- Consumer 150

- Posts

- Halloween: America’s Season of Celebration and Commerce

Halloween: America’s Season of Celebration and Commerce

How Participation, Creativity, and Early Shopping Drive Record-Breaking Holiday Spending

Introduction: Halloween’s Growing Power in the U.S. Consumer Calendar

Every October, storefronts across the United States turn orange and black, shelves fill with candy and costumes, and consumers prepare for one of the most celebrated and creative retail moments of the year, Halloween. What began as a Celtic tradition marking the end of the harvest season has evolved into a multi-billion-dollar cultural and commercial event, blending tradition, community, entertainment, and commerce. Today, Halloween is not only a night of costumes and trick-or-treating, it’s a month-long retail opportunity that brings together families, brands, and local businesses through shared experiences and themed consumption.

According to Numerator’s 2024 Holiday Intentions Preview, 97% of U.S. consumers plan to buy something to celebrate Halloween, the highest participation rate among all major holidays, even ahead of Christmas and Valentine’s Day. This extraordinary level of engagement highlights Halloween’s unique ability to transcend demographics: it appeals to children and adults alike, spans urban and suburban areas, and cuts across income groups. From candy and costumes to home décor and pet accessories, almost everyone takes part in some way.

However, when looking at spending patterns, Halloween’s position shifts. While nearly the entire population engages in the holiday, average spending per person remains relatively moderate. Data from the National Retail Federation shows that consumers spent an average of $114.5 per capita in 2024, placing Halloween near the bottom of the spending ranking, far below occasions like Mother’s Day ($259) or the Winter Holidays ($902).

This apparent paradox, high participation but modest spending, is precisely what makes Halloween so strategically important. Unlike other holidays driven by large, individual purchases (such as jewelry, electronics, or travel), Halloween thrives on volume, creativity, and accessibility. Its strength lies in micro-purchases, costumes, decorations, themed treats, party supplies, that, when multiplied across millions of households, generate substantial overall retail activity.

For marketers, this dynamic positions Halloween as a mass-engagement event rather than a premium one. The season rewards brands that lean into emotion, storytelling, and visual identity, capturing attention through design, nostalgia, and pop culture. Whether it’s limited-edition packaging, themed product drops, or experiential retail campaigns, Halloween offers fertile ground for creative marketing strategies that build awareness and strengthen customer connection.

In essence, Halloween is less about how much people spend and more about how many people participate, making it a standout event in the consumer calendar, where culture and commerce intersect in one of the most inclusive, playful, and enduring celebrations of the year.

A Decade of Growth – Halloween Spending Reaches Record Highs

While average spending per person remains moderate, the total scale of Halloween shopping has grown dramatically over the past decade, a clear reflection of how widespread participation continues to fuel the holiday’s economic impact.

Data from the National Retail Federation shows that total Halloween spending is projected to reach $13.1 billion in 2025, marking the highest level on record and nearly double the total recorded in 2015 ($6.9 billion). This growth has been steady and resilient, even through economic slowdowns and shifting consumer priorities.

After a brief dip in 2020, spending quickly rebounded, rising from $8.0 billion in 2020 to $12.2 billion in 2022. The upward trend underscores Halloween’s transformation from a one-night event into a month-long retail season supported by strong marketing campaigns, social media culture, and community engagement.

Several factors have contributed to this rise:

Extended celebration periods, with consumers beginning their Halloween purchases earlier each year.

The growing influence of social media and pop culture, driving interest in costumes, themed décor, and party ideas.

A diversification of spending categories, including pet costumes, home décor, and themed food and beverages, which have expanded the traditional scope of the holiday.

The rise of experiential spending, as consumers prioritize hosting gatherings, decorating, and sharing experiences over simply buying candy.

Taken together, these trends suggest that Halloween has evolved from a children’s holiday into a multi-generational cultural and economic event. Its sustained growth highlights the enduring appeal of affordable celebration and creative self-expression, and how even low per-person spending can generate significant market value when participation is nearly universal.

What Consumers Are Buying – Candy Still Rules, But Costumes and Decor Gain Ground

Halloween’s appeal may be nearly universal, but how Americans celebrate it continues to evolve. While candy remains the undisputed centerpiece of the holiday, other categories such as decorations and costumes are showing consistent year-over-year growth, reflecting shifting habits toward more immersive and expressive celebrations.

According to the National Retail Federation, 96% of Halloween shoppers plan to purchase candy in 2025, a slight uptick from 95% in 2024, confirming that sweet treats remain the foundation of the holiday’s consumer spending. However, the most dynamic growth is seen in decorations and costumes, where participation has risen from 75% to 78% and 67% to 71%, respectively.

This increase reflects how Halloween has shifted from a single evening of trick-or-treating to a month-long season of visual expression and themed gatherings. Consumers are not only buying candy but also transforming their homes, workplaces, and social media feeds into Halloween experiences, turning the holiday into a lifestyle moment rather than a one-day event.

Meanwhile, greeting cards, historically a niche category, are quietly growing too, with participation climbing from 33% to 38%. This rise, while modest, highlights the growing role of personal connections and nostalgic traditions within modern celebrations. It also suggests that even smaller product segments can benefit from the overall enthusiasm surrounding the season.

For brands and retailers, these shifts present a clear opportunity: success no longer depends solely on candy sales, but on creating multi-touchpoint experiences that blend food, décor, apparel, and emotional connection. As consumers seek ways to personalize their Halloween, the brands that can deliver creativity, accessibility, and shareable moments will capture the strongest share of this ever-expanding market.

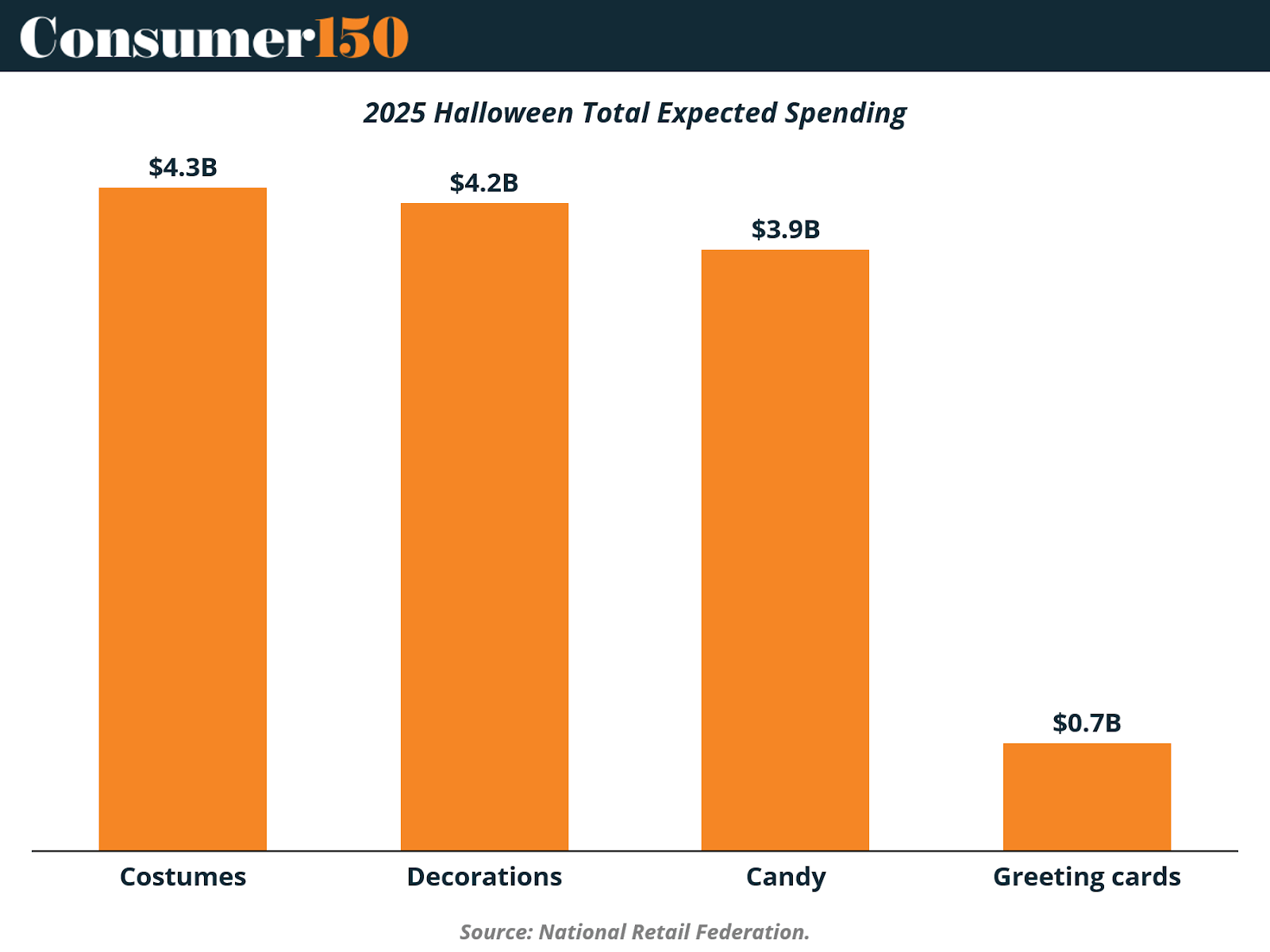

Category-Level Spending – Costumes, Decorations, and Candy Lead the Way

While participation rates provide insight into consumer behavior, the dollar amounts spent in each category reveal the true economic weight of Halloween. In 2025, total expected spending highlights the priorities of American shoppers:

Costumes: $4.3 billion

Decorations: $4.2 billion

Candy: $3.9 billion

Greeting Cards: $0.7 billion

Costumes top the list, reflecting both creative self-expression and the growing trend of themed parties and social media engagement. Decorations are nearly as significant, as consumers invest in immersive experiences that transform homes and public spaces into festive Halloween landscapes. Candy remains a central driver of spending, underscoring its enduring appeal across all ages. Even smaller categories, like greeting cards, contribute meaningfully to the overall market, signaling that personal and nostalgic traditions continue to play a role in modern celebrations.

Together, these figures underscore the multi-faceted nature of Halloween spending: the holiday is not just about sweets, but about costumes, decorations, and the creation of memorable experiences.

The Rise of Early Shoppers – Halloween Moves Up the Calendar

Halloween’s growing cultural footprint is not only visible in how people celebrate but also in when they begin preparing. Once considered a late-October rush, the season has steadily crept earlier into the calendar, transforming into a full-fledged retail period that now stretches across much of September.

According to the National Retail Federation’s 2025 Halloween Spending Survey, nearly half of consumers (49%) say they began their Halloween shopping before October, up from just 34% in 2015. This long-term rise reflects the increasing integration of Halloween into the broader U.S. shopping cycle, standing alongside major retail moments like Back-to-School and the early Holiday season.

Several factors have contributed to this shift. For one, the expansion of themed retail experiences, from store displays to limited-edition product launches, has encouraged shoppers to engage earlier. Social media and influencer culture also play a key role, fueling anticipation and inspiring consumers to plan costumes, décor, and parties weeks in advance. Moreover, as Halloween celebrations have become more multi-generational and experiential, families and young adults alike are spreading their purchases across a longer period, treating the season as an ongoing creative project rather than a one-night affair.

By late October, this early activity has already shaped the tone of the season. Neighborhoods, offices, and digital platforms are filled with decorations, events, and themed content, reflecting how Halloween has evolved into a shared cultural moment rather than a single date on the calendar.

While the season’s early start may not necessarily translate into higher per-person spending, it underscores a broader retail trend: consumer enthusiasm is now expressed through time as much as through money. The earlier people begin engaging with Halloween, the more opportunities brands have to stay top of mind, from the first candy aisle displays to the final round of trick-or-treating.

In 2025, the data makes one thing clear: Halloween has become one of the most enduring and anticipated retail events in America’s consumer year, a season that begins well before the pumpkins are carved and continues to grow in cultural and economic importance with every passing October.

Why Consumers Shop Early – Motivations Behind Pre-October Purchases

The trend of early Halloween shopping is driven by a combination of practical, emotional, and experiential factors. According to the National Retail Federation’s 2025 Halloween Spending Survey, consumers cite multiple reasons for beginning their holiday preparations before October, highlighting the diversity of motivations across age groups.

Among all early shoppers, looking forward to fall leads the way at 44%, followed closely by avoiding stressful last-minute shopping (33%) and planning out costumes and décor early (24%). For younger consumers aged 18–24, these motivations are even stronger: 52% shop early because they enjoy the season, 43% aim to avoid last-minute stress, and 32% plan costumes and décor ahead of time.

Other notable reasons include not wanting to miss out on popular items (33–37%), spreading out the shopping budget (26–30%), and avoiding crowded stores (28–32%). Interestingly, price incentives are a shared motivator, with 23% of early shoppers across age groups responding to deals and sales too good to pass up.

These insights underscore that early Halloween shopping is not solely about securing products; it reflects a broader desire to plan ahead, reduce stress, and extend the festive experience. For retailers, understanding these motivations provides opportunities to tailor campaigns, promotions, and product launches that appeal to both practical and emotional drivers, particularly for younger consumers who are the most likely to start shopping early.

Conclusion

Halloween’s evolution from a single night of trick-or-treating into a month-long cultural and retail phenomenon highlights its unique role in the U.S. consumer calendar. Nearly universal participation, combined with moderate per-person spending, creates a powerful paradox: the holiday generates immense economic impact not through big-ticket purchases, but through volume, creativity, and engagement.

Over the past decade, total Halloween spending has nearly doubled, fueled by growth in costumes, decorations, and immersive experiences. Consumers are starting earlier, planning elaborate celebrations, and seeking ways to make the season both personal and shareable. Candy remains a cornerstone of the holiday, but the rising importance of décor, costumes, and social experiences underscores how Halloween has become a multi-dimensional event that blends tradition, self-expression, and community engagement.

For brands and retailers, this presents a clear takeaway: success comes from understanding Halloween as an inclusive, participatory, and experiential holiday. Those that connect with consumers through creativity, storytelling, and accessibility, across products, displays, and social channels, will capture the largest share of attention and sales.

In short, Halloween’s power lies not in how much each person spends, but in how many people celebrate. Its blend of fun, tradition, and commerce ensures that it will remain one of America’s most enduring and engaging retail moments for years to come.

Sources and References:

National Retail Federation – Halloween Insights

NRF Press Release – Record Halloween Spending

NRF – Retail Holiday and Seasonal Trends

Numerator – 2024 Holiday Preview Report

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.