- Consumer 150

- Posts

- Price Hikes, Plug Ins, and a $1.3B Bet on Broken Windshields

Price Hikes, Plug Ins, and a $1.3B Bet on Broken Windshields

Consumers trade down to private labels and retailers stick to infrastructure tech, while Boyd Group drops $1.3B to roll up collision centers.

Good morning, ! This week we’re looking at how shipping behavior has changed over the past few years in relation to price increases, third party technologies installed on retail stores over the world, Boyd Group $1.3B acquisition, and how value seeking behaviour is influencing company strategy

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

TREND OF THE WEEK

Trading Down Is Now the Default

What started as an inflation workaround is now embedded behavior. New data shows trading down has stayed stubbornly high since 2022—less a reaction, more a habit. Private-label substitution remains the clearest signal, with roughly half of consumers consistently choosing cheaper brands over name brands.

The pattern doesn’t stop at brands. About half of shoppers are making product substitutions, opting for lower-cost formats like canned or frozen alternatives. Even pack size is shrinking, as consumers manage budgets by buying smaller quantities, not fewer categories.

The implication for brands and retailers is blunt: value-seeking is no longer episodic. It’s shaping everyday decisions across brand choice, product format, and basket size. Winning now means building affordability into the core assortment, not relying on promos to paper over pricing gaps. (More)

PRESENTED BY AFFY

Private equity firms face rising competition as auctions drive valuations higher and differentiation lower. The firms that consistently outperform are not simply deploying more capital. They are managing networks more strategically, uncovering warm paths into targets before processes begin, maintaining disciplined banker coverage, and creating visibility across every relationship.

This best practices guide highlights seven proven strategies used by leading firms to source proprietary deals, streamline execution, and position portfolio companies for stronger exits. Built around real-world examples, it shows how relationship intelligence is reshaping private equity deal making from origination through exit.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

Introducing No Off Button: Conversations with founders/investors

Relentless builders don’t wait for permission, and they don’t hit pause. No Off Button goes inside the minds of operators who keep compounding when others tap out.

This week, Aram sits down with Walker Deibel, WSJ bestselling author of Buy Then Build and founder of Acquisition Lab. Walker makes a PE-relevant case that hits close to home: building from zero is often the worst risk-adjusted bet, while buying profitable, owner-operated businesses offers immediate cash flow, control, and asymmetric upside.

The conversation dives into acquisition entrepreneurship, the Silver Tsunami of baby boomer exits, and why “boring” industries deliver better downside protection than most venture-backed plays.

Why PE should care: this is roll-up logic, applied at the individual-operator level, capital discipline, cash yield, and buying earnings instead of narratives.

ECOMMERCE

The Invisible Stack Running Retail

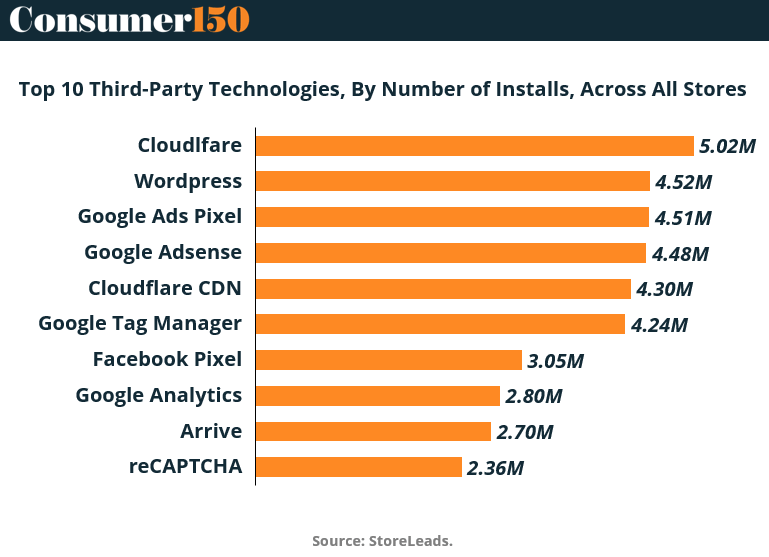

The most widely installed third party technologies across eCommerce storefronts are not flashy growth tools. They are infrastructure. According to StoreLeads data, Cloudflare leads with 5.02M installs, followed by WordPress at 4.52M, Google Ads Pixel at 4.51M, and Google AdSense at 4.48M across all stores .

The pattern is telling. Security, site performance, and traffic monetization sit ahead of analytics or customer experience tooling. Even within Google’s stack, execution layers dominate. Google Tag Manager at 4.24M installs outranks Google Analytics at 2.80M, suggesting merchants prioritize control and flexibility over insight depth. Facebook Pixel trails at 3.05M, reflecting both signal loss from privacy changes and more cautious paid social deployment.

What stands out most is what is missing. Loyalty platforms, personalization engines, and advanced CRO tools do not crack the top ten. Instead, the average store is optimized to load fast, stay online, and capture ad driven demand rather than to build differentiated owned channels.

Why it matters: eCommerce economics are increasingly shaped by infrastructure choices. The winners are not those adding more tools, but those extracting more leverage from the ones nearly everyone already runs. (More)

DEAL OF THE WEEK

Collision Course Correction

Boyd Group just threw $1.3 billion at the competition, acquiring Joe Hudson’s Collision Center and adding 258 shops in the U.S. Southeast. That’s a 25% boost to its North American presence and a direct play to bulk up in a fragmented industry where local mom-and-pops still reign.

The financing cocktail? A debut U.S. equity raise, a C$525M private note, and some good ol’ fashioned credit drawdowns. Strategic rationale: more density = more margin, especially when combined with Boyd’s internal Project 360 (aka "How to Make Money in Auto Repair 101"). The move gives Boyd 1,301 locations—making it harder to bet against their roll-up strategy. (More)

$29 Billion Sitting in Your Junk Drawer

If you're looking for a New Year’s resolution that requires zero effort and pays instantly, here it is: use your gift cards. January 17 marks the seventh annual National Use Your Gift Card Day, and Americans are currently hoarding $29 billion in unused cards. That’s the GDP of Iceland!

On average, people are sitting on $244 in forgotten value—thanks to gift cards lost, expired, or tied to shuttered retailers. Brands like Macy’s, Ace Hardware, and Applebee’s are all leaning in, offering post-holiday deals to stretch that plastic further.

The plan is simple: Find them, Organize them, Redeem them. Three steps to reclaiming your free money. Because in 2026, if you’re leaving cash in a drawer, you might as well be paying ATM fees voluntarily. (More)

CONSUMER BEHAVIOR

Value Isn’t a Trend—It’s the Operating System

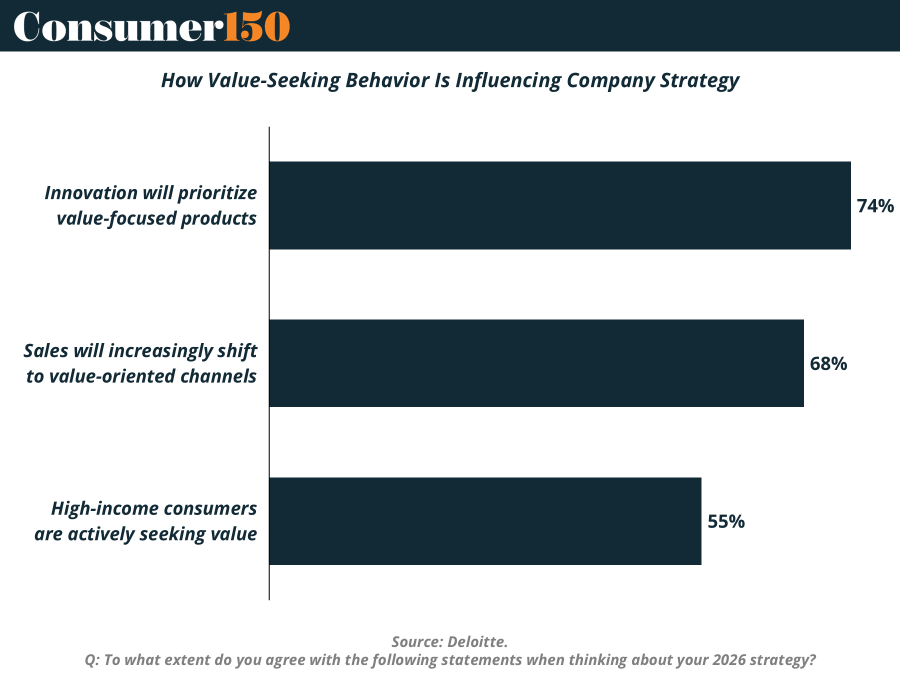

Consumers hunting for value used to be a pricing problem. Now it’s a strategy constraint. In recent surveys, changes in consumer behavior rank as the #1 threat to unit volume growth, leapfrogging distribution and marketing efficiency. Translation: demand hasn’t vanished—it’s gotten pickier.

Executives are responding accordingly. 77% say innovation investment is shifting toward value-seeking consumers, with less focus on premium storytelling and more on price–value optimization, pack architecture, and visible utility. The channel mix is following suit: 68% expect more sales through discounters, private labels, and digital value platforms.

The real kicker? 60% report even high-income consumers are trading down. Value is no longer a segment—it’s the baseline. Companies that don’t design for it risk pricing themselves out of relevance. (More)

INTERESTING ARTICLES

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time."

Thomas Edison