- Consumer 150

- Posts

- $2B Transport Deals, eCommerce Hits 20%, and Shein Shifts East

$2B Transport Deals, eCommerce Hits 20%, and Shein Shifts East

Inside: vehicle-driven mega-deals, e-commerce’s stealth share grab, and Shein’s Hong Kong listing gambit.

Good morning, ! This week we’re diving into the luxury M&A state, the retail ecommerce sales growth, distribution channels on luxury markets, and Shein’s Hong Kong IPO filing.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone deep in the consumer space? Pass this along—they’ll appreciate the edge. Share link.

— The Consumer150 Team

TREND OF THE WEEK

Luxury M&A Is a Vehicle Game—Literally

In 2023, the average fashion and luxury M&A deal was worth $274M, but forget handbags and hotels—this is a market steered by high-ticket transport. Cars led the pack with an average deal size of $2.009B, followed by private jets at $1.09B and cosmetics/fragrances at $817M.

Luxury mobility is clearly where the money is moving. These aren’t just vanity acquisitions—they reflect a broader investor play on mobility-as-status, global wealth concentration, and branding that transcends transportation. Meanwhile, traditional luxury categories like jewelry ($82M) and yachts ($31M) are at the bottom of the deal-value stack, suggesting fragmentation or saturation.

Why it matters: For consumer investors and strategics, luxury M&A is tilting toward asset-heavy, status-symbol categories with scalable branding potential. The era of handbags and high heels may still be stylish, but for dealmakers, it’s the engines that matter.

From a $120M Acquisition to a $1.3T Market

The wealthiest companies target the biggest markets. For example, NVIDIA skyrocketed ~200% higher last year with the $214B AI market’s tailwind. That’s why investors like Maveron backed Pacaso.

Created by a founder who sold his last venture for $120M, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And their target market is worth a whopping $1.3T.

No wonder Pacaso has earned $110M+ in gross profits to date, including 41% YoY growth last year alone. Now, with new homes planned in Milan, Rome, and Florence, they’re really hitting their stride. They even reserved the Nasdaq ticker PCSO.

And you can join well-known firms like Greycroft today. Lock in your Pacaso investment now for $2.90/share.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

ECOMMERCE

Growth Slows, Share Grows

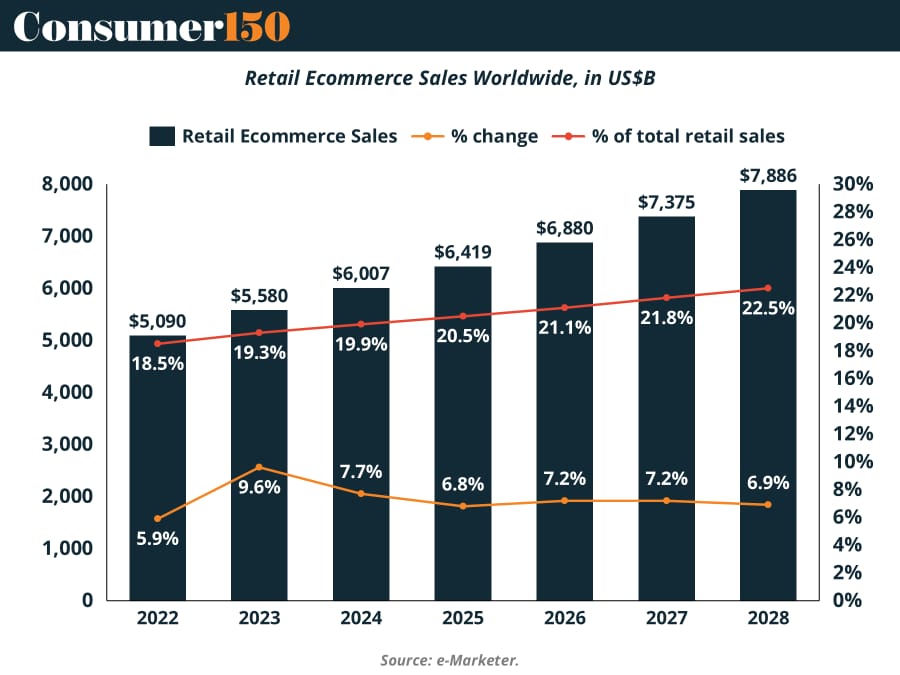

Global ecommerce sales will hit $6.42T in 2025, but the growth rate drops to 6.8%—the slowest in recent memory. The culprit? China’s cooling market. Still, that’s not a red flag. Ecommerce’s share of total retail will rise to 20.5%, climbing to 22.5% by 2028. In other words, online retail is taking a bigger piece of a slower-growing pie. Post-COVID normalization is here, but the long game is intact. Retailers betting on physical-first strategies? Recalibrate—digital dominance is now the base case, not the upside. (More)

DEAL OF THE WEEK

Shein Threads the Needle Between London and Hong Kong

Shein has confidentially filed for an IPO in Hong Kong, a pressure tactic to nudge UK regulators on its long-delayed London listing. While the FCA approved its prospectus earlier this year, China’s securities watchdog balked, reportedly over the human rights risk disclosures—especially those tied to Xinjiang cotton. With political opposition torpedoing its original New York plans, Shein’s now pivoting to the HKEX, where language may be more negotiable. Still, London remains the endgame, and a Shein debut could lift a market that’s seen more exits than arrivals this year. (More)

TOGETHER WITH GO-TO MILLIONS

Your boss will think you’re a genius

You’re optimizing for growth. Go-to-Millions is Ari Murray’s ecommerce newsletter packed with proven tactics, creative that converts, and real operator insights—from product strategy to paid media. No mushy strategy. Just what’s working. Subscribe free for weekly ideas that drive revenue.

The Great (Gift Card) Divide

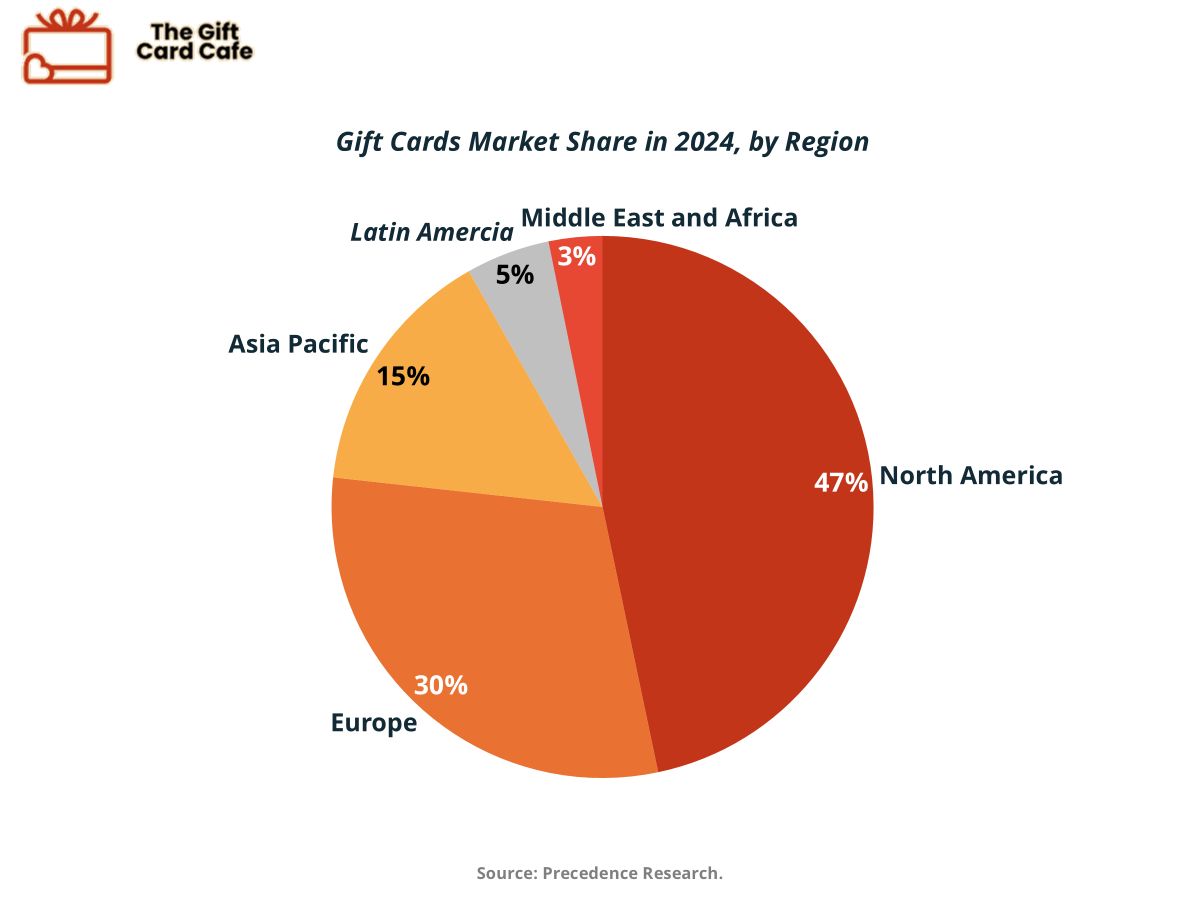

The global gift card game is splitting into two camps: North America, the legacy king, and Asia-Pacific, the upstart speedster. The U.S. continues to dominate with its tried-and-true formula of birthdays, loyalty programs, and digital convenience. Think: Zelle meets Zara gift card. But the real momentum? It’s eastbound. Asia-Pacific is racing ahead as the fastest-growing region, fueled by mobile-native consumers and rising e-commerce. China’s super apps are turning gift cards into ecosystem glue—WeChat and Alipay users can now send everything from hotpot dinners to skincare kits with a few taps. Meanwhile, global brands are catching on: Nike, Sephora, even Spotify are tailoring gift card programs for regional tastes and mobile habits. TL;DR: Gift cards are no longer just presents—they’re platforms. (More)

CONSUMER TECH

The Digital Trust Gap: Social Media Isn’t Moving Product

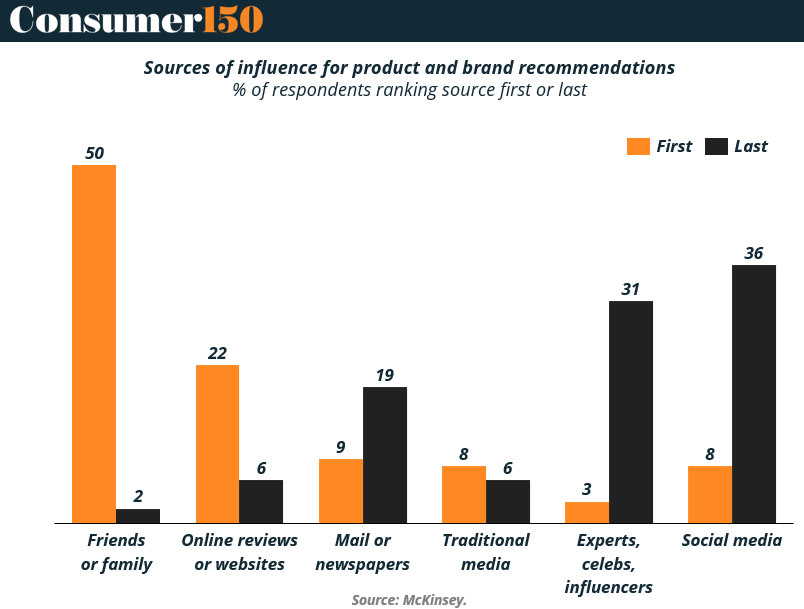

Despite the billions spent on influencer campaigns and algorithmic targeting, only 8% of U.S. consumers rank social media as their top source of product recommendations. In fact, 36% put it dead last—more than any other channel. That’s a signal, not just noise.

Friends and family dominate trust (50% ranked first), followed by online reviews/blogs (22%), underscoring that digital influence works best when it feels personal or peer-authenticated. Celebrities, traditional media, and even mailers still outperform social media in perceived credibility.

Why it matters: Consumer tech brands can’t afford to mistake reach for impact. The data suggests a growing skepticism around digital gloss and a premium on perceived authenticity. Platforms and marketers banking on TikTok virality should reconsider the long game: reputation > impression. (More)

CONSUMER BEHAVIOR

The Luxury Shopper Wants Direct Access

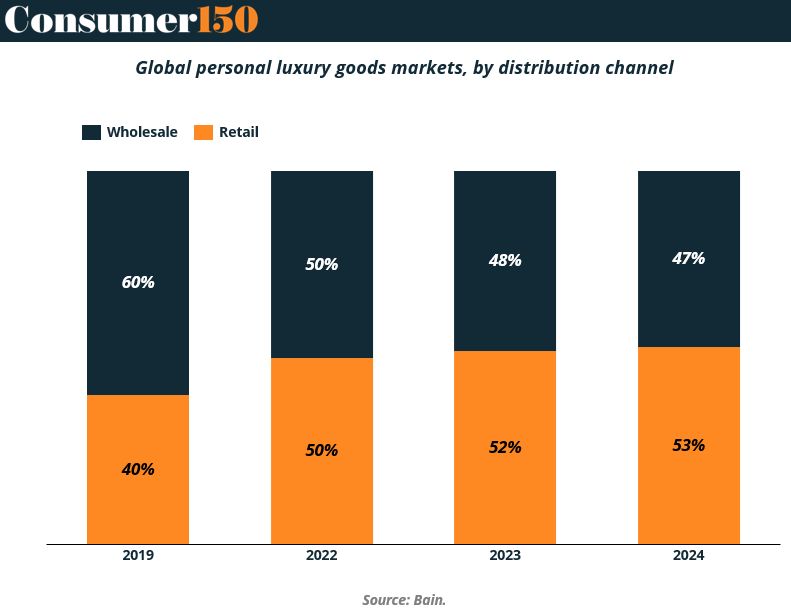

Retail is overtaking wholesale in the global luxury market—and fast. In 2019, wholesale accounted for 60% of personal luxury goods sales. By 2024, it’s down to 47%, while retail climbed to 53%, per Bain. This quiet but decisive channel shift reflects a deeper change in consumer behavior: today’s high-end buyers want control, customization, and connection.

Luxury brands are responding by ramping up owned retail and DTC platforms—not just for margin expansion, but to capture more data, build loyalty, and protect pricing power. For shoppers, that means fewer multi-brand shelves and more branded experiences, concierge perks, and product drops tailored to digital engagement.

Why it matters: The DTC pivot isn’t just a margin story—it’s a consumer trust play. As buyers seek more meaning (and less middleman), brands that own the relationship will own the future. (More)

INTERESTING ARTICLES

"Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful."

Albert Schweitzer