- Consumer 150

- Posts

- $83B BNPL Growth, $9B Sneakers, Temu’s Hype At Risk

$83B BNPL Growth, $9B Sneakers, Temu’s Hype At Risk

BNPL adoption matures, Skechers takes a $9B private step, and Temu faces questions after its explosive rise in downloads.

Good morning, ! This week we’re exploring the BNPL Market, is Temu on its way up or down?, and low-and-middle income country spending habits by generation.

Want to advertise in Consumer 150? Check out our self-serve ad platform, here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

DATA DIVE

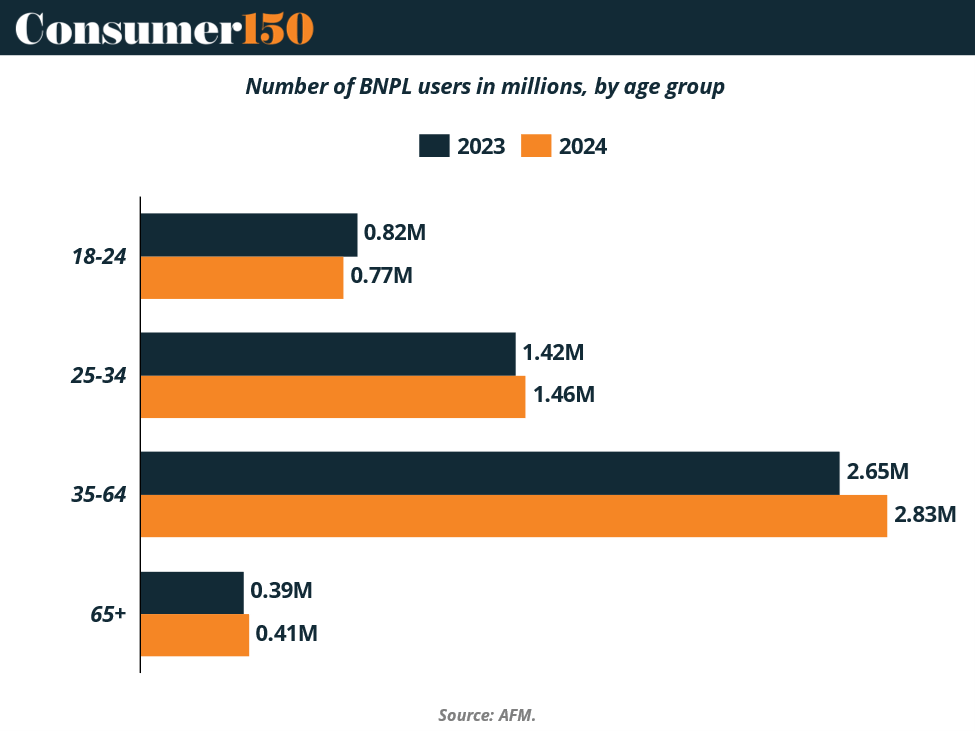

BNPL Grows Up

Buy Now, Pay Later (BNPL) isn’t just for college kids buying sneakers anymore. The biggest adoption surge is among 35–64-year-olds, adding 2.8M users, while the youngest cohort actually dropped off. Even retirees are joining the party: BNPL use among 65+ consumers jumped 40% in a year. Globally, the market is on track to hit $83B by 2034, growing at a 15% CAGR. But here’s the catch: BNPL looks very different by income. For high earners, it’s a “flexibility hack.” For low earners, it’s a financial lifeline—and one that risks overdrafts and long-term debt. Translation: BNPL is becoming mainstream credit, but with two very different customer stories.

TREND OF THE WEEK

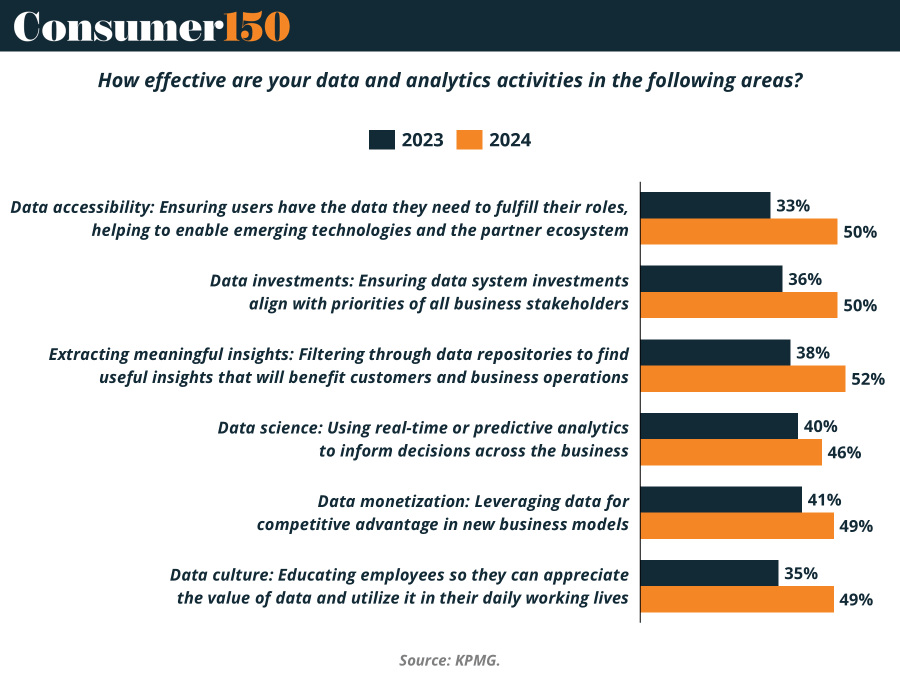

Data Maturity Hits Its Stride

Retailers are finally putting their data strategies to work. According to KPMG’s survey, companies have made double-digit gains in nearly every metric of data maturity. The biggest leap: Extracting meaningful insights, up from 38% in 2023 to 52% in 2024. Data accessibility also improved, with half of businesses now confident employees can find what they need (vs. 33% last year). Even data culture—long the weakest link—rose to 49%, showing that teams are starting to value data beyond dashboards. The upshot? Retailers are shifting from collecting data to acting on it—driving personalization, sharper pricing, and faster decisions. For consumers, that means smarter shopping experiences; for retailers, it means analytics as a competitive moat. (More)

PRESENTED BY SYNTHFLOW

Your Secure Voice AI Deployment Playbook

Meet HIPAA, GDPR, and SOC 2 standards

Route calls securely across 100+ locations

Launch enterprise-grade agents in just weeks

ECOMMERCE

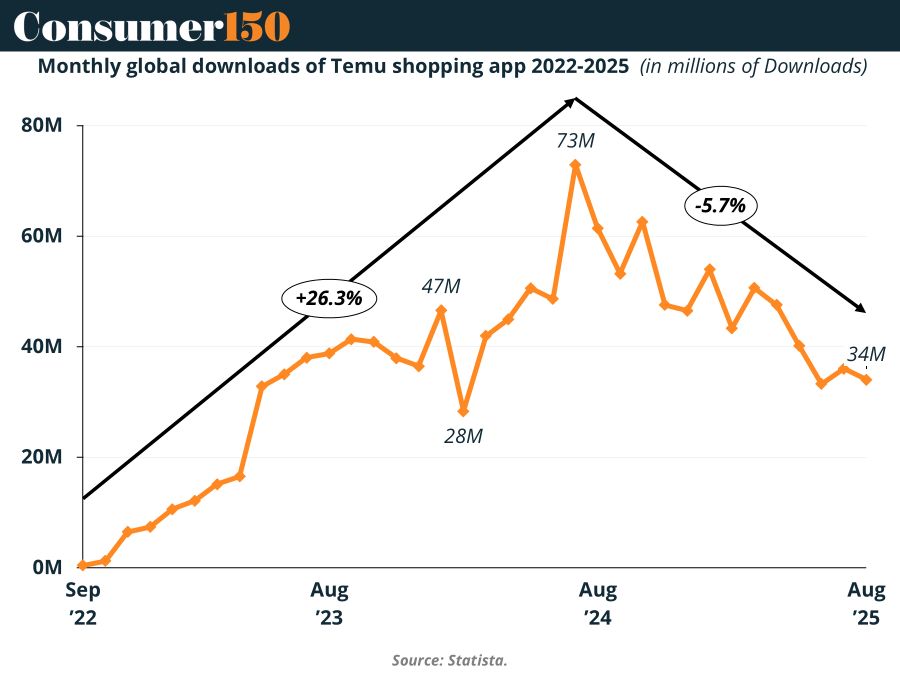

Temu: Peak or Plateau?

The chart says two things at once: Temu rocketed to ~73M downloads in Aug ’24, then cooled to ~34M by Aug ’25—still ahead of Amazon’s shopping app by downloads. Owned by PDD Holdings, Temu cloned Pinduoduo’s playbook: low prices, free/fast shipping, gamification, and tight personalization. The model resonated with inflation-weary shoppers, especially young users in the U.S. and Mexico; early proof came with $1.5B GMV in the first five months of 2023, and it was the most-downloaded U.S. shopping app in 2024. The watch items now: translating downloads into retention, managing cross-border logistics/returns, and sustaining unit economics if marketing cools. Even off its peak, Temu’s scale keeps pressure on everyone’s price perception. (More)

DEAL OF THE WEEK

The $9B Sneaker Shuffle

Skechers just tied the laces on the largest shoe buyout in history, going private in a $9B deal with 3G Capital. The Greenberg family will stay in charge, while public investors walk away with either $63/share or $57 + private equity units. Why now? Some credit 3G’s signature cost-cutting playbook. Others point to a volatile public market and a trade-war-fueled M&A boom—$21B in apparel/footwear deals so far this year. The Clothing Industry is Moving.

Either way, it’s clear: Skechers is betting that scale + privacy = speed, especially with tariffs stepping on margins. And yes, analyst John Kernan expects them back on the market "eventually." File this one under: take-private, cash-rich, tariff-jittery. (More)

TOGETHER WITH LEVANTA

Top Publishers Hand-Selecting Amazon Brands to Promote this Holiday Season

This holiday season, top publishers are handpicking Amazon brands to feature in gift guides, newsletters, and reviews — driving high-intent shoppers straight to storefronts.

Levanta is connecting a select group of 7–9 figure brands with publishers ready to promote products to millions of buyers.

The New Frontline in Fraud Prevention

Gift card scams are getting a regulatory reckoning. In 2025 alone, 11 U.S. states passed new laws targeting fraud schemes—from fake IRS calls demanding payment to tampered cards drained before purchase. Backed by AARP and the Gift Card Fraud Prevention Alliance, these efforts are reshaping the legal landscape and retail accountability.

New measures include mandatory signage warning buyers at the point of sale, retail employee training to spot red flags (like customers buying high-value cards while on the phone), and penalties for non-compliance. In Nebraska, the law allows civil fines up to $250 for stores that fail to comply. Meanwhile, states like Maryland and Texas are going further—requiring more secure packaging and tightening rules around how and when card PINs are accessible.

For consumer brands and investors, the message is clear: compliance isn’t optional, and liability exposure is growing. Gift card sales may be rising, but so is regulatory scrutiny.

Bottom line: As gift cards become more ubiquitous, expect more legislation—and rising expectations for retailers to protect both consumers and reputations. (More)

CONSUMER BEHAVIOR

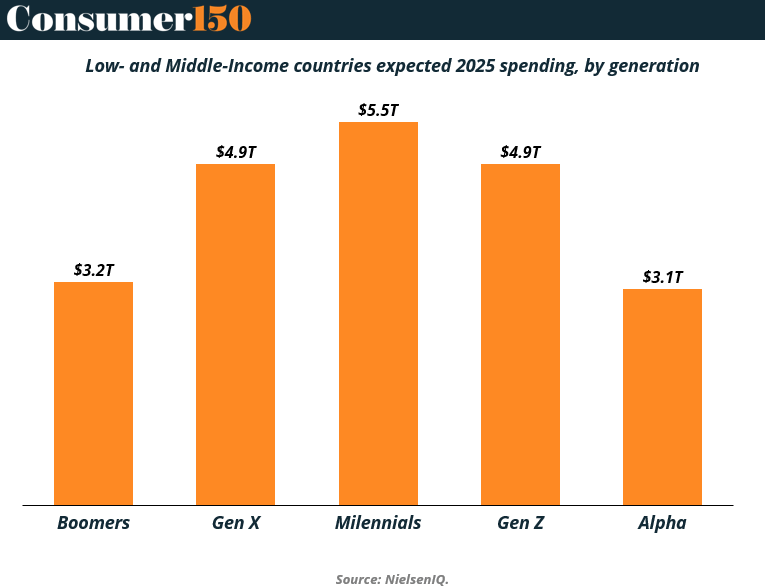

Millennials and Gen Z Are the Spending Core of 2025

In low- and middle-income countries, Millennials and Gen Z will account for nearly half of all consumer spending in 2025—each projected to spend $5.5T and $4.9T, respectively. That's more than Boomers ($3.2T) and Gen Alpha ($3.1T) combined.

The data confirms what many brands are already betting on: younger generations aren’t just digital natives, they’re economic engines. Millennials are aging into peak earning and family formation years, while Gen Z’s purchasing power accelerates as they enter the workforce and influence household buying decisions.

Importantly, Gen Z and Gen X are projected to spend the same amount ($4.9T), but their behavior couldn’t be more different—Gen Z leans into values, digital-first experiences, and rapid brand turnover, while Gen X anchors stability and brand loyalty.

Bottom line: The growth frontier for consumer brands in emerging markets lies with Millennials and Gen Z. Winning wallets in 2025 and beyond means understanding the why behind their spend, not just the what. (More)

INTERESTING ARTICLES

"There's no shortage of remarkable ideas, what's missing is the will to execute them."

Seth Godin