- Consumer 150

- Posts

- Cash’s Slow Fade: How Consumer Payment Habits Are Splitting the World

Cash’s Slow Fade: How Consumer Payment Habits Are Splitting the World

As digital wallets, contactless cards, and super apps redefine how consumers pay, the story of cash is becoming one of stark contrasts.

Around the world, the migration from bills to bytes is accelerating — but not evenly. New data from Worldpay’s Global Payments Report 2025 highlights two parallel realities: markets racing toward cashless societies, and others where physical currency remains deeply ingrained in daily life.

Back to the Future: The Stubborn Strength of Cash

Cash still has passionate defenders. For many consumers, it represents privacy, control, and trust — qualities digital systems haven’t fully replaced. In emerging markets like Nigeria, the Philippines, Indonesia, and Mexico, cash remains the primary payment method, driven by large underbanked populations and limited digital infrastructure.

In Nigeria, cash accounted for 99% of POS transaction value in 2014, and though it’s forecast to fall to 32% by 2030, it will remain one of the most cash-heavy markets worldwide.

Similarly, Indonesia and the Philippines show steady but incomplete transitions, where digital payment growth still coexists with reliance on cash.

Even in Japan and Germany, high levels of consumer trust in physical currency and cultural preference for cash slow the shift toward full digitalization.

Governments are balancing innovation and inclusion. From CBDC pilots to payment inclusion mandates in Europe and the U.S., regulators aim to ensure that no group is left behind in the digital transition. Yet, as the data show, cash’s persistence reflects deep cultural and socioeconomic roots, not just access to technology.

Low-Cash Use Markets: The Path to a Cashless Future

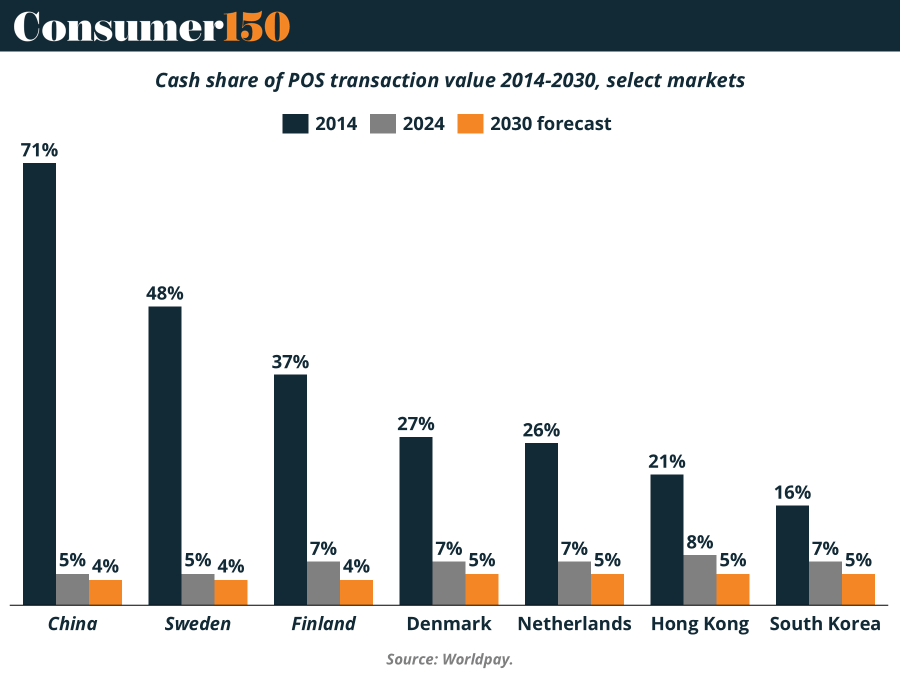

At the other end of the spectrum, cashless societies are no longer hypothetical — they’re emerging in real time. Markets such as China, Sweden, Finland, and South Korea have reached single-digit cash usage, setting new benchmarks for digital adoption.

In China, where mobile super apps dominate daily commerce, cash’s share fell from 78% in 2014 to just 5% in 2024, with further declines projected by 2030.

Sweden and Finland — early adopters of digital payments — now see cash accounting for under 5% of all POS transactions.

Even South Korea, once a high-cash market, has seen its physical currency use shrink to 6%, making it one of Asia’s leading digital economies.

In these markets, digital ecosystems have become the norm. Mobile payments, instant transfers, and embedded finance experiences are so integrated that cash has effectively lost its role in everyday transactions.

Two Worlds, One Direction

What emerges from the data is not a single global trend but a bifurcated payment landscape. On one side, consumers cling to cash for security, privacy, and stability. On the other, digital-first consumers see speed, rewards, and integration as the new currency of convenience.

The gap is narrowing, but unevenly. High-cash markets like Nigeria and Mexico are expected to halve their cash usage by 2030, while low-cash leaders like China and Sweden will stabilize around a 3–5% baseline — suggesting we’re reaching a global equilibrium, not a total extinction of cash.

The Consumer Takeaway

For the consumer industry, these payment divides are more than a financial story — they’re a window into behavioral and cultural shifts.

Digital trust is the new currency: where consumers believe systems are safe, cash fades faster.

Inclusion still matters: regions with lower banking penetration maintain higher cash use.

Cultural inertia plays a role: in Germany or Japan, habit and identity keep cash alive.

Ultimately, the decline of cash is less about technology adoption and more about consumer psychology. As payments become increasingly invisible — embedded in apps, wearables, and online ecosystems — cash remains a symbol of tangibility and control.

The future of payments isn’t purely cashless — it’s choice-driven, where consumers decide how to balance trust, convenience, and identity in every transaction.