- Consumer 150

- Posts

- The Return of Frugal Fever

The Return of Frugal Fever

After months of revenge spending, consumers are quietly putting their wallets back in their pockets.

KPMG’s latest data reveals a sharp reset in household budgets as discretionary categories lose steam and essential purchases take center stage.

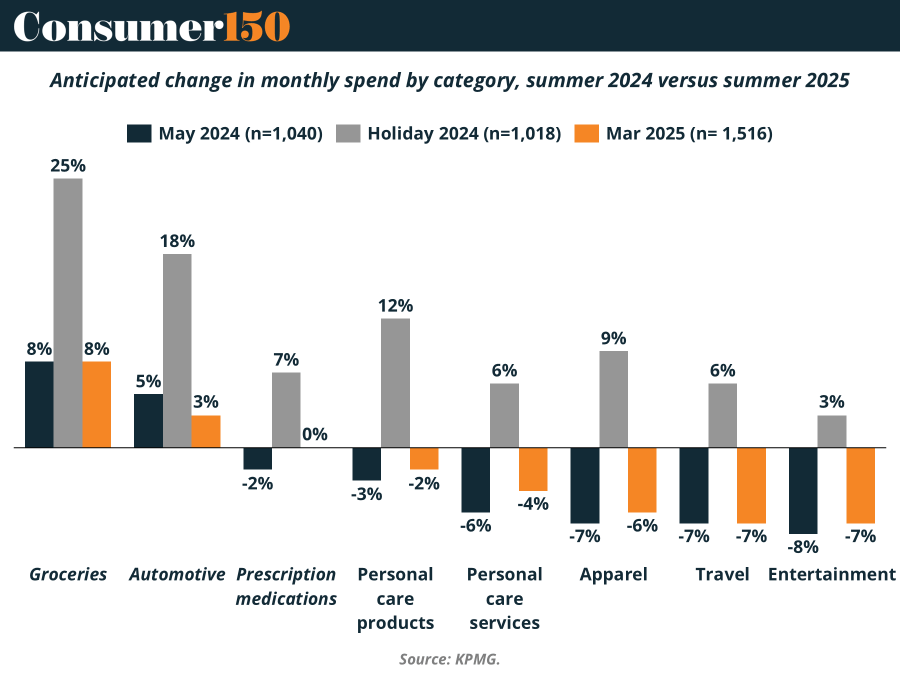

Across major consumer sectors, the 2025 summer outlook looks subdued. Spending intentions have fallen across nearly every discretionary vertical: apparel (-7%), travel (-7%), and entertainment (-7%) are all deep in the red. Even personal care products (-2%) and services (-4%) are sliding, suggesting that small luxuries are being trimmed too.

Meanwhile, groceries remain the lone bright spot, projected to rise 8%—though that’s a steep cooldown from the 25% surge recorded during the 2024 holiday season. The spending pendulum has swung decisively from “treat yourself” to “feed yourself.” Consumers are trading wants for needs, signaling a shift toward necessity-driven consumption.

Inflation Fatigue Meets Real-Life Restraint

Behind this frugality lies a potent mix of economic anxiety and behavioral recalibration. After two years of pent-up demand and “YOLO” spending, the cumulative weight of inflation, high borrowing costs, and stubborn interest rates is finally catching up.

Consumers aren’t just spending less because they want to—they’re forced to prioritize. Budgets are being rebalanced toward necessities, with groceries, healthcare, and auto maintenance now seen as non-negotiables. The mood is pragmatic: “If I don’t need it, I don’t buy it.”

This marks a profound psychological shift in the post-pandemic consumer landscape. What began as a temporary pullback is morphing into a sustained frugality trend, reshaping how households define value

Groceries: From Treat to Task

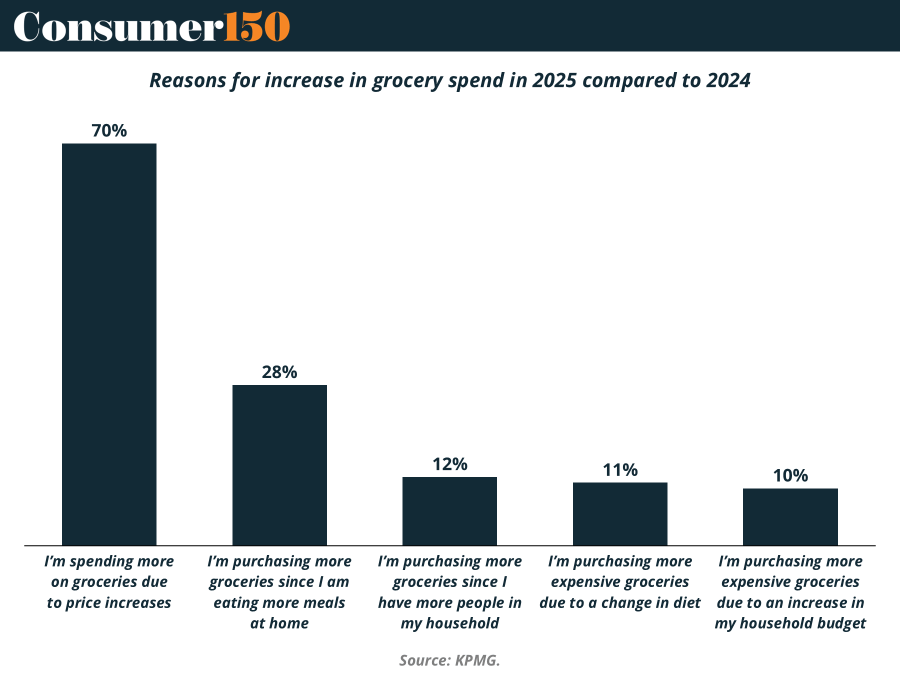

If one category still has momentum, it’s groceries—but not for celebratory reasons. KPMG data shows that 70% of consumers expecting to spend more on groceries in 2025 attribute it to price increases, while 28% say they’re eating more meals at home.

The numbers reveal a dual reality: consumers are paying more, but getting less. The grocery aisle has become a symbol of inflation fatigue—a place where shoppers are constantly reminded of higher prices, smaller packages, and tighter budgets.

This also aligns with the broader “homebody economy” trend that took off during the pandemic and never fully reversed. Even as mobility returns, consumers are cooking more, entertaining less, and rediscovering the economic logic of staying in. The kitchen table has replaced the restaurant booth as the new social hub—and the grocery basket has replaced the shopping bag as the main spending outlet.

The New Value Equation

For brands, the implications are clear—and urgent. The new consumer calculus revolves around trust, transparency, and tangible value. Loyalty is being redefined: it’s no longer about novelty or exclusivity, but about dependability.

Reposition around utility. Brands that emphasize durability, efficiency, or long-term savings will resonate more than those selling aspiration.

Recalibrate messaging. “Affordable quality” now outperforms “luxury lifestyle.” Emotional connection comes from helping consumers feel in control, not indulgent.

Adapt pricing strategy. Subscription models, refill programs, and loyalty discounts can help maintain engagement even as consumers scale back.

From Splurge to Sustain

The Frugal Fever sweeping through 2025 isn’t just a seasonal mood—it’s the new baseline for spending behavior. As inflation lingers and disposable income tightens, consumers are rediscovering restraint as a form of resilience.

Brands that understand this shift—and speak the language of value, balance, and credibility—will be best positioned to thrive. Because in the new consumer economy, the smartest spenders aren’t spending less—they’re spending smarter.