- Consumer 150

- Posts

- Tax Strategy in Employee Rewards Programs Using Gift Cards

Tax Strategy in Employee Rewards Programs Using Gift Cards

In today’s competitive business environment, companies are constantly seeking innovative ways to recognize and motivate their employees.

Among the most popular methods of employee appreciation are rewards programs that utilize gift cards. Gift cards offer flexibility, convenience, and a sense of personalization, making them an appealing option for employers and employees alike. However, while gift cards can strengthen employee engagement, they also raise important tax implications that organizations must carefully navigate to maintain compliance and optimize tax efficiency.

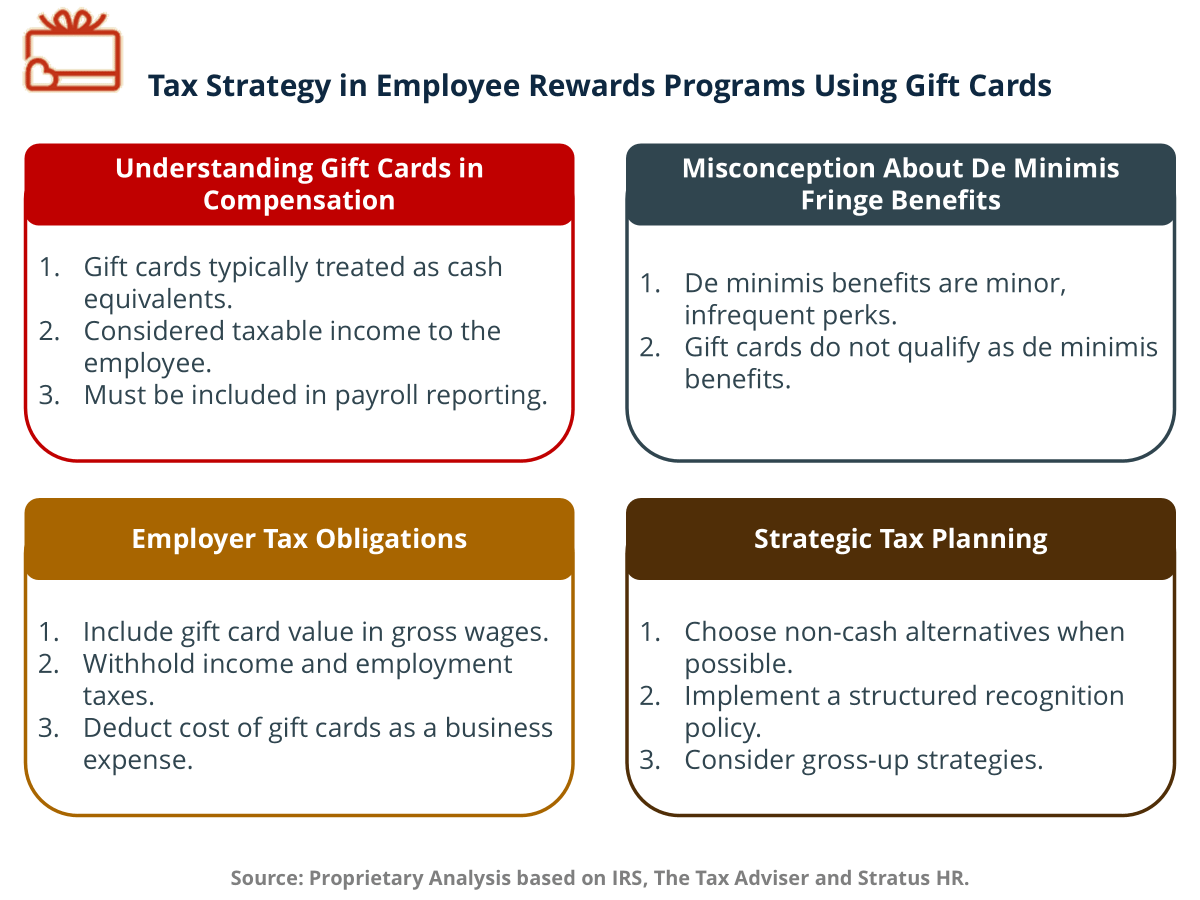

Understanding the Nature of Gift Cards in Compensation

From a tax perspective, gift cards are generally treated as cash equivalents. This classification means that, in most jurisdictions—including the United States, the United Kingdom, Canada, and Australia—gift cards are typically considered taxable income to the employee, just like regular wages. The Internal Revenue Service (IRS), for example, explicitly states that any cash or cash-equivalent award (such as a gift certificate or card) must be included in the employee’s gross income, regardless of the amount or reason for the reward.

This treatment applies whether the card is:

Redeemable for general merchandise (e.g., Amazon, Visa, Mastercard gift cards)

Redeemable for specific retailers (e.g., Starbucks or Target)

Distributed as a performance incentive, holiday bonus, or recognition of service

In short, if the gift card can be exchanged for goods, services, or cash, it is taxable. Therefore, employers must include the value of these cards in payroll reporting and withhold applicable income and employment taxes.

The De Minimis Fringe Benefit Misconception

Many employers mistakenly believe that small-value gift cards can be treated as de minimis fringe benefits, which are minor perks excluded from taxable income due to their low value and infrequent nature. Typical examples include small gifts like coffee mugs, company-branded apparel, or occasional snacks.

However, the IRS clearly distinguishes between tangible low-value gifts and cash equivalents. Gift cards, regardless of amount, do not qualify as de minimis benefits because they are considered readily convertible to cash. Therefore, even a $10 gift card is fully taxable unless it falls under a specific, narrowly defined exemption (e.g., a card that can only be used to purchase a specific item of minimal value and not general merchandise).

Employers should be cautious not to misclassify these rewards, as doing so can lead to penalties, back taxes, and compliance issues during audits.

Employer Tax Obligations and Reporting

When using gift cards as part of a rewards program, employers have several reporting and withholding obligations:

Include gift card value in gross wages: The value of each gift card should be added to the employee’s W-2 form for the applicable tax year.

Withhold income and employment taxes: Federal income tax, Social Security, and Medicare contributions must be withheld from the employee’s paycheck based on the gift card’s value.

Deduct employer payroll taxes: Employers can generally deduct the cost of the gift cards as a business expense, provided they are used for legitimate business purposes like employee recognition or performance incentives.

Proper documentation is essential. Employers should maintain records detailing the date, amount, purpose, and recipient of each gift card issued. This helps support the tax deduction and ensures compliance with regulatory requirements.

Strategic Tax Planning for Gift Card Programs

While the taxation of gift cards may seem straightforward, strategic planning can help organizations manage their tax exposure while maintaining employee satisfaction. Here are several effective approaches:

a. Choose Non-Cash Alternatives When Possible

Non-cash rewards—such as company-branded merchandise, event tickets, or experiential gifts—may qualify as de minimis fringe benefits if their value is low and distribution infrequent. These can reduce the employer’s tax burden while still fostering engagement.

b. Implement a Structured Recognition Policy

Establish clear policies that define when and how gift cards are awarded. This allows HR and finance teams to track taxable benefits more easily and ensure consistent treatment across the organization.

c. Use Gross-Up Strategies

To avoid reducing the perceived value of the reward, some companies “gross up” the amount of the gift card. This means the employer covers the tax liability on behalf of the employee, ensuring the employee receives the full intended benefit. For example, if a $100 gift card incurs a $30 tax, the employer provides $130 total value to offset the taxes.

d. Consider Jurisdictional Variances

Tax treatment can vary across regions and countries. For multinational companies, it’s crucial to understand local laws governing employee rewards and adjust tax reporting accordingly. Consulting with local tax advisors ensures compliance with each jurisdiction’s rules.

e. Partner with a Reward Program Provider

Many corporate reward platforms now integrate tax reporting features that automatically track gift card issuance and generate payroll-ready data. These tools help streamline compliance, minimize errors, and simplify administration.

Balancing Compliance with Motivation

While the tax implications of gift cards add complexity, they remain a highly effective motivational tool when managed correctly. Gift cards provide employees with choice, convenience, and a tangible token of appreciation—qualities that enhance morale and reinforce positive workplace culture.

To strike the right balance between compliance and engagement, employers should:

Communicate transparently about the taxable nature of rewards.

Offer a mix of taxable and non-taxable recognition methods.

Integrate compliance processes into HR and payroll systems.

By doing so, organizations can maximize the motivational value of gift cards without risking tax complications.

Conclusion

Gift cards have become a cornerstone of modern employee reward strategies, offering flexibility and instant gratification. Yet, they also carry important tax responsibilities that must not be overlooked. By understanding how tax laws classify and treat gift cards, employers can design programs that are both motivational and compliant. With thoughtful planning—such as gross-up methods, alternative rewards, and automated compliance tracking—businesses can maintain a tax-efficient approach while fostering a culture of recognition that drives performance and loyalty.

Sources & References

Eide Bailly. (2024). Are Gift Cards Taxable to Employees? https://www.eidebailly.com/insights/articles/2019/11/what-you-need-to-know-about-the-gift-of-gift-cards

IRS. (2025). Publication 15-B (2025), Employer's Tax Guide to Fringe Benefits. https://www.irs.gov/publications/p15b

IRS. (2025). De minimis fringe benefits. https://www.irs.gov/government-entities/federal-state-local-governments/de-minimis-fringe-benefits

People Keep. (2024). Are gift cards taxable employee benefits? https://www.peoplekeep.com/blog/are-gift-cards-taxable

Stratus HR. (2024). Are Gift Cards Taxable? A Guide for Employee Rewards. https://stratus.hr/resources/employee-gift-card-taxable

The Tax Adviser. (2024). Tax consequences of employer gifts to employees. https://www.thetaxadviser.com/issues/2024/apr/tax-consequences-of-employer-gifts-to-employees/