- Consumer 150

- Posts

- LATAM’s $265B Surge, The 29% Savings Squeeze, and Boats Group’s Big Bet

LATAM’s $265B Surge, The 29% Savings Squeeze, and Boats Group’s Big Bet

General Atlantic backs Boats Group and LATAM e-commerce targets $265B by 2028, while 43% of consumers cite inflation as their primary concern.

Good morning, ! This week we’re diving into the sources of concern for US consumers, reduced monthly income that goes into savings, LATAM E-commerce dominated by Argentina, Brazil and Mexico, and Boat Group attracting a new investment round from General Atlantic.

Want to advertise in Consumer 150? Check out our self-serve ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

The Quiet Erosion of Savings

Consumers may say their savings are “holding steady,” but the behaviors underneath tell a different story. A rising share is dipping into savings (26–29%) and reducing income directed to savings (26–29%), essentially keeping balances flat through financial gymnastics rather than financial progress. Add more credit-card usage (26–28%) and increased expense tracking (28–29%), and the picture becomes clear: stability is being manufactured, not earned. Even essential categories aren’t safe—food spending cuts rise to 26%, signaling deeper strain. Slight bumps in BNPL adoption (15–16%) and more consumers working extra hours (11–13%) reinforce the pressure. Consumers are staying afloat, but only by leaning harder on short-term fixes. (More)

PRESENTED BY ROKU

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

ECOMMERCE

LATAM Checkout: Mobile-First, Social-Driven, and Still Scaling

Latin America’s e-commerce momentum isn’t slowing—gross merchandise value (GMV) is projected to more than double from $125B in 2023 to $265B by 2028, according to Statista. What’s driving this surge? A perfect mix of digital adoption and market opportunity.

Mobile is the battleground, with smartphones expected to account for 55% of e-commerce spend by 2028. This is a sharp shift from desktop-centric behavior just a few years ago. Meanwhile, social commerce is heating up, projected to hit $38B by 2028, driven by WhatsApp and Instagram integrations unique to LATAM’s digital culture.

Brazil remains the regional heavyweight (nearly $85B in GMV by 2028), but Mexico and Argentina are growing fast. Cross-border commerce is also on the rise, signaling a more globally connected LATAM shopper.

Why it matters: For brands and investors, LATAM e-commerce is no longer a fringe bet. It’s becoming a scalable, mobile-first growth story with real infrastructure. Logistics, last-mile solutions, and embedded fintech will be key to unlocking the next wave. (More)

DEAL OF THE WEEK

Smooth Sailing: Boats Group Attracts New Capital from General Atlantic & CPP

Boats Group, operator of leading marine marketplaces including Boat Trader, YachtWorld, and boats.com, has secured a strategic investment from General Atlantic and CPP Investments, with Permira retaining a significant minority stake. While financial terms were not disclosed, the message is clear: investors are doubling down on the digitization of niche, high-value verticals.

Under CEO Patrick Kolek, Boats Group has transitioned into a data- and AI-driven marketplace connecting buyers and sellers across the global boating ecosystem. The investment aligns with broader tailwinds, including the shift from offline to online in complex asset categories and growing demand for more transparent, efficient transactions.

This is more than a liquidity event. CPP’s participation signals long-term conviction, General Atlantic brings a growth and global scaling lens, and Permira’s continued involvement reflects confidence in the platform’s trajectory. Together, the capital stack points to further technology investment and category leadership. (More)

TOGETHER WITH GLADLY.AI

Can you scale without chaos?

It's peak season, so volume's about to spike. Most teams either hire temps (expensive) or burn out their people (worse). See what smarter teams do: let AI handle predictable volume so your humans stay great.

Why Gift Cards Win in a Budget-Conscious Holiday

In a season shaped by inflation and tariffs, gift cards are the safe bet. As Axios noted, nearly 60% of holiday shoppers bought one by September—more than any other category. A $50 card still costs $50, even if it buys less, making it a practical, inflation-proof gift.

But this isn’t just thrift. Cards to favorite restaurants or stores still feel personal, especially for younger shoppers navigating tighter budgets. Gen Z is pairing cards with handmade gifts—from bath bombs to pottery—blending thoughtfulness with affordability.

Bottom line: Gift cards are now where sentiment meets strategy. They're cheap to offer, high-margin, and emotionally relevant. Expect the trend to stick. (More)

CONSUMER BEHAVIOR

The Inflation Reality Check

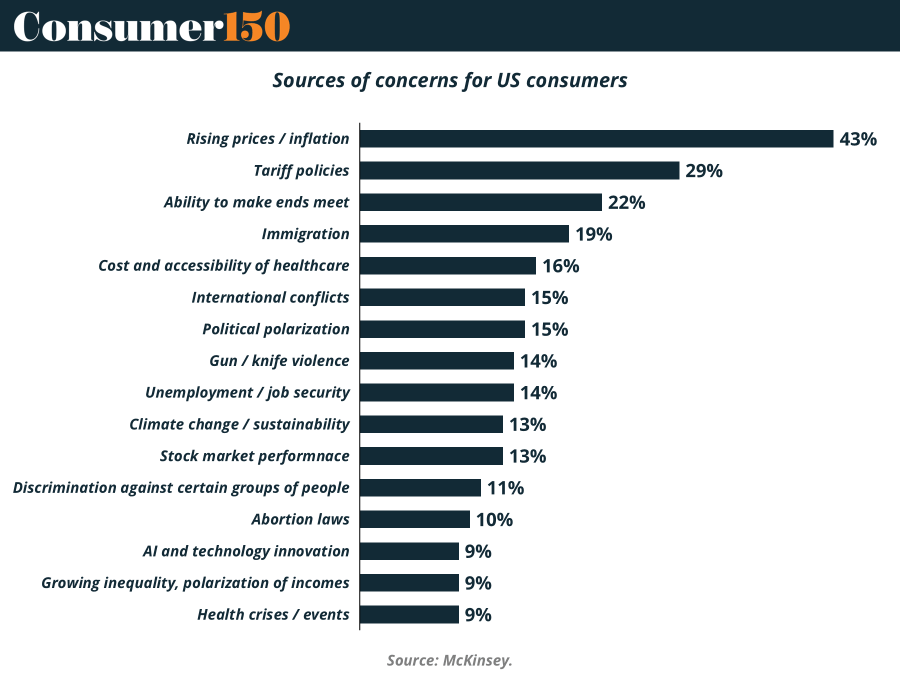

U.S. consumers are still fixated on one thing: inflation. A full 43% rank rising prices as their top concern, a level of obsession usually reserved for celebrity breakups or iPhone launches. Layer in tariff policies at 29%, and you get a consumption environment where shoppers are connecting global trade headlines directly to their weekly grocery bill. Add pressure points like making ends meet (22%) and healthcare costs (16%), and it’s clear that value-seeking behavior is no longer a trend—it’s the default. Long-term issues like climate change, inequality, and AI barely break 10%, signaling that consumers are prioritizing what hits the wallet now over what hits society later. For brands, the ask is simple: show value, show stability, and don’t complicate the message. (More)

INTERESTING ARTICLES

"Nothing is impossible. The word itself says 'I'm possible!'"

Audrey Hepburn