- Consumer 150

- Posts

- Trading Down Becomes the New Normal for Shoppers

Trading Down Becomes the New Normal for Shoppers

As price pressures continue to weigh on household budgets, consumers are increasingly adjusting how they shop rather than whether they shop.

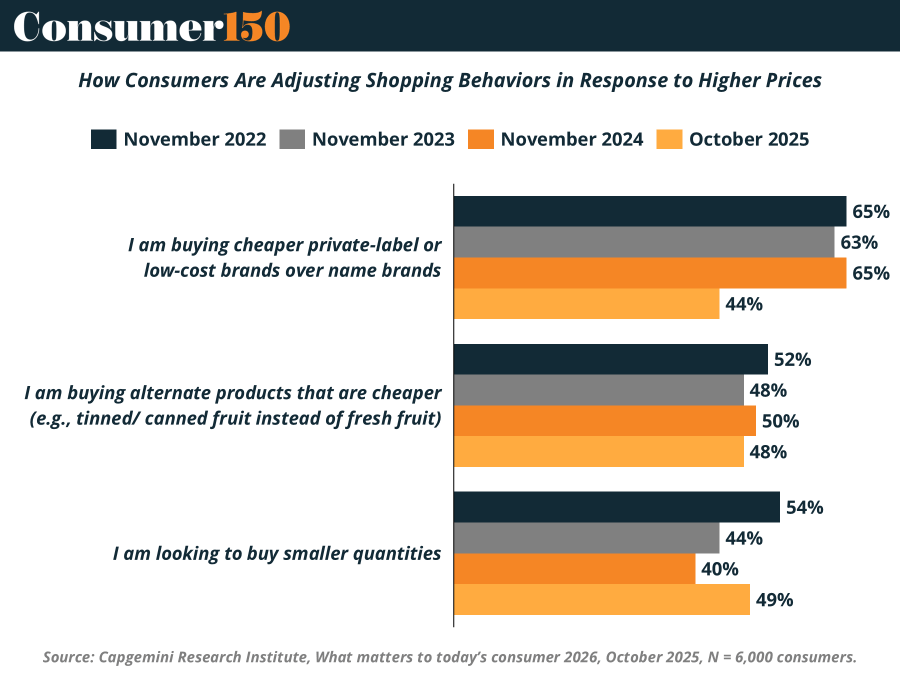

New data from the Capgemini Research Institute shows that trading down — opting for cheaper brands, alternative products, or smaller quantities — has become a sustained behavioral shift rather than a short-term response to inflation.

Cheaper Brands Gain Ground Over Name Brands

Around two in five consumers are now choosing cheaper private-label or low-cost brands over name brands, a notable shift from earlier years. While this behavior peaked in 2022 and 2023 amid sharp inflation, it remains elevated through October 2025. This persistence suggests consumers have become more comfortable with private-label quality and less willing to pay a premium purely for branding.

For retailers, this trend reinforces the strategic importance of own-brand portfolios. Private labels are no longer just value substitutes — they are becoming core to customer loyalty and margin management.

Product Substitution Reflects Value-Driven Decision-Making

Beyond brand switching, consumers are also changing what they buy. Roughly half report purchasing cheaper alternative products, such as canned or frozen items instead of fresh produce. While this behavior has moderated slightly since its 2022 high, it remains widespread.

This signals a more calculated approach to spending: consumers are prioritizing functional value and shelf life over perceived freshness or premium attributes. For consumer goods companies, this trend underscores the need to balance innovation with affordability, especially in essential categories.

Smaller Baskets, Tighter Control

Another clear shift is toward buying smaller quantities. Although this behavior has eased somewhat since 2022, a significant share of consumers continues to downsize purchases to better manage weekly spend. Rather than cutting categories altogether, shoppers are spreading purchases over time — a pattern that can pressure volume growth even when foot traffic remains stable.

This has implications for pricing, pack-size strategies, and promotional planning, particularly in grocery and household staples.

What It Means for the Consumer Industry

Taken together, the data paints a picture of a consumer who is highly value-conscious, intentional, and increasingly comfortable breaking old brand loyalties. While inflation rates may be moderating, price sensitivity remains deeply embedded in shopping behavior.

For brands and retailers, winning in this environment means:

Offering clear value propositions, not just promotions

Strengthening private-label and entry-price offerings

Aligning pack sizes and formats with budget-conscious purchasing patterns

In short, the “trade-down” mindset is no longer a temporary adjustment — it’s becoming a defining feature of today’s consumer economy.