearables—but here’s the catch: most consumers still don’t care. Shoppers continue to prioritize battery life, form factor, and storage capacity over AI smarts. And with privacy concerns ranking as the top barrier for voice assistants and #2 for smart appliances, the messaging isn’t sticking. The challenge for brands? Translate AI into utility. That means showing how it solves real pain points, not just slapping “AI-enabled” on a box. Until AI can cook dinner, walk the dog, and guarantee data safety, it’s still just another feature fighting for attention. (More)

CONSUMER BEHAVIOR

Premium Feels Personal Now

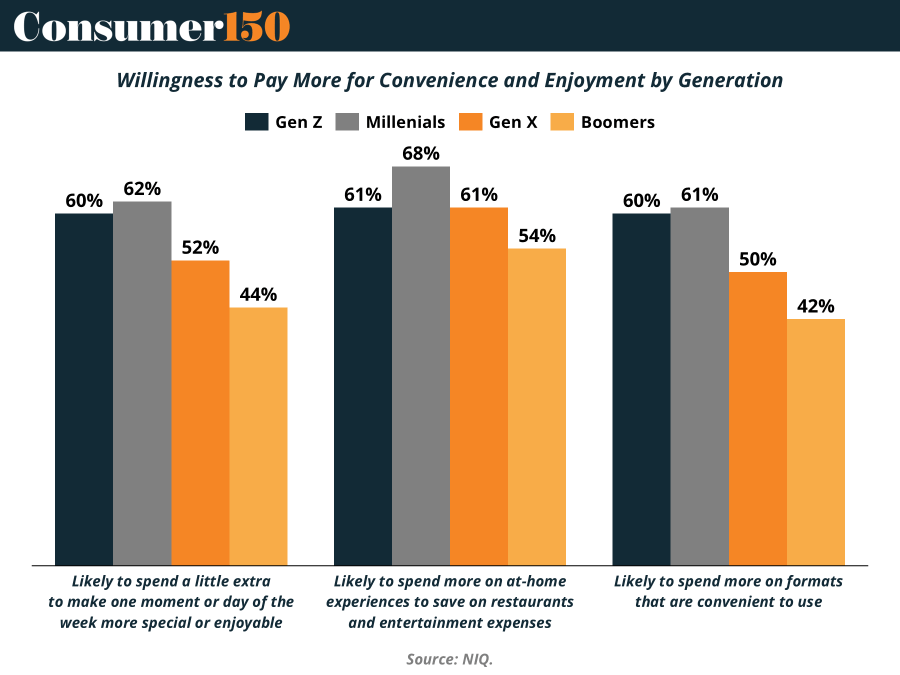

Don’t let the headlines fool you—younger consumers aren’t afraid to spend. They’re just choosier about what’s “worth it.” According to NIQ, Millennials and Gen Z are leading the charge in premium purchases—but only when the value feels personal. Think at-home upgrades, smart subscriptions, and time-saving convenience. Over 60% of both groups say they’ll pay more to make everyday moments better. The takeaway? Upselling isn’t about luxury anymore—it’s about relevance. Brands that frame premium as emotional ROI—less stress, more joy—are winning wallets. It’s not frugality vs. splurging. It’s intentional spending. (More)

INTERESTING ARTICLES

"The future belongs to those who believes in the beauty of their dreams"

Eleanor Roosevelt